Digital advertisers expect connected TV to look and feel more like digital and less like TV.

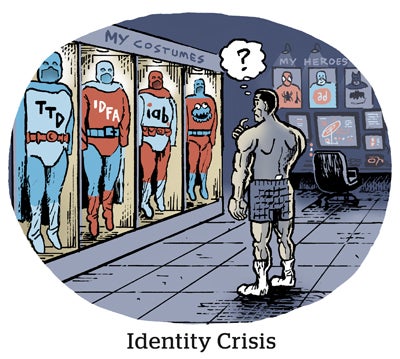

One reason some digital advertisers hesitate to spend more on streaming is that the channel still relies on different data sets than digital mediums, like panels and household identifiers. Signal loss is also an issue. While IP addresses could be on the way out due to privacy, advertisers also still use third-party cookies to connect CTV ads to online media.

To help bring CTV into the digital stratosphere, Yahoo announced on Tuesday that it’s expanding its identity solutions to CTV media. The objective is to make it easier for digital marketers to incorporate CTV within their digital media plans.

Having consistent data sets for campaign planning helps advertisers target and measure their CTV investment “in concert” with other channels, said Yahoo CRO Elizabeth Herbst-Brady. Parity between CTV and the online world for data and targeting is one of the biggest asks from Yahoo clients, she added.

Plus, having more data sources at hand should help advertisers brace themselves for signal loss, she said.

Yahoo’s ID set is available for CTV campaigns using its own demand-side platform, while FreeWheel acts as both an ad server and supply-side platform.

It’s a match

Historically, Yahoo’s two identity solutions – ConnectID and Next-Gen Solutions – were only available through Yahoo Exchange (which since became its supply-path optimization initiative, Backstage).

ConnectID is an identity graph based on Yahoo’s first-party data and logged-in accounts from Yahoo mail and a hodgepodge of media properties. Next-Gen Solutions creates panels and lookalike audiences based on ConnectID.

Perhaps most importantly, advertisers can match ConnectID with other third-party data providers such as Acxiom and Epsilon. The IDs are also compatible with LiveRamp’s RampID and Twilio’s consumer data platform.

With more first- and third-party data in the mix, advertisers should see higher match rates, Herbst-Brady said. As a result, advertisers should have better return on ad spend. They’ll also be able to compare campaign performance on CTV with channels like display and online video.

The same idea applies for Next-Gen Solutions, which uses lookalike models and is therefore less deterministic. But buyers will still be able to see data in bid requests about audiences that are similar to their own, said Chandra Cirulnick, Yahoo’s VP of global supply partnerships.

Either way, making ID products more widely available should help publishers make better use of their viewing data and inventory.

For example, with additional ad identifiers like Yahoo’s ConnectID, Paramount can overlay more useful data to its first-party audience graph, according to Leo O’Connor, the network’s SVP and head of programmatic advertising. When advertisers improve their match rates, he said, publishers are better at forecasting and filling supply.

So when it comes to ad identifiers, O’Connor said, more is better.

Minding measurement

But targeting and measurement accuracy isn’t Yahoo’s only reason for widening access to its IDs. It’s also trying to address signal loss.

TV ad units themselves don’t carry cookie data fields, but streaming advertisers use third-party cookies to connect CTV ad exposures to online conversions.

“Our ability to associate CTV impressions with [online behavior via] cookies is really degrading,” Cirulnick said. This product expansion could help “preserve cross-channel measurement” in the face of signal loss, she said, by linking TV ads with online behavior without using cookies.

Plus, third-party cookies aren’t the only form of signal loss.

IP addresses have historically been the basis for CTV targeting and measurement, but they too “continue to degrade over time,” Cirulnick said. Plus, more privacy laws now classify IP addresses as personal information, which will lead to more restrictions.

The rise of new ad identifiers helps marketers “migrate away from riskier signals in the programmatic world,” O’Connor said.

But, to be clear, Yahoo “is not moving away from IP addresses and device IDs,” Cirulnick said.

Even so, Yahoo needs to support as many data sources as possible to improve the accuracy of its targeting and measurement for CTV while also braving signal loss.

As streaming ad targeting and measurement standards catch up to the web and other biddable channels, O’Connor said, more advertisers should start spending on CTV.