“Thank god we’re done with shrinking quarters,” Netflix co-CEO Reed Hastings told investors during the company’s third-quarter earnings call on Tuesday.

Although the streaming giant lost roughly 1 million users in Q2, Netflix gained 2.4 million subs in Q3, which helped boost the company’s revenue by 6% year over year.

The question is: What happens to Netflix’s subscriber count when it flips the switch on ads in less than two weeks?

How much will ads add?

According to CFO Spencer Neumann, Netflix is projecting 4.5 million new subscribers for Q4, spurred by the lower price ($6.99) for its ad-supported tier.

Netflix doesn’t appear to be worried about cannibalizing its existing subscriber base.

COO Greg Peters stressed that sign-ups for Netflix Basic with Ads will mostly be net new subscribers rather than existing subscribers hopping to a cheaper plan.

“We don’t see a lot of members switching plans,” he said, adding that membership plans are typically a “pretty sticky choice.”

Meaning Netflix has an uphill battle if it wants to woo subscribers away from the competition.

Battle cry

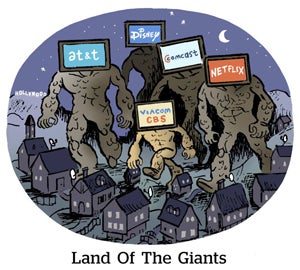

Competition is a serious “near-term limitation” for Netflix, Neumann said. Subscribers aren’t churning because they’ve stopped streaming – they’re switching to other streaming service providers.

They don’t call it the streaming wars for nothing.

Netflix “and Disney will be two of the biggest brands investing heavily in the premium space,” Hastings said. “We’re battling it out to see who has the best content and the lowest prices.”

Back to the basics

Although Netflix is new to ads, it’s not for want of buyer demand.

Netflix is sold out of its inventory for launch and actually had to turn some buyers away, Peters said. Although that speaks to the level of interest, it also speaks to the lighter ad load Netflix is planning for its ad-supported tier.

But any ad buyers looking for sophisticated targeting won’t find it. Netflix acknowledges that ad targeting for its Basic with Ads plan will also be, well, pretty basic.

“We have relatively basic targeting capabilities [at launch], including contextual and genre-based,” Peters said.

One reason Netflix is launching with limited targeting options is because it accelerated the release of its ads tier.

Although Netflix is planning to collect gender and date of birth at sign-up, that information won’t be used to support age and gender-based targeting (yet).

But Netflix knows that the novelty of its ad inventory could wear off if it doesn’t eventually provide more targeting levers for advertisers to pull.

“Our job is to move from [basic targeting] to what buyers expect in a digital world with fully addressable audiences,” Peters said. “We’re building in a lot of capabilities over the next few quarters to make our ad offerings increasingly attractive by checking a bunch of boxes they have.”

On the measurement side, Netflix recently announced partnerships with DoubleVerify and Integral Ad Science to handle ad verification, viewability and brand safety, and with Nielsen for audience measurement (although some ad buyers are less than enamored with Netflix’s choice of Nielsen).

Teaming up

Netflix also reiterated where Microsoft fits into the equation.

The industry was surprised that Netflix chose Microsoft as its ad sales partner over other companies with deeper roots in connected TV advertising.

But Netflix says its focus on data privacy factored into its decision.

“We’re very cognizant of privacy,” Peters said, “and all the data we [collect] will only be used to deliver more relevant ads on Netflix. We’re not using that data in any way, shape or form for profile-building off of Netflix.”

Pass it on

Netflix is also very cognizant of password sharing, which is eating into its bottom line.

The streamer announced Profile Transfer earlier this week, which allows nonsubscribers to keep all of their settings, including their personalized recommendations and viewing history, when they stop piggybacking and start their own membership.

“We want to continue supporting consumer choice and customer centricity,” Peters said, “but we also want to make sure we’re getting paid when we provide a service.”

Netflix plans to get stricter about password sharing in 2023 and will consider that revenue stream as complementary to its ad sales, Peters added.