By John McDermott

The three largest walled garden advertising platforms are investing in new measurement solutions, namely media mix modeling (MMM) – even if it means giving credit to their competitors for driving conversions.

It’s unusual for any major ad platform, let alone the Big Three, to embrace a measurement tool like MMM that uses statistical methods to show the effectiveness and influence of competing advertising channels.

MMM is typically conducted by the brands themselves, which use statistical models to analyze their sales and media spend data.

But measurement has been so hampered by recently enacted privacy restrictions that Meta, Google and Amazon are finding that any measurement tool is better than not demonstrating attribution at all.

“I’m not especially surprised everyone is getting in on this fun,” Kieley Taylor, GroupM’s global head of partnerships, told AdExchanger. “Everyone is recognizing [that] signal is going away.”

MMM mania

Meta was first to the party three years ago when it quietly released Robyn, an open-source tool that automates much of the modeling and other mathematical aspects of MMM. Robyn doesn’t rely on cookies, pixel data or any form of personally identifiable information.

It makes sense that Meta started working on Robyn right around the time Apple began making it easier for iPhone users to opt out of cross-app tracking through its AppTrackingTransparency (ATT) framework. ATT made it virtually impossible for large advertising platforms to determine whether their ads led to conversions. Facebook was heavily affected.

The policy had such a drastic effect on Facebook that some claimed the company was in a “death spiral,” although it’s since been able to rally thanks to ongoing investments in AI and privacy-enhancing technologies.

The gang’s all here

Amazon and Google are also adapting their measurement approaches to ongoing privacy changes.

In November, Amazon launched an automated MMM application to make it easier for brands to export their Amazon Ads data for MMM analysis.

In November, Amazon launched an automated MMM application to make it easier for brands to export their Amazon Ads data for MMM analysis.

“We believe that MMMs are a useful tool for advertisers to assess ad effectiveness,” an Amazon spokesperson wrote in a statement to AdExchanger, adding that Amazon’s first-party retail data is especially helpful for MMM analysis.

Google appears to be following suit on the MMM front.

The company told AdExchanger that although it doesn’t have anything to announce now, it’s looking into building an MMM tool to help brands measure advertising campaign performance across various channels.

“We are currently in the early stages of exploring MMMs,” a Google spokesperson wrote to AdExchanger in response to questions about the company’s MMM plans. “Any solution we explore will be open to the industry to leverage and validate.”

Reject modernity, embrace tradition

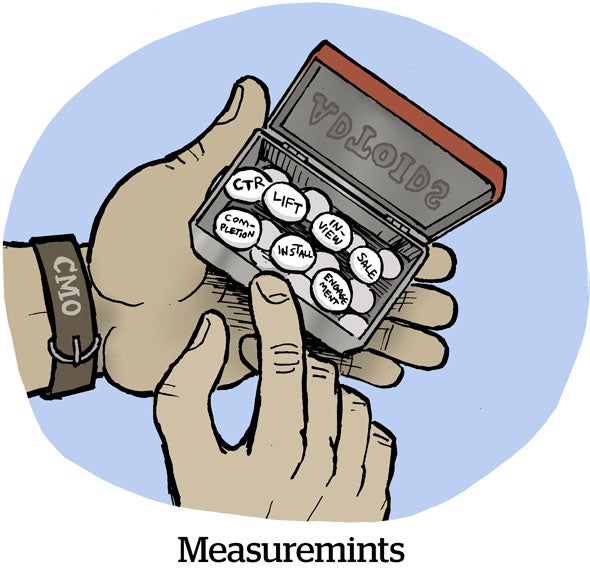

It’s perhaps peculiar in this age of data-driven advertising to see Meta, Amazon and Google advocating a measurement technique that’s been around for decades.

Agencies first started using statistical analysis in the 1960s to determine how spend on various advertising channels affected sales. (Mad Men fans might remember the later seasons, when Don Draper felt threatened by the agency introducing computing to inform advertising strategy.)

MMM fell out of fashion with the rise of digital advertising, however, because brands could target, track and measure their campaigns with one-to-one precision.

“MMMs are longitudinal in analysis and go along with the longer timescales of measuring traditional channels,” GroupM’s Taylor said. “Whereas, with digital, you get more fine-grained results, measured all the way to direct sales in some instances.”

But MMMs are in the midst of a revival now that more precise methods have been restricted due to privacy concerns. And as marketers adopt old-school measurement approaches, particularly MMM, the large platforms want to make sure they have a say in how MMM analysis is conducted.

“We understand some companies have or are building in-house MMM capabilities,” a Meta spokesperson told AdExchanger, “and Robyn can provide them with an additional measurement and analytics resource.”

New data, old approach

But although MMMs have an old-school rep, they aren’t all that old-school anymore. Modern MMM models benefit from the vast troves of data collected by the large platforms.

Amazon can feed its MMM models with first-party data from the largest retail media network in the world. Meta can offer first-party data on billions of users across its family of apps. Likewise, Google can tap into data culled from YouTube, Search, Chrome and Maps.

These capabilities make this new crop of MMMs attractive, especially for many small- to mid-sized brands and agencies that might not have the time, money and/or technical resources to build one from scratch.

These capabilities make this new crop of MMMs attractive, especially for many small- to mid-sized brands and agencies that might not have the time, money and/or technical resources to build one from scratch.

“If you’re a 10-, 20- or 30-person company, and you have a five-person marketing team, you’re not going to make your own MMM solution,” said Sean Odlum, chief product officer at performance marketing agency Tinuiti.

Implicit in that comment, though, is that platform-provided MMMs are less appealing to agency holding groups and large, established brands with sophisticated in-house data operations. The fundamental issue is whether the results are trustworthy.

Grading their own homework

For years, marketers have complained about the lack of objective, third-party measurement tools for the walled gardens. Large platforms such as Facebook and YouTube can essentially “grade their own homework” when it comes to determining whether their ads performed well.

An MMM provided by Meta, Google or Amazon suffers from the same conflict of interest.

In the words of one agency executive who spoke on condition of anonymity: “Any large advertiser, anyone that pays a largeish agency, anyone spending a large amount of money on any number of channels, is not trusting Facebook’s cross-platform metrics.”

If these three tools are truly unbiased and accurate, then they should all deliver near-identical results and treat all advertising channels equitably. But according to an agency executive who has used Meta’s Robyn, the tool tends to show more favorable results for digital advertising channels, specifically Facebook. (Shocking.)

For example, Robyn doesn’t do as well measuring terrestrial radio and broadcast TV, the executive added, which is not surprising considering who built it.

“I don’t think there’s anything dishonest about [Robyn] preferring digital channels,” the agency executive said. “But to the extent Meta can get agencies like us using [the tool], it’s going to maximize the chances that Facebook’s advertisements continue to look productive.”

In other words, if you let someone grade their own homework, don’t be surprised when they give themselves an “A.”

Updated 9/8/23 to include a comment from Meta.