Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Going ‘Green’ Costs Green

Digital advertising contributes to carbon emissions. Every programmatic ping, bid and load consumes electricity, and the overcrowded programmatic supply chain just makes the problem worse.

Everyone agrees that sustainability should be a priority. But changing workflows costs money, and industry stakeholders are mulling over whose responsibility it is to open their wallet, Digiday reports.

One way to foot the bill, according to Jounce Media Founder Chris Kane, could be to transparently raise ad auction prices to fund carbon offsets. Otherwise, the burden would fall primarily on publishers since that’s why the impressions fire. (Publishers left holding the bag? What’s new.)

There’s also concern as to whether a “green levy” will feel like an addition to the “ad tech tax” if it’s advocated for or forced by third-party ad tech vendors.

A green levy is similar to taxing cigarettes – it’s meant to dissuade people from an “extremely bad habit,” Brian O’Kelley, founder of sustainability startup Scope3 (and a co-founder of programmatic, in a manner of speaking), tells Digiday.

O’Kelley is an interesting figure to see at the heart of this debate. One could argue that he’s trying to right the karmic scales for having helped RTB in the first place.

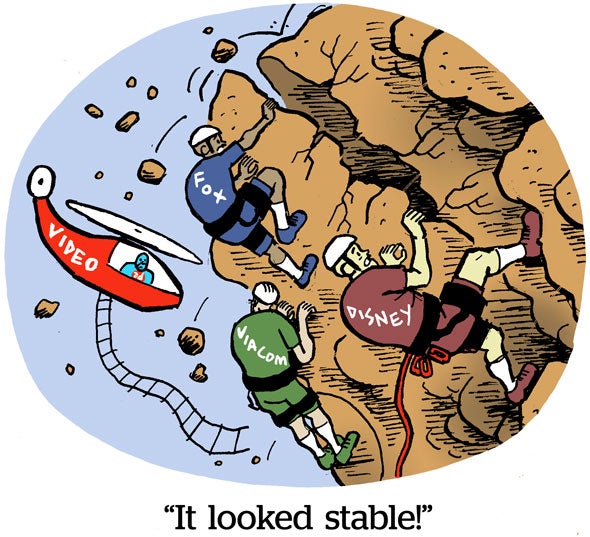

When Cash Cows Go Dry

2021 was the year of churn for streaming television. After many major broadcasters launched streaming subscription apps in 2020, people were bumped up to nonpromotional prices, and they weren’t amused.

But this year and next might go down as the years of comeuppance for the TV industry.

“For the past few years, enthusiasm about streaming allowed media companies and investors to forget that their primary ATM was running low on cash,” writes Bloomberg newsletter author Lucas Shaw.

A few years ago, the linear TV cash cow was producing, well, cash, and absorbing multibillion-dollar losses on streaming investments felt like a manageable transition, since those viewers were considered to be accretive to the business.

Now, streaming media looks like a longer, tougher slog, with a great deal of strong competition and trickier monetization. Production costs are rising at the same time that TV ad prices are coming down, which wasn’t factored into original plans.

The ground is crumbling beneath the feet of once-mighty programmers, and the bridge doesn’t seem steady.

“It appears that cliff may be closer than any of us thought,” wrote Michael Nathanson of the investment bank MoffettNathanson following Disney earnings last week.

Linear TV and satellite are sitting right at the cliff’s edge.

“Alexa, Be Profitable”

The Amazon Alexa smart speaker group will be hit hard in a company cost-cutting review, The Wall Street Journal reports.

The Alexa team numbers in the thousands and was a priority for Jeff Bezos. The appeal was clear. If even a small percentage of Amazon customers became Alexa-based shoppers, the lifetime value potential was great. Amazon gave away Alexa-enabled devices like candy for years, often tossing a free Echo puck into holiday deliveries.

But just like how investments in promising commerce trends backfired on Shopify, Meta and others (including Amazon), the Alexa investments have apparently flopped. Voice-based shopping never caught on.

That’s not to say the speakers aren’t handy, and Amazon isn’t quitting on smart home devices. But selling at or near cost and banking on high lifetime value accrual isn’t working for purchases or ads.

The Alexa unit has had an operating loss of about $5 billion annually in recent years.

Amazon posted a loss of $3 billion in the first three quarters of 2022, the first full year at the helm for CEO Andy Jassy, who replaced Bezos last June. In 2021 and 2020, Amazon had a combined profit of $54 billion.

But Wait, There’s More!

Apple’s web search chief and other key search execs decamp for Google. [The Information]

Spotify and Google begin rolling out user choice billing. [blog]

Musk’s Twitter may have already violated its latest FTC consent order, legal experts say. [CNN]

Amazon Music debuts ads amid a messy rollout. [MediaPost]

TV’s scatter market has gone from bad to worse as advertisers curtail extra spending. [Marketing Brew]