Evan Hovorka, head of retail media products at Albertsons, was hired by the grocery store chain nine months ago after a 17-year stretch at Target.

Evan Hovorka, head of retail media products at Albertsons, was hired by the grocery store chain nine months ago after a 17-year stretch at Target.

He joined Albertsons shortly after it added former Target exec Kristi Argyilan as retail media SVP. Argyilan came aboard to build out an ad platform business akin to Roundel, the media network group she previously led at Target.

She started making big changes to the Albertsons ad business right off the bat. In November, Albertsons began to wind down its more than five-year relationship with third-party vendor Quotient, which until then had supported its retail media, digital coupons, online ad attribution and agency services. Why? To launch its own in-house advertising business, of course.

Albertsons exited the Quotient partnership in February after releasing its own managed service and self-serve platform offerings.

“It’s really about owning the tech stack and the product vision,” Hovorka said.

Last week, Albertsons expanded further into programmatic through a new partnership with The Trade Desk, which is now one of just two off-site DSP buying platforms that the chain uses. The other is Google.

AdExchanger: What makes the in-house offering different, since the ads and inventory are still the same?

EVAN HOVORKA: Now, as much as possible, we have everything running through a centralized set of data and decisions. We do the planning, execution, measurement and product development, all in-house.

We have a better set of controls around which tool or which strategy we want to use for various products. That allows us to bring things like consistent measurement methodology and a more focused product development track.

Albertsons recently integrated with The Trade Desk and Pacvue. Are you open to more vendor partnerships?

Pacvue is a partner for on-site search demand in particular. But the off-platform world is expansive and that includes The Trade Desk, which was just announced, and our pre-existing integration with Google DV360.

Through those two DSP deals we enable programmatic advertising with closed-loop incremental measurement. That’s the golden egg sophisticated CPGs are looking for so they can buy their own inventory, sometimes at better rates off-platform, but tied to the retailer’s audience and to incremental sales reporting.

That’s also part of the unique capabilities that an in-house product team and measurement team can add.

Does the DV360 integration work the same way as the new integration with The Trade Desk?

It’s quite different, actually, and purposely so.

If you’re new to building these internal products, there’s quite a bit of time and maturation required to streamline the DSP of record, which for us is DV360. We use The Trade Desk as an innovation extension, because some CPGs want to do their own thing with particular data partners or use cases, or have their own particular system for how to traffic media.

Some CPGs prefer to pick and choose. That’s what The Trade Desk brings with a wide range of self-serve options and a little more flexibility.

Walmart used The Trade Desk to create a mini walled garden. Those campaigns can’t be connected to IDs from general open web programmatic campaigns. But DV360 I assume would connect your off-site inventory to general programmatic supply?

You’re not wrong.

It comes down to the maturity of the relationship and of the product teams. With our managed service partnerships through Google we’re prioritizing that we can get a lot of scale.

To do that on our own requires custom coding, privacy management and a lot more hands-on-keyboards work. And there is only so much capacity we have as a team right now to set that up and deploy it.

There are some privacy concerns doing it this way, as in how a data broker might do it. I don’t want to give the impression that this is like opening the floodgates, because that’s certainly not the case. Anything that connects to Albertsons’ data has strong provisions in place for CCPA, CPRA and all other policies we adhere to.

But we are trying to flex in safe, proactive ways to help CPGs accomplish the goal of incremental sales.

Would you separate the data to sell as a standalone asset or for analytics, without brands having to buy ads through Albertsons?

That is a popular question.

I’ll put on my industry theoretical cap for a second. Decoupling the different assets would certainly be a faster path to revenue growth and would make the CPGs happy. The problem is that it’s just not feasible from a privacy compliance perspective. There’s absolutely no way a Fortune 500 company can stand behind true data autonomy and democratization with third parties – and that scrutiny is getting tougher and tighter every week.

The other angle to that, though, which gets into a more positive story, is as an à la carte product. If you’re a research company looking to do industry assessment of customer behavior, say, the standalone dataset could provide value.

But if you’re looking to sell products and use the data as part of a long-term, multichannel relationship with a customer, and have sales data tied to low-funnel inventory – especially if there’s a coupon available or a recipe that complements that brand’s product – going through Albertsons is a high-performance place to marry data with inventory.

Things like coupon data and localized pricing are not as sensitive as customer data, but they are still tough to manage.

What is the most exciting opportunity for retailer-owned advertising technology right now?

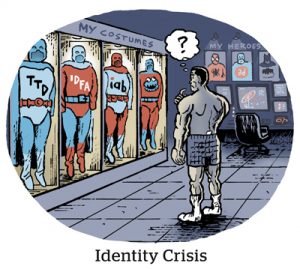

There’s such a unique footprint within each store – Walmart vs. Target vs. Amazon vs. Albertsons – so it would be great to have industry standardization of retail media networks, and maybe that will come.

But the thing I’m most excited about and the biggest opportunity is that US retailers have not leveraged their store assets nearly to the degree they should. Retail media is not designed to just drive ecom sales – it’s always the smaller piece of the puzzle, unless you’re a digital-only retailer.

Most of the sales and the customer relationship are still in physical stores and stores are capable of delivering unique experiences that add value for the customer. I’m not talking about just slapping banners and display screens across the store, but finding those unique ways to connect with the customer and introduce new products.

For example?

One thing we have in a testing phase is a mix of hardware and technology embedded across stores. In quite a few stores on the west coast we have gas stations with digital out-of-home screens. We’re testing smart carts with screens and in-store kiosks that can offer coupons or free samples.

And there’s the opportunity to be able to work with a CPG. If they’ve developed a product for a specific diet or demographic, can they start offering free samples or coupons specifically to customers they know are their target demographic. It becomes part of how the CPG develops products and goes to market.

As this digitization of store assets happens over time, it’s going to help power retail media concepts in a big way.

This interview has been edited and condensed.