Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Ad Nauseam

Launching an advertising business is almost always trickier than it might seem on the surface. Beyond the mechanics of ad serving, verification and measurement, introducing ads complicates a business model in unexpected ways.

Take Netflix, which launched ads, like, a minute ago. It’s obvious why ad tech vendors and agencies are amped up about AVOD Netflix, but by making revenue observable through ads, Netflix also gives stars and producers a way to claim a cut.

“A show that does really well will get more advertisers and more revenue will flow to Netflix,” Jeremy Zimmer, CEO of major Hollywood agency United Talent Agency, tells the Financial Times. “Therefore, our clients who created that show should be compensated for that additional revenue.”

But that’s just not how Netflix works. Or maybe that’s just not how Netflix used to work. Apparently, all bets are off.

“They’ve changed all the rules [by saying] it’s no longer an ad-free environment,” Zimmer argues.

Netflix historically struck production deals tied to upfront one-time payments for studio talent rather than doling out a cut of the profits. And why not? Netflix had no box office take or DVD sales to divvy up, only intangible subscription gains. The question now is whether Netflix will hold the line on rev-sharing when it comes to advertising.

Make It Count

The race is on to become TV’s main measurement currency alternative.

On Tuesday, Warner Bros. Discovery struck a deal with VideoAmp for TV ad measurement after a test-and-learn phase that WBD ran with alt currencies last year.

The broadcaster has been looking for solutions to package audience guarantees across both linear and streaming.

WBD especially hopes to improve counting accuracy for linear viewership. According to the announcement, advertisers that used VideoAmp viewership data during the media planning test last year generated 1.2 times greater reach per spot within the WBD portfolio.

Warner Bros. Discovery should be able to “more confidently measure advanced audience segments across the data-driven linear business,” Andrea Zapata, EVP and head of ad sales research, measurement and insights at WBD, tells AdExchanger.

NBCUniversal has a similar partner setup for advanced audience guarantees, but it counts VideoAmp, iSpot.tv and Comscore among its partners.

WBD also plans to use multiple measurement partners, Zapata said, but the broadcaster’s “core focus” for now is preparing to transact against alt currencies across its portfolio.

View From The Top

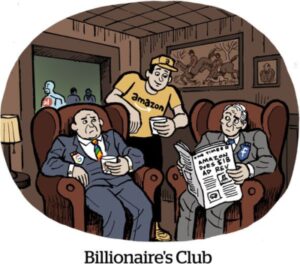

Despite Google’s and Meta’s ongoing privacy-related migraine, the two remained way ahead on the top-10 list of digital ad earners last year, with $168 billion and $113 billion, respectively, Digiday reports based on Insider Intelligence estimates.

Amazon, at $38 billion, is fourth overall and just a tad short of Alibaba at $41 billion. ByteDance, which owns TikTok, rounds out the top five at $29 billion.

Apple’s ad revenue was just $7 billion, behind Microsoft at $12 billion. That sets them alongside Chinese tech giants Tencent ($12.51 billion), Baidu ($10.33 billion) and Kuaishou ($8.37 billion).

(It’s worth noting that Apple’s $7 billion in ad revenue doesn’t count the $15 billion or so that Google pays per year to be the default search and advertising engine for iOS devices.) And Microsoft Advertising isn’t Microsoft’s only ad-related business. LinkedIn is a separate fiefdom with its own multibillion-dollar advertising biz.

By 2024, Insider forecasts that Amazon will separate itself as the clear bronze medal winner behind Google and Meta – but Google and Meta will pull further away. Microsoft Advertising is expected to grow 33% by 2024, and Google a (mere) 20%. Still, those percentages translate to $4 billion in raw growth for Microsoft and $31 billion for Google.

But Wait, There’s More!

A Google research report provides a unique window into monitoring for low-quality or machine-generated content. [Search Engine Journal]

Punchbowl adds text alerts as outlets seek Twitter alternatives. [Axios]

The copyright death (and rebirth) of Mickey Mouse. [Puck]

Startups spring from the ashes of Big Tech layoffs. [Reuters]

You’re Hired!

IAPP appoints Joe Jones as its new director of research and insights. [release]

Constellation appoints former Pfizer exec Melissa Gunn as SVP of customer success and strategic partnerships. [release]

Garrett MacDonald is named chief commercial officer of AUDIENCEX. [LinkedIn]