Tracking is a mess. Attribution is broken beyond repair. IP address identity data may go the way of the dodo.

Which means marketing mix modeling is back, baby!

If you need proof, Google launched its open-source MMM model, called Meridian, last month.

A marketing mix model (MMM) is a way to attribute ad spend channel by channel over weeks or months. It’s the old-school method brands used to measure TV, radio, out-of-home and other ad campaigns to hopefully understand which channels contributed the most to sales or ROI.

With growing access to user-level data online, however, MMM gave way to multi-touch attribution.

But now, as signal loss becomes more acute, Google, Meta and other walled gardens are embracing MMM – once considered as outdated as rotary phones or dial-up internet – as a foundation for how advertisers should run attribution.

“As the privacy and regulatory environment continues to change, MMMs are once again becoming an increasingly important part of an effective measurement strategy,” Harikesh Nair, Google’s senior director of data science who penned the blog post introducing Meridian, told AdExchanger.

Platform MMM

Because mix modeling works without relying on device IDs or user-level information, it’s a good fit for Google’s Performance Max and Facebook Advantage+ Shopping Campaigns.

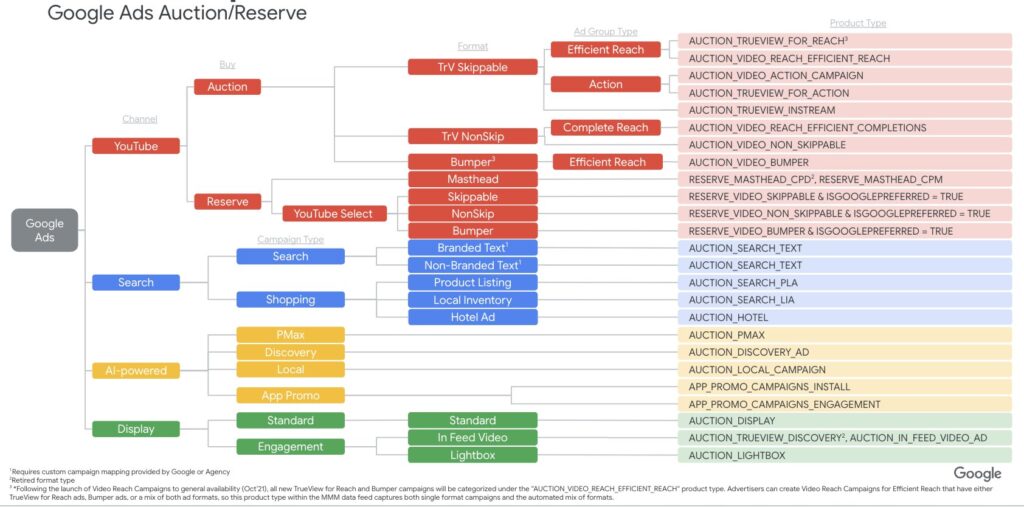

Those machine-learning-led ad products treat each company’s entire product suite as one channel. For instance, PMax spans Gmail, Search, YouTube, Google Maps, the Google audience network and more.

But Google doesn’t allow visibility into each media property via PMax. All of Google becomes one channel. That’s a huge problem for deterministic attribution, but a good fit for MMM, which measures by broad channel categories. In that sense, “Google” becomes like “TV” or “radio.”

Although Google only launched Meridian in March, it was built on Google-authored open-source code called LightweightMMM that’s been around since 2022. Meta released an open-source MMM of its own, called Robyn, in 2020. Even Uber has been in on it, with an open-source MMM called Orbit launched in 2021. (Amazon launched an MMM in 2022, too, but it isn’t open source.)

Why all the open sourcing?

One rationale for open-source development is the pace of innovation, since any developer can contribute to the code.

Nair said Meridian had always been planned as an open-source product to help encourage industry collaboration.

Google often turns to open source to help with product development.

Meridian emerged from a GitHub repository of almost 60 other projects related to Google ads and measurement, including tools such as a library of matched markets for geo-testing experiments, a method for clustering multilingual search terms and a predictive customer lifetime value model.

Another important factor for open-source MMM is standardization, according to Alvin Lim, VP of data science at attribution company Measured. Open-sourcing MMM products creates a good environment to foster industrywide consensus, which shapes development.

Still, it will be tough to bridge MMMs like Robyn and Meridian.

Google’s version, for example, democratizes the tech a little more than Meta’s Robyn. Whereas Meridian uses Python, an accessible coding language familiar to marketers and developers, Robyn uses the coding language R, which is more familiar to statisticians and data scientists.

It’s also important to note that “open source” doesn’t mean that just anyone can easily pop in and use these MMM models, Lim added. Even if Meridian is technically more accessible, an organization still needs data analysts and rigorous oversight.

And the hope for eventual standardization doesn’t mean all these platforms are working together hand in hand, either.

Having an open-source model as an alternative to Meta’s Robyn is strategically important for Google. If marketers eventually standardize on one version of MMM, Google wants it to be Google’s version.

The Google angle

Open source aside, Meridian includes unique, built-in selling points for Google.

For instance, if an advertiser is working with Google Ads to measure a campaign, the open-source model includes ways to gather reach and frequency data from YouTube and incorporate Google search data, both of which are considered indicators of organic interest in a product or business.

For instance, search queries are sometimes used as a metric for TV ads, because if a brand runs a TV campaign in Chicago, say, it should see a related spike in local search queries. By incorporating search query volume into its MMM model, Google provides an exclusive way to sharpen the model and attribute credit to certain channels, including, of course, its own.

“You can really see how well Google understands and has mapped its own auction environment with Meridian,” said Mike Ryan, head of ecommerce insights at the consultancy Smarter Ecommerce.

Meridian maps out the Google ad system in what Ryan refers to as “intricate, loving detail.”

And that’s not a criticism, he said. It’s no surprise that Google knows its own system better than anyone else.

But the counterpoint to Google’s level of detail and sophistication with its own platform and media is that it doesn’t know other channels as well. Meridian does seem to over-index to Google properties, Ryan added. “That’s the criticism.”

Lim also noted that Meridian is still missing a great deal of necessary inputs and steering factors for an MMM model. Although it deftly forecasts and attributes for Google-owned properties, many external factors must be incorporated manually by the advertiser, or outputs from the model are skewed. Think seasonal shopping patterns, price fluctuations, competitor pricing, offline or other promotional activity and macroeconomic factors.

Open-source tools aren’t like Shopify apps, Ryan said, that can be turned on and immediately start to hum. These tools require a great deal of expert setup and maintenance to work at all.

It’s too early to tell how the differences between Meridian, Robyn and other MMMs may work themselves out or how the tools will contrast when reporting results. Since they’re free, though, marketers can use them together.

But don’t let words like “free” and “open source” delude you into believing these models aren’t a further effort to bind businesses to the Google or Meta platforms.

“The exclusive part comes when a brand is deciding where to spend the next incremental marketing dollar,” Ryan said. “Who will they trust?”