As the digital advertising industry upgrades its privacy protections for consumers, some ad tech providers have wondered what the business impact for improving privacy will be. But how often do ad tech providers consider the cost of staying on legacy technologies such as third-party cookies?

The good news is that new digital advertising technologies like the Privacy Sandbox not only improve privacy for consumers but can also boost results for businesses in crucial ways compared to third-party cookies.

One example is audience matching between ad tech providers for real-time bidding. Audience match rates are the percentage of audiences two ad platforms (e.g., DSP and SSP, DSP and DMP) both recognize and enable an advertiser to reach programmatically.

This new study shows how ad tech that uses legacy third-party cookies to audience match could lose millions of dollars due to low match rates, typically around 31%-45%, suppressing actual reach. In comparison, new privacy-preserving technology like Privacy Sandbox enables vastly superior match rates and privacy protection. Here’s how.

Cookies Are Failing

Since the emergence of programmatic advertising in the early 2000s, the primary mechanism for web audience matching has been to match together different third-party cookies from different ad tech providers. This allowed multiple ad tech companies to synchronize ad delivery for a specific audience by knowing it was the same audience they were each seeing on another page.

Bad cookie match rates mean poor results. In the survey, an ad tech VP spoke to this issue and said, “Low cookie syncing leads to less scale, which means it’s harder to find the audience and serve media.”

With the deprecation of third-party cookies on the horizon, the days of cookie matching are numbered – but it’s no secret that cookie matching is already unreliable. Fifty-five percent of study respondents see cookie matching succeed less than 45% of the time.

Low match rates happen because when two ad tech platforms match a user via cookies, both need to load on the same page for the same user but often don’t have the opportunity to do so. Platforms must prioritize these calls to keep page latency down and load these before the user changes pages. Ad tech tends to prioritize calling their largest partners first and proceed to deprioritize the smallest ones and call them less frequently.

When asked for the “worst-case” match rates executives have seen, 81% reported rates below 30%.

Ad tech companies’ and agencies’ typical cookie syncing percentage – and worst-case matching performance

Cookie syncing’s poor performance is costing ad tech millions.

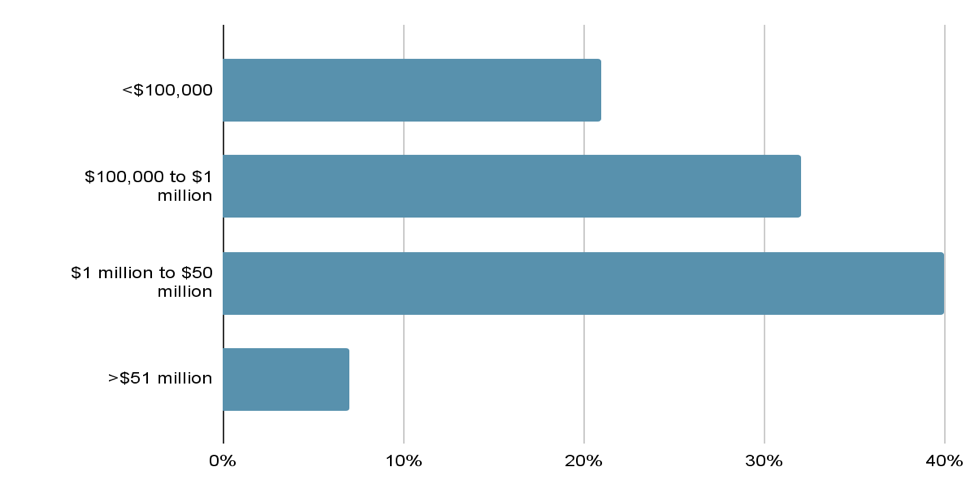

Seventy-eight percent of those surveyed believe increased cookie syncing rates would drive more revenue. If sync rates were boosted by 20%, the expected revenue increase would be between $1 million and $50 million, according to 40% of the survey respondents.

“We’ve seen that delivering better user matches directly impacts bid and win rate with buyers, leading to better efficiency and increased revenue,” noted a supply-side platform VP.

Privacy Sandbox offers purpose-built API for ads and privacy

Despite their limitations, cookies have been considered the best available solution for real-time bidding for a long time. Now, new technologies such as the Privacy Sandbox can help advertisers better reach relevant audiences, publishers get more demand and ad tech be more effective, all while moving advertising to be private by design.

For example, Topics and FLEDGE APIs have been developed to enable relevant audience selection to occur on device matched across programmatic ad tech providers. The on-device design protects user data better by enabling ad tech to operate without a user identifier. With Topics, if an ad tech company receives a Topic for a user, they can have high confidence that the user has viewed content related to that interest in the last three weeks, with a 5% chance that the Topic will be randomized.

With FLEDGE, marketers can be 100% confident that users in a FLEDGE interest group have met the advertiser-defined behavior to be added to the interest group. The FLEDGE auction’s privacy mechanisms ensure that FLEDGE interest groups do not individually identify consumers, but advertisers can be completely certain that they have reached their intended segment.

Audiences being created and stored securely on device ensures they are available to ad tech providers for cross site bidding without the risks associated with cookie matching of loss due to failed server to server calls. Overall, this is a much more reliable and secure approach.

With better match rates between ad tech companies, more media is activated, resulting in better reach and performance for the buy side and more demand and yield for the sell side. But most importantly, Privacy Sandbox enables the digital ad ecosystem to offer more privacy protections and earn consumers’ trust.

Everyone in the ecosystem can begin unlocking these benefits today by trying on-device-based solutions like Topics and FLEDGE APIs, already available today on Chrome.

About the Respondents: The survey respondents are primarily ad tech companies (38%) and agencies (22%). An additional 11% noted they are an SSP, while 8% work for DSPs, and 6% with DMPs. Fifty-five percent of the respondents are C-level or EVP/VPs, and 41% are with companies with over $100 million in revenue. The survey was conducted in paid partnership with AdExchanger and Privacy Sandbox, in February 2023 and received 246 responses.

For more articles featuring Joey Trotz, click here.