Publisher frustrations with the algorithm-driven internet are boiling over.

Users just don’t visit websites like they used to. And although today’s audiences primarily access publisher content via search and social media, referral traffic from these sources is down.

That lament has been repeated ad nauseam in publisher earnings reports throughout the year, and it’s contributed to a terrible year of publisher layoffs, with around 19,000 jobs lost as of October, compared to 3,000 last year.

Unfortunately, the outlook on referral traffic isn’t getting any better. Search and social platforms are taking a more oppositional stance with publishers as they try to keep users from leaving their own walled gardens. And publishers have legitimate concerns that the rise of generative-AI-powered search, which rarely links to the stories it scrapes, will cause irreparable damage.

Some publishers like BuzzFeed are turning to their own generative AI solutions or TikTok-esque video feeds to draw users to their sites and keep them engaged.

But no matter the media format, when it comes to attracting a loyal audience, there’s no substitute for creating worthwhile content.

The death of ‘destination websites’

In B2B publishing, it’s easier for publishers to cultivate an audience than it is for general-interest outlets. Professionals want to be dialed into the developments in their particular industry, and they typically choose from a small number of sites that report that news.

But for general-interest publishers, there’s a cacophony of competing voices – and it’s harder than ever to cement themselves as must-visit destinations.

The death of the “destination website” has even become a meme, with internet old-heads – including elder millennials like myself – pining for the days when we had a few websites we’d visit every day. That was before search and social took over and devolved into morasses of paid content and SEO-optimized junk.

Calls for the return of the homepage are now common heading into 2024.

A strong social presence used to be the best way to stand out from the pack before algorithms changed circa 2018. For example, BuzzFeed built its brand on Facebook traffic, but it has had to rethink its dependence on social this year and shift to attracting traffic directly to its site.

That’s because the social platforms are increasingly competing for audience attention share between not only themselves, but also other websites. And social networks are loathe to redirect users from their feeds to external sites because doing so means fewer impressions and less ad revenue.

Take the many ways X (formerly Twitter) has messed with referral links this year – from throttling page load times for certain sites to overhauling its external link cards in an attempt to get publishers to post full-length content on the platform instead.

Meanwhile, Google and Meta fought regulations that would force them to share revenue with news publishers. Meta resorted to disabling the sharing of news content in Canada, and Google threatened to do something similar before working out a deal with regulators.

The walled gardens are not your friends

All these issues point to the fundamental flaw of an internet that’s beholden to a handful of major tech platforms, said Tom Triscari, founder and CEO at programmatic advisory firm Lemonade Projects.

Publishers can build a strong business model on what’s good for Google, Apple and Meta – until working with publishers no longer works for those platforms, as the examples above demonstrate.

These platforms will throw publishers under the bus to generate more ad revenue by keeping users locked inside their own walled gardens, Triscari said. “If you’re reliant on walled gardens,” he said, “that’s dangerous because everyone who’s ever done that has eventually eaten it.”

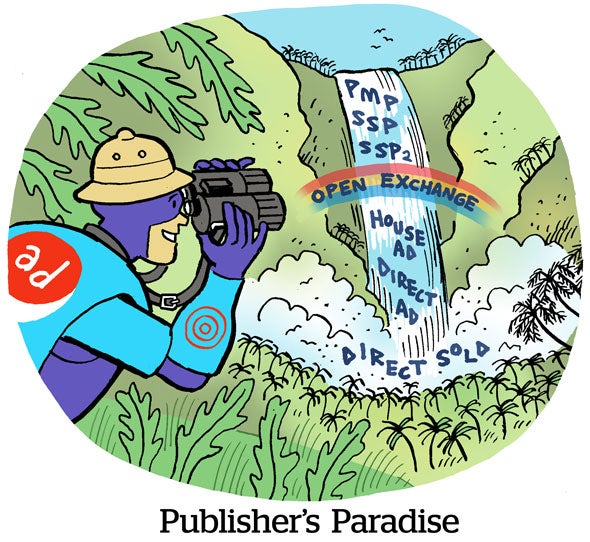

Plus, advertisers and publishers are dependent on the audience data hoarded by Google and others in order to power their targeted advertising.

The publishing community’s deeply entrenched dependence on Google in particular might eventually amount to an “extinction-level event,” added Matthew Goldstein, publisher of the What I Saw Happen media newsletter.

“Google traffic is down and will be down even more in 2024,” he said, “because Google, the benevolent dictator, is fighting for its monopolistic search life and, in turn, keeping way more traffic in the Google world.”

One way Google is looking to own all the eyeballs is with the rollout of its Search Generative Experience (SGE), which uses generative AI to return full-length responses to search queries by scraping information from publisher sites.

However, these results don’t always include links to the sites that Google’s AI sources its responses from, and it’s an open question whether the final version of SGE will include links. Plus, there are no concrete plans to share any ad revenue earned from AI-powered search with publishers.

Microsoft and other search providers are also experimenting with generative-AI-enabled search as the race to corner that market continues.

As a result, publishers could see the roughly 50% of referral traffic they get from search disappear next year, said Michael Sanchez, CEO of publisher ad network Raptive.

Publishers plan their attack

So what recourse do publishers have?

One thing they can do is invest in creating content that matters to their audience and foster a relationship with readers that will keep them coming back for more.

For example, roughly one third of traffic across Raptive’s publisher network comes from direct entry either via a homepage visit or a site’s newsletter, said Marc McCollum, Raptive’s EVP of innovation. Publishers should lean into those strengths, he said.

Raptive has also prioritized helping its publishers monetize the first-party data they have on their audiences and content, Sanchez added. Doing so can weaken the dependence advertisers have on the Big Tech platforms they use for audience data.

In other words, publishers should use the walled garden playbook against the walled gardens. Generate the data you need to power your ad business on your terms and keep users engaged for as long as possible using the same generative AI tools Big Tech uses.

But, above all, empower the people who generate the content that built your publishing brand.

Take it from a journalist.

“The Sell Sider” is a column written by the sell side of the digital media community.

Follow Anthony Vargas and AdExchanger on LinkedIn. And if you’re still on Twitter/X, follow me at @avargasedits.