If another war breaks out, if Apple tightens the screws even more on targeted advertising, if shopping shifted: Amazon would still report strong and healthy earnings.

If another war breaks out, if Apple tightens the screws even more on targeted advertising, if shopping shifted: Amazon would still report strong and healthy earnings.

Q2 this year is no exception.

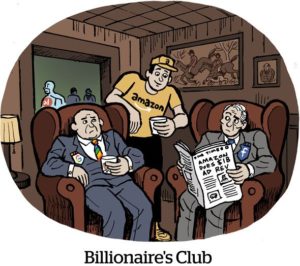

Earlier this week, Facebook reported its first-ever drop in year-over-year ad revenue and Alphabet hosted a defensive investor call, during which the C-suite said they had already seen advertiser pullbacks. The numbers also indicate that YouTube is headed toward its first annual revenue decline, with its growth rate on a steep decline.

“You’re probably wondering again about softness – potential for softness in [advertising] or macroeconomic factors,” Amazon CFO Brian Olsavsky said after an investor asked whether there was any concern about Amazon’s ad business given the pessimistic results reported by others earlier in the week.

“Right now,” Olsavsky said, “we still see strong advertising growth.”

Amazon Advertising generated $8.76 billion in Q2, up from $7.45 billion during the same quarter in 2021.

The advertising growth rate has slowed. It was up by half YoY by this point last year, then grew by a third, then by a quarter and is now up by a fifth. But it’s only normal that the growth rate is slowing now that the baseline is so large.

Amazon is also continuing to grow on top of its unusually high growth rates in 2021, whereas Google and Facebook had to warn investors that year-over-year comparisons would look strange, because growth shot up last year compared to 2020 and then tailed off this year. Amazon saw some the same trend, but was far more insulated from the dropoff.

“Our advantage is that we have highly efficient advertising [and] people are advertising at the point where customers have their credit cards out and are ready to make a purchase,” Olsavsky said. “It’s also very measurable, so when companies are looking to potentially streamline or optimize their advertising spend, we think our products compete very well in that regard.”

And since Amazon owns the credit card data and the shopper relationship, it can still optimize and attribute ad campaigns based on deterministic conversions, which used to be Facebook’s bread and butter.

The company also touted new ad platform products during its quarterly investor call – a change from previous calls during which Amazon execs acknowledged that the platform lagged other major players and required basic improvements.

One new beta product is the Amazon Marketing Stream, an API that lets advertisers and agencies update campaigns and ingest conversion data at an hourly cadence.

Amazon’s Ads team also collaborated with AWS on an insights product for the Amazon Marketing Cloud, which is Amazon’s data warehouse and clean room product. Amazon Marketing Cloud is akin to Google’s Ads Data Hub, and both are housed within their respective parent’s cloud platform.