Here’s today’s AdExchanger.com news round-up… Want it by email? Sign up here.

Mis-Addressed

Google Chrome will reintroduce a way to disable tracking by IP address by giving users a toggle to block IP tracking.

If that sounds familiar, it’s because the product works not unlike Apple’s Private Relay – and will have a similar impact on data-driven marketing.

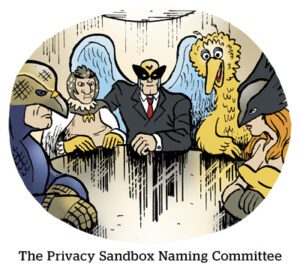

Google’s version is called IP Protection. (The first iteration was a product called Gnatcatcher back when privacy tech was going by bird names for no explicable reason.)

According to James Bradley, a Google product manager for Privacy Sandbox, IP Protection is “an opt-in feature initially, which will later on become the default setting.” Bradley made that comment in the IP Protection GitHub repository.

Chrome will test the tool only on Google-owned domains with a small group of accredited beta users. Third-party ad tech and publishers won’t be affected until Google tries out the product more widely.

The writing is clearly on the wall for IP addresses as a tracking mechanism.

The new Google Analytics, GA4, doesn’t log IPs at all. Even in countries and instances where IP address collection is legal and consent-based, GA4 will not register it.

Which is to say, Google’s rationale goes beyond privacy protection. The company is simply scrubbing IP address data.

How Snap’s Crackle Popped

Snapchat has long been seemingly on the cusp of escaping the near-orbit of its closest competitors for ad dollars. But the reality is that it’s been lagging.

“Snap almost suffers from a first-mover disadvantage – they run through the door first, then they trip,” one anonymous ad buyer tells Insider.

Snapchat was disadvantaged by being the first scaled non-Facebookagram platform. It invested heavily in augmented reality tech and top-end creative formats, making it an attractive platform for TV buyers and major branding budgets.

Buuuuuut while Facebook was quick to copy Snapchat, Snapchat was slow to adopt the idea of a pixel- and conversion-based ad flywheel.

Meaning Snapchat campaigns may win your agency a Cannes Lions award, but they don’t effectively demonstrate on-platform ROAS.

Snapchat is also deeply dependent on Apple. Its AR and camera features practically required iOS for years, and the company more readily accepted Apple’s new privacy standards.

Meta, on the other hand, is much closer than Snapchat to being back at its previous ROAS levels because it was faster and more aggressive about treating Apple ATT as an impediment, not the new road forward.

Hot Spot

Spotify is playing a happy tune.

The company reported its second-highest quarter of growth in monthly active users (MAUs), with paid and free subscriber numbers each growing by double digits.

Combined with lower marketing spend and a 2% headcount reduction, Spotify was able to turn its first quarterly profit in the past year and a half.

Spotify now has 574 million total MAUs and is on track to hit 600 million by 2024 and 1 billion by 2030, CEO Daniel Ek told investors.

Paid subscribers climbed by 16% year over year to 226 million – despite Spotify raising its subscription prices during Q3. Subscription revenue for the quarter was $3.1 billion, up 10%. (The increase in paid subscribers and subscription revenue isn’t apples to apples, because Spotify charges different prices in different geos.)

Meanwhile, the subscriber count for Spotify’s ad-supported tier grew by almost one-third to 361 million. Ad revenue was $473 million, up 16% YOY. But ad revenue has remained roughly 13% of Spotify’s total revenue since Q4 2021 – in other words, flat.

Spotify’s ad network is also seeing some traction, however. The number of publishers using the network grew by double digits compared to last quarter, while ad spend grew in the high single digits.

But Wait, There’s More!

Nearly every US state is suing Meta, claiming its platforms are harmful to the mental health of children. [The Washington Post]

How the bankruptcy of Kristen Bell and Dax Shepard’s diaper brand illustrates the changing digital ad market. [The Information]

Google is bundling more of its video formats into YouTube buys. [Adweek]

Amazon and TikTok hope to combine influencer advertising with programmatic commerce. [Ad Age]