Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

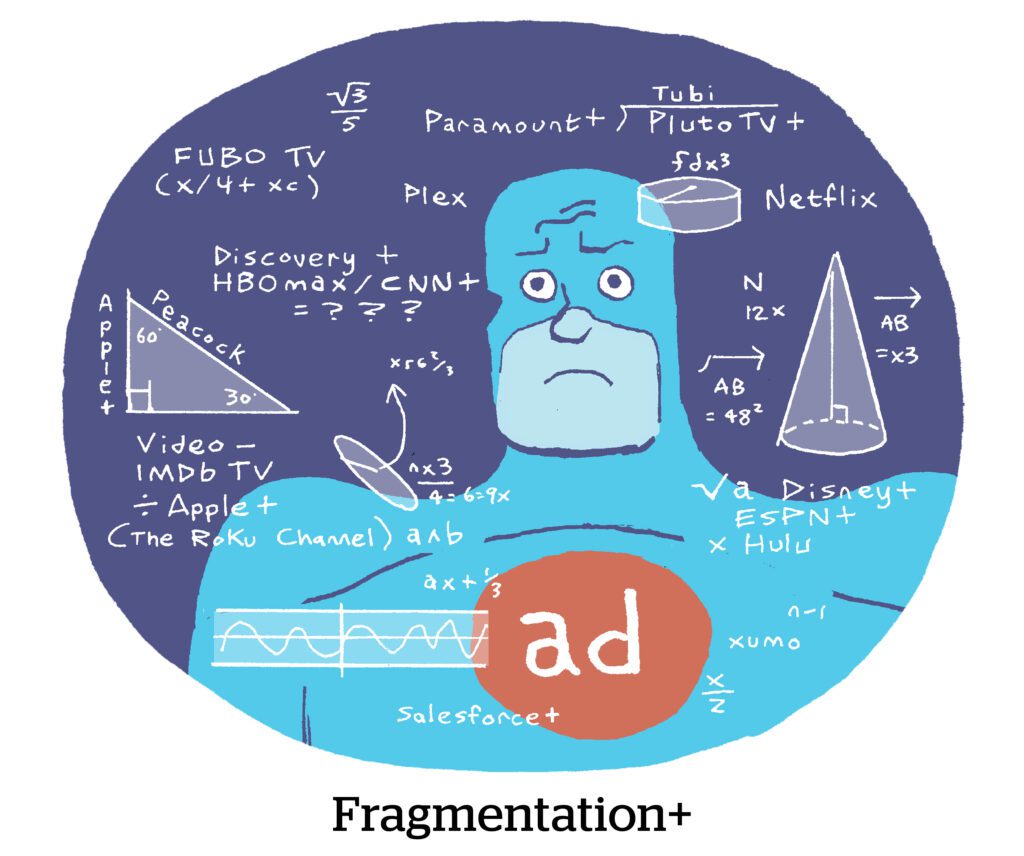

Going Nowhere FAST

Streaming TV services want people to pick a show already. Too often, viewers peruse a streaming app for a bit and never actually settle on a show, then try another app.

It’s an underappreciated linear advantage that something is always up and running when the television turns on.

“Everyone needs a FAST platform,” Kelly Metz, Omnicom’s managing director for advanced TV activation, tells Marketing Brew. “There needs to be an equivalent to broadcast in the streaming world.”

FAST stands for “free ad-supported streaming,” and the value prop is that FAST networks just play like a TV channel, as opposed to on-demand content. Someone who browses a carousel of assorted programs under a Netflix “reality show” category, for instance, may never be inspired to click. But if a channel with preprogrammed reality shows came on to start, they may have happily stuck with the selection. Or, at least, that’s the idea.

As Netflix and apps like Disney+ and HBO Max add advertising, there will be a stronger effort to speed-load channels or programs to get that sweet, sweet ad load, rather than let users browse and potentially exit.

Dead Letters

Is the newsletter bubble ready to burst?

Legacy news publishers and startups alike invested big in newsletters as a subscription driver. And newsletters did prove to be a valuable source of first-party data and recurring revenue.

But the “peak newsletter” moment may have passed, writes The New York Times.

For example, The Atlantic is rethinking its newsletter program, which incentivized new subscriber sign-ups with writer bonuses. Under that program, newsletter writers earned a base pay of $100,000, with a chance to quadruple that if they converted 14,500 subscribers. The Atlantic scaled back the program as it reassesses how likely readers are to maintain subscriptions.

Meanwhile, Meta shut down its Bulletin newsletter service earlier this month. And Substack, the category leader, is cutting the upfront payments it used to lure writers.

But the newsletter isn’t dead just yet. Mailgun, an email delivery service, says digital publishers have quadrupled sending volume over the past two years. But, as the volume of newsletters goes up … quality does what?

Think Inside The Box

A class-action lawsuit in the UK is targeting Amazon’s Buy Box product placements.

The suit claims Amazon uses a “secretive and self-favoring algorithm” for the Buy Box, Bloomberg reports. The Amazon Buy Box drives serious purchase traffic to private-label brands and has an inscrutable methodology for who gets the coveted placement.

From Amazon’s perspective, the algorithmic approach is important. Brands can’t buy the spot, so, ostensibly, it’s a better actual fit for shoppers.

The suit is also one of the first in a potential deluge of British class-action trials against US Big Tech. Class-action suits are common in America, but not so much in Europe. At least one European plaintiff even tried to bring a class-action GDPR suit in a US court, because class-action laws are stronger in America. (It was tossed by the judge.)

The UK is making its class-action laws more like America’s, where a company can sue on behalf of, say, an entire mobile service provider’s subscription base if the company is taking advantage of them. (Ever gotten a letter or email informing you that you’re entitled to, like, a 16-cent settlement from a case you weren’t aware of?)

But Wait, There’s More!

Here is how much TikTok, Meta and other social platforms are paying creators. [Digiday]

Figma CEO Dylan Field on why he sold to Adobe. [TechCrunch]

TikTok’s secret plans for an online shopping empire in the US. [Semafor]

Snap plunges more than 25% on third-quarter revenue miss. [CNBC]

The South Korean super app Kakao went down this weekend, and it put life on halt. [NYT]