Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Unfulfilled

One of TikTok’s advantages has been that, as a private company, it doesn’t report earnings to anxious shareholders. Having a Chinese tech backer with bottomless pockets doesn’t hurt. (Actually, sometimes it does. More on that later.)

But while Google, Meta, Snap and others cut marketing and headcount, TikTok spent through the downturn on user acquisition and hiring.

And that’s small potatoes compared to hiring for a potential US-based ecommerce fulfillment network. Axios spotted job listings for roles to oversee warehouses, delivery and customer service. “Our mission is to help sellers improve their operational capability and efficiency, provide buyers a satisfying shopping experience and ensure fast and sustainable growth of TikTok Shop,” according to the listings.

But it’s a tall order.

Even more established player Shopify isn’t so far ahead in terms of warehousing and fulfillment. And Walmart spent billions over a couple years to acquire Jet.com, Bonobos, ModCloth and Moosejaw, which weren’t important brands but provided a foothold in fulfillment. Google could never stomach the idea of managing delivery and customer service itself.

Even if TikTok would spend, say, $20 billion to buy DoorDash or Gopuff, would the US government allow it? Unlike Walmart, TikTok may have to build from the ground up.

Byte The Bullet

Chinese nation-state opponents (like, uhhh … the US government) hate TikTok. But advertisers are not dissuaded.

The platform’s reach with Gen Z consumers and content that spreads like wildfire make it an attractive testbed.

Brands are also spending more on TikTok because of its relatively low CPMs compared to Facebook and Instagram.

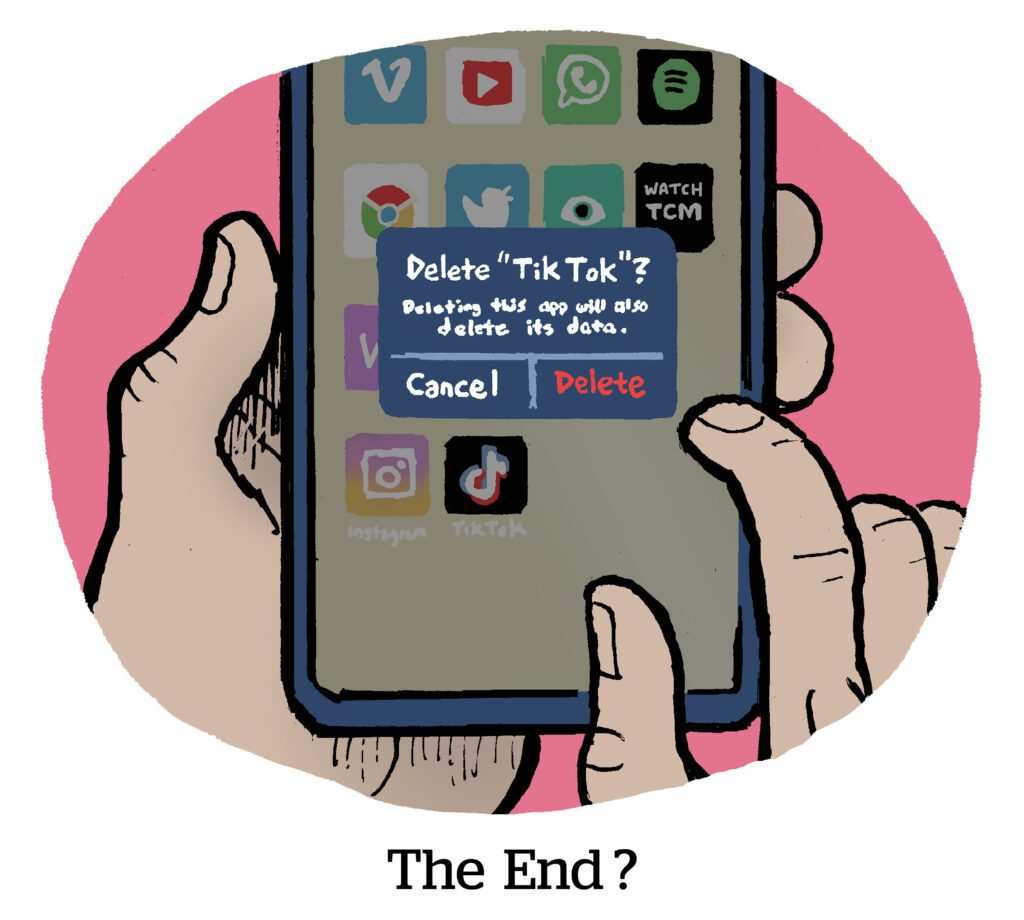

Lawmakers and regulators are resurfacing privacy concerns about TikTok’s parent company, ByteDance, which could pose a security risk since US citizens’ data is sent to Chinese servers.

Advertisers are wary of these concerns – but only to a point, Digiday reports.

Some brands advertise on TikTok but don’t carry the TikTok site pixel because the pixel doesn’t pass internal privacy and security standards, says Adam Telian, VP of media services at marketing agency New Engen.

That might be a bit of an overreach by legal, depending on the market (third-party site tags are more complicated in Europe since GDPR went into effect). But as long as TikTok controls young eyeballs and provides serious cultural cache, advertisers will turn a blind eye to whoever controls TikTok.

Content Means Conflicts

The newsletter revolution feels like, well, a revolution. But the explosion of Substacks and newsletter-based subscription offerings are part of a well-worn trail of business ventures that began as newsletters or small content operations, writes Byrne Hobart in, well, his newsletter on tech and finance trends.

Ray Dalio’s early newsletter musings led to people entrusting him with investments, and that’s now Bridgewater Associates, one of the largest investment management firms. Charles Schwab ran a newsletter before switching to a brokerage. Craigslist was an email news update service before becoming Craigslist as we know it.

The post offers a useful glimpse into newsletter monetization.

For instance, Hobart says he “could probably cut my workload and increase my income if I stopped doing subscriptions entirely and switched to weekly sponsored posts instead.” But that requires managing conflicts of interest and dealing with deeply disappointed sponsors, since the writer may not produce something glowing about the business.

“Basically any media business is a balance between monetization and growth,” writes Hobart. “Usually, the right growth pattern is to slowly reduce the share of free content as the newsletter gets closer to saturating its target market.”

But Wait, There’s More!

Bloomberg Media is removing its open-market programmatic inventory. [Adweek]

Hollister will let teens send online shopping carts to their parents for checkout. [WSJ]

Will the creator economy outpace TV content production? [MediaPost]

How CMOs are navigating privacy restrictions. [Marketing Brew]

Macy’s officially launches its marketplace. [Digital Commerce 360]

YouTube announces @name handles, its latest TikTok imitation. [The Verge]

You’re Hired!

The Trade Desk hires programmatic leader Bill Simmons as VP of product. [release]

Bill Swanson joins Connatix as SVP, EMEA. [release]

Myles Younger joins U of Digital as head of innovation and insights. [release]