Free market economies expect inflation to occur every so often. Both consumers and businesses expect it — whether it starts from increased wages or a decline in productivity — the cause and effect of the phenomenon leave lasting consequences for the spending power of both parties.

Brands are being cautious with their ad spend right now. Amid a recession, they are worried about their revenue gain as inflation takes its course. On the other hand, consumers are still spending money. While they are allocating more funds to non-discretionary spending, discretionary spending is still rising.

Inflation is not keeping consumers from spending money, and brands should take notes.

“If consumer spending is still strong in their category, now is not a good time to cut ad spend,” said Nick Mangiapane, CMO and Head of Partnerships at Commerce Signals, a TransUnion Company.

TransUnion discusses this in their survey, Consumer Spending Remains Strong as Headwinds Build. Inflation may be at an all-time high, but Consumers are still spending and pushing the economy forward. How much longer the consumer can keep up their spending power is up for debate, but advertisers can play a role in assisting them.

Non-discretionary V. Discretionary Spending

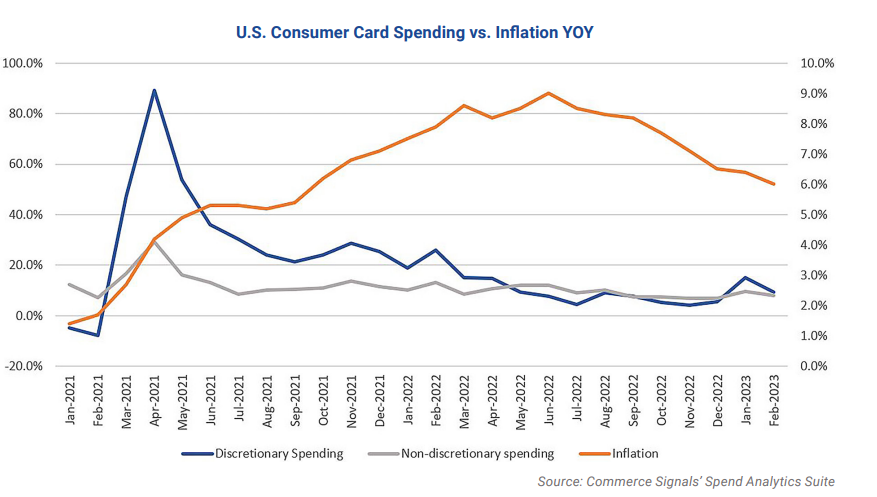

Last year, consumer discretionary spending was slowing down. While the rate was not decreasing, economists were unsure how long the trend would last. In a shocking turn of events, the data shows that consumer discretionary purchases and spending have shown signs of growth in 2023.

While some may infer that increased inflation meant less consumer spending, last year, the data showed that consumer card spending increased by 14.6% in July. Due to the strong job market and the high consumer saving rate during the pandemic, consumer spending has stayed above inflation. Although, as the market effects of COVID-19 waned away, consumer habits changed.

For instance, inflation forced consumers to distribute much of their revenue to non-discretionary segments such as food, gas, rent, and utilities. While discretionary spending slowed, the spending is still strong.

In January and February of this year, there was an uptick in discretionary spending, specifically in the travel industry. Consumer spending continues to remain strong in both non-discretionary and discretionary categories.

“Discretionary spending through February is up 12.3% year over year, so while growth may slow, there is still a long way to go before it becomes negative,” said Mangiapane.

The news is good for now, but economists had contrasting views on how much longer discretionary spending will grow:

- JPMorgan Chase & Co. Chief Executive Jamie Dimon said U.S. consumers have about six to nine months of spending power left.

- Bank of America Corp. CEO Brian Moynihan asserted that other than gasoline, consumer spending was higher than inflation, and he believes the trend will continue.

- “The spending is strong, and then customers have more money in their accounts than they did pre-pandemic by multiples,” Mr. Moynihan said. “They’ve got plenty of money to spend.”

Trading Down and the Flourishing Travel Industry

Last year, consumers implemented a trading down strategy to compensate for the high prices. This included continued spending on high-priority discretionary categories and cutting back on lower-priority discretionary categories. In the packaged goods industry, consumer purchases increased by 3.4%, while food prices were up by 10.4%. The caveat was that consumers purchase cheaper items like burgers instead of steak.

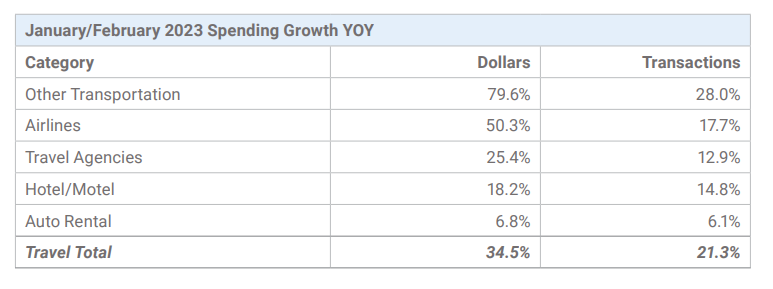

In 2023, the high spending rate in the travel industry was vital for the uptick of discretionary spending. Travel spending saw the highest growth, with an increase of 34.5%. The number of consumer transactions also increased at a rate of 21.3%, highlighting that consumers are traveling more than they were a year ago. Evidence highlights that the increase is due to higher average ticket prices directly influenced by inflation, but purchases were still up. Is it because the pandemic trapped consumers inside their homes?

With travel bans implemented worldwide during the pandemic, disaster struck the travel industry. Christine Maguire, VP Of Global Ad Revenue at TripAdvisor, said that while the trip planning company had a tough time, their business needed data and revenue to weather the storm.

“In reaction to the pandemic’s impact on the economy, specifically our business, we had to go into action mode to weather the uncertain storm immediately,” said Maguire. “After being in hyper-growth mode to maximize the media business, I had to put my finance and operations hat on quickly to manage costs, reimagine a streamlined and consolidated global organization, while managing the changing dynamics in the marketplace due to the pandemic.”

Last year, the travel industry bounced back due to their tenacity, innovation, and the consumers’ eagerness to travel once federal governments started to lift travel bans. This year the travel industry is continuing that growth. The transportation category, which includes cruises, ride-sharing, taxis, and trains, had the highest increase in spending at 79.6%. Airline spending also started the year very strong, with a growth of 50.3%.

Don’t Reduce Your Ad Spend

During inflation, advertisers might want to decrease their ad spend budget, but the data urges you to do the opposite. You must increase your ad spend budget to encourage consumers to keep spending.

Economic uncertainty causes some to decrease their ad budget, but most industry experts will agree that it is a disastrous move for both brands and consumers. Brand exposure, brand prominence, and audience targeting will decrease.

“As a marketing leader, I’m very familiar with leadership requesting marketing budget cuts,” said Mangiapane. “However, cutting budgets expecting lower revenue can be a self-fulfilling prophecy in times like this. Advertisers with reliable incremental sales studies will easily defend their budgets.”