Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Pairing Performance

Google snagged its first major CTV publisher for PAIR last week when NBCUniversal announced that it’s integrating with the solution through DV360, Broadcasting+Cable reports.

For the uninitiated, PAIR stands for Publisher Advertiser Identity Reconciliation, and it’s Google’s protocol for securely matching first-party data between an advertiser and a publisher. (Yes, we know it sounds like a clean room, but Google prefers the term “protocol.”)

When Google first launched PAIR in 2022, many framed it as a UID2.0-style identity framework, but without a pooled ID graph acting as the source of truth.

It’s important to note that the data being matched doesn’t involve Google’s first-party data. In this case, advertisers use LiveRamp’s clean room in combination with PAIR to target NBCU viewers without relying on third-party signals. The hope is that match rates will improve for NBCU inventory.

PAIR appeals to publishers because they can use their own SSPs and third-party clean room vendors. LiveRamp, Habu and InfoSum have been integrated with PAIR since launch. (LiveRamp and Habu have since merged.)

DV360 is PAIR’s only demand source, but we’re talking about Google here, so there’s enough scale to generate ID resolution gains.

“There’s no need to compromise between privacy and performance,” says Ryan McConville, NBCU’s EVP of ad platforms & operations, quoted in a post on LiveRamp’s blog.

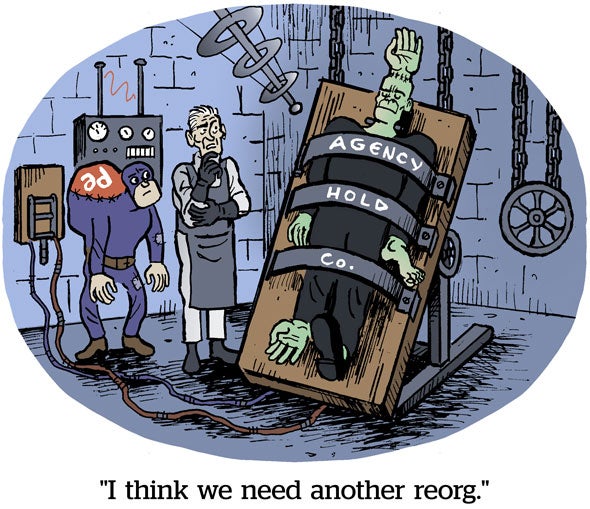

Strange Bedfellows

On paper, Madison Avenue and Hollywood are a perfect match. But in practice, not so much.

The advertising world and Hollywood are ego-driven industries, and their occasional forced unions often devolve in acrimony, Digiday writes.

Case in point: Last week, scandal erupted when talent agency UTA sacked and sued Michael Kassan, CEO of its subsidiary MediaLink, a well-known media consultancy and events company.

Hollywood talent agencies move quickly compared to the advertising industry, which is beholden to Wall Street’s unrelenting demands for reliable growth. Talent agencies push for new deals while account execs are busy reassuring risk-averse marketers. Lights, camera, tension.

Celebrities will, of course, continue to work with brands – you don’t hear about influencer marketing and “authenticity” all day long for nothing – but those partnerships often work better as one-and-done deals.

Put it this way, says Andrew Essex, a senior managing partner at media consultancy TCS Interactive: Madison Avenue and Hollywood “will always sleep together, but never get married.”

Currency Exchange

Will this be the year for alternative currencies at the TV upfronts – or are we just embarking on a new “year of mobile” gag?

Nielsen alternatives are better suited to strategic audience targeting than demographic targeting, according to Horizon Media SVP Lauren Chaplin, who appeared on a panel of TV buyers at last week’s CTV Connect event. And the majority of TV campaigns are still transacted on demographics.

Still, alt currencies should increase their share of deals as marketers and sellers do more audience-based targeting, Chaplin says. But, currently, Horizon doesn’t feel there’s an alt currency provider whose methodology for demo-based campaigns can stack up to Nielsen.

And there are also other important issues still in limbo for advertisers.

Chaplin and her fellow panelists lamented the continual lack of show-level data provided by CTV platforms.

Publishers worry that advertisers would use this information to cherry pick shows to target, Chaplin says, which is partly why they limit content-based measurement to genre-level reports. But that’s not especially helpful for developing consistent ad strategies.

Platforms argue that, because CTV buyers prize audiences above content, they don’t actually need show-level data, says Michael Gambelli, VP of video investment at Digitas. But the need for show-level transparency hasn’t gone away, he says – buyers are just getting a bit tired of asking.

But Wait, There’s More!

Phony billionaires on social media are scamming Americans out of their life savings. [WSJ]

DTC brand Parachute Home goes offline and doubles its experiential investment amid a changed digital landscape. [Digiday]

Job posting: Netflix continues to expand its ad measurement team. [LinkedIn]

What would a TikTok ban or sale mean for advertisers? [Adweek]