After a dramatic courtship between Unity and ironSource, Unity put a ring on it.

The merger closed on Monday.

The purpose of the deal is to bring together under one roof all of the tools developers need to create, test, launch, grow and monetize their games.

As a quick recap: Unity first announced its plan to acquire ironSource in July for $4.4 billion in stock. The following month, AppLovin made an unsolicited bid to merge with Unity in an all-stock deal valued at $20 billion, but only if Unity agreed to jettison its pending ironSource acquisition.

Unity unanimously rebuffed AppLovin’s offer the week after it was made, and now here we are.

With the deal done, the newly combined company can move forward with its vision, which, said Ingrid Lestiyo, SVP and GM of Operate Solutions at Unity, is to provide a platform that “takes ideas from inception to becoming truly viable businesses.”

UnifiedUnity has two main business lines: game creation tools (called Create Solutions) and tools for monetization, advertising and user acquisition (called Operate Solutions).

IronSource’s technology will support both sides of the house.

Supersonic, for example, ironSource’s game studio, will become part of Create to help developers use analytics to launch and scale their ads. While LevelPlay, ironSource’s mediation offering, is being integrated into Operate.

IronSource also has a few other bits and bobs from its own acquisitions, including creative performance analytics through its purchase of Bidalgo in October 2021, in-app rewards through the Tapjoy deal, which closed in January, and creative management and optimization capabilities from its acquisition of Luna Labs in March.

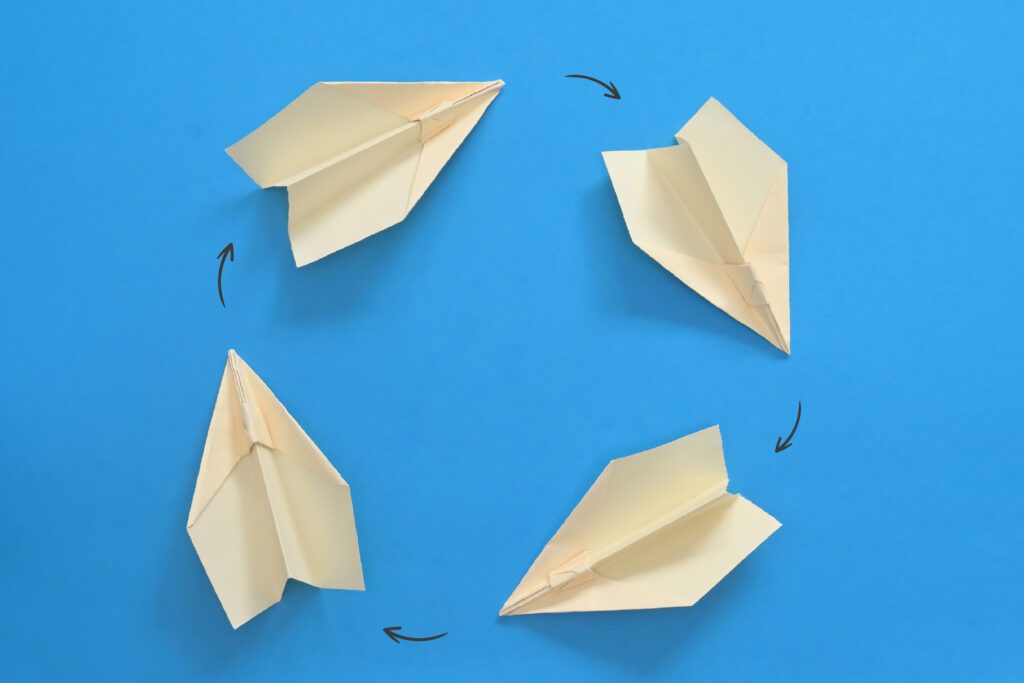

The purpose of bringing these tools together with Unity’s game-creation and monetization software is to create “a feedback loop,” said Omer Kaplan, ironSource CRO and co-founder.

Connecting the monetization and growth data earlier on in the game development process means developers can hone their games based on real-time insights. “The entire creation process can be more effective from Day One,” he said.

Feedback on the feedback loop

But not all developers love the idea of tying together monetization and the game creation engine.

The bees were not attracted by honey when, a few days after the merger between Unity and ironSource was proposed in July, Unity CEO John Riccitiello (also now CEO of the combined company), flippantly commented in an interview with PocketGamer.biz that despite being brilliant in many ways, developers who don’t prioritize monetization are “[f-bomb] idiots.” (Riccitiello later apologized.)

According to Lestiyo, developers aren’t forced to change the way they operate. Integrating more monetization tools into Unity’s stack is about giving developers the option to test how ad placements affect engagement and retention.

“They make the decision as to whether they want to do it and what business model they want to go with,” she said, “but we allow them to experiment.”

And advertising helps fuel Unity’s game creation engine. Unity invests a portion of the revenue from its ads business back into R&D for Create. “It’s kind of a virtuous cycle,” Lestiyo said.

To keep its flywheel spinning, the ironSource deals allows Unity to focus more attention on mediation.

LevelPlay is already available through a Unity plugin, but the plan is to make it natively available in the Unity game editor starting early next year. (In-app bidding and LevelPlay mediation will be in closed beta for Unity Ads, Unity’s ad network, until around that same time.)

Unity will retire its own mediation tool, Unity Mediation, and replace it with a rebranded LevelPlay, which will now go by the name (you guessed it) Unity LevelPlay.

IronSource and Unity will each continue to run their own respective ad networks, but both networks will use one mediation platform. Demand will also come from more than 25 other partners that integrate with LevelPlay.

“The integration will give publishers bidding access at scale,” Lestiyo said.

There is, however, a largish elephant in the room. And its name is AppLovin.

MAX, AppLovin mediation platform, already has major scale. After buying MoPub last year, AppLovin shut it down and doled out more than $210 million in one-time bonuses to incentivize developers and ease the process of migrating over to MAX. The vast majority of app publishers took AppLovin up on its offer.

But the benefit of Unity LevelPlay is that it’s built specifically to meet the needs of developers, who need to connect their UA to their monetization, Kaplan said.

“It’s much more than, say, yield monetization or ad monetization,” he said. “It’s a really comprehensive approach.”

Privacy prep

Competitors aren’t the only challenge, though. Macro headwinds are blowing.

Name me a company that makes its money through advertising, and I’ll show you a company that’s been grappling with Apple’s privacy changes for well over a year. And that’s not to mention Android 13, which was released in September along with a feature called SDK Runtime, which cuts off a third-party SDK’s ability to gather in-app data without explicit consent.

But Lestiyo claims that Unity is in a good position to weather the changes.

“We’ve prepared for it, both in terms of making sure we’re compliant in how we collect data, but also in how our models work to make sure we invest enough in contextual models, so that we can perform as well as possible for the users that opt out,” she said.

There have been hiccups along the way.

During its Q1 earnings call, Unity alerted investors that its machine-learning-based UA tool, Audience Pinpointer, which is an important piece of its post-ATT ad stack, malfunctioned after “ingesting bad data from a large customer,” as Riccitiello put it at the time. The result was that Unity’s training data was influenced by the garbage data, distorting its performance picture.

Unity suffered a $110 million revenue hit as a result, but the problem isn’t expected to carry over into next year. “All of the data issues are now in the past,” Lestiyo said. “We’ve addressed them.”

Synergies vs. turkeys

But skeptics remain, well, skeptical, as to whether the overarching Unity/ironSource deal will be accretive.

Eric Seufert has written that he believes “the union of these two companies will produce a whole that is greater than the sum of its parts.”

But in a note to investors in July, Arete Research wrote that “two turkeys don’t make an eagle.” In other words, the proposed synergies very well might not materialize, and the deal overall is “a huge dilution, an integration risk and does nothing to stave off the reduction of user signal coming from Apple and Google.”

To which Lestiyo said, “There are no guarantees in life or in general. But I think we have a very strong foundation for this to be successful.”