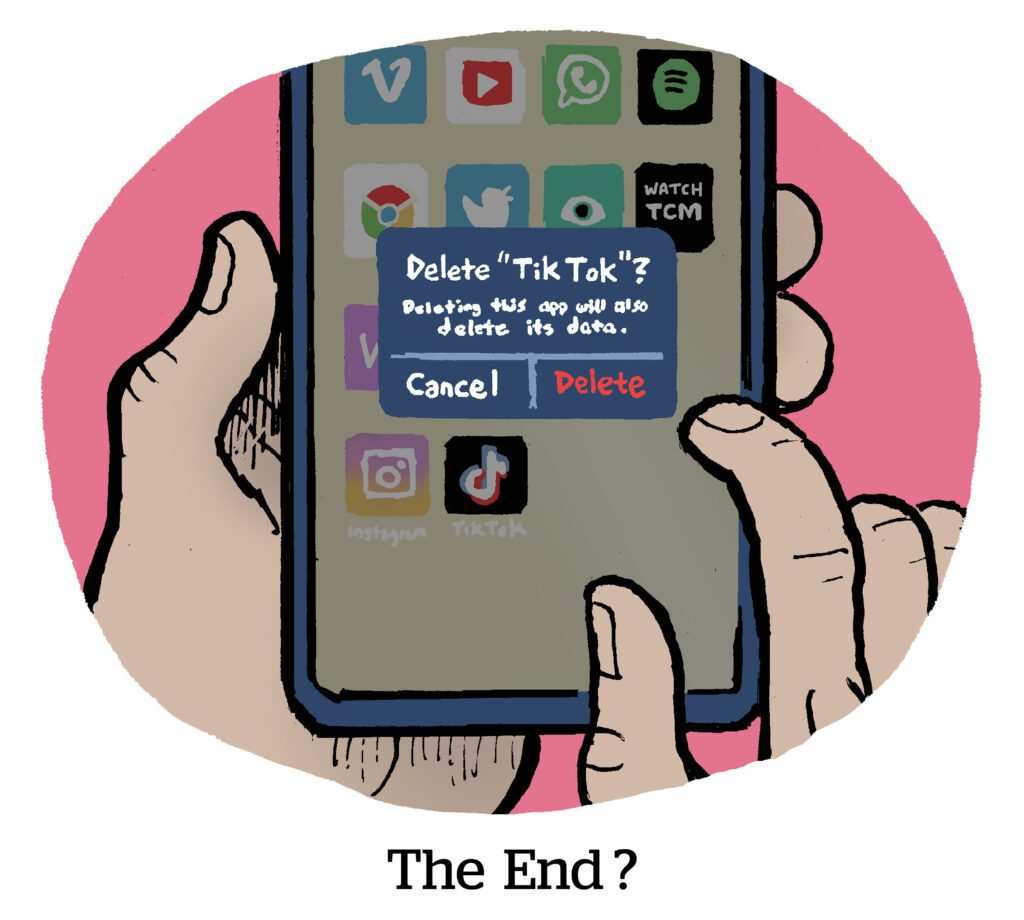

We laughed. We scoffed. But now it’s real: TikTok faces a possible ban in the US.

This week, President Joe Biden signed a bill into law that will ban TikTok from US app stores unless its Chinese parent company, ByteDance, sells the platform within a year. The new legislation was bundled into a foreign aid package.

The legislation stems from concerns among politicians and privacy advocates that Chinese companies share user information with the Communist Party in China. Politicians and lawmakers believe the party could use TikTok to track or influence American perceptions of China.

The ban has been brewing since Donald Trump’s presidency, but it took time to move it forward because of TikTok’s popularity, particularly among Gen Z. In the meantime, the app quickly gained a foothold among digital advertisers and began to draw media budgets.

But if ByteDance doesn’t divest TikTok, and the app is eventually banned in the US, marketers will have to invest more in other social platform. Instagram and YouTube would be two of the biggest beneficiaries.

Then again, TikTok may not get banned. It may just get bought out. And if TikTok fights this legislation in court, which it plans to, then the entire process faces delays. (The ad industry is quite accustomed to delays.)

AdExchanger asked the experts: What would a TikTok ban mean for marketers and media buyers, and how would they reallocate digital ad spend accordingly?

- Mohammad Chughtai, global head of advanced TV, MiQ

- Vic Drabicky, founder and CEO, January Digital

- Shannon Wilcox, VP of media investment, Goodway Group

- Colleen Fielder, group VP of social media solutions, Basis Technologies

- Geoff Gates, creative director of social strategy and content, Boathouse

Mohammad Chughtai, global head of advanced TV, MiQ

If this ban happens, it’ll take a while to become a reality. TikTok has to either find a buyer or contest this legislation in court. So, we’re advising marketers to keep their TikTok campaigns active – for now.

While the potential ban probably won’t stop marketers from spending on TikTok immediately, it likely will curtail ad spend growth. Instagram and YouTube will pick up some of these budgets. We’re telling marketers to start allocating larger test budgets to Instagram or Facebook Reels and YouTube Shorts, to run A/B tests and compare performance on these platforms.

I expect Google will capitalize on this moment by pushing YouTube Shorts. Google’s efforts to add more targeting features to YouTube Shorts and include the format in its connected TV plans should help with that push.

Vic Drabicky, founder and CEO, January Digital

It’s important to remember this law isn’t forcing TikTok to go away – it’s forcing them to sell. Marketers will keep using the platform the way they have been.

But there is a tiny chance TikTok doesn’t sell in the allotted time and actually gets shut down in the US. Because of that possibility, we’re advising clients to plan spend for TikTok alternatives. Meta, YouTube and Pinterest are the most logical substitutes in terms of user engagement.

Given the creative nature of TikTok, digital out of home (DOOH) and CTV could be options, too.

Shannon Wilcox, VP of media investment, Goodway Group

Although TikTok is fighting back, some brands may pull back due to volatility, which would lower the cost of ads on TikTok.

We advise clients to have a contingency plan to move spend to other short-form video platforms, and marketers may also want to invest more in other digital media channels that scale, including DOOH or affiliate marketing.

Colleen Fielder, group VP of social media solutions, Basis Technologies

Realistically, advertisers likely have a year before they’d have to seriously consider reallocating their TikTok budgets, so we’re not recommending that our clients pull spend from the platform just yet. Brands will want to capitalize on TikTok while it’s still around.

But if a ban happens, then Meta may win this battle between the US government and TikTok.

From a paid media perspective, a lot of TikTok ad spend will likely go to Instagram because it’s the most similar and efficient replacement. YouTube and Snap will probably gain some diverted spend as well, but not as much as Meta.

Geoff Gates, creative director of social strategy and content, Boathouse

For now, nothing should change. Marketers should continue with the strategies they’re already executing.

But in the meantime, advertisers should examine what value TikTok has added to previous campaigns (conversions, awareness, follower growth), and assess which other social media platforms can help achieve those KPIs. Many platforms have been copying TikTok, so the transition could be relatively smooth.

A scarier question may be: Who can afford to buy TikTok?

Answers have been lightly edited and condensed.