The holdcos really want to cash in on the retail and commerce media trend.

On Monday, Omnicom entered the ecommerce marketplace services space in a big way with an $835 million deal to buy Flywheel Digital.

Founded in 2014, Flywheel was one of the first players in the now-crowded category of Amazon ad agency specialists. It was acquired by Ascential, a UK-based consultancy and B2B media business, for roughly $60 million in 2018, including up to $400 million in earn-outs over three years.

Omnicom will add around 2,000 Flywheel employees as well as the company’s co-founding team, including current Ascential CEO Duncan Painter, who now becomes head of Omnicom’s ecommerce and retail media practice.

Get the Flywheel going

Flywheel, which has a suite of tools to help enterprise brands manage their ecommerce efforts, was a direct competitor of Omnicom’s, and the two also had many overlapping accounts, Omnicom CTO and EVP Paolo Yuvienco told AdExchanger.

But what Flywheel provides is new to traditional agency structures. For instance, an important part of Flywheel’s services is to manage product pages, warehousing, inventory movement and product pricing across sometimes dozens or hundreds of sites.

For a time, these needs were unique to Amazon, Yuvienco said.

That led to the rise of Amazon-only ad agencies like Flywheel, Marketplace Ignition (which was bought WPP) and The Ortega Group, (now owned by Tinuiti).

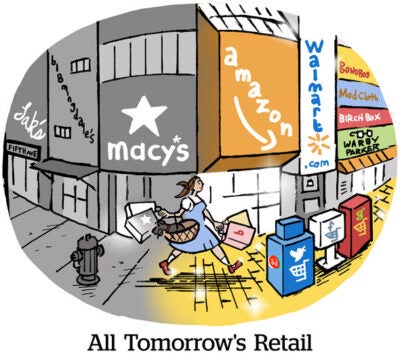

But now there’s Walmart Connect, Target’s Roundel, Kroger, Albertson’s and a host of other large retailers that have launched scaled retail media networks. Each network has similar dynamics as Amazon, Yuvienco said, which means that agencies need to have in-house commerce marketplace chops in order to keep up.

Commerce data grab

Flywheel also “comes with massive amounts of data,” Yuvienco said, “almost equal to what we have with Omni.”

You can think of Omni as the holdco’s metadata hub. It spots trends and patterns of how different audiences and media are performing. Rather than tracking individuals – Omni isn’t itself an identity graph – it analyzes data at the metadata level to see what insights can be pulled from its aggregated media-buying info.

Flywheel will contribute greatly to Omnicom’s dataset, Yuvienco said. Although it doesn’t have user-level payment data like Amazon has to run closed-loop attribution, it does have aggregated, non-PII information about product sales.

Flywheel sees how products are displayed and where they’re purchased around the web, he said, which provides another layer on top of Omnicom’s audience and behavioral data.

“Ultimately, our clients are looking to drive higher sales,” Yuvienco said. “That’s the reason why we exist.”