Here’s another bit of jargon for your industry hype lexicon: “g-commerce.” It’s ecommerce, but for gaming.

So, why does gaming need its own version of ecommerce?

Gamers tend to be highly engaged with playing their favorite titles for hours every day – and they also need to buy stuff, said Nicholas Longano, founder and CEO of SCUTI, a rewards-based g-commerce platform that aims to replicate an Amazon-like online shopping experience inside of gaming apps.

On Tuesday, SCUTI announced its $10 million Series A, bringing its total funding to $17 million since the company was founded in 2019.

SCUTI’s technology is integrated with more than 120 games that have a collective audience of 50 million monthly users. In addition to offering rewards, SCUTI also sells display, video and audio inventory on its shopping platform, as well as intrinsic in-game ads (think digital billboards) placed inside certain titles.

New markets & merchandising

Longano described the lead contributor to this Series A as “private syndication of investors” and declined to name any specific members.

SCUTI’s seed funding was handled by investment firm Fasanara Capital, which was not involved in the Series A round.

But Longano did share that, as part of the new round, SCUTI is adding Mario Alioto, former EVP of business operations for the San Francisco Giants, to its advisory board.

Alioto – the man popularly credited with pioneering player bobblehead giveaways at baseball stadiums – will be instrumental in striking deals with major sports leagues and professional franchises to sell their branded merchandise and memorabilia within SCUTI, Longano said.

And another top priority for 2024 is entering into a partnership for access to a major publisher’s gaming IP, what the video game industry refers to as an AAA game.

SCUTI is also looking for help with localizing its platform as it expands beyond the US into new tier-one gaming markets, including countries across Latin America and Asia-Pacific. The company will prioritize striking partnerships with retailers that can sell and ship merchandise in these markets.

But most of the Series A funding will go toward hiring, including sales, ecommerce and programmatic support people. SCUTI currently has 29 employees with plans to bring on an additional 16 during the first half of this year.

The g-commerce game

Building a dedicated ecommerce platform for gamers may seem like a lofty goal. But Longano and his team just might have the gaming industry expertise to pull it off.

Longano was previously president of new media for in-game ad company Massive before it was acquired by Microsoft in 2006. He considers SCUTI to be a spiritual successor to Massive and referred to his startup as “the Amazon of games.”

The name “SCUTI,” in fact, is an attempt at one-upmanship, he said. Amazon may be named after the biggest river and rainforest on Earth, but SCUTI is named after one of the largest known stars in the universe.

Still, SCUTI obviously has a long road ahead before it even comes close to competing with Amazon.

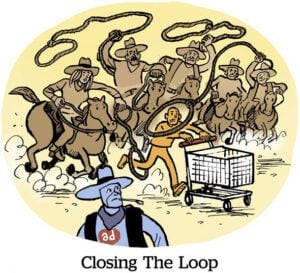

But it’s not trying to reinvent the ecommerce wheel. SCUTI is applying tried-and-true ecommerce tactics to video games, an area that remains underserved by advertisers, Longano said. One reason for that is because they need easier-to-use technology.

SCUTI’s platform combines a shopping interface for real-world items (and, eventually, digital purchases) with digital advertisements. Users who opt in see personalized ads and product recommendations based on their purchase data and the games they play.

The platform is generally available for users age 14 and up. To this point, it has only been used to serve targeted ads to users over 18, Longano said.

Today, SCUTI sells roughly 80% of its supply programmatically, with the rest coming from direct sales, Longano said. He anticipates that the programmatic side will grow to 90%.

SCUTI shares revenue from in-app purchases and ads with its network of game developers. But the real selling point is the g-commerce aspect, which gives publishers the opportunity to expand monetization beyond advertising other games.

Plus, sales of physical goods are not subject to any app store fees. SCUTI has its own payment processor to avoid Apple and Google taking their cut of digital purchases.

Ultimately, SCUTI’s business model isn’t about trying to change consumer behavior, Longano said, but rather to reach shoppers where they’re already active and to do so across more markets.

“We’ve proven the case that gamers will shop prolifically, especially if it benefits their game experience,” he said. “Now, it’s about delivering the experience outside of the US.”