As April 15 marks the deadline for filing personal taxes in the US, it’s crucial to bring attention to a less acknowledged but equally significant tax in the CTV landscape. Unlike the annual tax day, the ad tech tax is a perpetual drain on advertisers’ budgets, diminishing their return on investment with every campaign run through the programmatic CTV pipes.

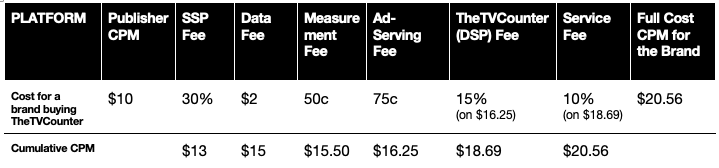

To best illustrate this, let’s run an autopsy on a TV campaign managed via the “largest CTV” DSP (not Google 🙂, but let’s call it TheTVCounter). TheTVCounter will add a myriad of often hidden fees, inflating a hypothetical $10 inventory CPM to a whopping $20.56 full-cost CPM.

Let’s break down these costs:

- SSP Fees: For TheTVCounter to access the inventory, it must buy programmatically from the SSP. The SSP needs to be compensated for this – typically, 30%. TheTVCounter will completely mask this, instead suggesting it’s the direct publisher inventory cost.

- Data Fees: Targeting requires data, and data costs money. For the sake of this exercise, we assume $2. TheTVCounter will show this.

- Measurement Fees: TheTVCounter doesn’t come with measurement. For the sake of simplicity, we are assigning $0.50 here (i.e., this varies by measurement partner).

- Ad Serving Fees: Notoriously inflated, the fee is an exorbitant $0.75 CPM.

- DSP Fees: The fees listed by TheTVCounter, clearly visible in the contract. Apart from data and measurement fees, this is the only true visible part of the brand and will often be perceived as reasonable. In addition to the fees above, DSP fees are also sneakily applied to data fees, measurement fees and ad-serving fees. This is nothing but a tax levied on a tax. Whoa!

- Service Fees: Optional yet prevalent, these fees can add layers of costs for additional services provided by TheTVCounter.

The true tax rate is 106%, which makes personal taxes look like a bargain. Except for TheTVCounter, nobody wins. In particular, brands see a massive portion of their budgets siphoned off in fees, and/or CTV publishers only get a fraction of the money brands were willing to pay.

The case for direct integration

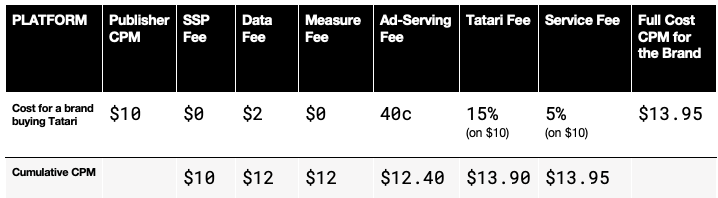

Tatari’s media execution strategy focuses on direct relationships with publishers. To be clear, we are not talking PMPs (short for private marketplace pricing). A PMP is a pre-negotiated floor price for the publisher.

For some reason, DSPs like to position this as an advertiser max price, while, in reality, it’s the minimum. Direct media execution, instead, bypasses the programmatic pipes and places the orders directly into the publisher ad server.

Think of it as an automation of direct insertion orders, made possible with Tatari’s publisher technology stack (TheViewPoint) and integration with the leading CTV ad servers, e.g., FreeWheel. This comes with significantly lower taxes and cost savings.

To make a meaningful comparison, we assumed equal data fees. Note that Tatari offers free measurement, no SSP fees and no programmatic buying. The DSP/service fees are placed on the media only, which means no double taxation.

The comparison between programmatic CPM rates and Tatari’s direct CPM rates further underscores the substantial cost savings achievable through direct integration. Advertisers can realize an average of 32% savings, directly translating into enhanced campaign performance and ROI.

Reevaluating the need for DSPs and the programmatic model

As we navigate the complexities of the ad tech landscape, it’s imperative to critically assess the true cost of programmatic advertising and explore more transparent and efficient alternatives.

The role of DSP technology is uncertain. Direct media execution presents a compelling alternative beyond avoiding taxes. It aligns brands and publishers, adds transparency and reduces fraud. It also fosters stronger partnerships between advertisers and content providers, paving the way for more strategic and impactful advertising engagements.

By embracing direct integration and challenging the status quo of DSP reliance, advertisers can reclaim control over their advertising spend, ensuring their budgets deliver maximum impact.

We’re calling for April 15 to be a CTV tax review day! Liberate your CTV advertising strategy from the unnecessary burden of the ad tech tax.

For more articles featuring Philip Inghelbrecht, click here.