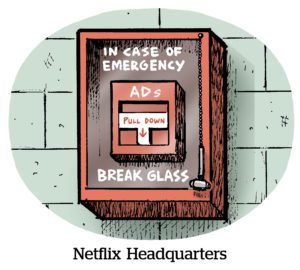

Netflix reported its first earnings on Thursday since launching ads late last year.

The results? AVOD seems to have helped grow Netflix’s profitability in the short term. The streamer reported 7.7 million net new subscribers in Q4, a 4% year-over-year increase in paid memberships, which boosted quarterly revenue by 2%.

But it was a good quarter in a not-so-good year. The company is still reeling from losing nearly a million subscribers in 2022, and has been steadily losing profit throughout the year. Plus, what would media be without a good ol’ leadership shake-up when the going gets tough?

On Thursday, Reed Hastings stepped down as CEO, passing the torch to Ted Sarandos and Greg Peters, now co-CEOs. (Hastings is still on the job as executive chairman.)

But current leadership is optimistic that Netflix’s new ad tier will help the company build back.

“Subscriber churn is a near-term limitation, not a fundamentally long-term one,” CFO Spencer Neumann told shareholders during the company’s investor conference.

“We have high confidence in accelerating revenue growth throughout 2022 as we start to scale ads and enforce paid sharing,” Neumann added.

Ads, ads, ads

Netflix’s ads business is “still in the crawl phase” relative to what digital targeting is capable of, Peters said. The streamer’s Basic with Ads has only been live for under three months – but the company knows advertisers will need targeting based on more than just genre and country.

“We need to move on to the walking phase [of AVOD],” Peters said, “but there’s a lot we still have to do to get there from a technical standpoint, including ad delivery verification, measurement and targeting improvements.”

Netflix has a slew of first-party log-in data that, for example, if used for more personalized ads and content recommendations, could set the streamer apart from traditional broadcasters, Peters added.

“Both the teams at Netflix and Microsoft will have to better serve a growing number of advertisers with an increasing demand [for targeted inventory],” he said.

Even though Netflix’s ad tech is rudimentary, the new subscription tier is bringing on the new subscribers that Netflix was hoping for, Peters said. That’s even amid reports that Netflix had to issue some refunds last year for missing advertiser viewership targets.

“As we expected, we’re not really seeing members switching plans,” Peters said. “Most of our subscriber growth is coming from incremental subscribers joining the platform for the lower price point – more than we modeled for.” But Netflix did not share the total number of AVOD subscribers. It also didn’t break down advertising revenue.

Because AVOD is bringing in new subscribers, “there’s a lot of elasticity to continue scaling our ads business,” he added.

Sharing isn’t caring

Besides new or previous subscribers who like the smell of a cheaper Netflix plan, the streamer expects to turn account moochers into subscribers this year. Password sharers, beware.

Other than scaling ads, “our goal this year is to convert password sharing into paid accounts,” Peters said.

As it clamps down on password sharers, ad-supported access serves as a “good nudge” because it’s a more wallet-friendly option, he added.

After testing password sharing enforcement in phases throughout different countries, Peters said Netflix is finally “ready to roll out paid sharing later this quarter.”

But, he added, it won’t be a universally popular move. Netflix does expect a certain level of subscriber churn from users who won’t pay more to share their accounts, Peters said, so it won’t be a long-term inhibitor to growth. By Q2, it expects subscriber growth to really pick up.

“We expect atypical seasonality – Q2 will be a better performing quarter in terms of net paid account adds,” Neumann said.

Building scale with ad-supported new accounts will be “an even more gradual build,” Neumann added.

But still, the company is confident short-term stumbles will result in long-term growth.

“Ads and paid sharing will both be meaningful and significant sources of revenue and profit for us over many years to come,” Peters said.

“We’re only just getting started,” he added.