Well, it’s official. Netflix has ads starting in November.

The Netflix Basic with Ads plan is launching in 12 countries on November 3, including the UK, Italy and Korea, and will cost viewers $6.99 a month (take that, Hulu). Canada and Mexico get first dibs on November 1.

Netflix was originally planning an ad tier for 2023, but the streaming wars are moving full steam ahead. Disney announced ads will hit Disney+ in December, so Netflix decided to hurry up the process quite a bit in order to compete for advertiser budgets.

Besides beating Disney on launch date, Netflix also wants to have the lightest ad load. Peacock has been bragging about having the streaming landscape’s lightest ad load for years, which hovers at about five minutes, so Netflix is promising no more than four to five minutes of pre- and mid-roll ads per hour of content. While shorter six-second ads have become popular on CTV, Netflix will run 15- to 30-second spots at launch.

Netflix is taking a conservative approach to targeting. At launch, Netflix will start off with broad audience targeting capabilities such as by country or by genre, including letting advertisers target against Netflix’s top ten shows.

“Netflix [user] data will only be used to support advertising experiences on Netflix, and won’t be used to build profiles for targeted advertising elsewhere,” said Jeremi Gorman, Netflix’s new president of worldwide advertising, during a press conference call on Thursday. Gorman was Snap’s chief business officer before joining Netflix a couple months ago.

Netflix also revealed more of its ad tech and measurement partner lineup, after surprising the ad tech industry with its choice of Microsoft as its ad sales partner over the summer.

“None of this [progress] would’ve been possible without Microsoft,” Gorman said. “Microsoft is supporting us both on the tech and the sales side, as well as focusing on a privacy-first approach for our consumers.”

For ad verification around viewability and valid traffic, the streaming titan signed deals with both DoubleVerify and Integral Ad Science (IAS) earlier this week. Those integrations won’t be complete until Q1 of next year. Brands will also be able to exclude their ads from content that isn’t brand suitable.

And on the audience measurement front, Netflix tosses in a vote for Nielsen. The streaming giant will be using Nielsen’s Digital Ad Ratings tool, which will become a part of Nielsen ONE starting in 2023.

Netflix also underscored its rationale for launching ads, which is to curb subscriber churn with cheaper pricing options.

Netflix has been losing subscribers to its competition rapidly – it recently celebrated losing “only” one million subscribers instead of two million.

“A lower consumer-facing price – with good incremental ads monetization – will help us both grow membership and, at the same, grow an incremental revenue and profit stream,” said Netflix Chief Product Officer Greg Peters on the conference call.

Subscriber churn is why Netflix’s choices for its ad-supported tier reek of competition. Besides rushing to beat Disney to the punch getting its ad-supported tier out to market first, Netflix is also being strategic about pricing (not to mention poaching two of Snap’s executives).

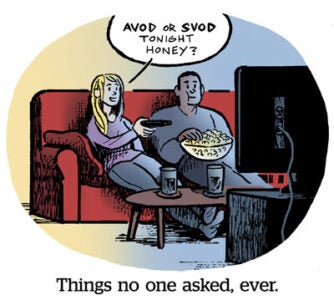

Netflix’s $6.99 per month price beats Hulu’s AVOD option, which just went up in price from $6.99 to $7.99 per month. Disney also plans to charge $7.99 per month for ad-supported Disney+.

It’s early days for Netflix’s ad sales, but not for want of demand. While the bumped-up launch feels rushed, and the company is brand spanking new to ad sales, Netflix has already been working behind the scenes to sell out its inventory.

“We’ll be working with hundreds of advertisers at launch, from major automotive marketers to CPG companies,” Gorman said. “Our inventory for launch is nearly sold out.”