Commerce and retail media suddenly became an incredible tailwind for online advertising.

Retail media is now an important part of the growth picture painted for investors by The Trade Desk. And a report published by McKinsey last month forecasts that retail media networks (RMNs) will grow from about $45 billion in ad spend to surpass $100 billion in 2026.

“It has the potential to generate over $1.3 trillion of enterprise value in the United States and create a paradigm shift in digital advertising not seen since the rise of programmatic,” according to the consulting firm.

It’s easy to see the appeal: RMNs connect impressions directly to purchases, a neat trick that’s helped Amazon become an advertising powerhouse. And RMNs are entering the scene at a time when reliable conversion attribution is evaporating.

But anyone banking on RMNs to power programmatic growth for years to come needs a reality check. The enticing prospect of potential growth opportunities in retail media mask a category with less growth opportunity for ad tech than may appear in the raw numbers.

The shopper silo

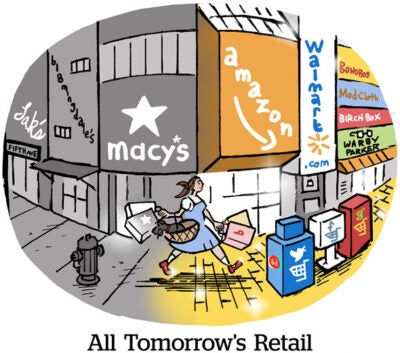

The incredible trajectory of retail media from being comprised of Amazon and a few marginal business groups at Walmart, Kroger and Target a few years ago to now a broad network of RMNs – Michael’s, Albertsons, Dollar General, Macy’s, Best Buy and Petco among them – that process tens of billions of online ad dollars per year and could double again in a few years gives a distorted sense of potential growth.

Those RMN budgets, excluding Amazon’s, are still largely trapped inside shopper marketing siloes. Earlier this year, Walmart and Target disclosed annual ad revenue for the first time. Walmart earned a little more than $2 billion in 2021, and Target Roundel cleared $1 billion. But they’re not going out and winning open programmatic budgets, at least not yet.

Brands carried by those companies and other large store chains are contractually obligated to re-spend a percent of sales, typically 5% to 10%, on trade marketing with the retailer. Historically, that money would go toward coupon deals, in-store brand displays or shelf placement. Now it’s packaged into online ad platforms.

The relationships between retailers and brands, as well as the budgets themselves, have existed for years and are only just transitioning online. It’s a very different dynamic than with CTV, the other big programmatic tailwind, which brought thousands of entirely new kinds of advertisers to TV advertising for the first time and brought many tech companies their first scaled source of video supply.

The non-endemic non-story?

RMNs have a compelling pitch to escape their trade marketing siloes.

If advertisers can’t target based on income bracket on Facebook anymore (which they can’t), and popular third-party audience segments such as “High Earners” or “Power Consumers” lose their luster (which they have), retail media can be the next-best option. A mortgage company that can no longer simply target low-income households or an airline looking for spendthrift consumers might use the Dollar General Media Network as a proxy. Or if Peloton believes there’s an overlap between its customers and, say, people who buy certain organic groceries, they can target Kroger and Target shoppers who they know buy those products. That strategy works even if Kroger and Target don’t sell Peloton bikes.

The problem is that, aside from Amazon, non-endemic growth (meaning growth among advertisers that aren’t carried by the store) is hypothetical.

Growing a non-endemic base isn’t on the radar for many retailers; even the biggest are still working on the basics just to collect the low-hanging fruit of brands they carry. But even if non-endemic brands were a priority, something would have to give for advertisers to jump in.

And we know what would have to give: price.

Retail media CPMs are bonkers. Buying impressions on a big-box store site can cost as much as the shiniest CTV inventory, in the $20 to $50 range.

Retail media CPMs are bonkers. Buying impressions on a big-box store site can cost as much as the shiniest CTV inventory, in the $20 to $50 range.

For non-endemic advertisers, retail media price points may be tough to swallow. Brands may pay that much when ads generate direct ecommerce sales and can be attributed later to store sales. But, again, those brands are obligated to re-spend a percent of sales on retail trade marketing. There isn’t the same constant downward pressure on pricing as the rest of programmatic, where every dollar must be justified or it’s going somewhere else next time.

The walled garden evolution

Another retail media growth block for the programmatic industry is the potential (not to say inevitable) transformation from primarily open programmatic infrastructure to a walled garden approach.

Retailers, even the biggest and most advanced, have leaned heavily on programmatic partners to support their online ad platforms. In June, Kroger launched an API with new ad partners Skai, Pacvue and Flywheel Digital. A week later, Sam’s Club rebranded its ad business, now the Member Access Platform, with partners The Trade Desk, LiveRamp and Criteo. And in the past few months, Walmart Connect, the company’s ad business, created a partner program that now has 14 ad-buying and ad-measurement vendors.

Wait, you might say, didn’t I say this transformation was bad for programmatic vendors?

Yes, and that’s because the current state of retail media is not the end state. Programmatic vendors are a current necessity that retailers begrudge.

Expanded partner programs, especially for sponsored product search ad specialists like Skai and Pacvue, are a sign that retailers need help sourcing demand for their sites. But if at some point they can do it themselves, they’ll drop the middlemen and take the margin.

Amazon Publisher Services once had a Fire TV inventory program that included dataxu (before it was acquired by Roku) and The Trade Desk and allowed open web ad IDs to be connected to Amazon sales.

“This agreement is an important indicator of where the industry is going, and will become just one of many, over time,” The Trade Desk CEO Jeff Green said in a memo at the time. “APS [Amazon Publisher Services, the company’s sell-side tech for Fire TV and other media] is supporting the open internet, in contrast to other big tech walled gardens.”

In retrospect, Green likely hopes the APS Fire TV partner program is not an indicator of where the industry is going. Because dataxu was kicked out after the Roku deal in 2019, and The Trade Desk was expelled in 2020.

Now only the Amazon DSP can buy Fire TV inventory and attribute it to sales data.

At some point, the Walmart DSP brought to you by The Trade Desk may just be the Walmart DSP.

It’s a better bet than the chances of open programmatic vendors getting a ten-billion-dollar slice of the retail media pie by the time it reaches $100 billion.

For more articles featuring James Hercher, click here.