There is no shortchanging the complexity of today’s media industry or the impact that the ever-expanding range of choice has on effective cross-media measurement. That complexity, however, doesn’t grant marketers any leeway when it comes to delivering on business objectives. In reality, increased complexity amplifies accountability.

And managing complexity isn’t enough. Marketers need to find ways to keep things simple, streamlined and clear – often with reduced budgets and fewer resources. Marketers are on the hook to deliver for their businesses and justify their investments. In that way, the complexity of today’s media landscape has become both a unique and a universal challenge.

The proliferation and growth of new media channels presents one of the most pressing difficulties in the quest for effective cross-media measurement, especially as audiences increase their connected TV (CTV)[1] usage. Yet being flexible will be essential – the future of cross-media measurement will need to be adaptive to many new channels as they emerge.

A spotlight on streaming

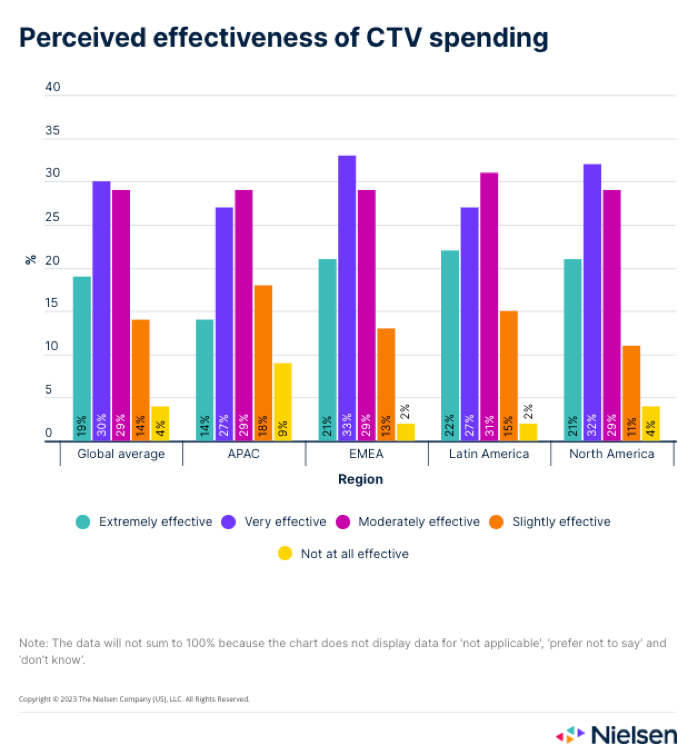

Marketers know that streaming is where the audience is, and they’re adjusting their marketing plans accordingly. In fact, the 2023 Nielsen Annual Marketing Report found that, on average, 45% of ad budgets globally are shifting to CTV channels. The flip side, however, is that marketers don’t yet see the value in their CTV spending, as only 49% of marketers say CTV is either very or extremely effective.

Given the appeal of streaming, it makes sense that marketers are leaning in – even though the perceived effectiveness is currently low. When any new channel gains audiences, marketers need to balance between spending where they know the audience is and the associated risks of the unknown.

But measuring audiences across the streaming landscape won’t be marketers’ last hurdle. It’s simply the one they’re facing now. Widespread connectivity will continue opening the doors to new options, all of which will have their own measurement obstacles .

Tools and solutions that measure engagement at the channel level have never provided marketers with a holistic view of how individual people are engaging across all channels. Historically, the road to cross-media measurement has relied on marketers’ ability to aggregate channel measurement, then surmise the complete consumer journey .

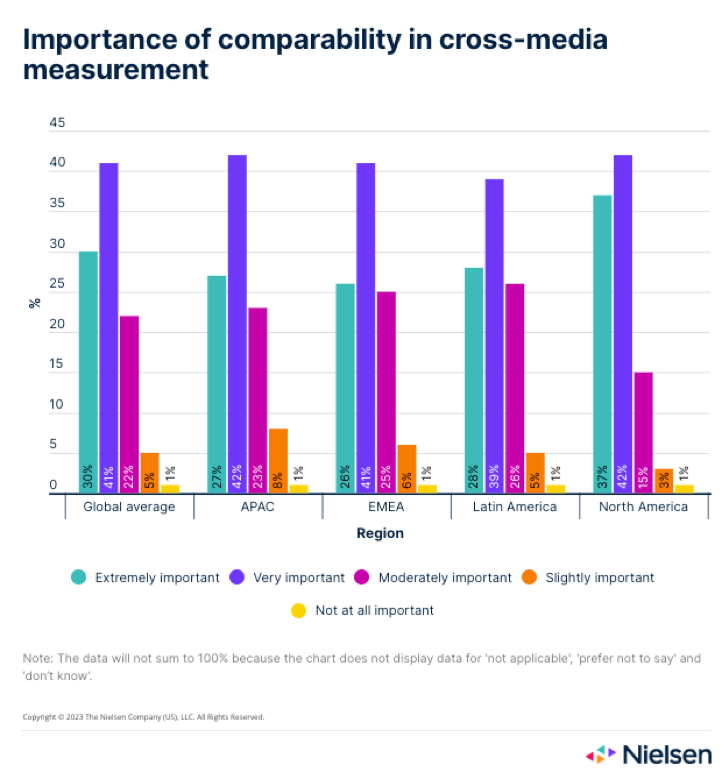

Channel proliferation and increasing privacy regulations make that a taller order, and sentiment from global marketers reflects the increasing difficulty: Only 54%, on average, say they’re extremely or very confident in their ability to measure for full-funnel ROI across channels. Still, 71% overwhelmingly acknowledge the importance of arriving at a single view of audience engagement across channels (i.e., comparable, deduplicated measurement).

If marketers truly desire that single view of audience engagement across every touch point, they’ll need to abandon any tool or solution that isn’t complementary from a data perspective. Marketers should consider using as few tools as possible to arrive at that single view of audience engagement. A shift like this could be unsettling for many. But as marketing dollars span an increasing number of channels, disparate data sets from channel-specific tools will require an increasing amount of manual reconciling.

With confidence in arriving at full-funnel ROI measurement at relatively low levels today, an increasingly rich media landscape in the years ahead suggests the need for transformative thinking based on data and solutions that are both trusted and channel-agnostic. With audiences adding and seamlessly switching from channel to channel, measurement should be able to do the same.

A version of this article originally appeared on Forbes.com.

For additional insights, download the 2023 Nielsen Annual Marketing Report.

[1] Connected TV (CTV) refers to any television that is connected to the internet. The most common use case is to stream video content.