YouTube is almost too big to succeed in the annual TV and streaming advertising upfront market.

As the most-watched streaming service on TV screens for 15 months running, brands can hardly avoid advertising on the Google-owned platform. But between the breadth of YouTube’s programming — from NFL Sunday Ticket to not just cat videos but videos for cats — as well as the sheer amount of ad inventory it has available, the question facing YouTube heading into the upfront market, as ever, is whether advertisers feel not only the desire but also the need to commit to spending on YouTube in an upfront fashion.

“Because you’re not buying program-specific or even channel-specific, it’s not content that’s going to sell out. So the need to make that upfront commitment — there’s not really the scarcity element to it,” said an agency executive who had been briefed on YouTube’s latest upfront pitch.

Naturally, YouTube would like to change that.

As this year’s upfront cycle kicks off, YouTube is refining its pitch to advertisers to create more scarcity. Specifically, it is raising the threshold for its YouTube Select program that packages inventory across the top channels on the platform and introducing a new option for advertisers to overtake individual channels in that package.

“If you’re layering the top tier of YouTube Select and you look at their following — 10 million, 20 million, 30 million — and the views that they garner, it’s larger than most primetime shows in their category. And that’s an example of how people used to buy. And we’re just showcasing that this same effect shows up on YouTube, and you can start to put your brand around a big event with a show and a creator that has a very high following,” said Sean Downey, president of Americas and global partners at Google.

YouTube is also adding an AI-powered ad optimization tool for non-skippable ads and updating the look of QR codes appended to ads.

The latter two announcements seem neatly timed to this year’s upfront. Advertisers are obsessing over the ROI of their commitments, and upfront ad sellers are seeking to sell them on more performance-oriented options.

The upfront commitments that advertisers make to YouTube are a bit different. Instead of the traditional upfront commitment that locks an advertiser into spending a certain amount of money ahead of time, YouTube follows the endeavor deal model, in which advertisers set a spending goal and are rewarded as they reach it. Of course, advertisers would like to receive bigger rewards. Typically, advertisers receive advertising credits equivalent to single-digit percentages of the spending amount for reaching their endeavor goals, according to two agency executives.

YouTube does not plan to change how it structures its upfront deals this year, said Downey. “We’re hoping our platform speaks for itself, and the value that we’re giving to marketers speaks for itself,” he said. To that point, here’s exactly what YouTube has to say to advertisers in this year’s upfront.

YouTube Select gets more select

YouTube is tweaking its package of top creator channels. In the past, YouTube Select consisted of the top 5% of channels on the platform. Now it is the top 1%.

“As our content has become even more vast, we want to make sure that YouTube Select really represents the most sought-after, popular, top content on our platform,” said Nicky Rettke, vp of product for YouTube Ads.

In other words, YouTube Select is the platform’s way of addressing advertisers’ criticism that YouTube videos are not on par with the programming that TV networks and streamers sell in the upfront. In addition to viewership, watch time, likes and shares, YouTube picks channels to include in YouTube Select based on brand suitability as well as production quality, said Rettke. The production quality signals that YouTube’s evaluation includes videos’ cinematography and editing.

To be clear, YouTube Select has been around since 2020, and its previous incarnation, Google Preferred, debuted in 2014. Meanwhile, ad buyers’ perception that YouTube isn’t TV persists. But YouTube has more examples of TV-quality programming on its channels.

Consider Michelle Khare, a creator whose channel has more than 4 million subscribers and is included in YouTube Select. Not only are her videos the length of traditional TV shows — typically 20 to 40 minutes long — but they are TV-level productions, with teams of 40 to 50 freelancers working on them in addition to Khare’s staff of five full-time employees.

“A lot of our videos can take up to a year to produce,” Khare said in an interview. That can include a post-production process that involves “professional color correction and sound design so that it can be enjoyed across mobile, desktop and in the living room,” she added.

That last point is an important one. YouTube’s viewership on TV screens has been ballooning, to the point that people in the U.S. spend more time watching it on TV screens than any other streaming service. For Khare, connected TV accounts for 40% to 50% of her videos’ viewership. And more than 75% of YouTube Select impressions served in the U.S. in the first half of 2023 ran on TV screens, according to YouTube. The growing share of YouTube viewership occurring on TV screens could help YouTube to be seen by ad buyers in that broader TV bucket. Because right now it’s just not.

“It’s still considered more of a short-form, online video budget decision versus a CTV decision,” said the first agency executive.

Taking over YouTube Select channels

That online video versus CTV decision can be made because advertisers are taking the mean of the platform’s programming. But again, with Khare as an example, there is TV-quality programming on YouTube, and now advertisers can cherry-pick that programming even more within YouTube Select.

Through YouTube Select Creator Takeovers, brands can effectively buy out a given channel’s ad inventory. At a fixed CPM, the brand secures 100% share of voice as the only advertiser on that channel’s videos for a two-week period, according to a YouTube spokesperson.

Agency executives expressed mixed feelings on taking over a creator’s channel. While it can provide exposure and exclusivity, there’s also the risk of overexposing a brand to a creator’s channel by having ads airing in every video from that channel. “A client would need to have enough creative to cycle through, and I would want to make sure we’re minding any frequency caps,” said a second agency executive.

YouTube is aware of this concern. Advertisers “will have to provide multiple assets. So we’re not showing the same type of creative over and over again,” said Rettke. Additionally, YouTube will not be introducing new ad slots for Creator Takeover campaigns, “so it’s not going to increase the ad load on the videos,” Rettke said.

Creators may have their own concerns, though. For example, a creator who discusses environmental issues may not want a brand like ExxonMobil to be able to take over their channel. While creators won’t be able to have a say on which advertisers can or cannot take over their channels, they will need to opt in to the Creator Takeover program, according to the YouTube spokesperson.

Sydney Morgan, a creator with 8 million subscribers on YouTube, said she thought the Creator Program was a great idea because the longer association between a brand and creator could make it feel like more of an organic connection for creators’ audiences. Asked whether she would want to have a say in which brands could or could not take over her channel, she said, “yes, but I also would trust YouTube if they had some sort of screening process to know that it made sense on your page.”

AI, QR and ROI, oh my

If the YouTube Select updates are meant to cater to advertisers seeking scarcity in the upfront, then the introductions of video reach campaigns for non-skippable ads and branded QR codes are tailored to advertisers seeking to ensure their spending pays off (acknowledging these two advertiser cohorts can be one and the same).

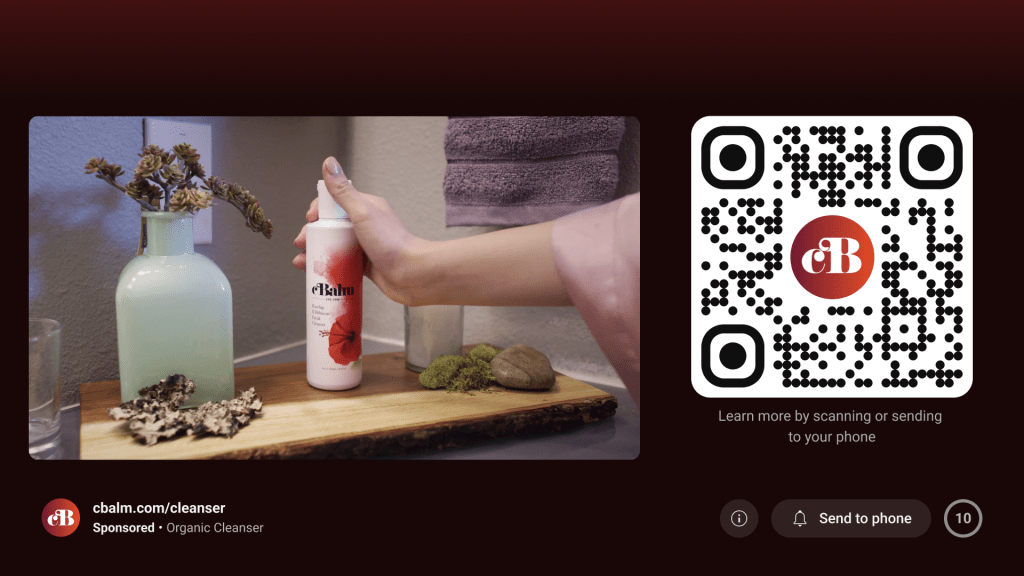

The branded QR codes are exactly as they sound (see below): A brand has its logo appear within the QR code when appended to an ad running on YouTube. They can be purchased through YouTube Select or be attached to direct-response ads running on CTV, which are typically sold on a cost-per-action basis, according to the YouTube spokesperson.

Video reach campaigns for non-skippable ads similarly are as they sound. They incorporate AI (of course) to determine the right mix of non-skippable ads an advertiser should run to deliver a favorable balance between viewer reach and completed views. Advertisers can supply an unlimited number of assets, but for now, only six- and 15-second ad lengths are supported.

“The reason you would do this is you want to find that balance of reach and efficiency,” said Rettke. “So you want to drive completed views, but blending in some shorter creatives allows us to reduce the CPMs and get a more efficient cost-per-reach for you.”

The ads are being sold on a per-impression basis, and the exact pricing varies between six- and 15-second spots. The agency executives said they are interested in the tool’s potential to make clients’ YouTube ad buys more efficient.

“Because [the six-second ad] is a newer format and shorter, we have some clients [that have historically bought 15- and 30-second ads, which are common on traditional TV] that question it for brand-building,” said the second agency executive.

“This could be interesting, both to maximize performance and also to gain learnings on which lengths garner the highest completion percentages. That said, it should take into account cost as well, since [six-second ads] generally cost less than [15-second ads]. It might be even better to optimize to cost-per-completed-view rather than just completed views,” said the first agency executive.

That interest in optimizing toward cost-per-completed-view befits the pressure that ad buyers seem poised to put on all upfront ad sellers to justify their pricing, as covered in Digiday’s recent “The Future of TV” video series. Despite standing apart in the upfront in some ad buyers’ eyes, YouTube is no exception to that pressure.

For example, the agency executives said they would like to see YouTube Select move from a CPM model to a cost-per-completed-view model, given that they are able to buy YouTube’s inventory outside the upfront on a cost-per-completed-view basis. In response to that feedback, Downey said that YouTube delivers “a pretty effective CPM cost structure” for advertisers as well as the flexibility for advertisers to “mix and match formats, lengths, buying types.”

And the agency executives acknowledged as much. They noted that YouTube Select CPMs are in the high $10s, low $20s range, whereas top ad-supported streaming services’ CPMs typically range from the high $20s to low $40s.

YouTube Select “is still very efficient relative to either what you might call premium online video or CTV buys. I don’t think [its pricing is] prohibitive,” said the first agency executive. “But I will say, I’ve seen clients leaning more and more into auction.”

More in Future of TV

Future of TV Briefing: How TV and streaming companies’ advertising businesses fared in Q1 2024

This week’s Future of TV Briefing looks at what TV and streaming companies’ latest quarterly earnings reports indicate about the state of the TV and streaming ad business.

Future of TV Briefing: One area where the upfront measurement currency conversation is advancing

This week’s Future of TV Briefing looks at the state of play for measurement currencies as advanced audiences become a focal point in this year’s upfront market.

Research Briefing: Marketers are set to increase their upfront spending this year

In this edition of the Digiday+ Research Briefing, we examine how advertisers are approaching spend in the upfront market, what metrics marketers use to gauge ad campaign success on streaming platforms, and how brands, retailers and agencies are investing in programmatic ads, as seen in recent data from Digiday+ Research.