Many developers specifically target Apple device owners because they’re known to spend more on in-app purchases than people who own an Android device.

But Mode Mobile has a very different target audience in mind: budget-conscious Android users looking to generate a little extra income.

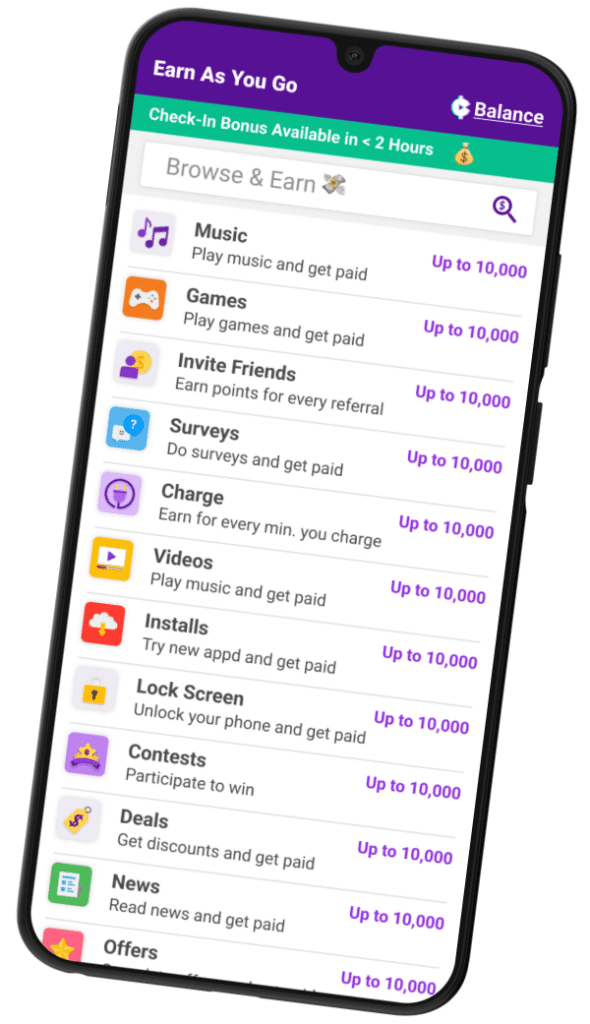

Mode owns an app called Earn that lets people collect in-app points in exchange for engaging in everyday activities on their smartphone, like playing games, listening to music, tracking their fitness, taking surveys or even charging their device. Points can later be redeemed for cash payouts or gift cards.

Because Earn monetizes primarily through third-party marketing and advertising partners, Mode generates more revenue the longer people spend in its app.

But, like all developers, Mode is itself on a budget of sorts.

The cost of running a user acquisition (UA) campaign can’t be more than the users themselves end up being worth.

Go with the flow

In a casual gaming app, the cues for what actions will lead to high lifetime value (LTV) are relatively straightforward. If someone watches the game’s tutorial video, then quickly progresses through the first few levels, that’s a good sign they’ll stick around.

But user behavior in a non-gaming app like Mode’s “isn’t quite as linear and predictable,” said Steve Dunkley, the company’s director of user acquisition.

There are many different flows users can go through in the Earn app. People can dip in and out and engage with features in whatever order they want.

Mode has to figure out which flows are the most valuable to its own bottom line. Is it a better indicator of strong LTV if someone watches a video, reads a news story and listens to a song before cashing out? Or do users who surf the web, read a news story and track a workout generate more revenue for Mode over time?

“Our challenge has been to pinpoint events that signify habit-forming behavior in our users and in what combination,” Dunkley said.

Last year, Mode started testing AppLovin’s mobile user acquisition platform, AppDiscovery, to determine which in-app events are most valuable and target new cost-conscious Android users with a high likelihood to engage with the Earn app.

AppDiscovery is built on Axon 2.0, an AI-powered engine that uses predictive machine learning to target app install ads to users with the greatest probability to download. The Axon algorithms were trained using first-party data from AppLovin’s own portfolio of games, including trillions of daily in-app events.

Quick study

Typically, it can get pricey for user acquisition managers to gather enough signal to optimize a campaign efficiently, Dunkley said.

Apps have to spend money to learn what targeting parameters work, and the longer it takes to learn, the more it costs. On the flip side, a shorter learning curve means an app can run more tests at a lower cost and also test more specific behaviors.

Using AI helps shorten the curve.

Mode’s most valuable users usually hit a series of nonlinear milestones before becoming more engaged in the Earn app. Someone who listens to music three times over three days, for instance, may eventually prove more or less valuable than a user who reads four news stories before playing a song – and on and on through myriad different behavior combos.

In a recent campaign, Mode targeted a very specific and highly valuable user cohort that it refers to internally as “core redeemers,” meaning people who unlock 3,000 reward points, redeem them for a gift card and go on to use the card to buy stuff within the Earn app.

This is a very custom – and also very desirable – in-app event that’s particular to Mode Mobile, Dunkley said, “and with a slower, more traditional calibration curve, we wouldn’t be able to test and target such unique behaviors.”

Using AppDiscovery, Mode was able to reduce its learning curve and, as a result, lower its acquisition costs by 29% from $2.69 to $1.90. Mode also increased its return on ad spend by 92.5% between May and June for people who were still using the Earn app after 90 days.

Being able to target less frequent behaviors that are important to Mode but may not happen very often “opens up lots of new targeting possibilities for us,” Dunkley said.

“And the deeper we can go into our funnel,” he said, “the more valuable the events become.”