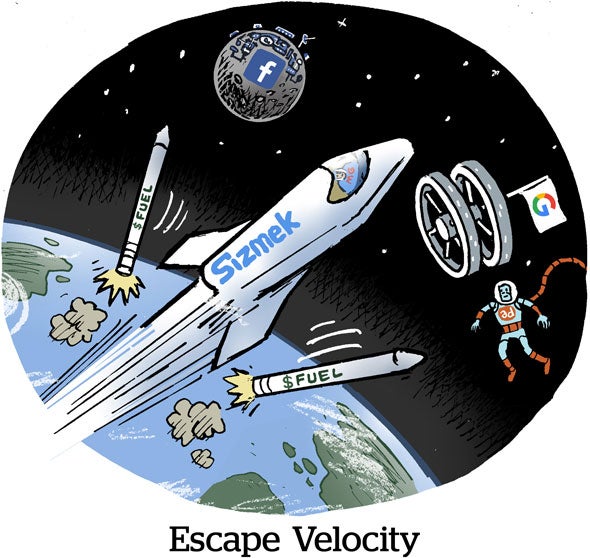

Despite great expectations, the end of Sizmek has been far from, well, seismic.

According to emails seen by AdExchanger that were sent to Amazon customers this week, Amazon is officially naming integration partners to offload clients of the Sizmek ad suite, now the Amazon Ad Server.

Amazon initially disclosed its plan to sunset the ad server in October, and the date when advertisers must officially drop the Sizmek interface is by Q4 2024. Many advertisers run two ad servers simultaneously during a transition to make sure the data matches one another.

This is an ignominious end for Sizmek, which, going back more than a decade, had amassed the largest ad server footprint outside of Google.

Sizmek went public in 2013, was delisted by NASDAQ in 2016, then began a private-equity-backed roll-up attempt that ended in bankruptcy in 2019. From that fire sale, the core Sizmek ad server business was bought by a retail marketplace with big ad tech ambitions – as in, Amazon.

Amazon was new to ad tech at the time, so Sizmek’s large account book in the industry and knowledge of programmatic pipes was useful. But the ad server itself turned out to be more work and ongoing investment than the company was apparently willing to shell out.

Instead, Amazon Advertising is offering two onboarding options for current ad server clients: Mediaocean-owned Flashtalking and PE-owned Smartly.io.

Here to server

While Amazon Advertising will still allow customers to use other third-party ad servers, it’s recommending that former Sizmek customers use either Flashtalking or Smartly, partly because those vendors put in the time to make the integration process easy.

Flashtalking is the more intuitive alternative because it’s a classic ad server with tools and functionality similar to what Sizmek offered. In fact, Flashtalking was the runner-up bidder behind Amazon when Sizmek went bankrupt.

“Clearly, we are not as deep-pocketed,” joked Flashtalking COO Ben Kartzman.

Flashtalking will help Amazon clients manage the minutiae of switching ad servers, including swapping Sizmek-specific tags and metadata labels to the mirror versions used by Flashtalking so historical campaign data can be exported cleanly via API. The company has also been hiring former Sizmek and Amazon execs, Kartzman told AdExchanger, especially in markets where Flashtalking didn’t previously have a presence.

Flashtalking has little competitive friction with Amazon Advertising, because it doesn’t have a DSP itself, and no other Mediaocean-owned company buys media.

Smartly, however, is an unconventional partner. It isn’t really an ad server; it’s a dynamic creative optimization (DCO) shop, particularly for Google and social media, built on the Google ad server.

But Amazon wasn’t just looking to replace the old-school Sizmek business, said Smartly CEO Laura Desmond. It wants to offer an option built primarily for creative management and DCO.

Amazon is directing its investments and energy toward its own media and customer experience, she said. Hence why it’s ditching the ad server. Amazon cares more about focusing on answering questions like “What makes the Amazon site special?” and “What brings people back to Prime Video or Twitch?” than about providing basic ad-serving functionality.

End of an error?

But Amazon’s decision to sunset its ad server raises an important question: Is building or owning an ad server even worth it?

Flashtalking would no doubt say yes. It’s an ad server.

But history has another tale to tell: Facebook acquired the Atlas ad server in 2013 and promptly spat it back out. The Trade Desk and Xandr (including back when it was still AppNexus) both offer ad servers, but neither has made much of an effort to turn their respective servers into bona fide revenue lines. AT&T and Microsoft came to the same conclusions about the AppNexus ad server.

Smartly isn’t trying to be an ad server, though.

The walled garden platforms all have their own creative specs and proprietary ad serving requirements, Desmond said, and they’re also starting to buy more of the open web through machine-learning-based products, such as Google’s Demand Gen (a close cousin to Performance Max, but built for feed-style social performance marketers).

Instead of the classic cookie and tag-based ad server, she said, advertisers need to focus more on creative and what works platform by platform, but with all the creative assets in one centralized place.

The creative process

In light of signal loss, the creative itself has become a key component of ad tracking and server log-file data, especially in retail and ecommerce.

For instance, Amazon DSP advertisers can tag specific creatives and only use those units for, say, Target Roundel campaigns. That way, even when the first-party cookie, advertising ID or other identity signals aren’t passed to the advertiser – which is often the case nowadays – the creative gets tagged.

After serving ads to thousands of Roundel SSP audiences – Amazon requires a high threshold of users to export data for targeting – the advertiser will have a segment of known Target customers who can be retargeted on Amazon.

Retailers must accept that if they allow third-party programmatic tech to bid against their IDs, platforms like Amazon will have access to their audience data. And when retailers block ad IDs and other identity signals, creative tags can still slip through.

Flashtalking, for instance, has been working on a creative auto-tagging product that bolsters every ad it places with metadata, Kartzman said.

There’s no way for a human to tag creative at scale with descriptors, like “the frame shows two individuals, one a woman in a dress, the other a man in a blue shirt” – plus having to add all the other details about the imagery and how the ad is being used, such as whether it’s a product listing. But generative AI tech can easily do that in the background.

The data is used for analytics and parsing campaigns. But, in theory, a brand could serve ads with people in blue clothes to Walmart Connect customers and red clothes to Target Roundel shoppers as a way to jury-rig analytics by tracking the creative metadata rather than the standard ID fields.

Targeting efficiency is down across the open web, Desmond said.

“All of a sudden creative becomes the most important driver of performance,” she said. “The platform companies have invested in creative as a way of differentiating the experience.”