In this week’s Week in Review: The Trade Desk has a strong Q3 but investors show concern at Q4 outlook, Roblox introduces video ads, and Reach lays off ten percent of its staff.

Top Stories

The Trade Desk’s Share Price Slides as Ad Demand Stutters

Demand side platform The Trade Desk saw its share price fall by nearly 30 percent after the company said it’s seen a slowdown in ad demand on its platform in its Q3 earnings.

The company actually posted strong revenue growth, up 25 percent year-on-year across the quarter. But The Trade Desk’s projections for Q4 spooked investors. The company is forecasting Q4 revenues of $580 million significantly below analysts expectations of over $610 million (according to Reuters). CEO Jeff Green noted on the company’s earnings call that The Trade Desk “saw some reduction in brand spend in verticals such as automotive and consumer electronics, for instance, specifically around cellphones and media and entertainment”.

Jeff Green also spoke on the call extensively about the company’s plans for connected TV (CTV). Specifically, he said the company wants to build a “futures market” for CTV inventory. Green says this product will aim to “bring the best of the traditional upfront guarantee and combine it with the power of data driven decisioning or programmatic advertising [where] advertisers commit to certain levels of spend on specific audiences in a decisioned, programmatic forward market”.

Reach to Cut 10 Percent of Workforce

UK publishing group Reach has announced plans to cut 450 full-time jobs, representing 10 percent of its workforce. The business has already cut 330 roles this year, and expects the next round of redundancies to affect editorial and commercial roles across all Reach titles next year.

In July, the Daily Mirror owner said energy prices had driven up the cost of printing newspapers by 60 percent. On Wednesday, the company warned that inflation would push into 2024. As a result, the company needs to reduce operating costs by another 5-6 percent, on top of the 5-6 percent it was due to cut this year.

Reach added that ad demand has been soft so far this year, while Facebook’s deprioritisation of news content has also knocked the publisher’s revenues. In the last year, Meta has scrapped its mobile news product Instant Articles, as well as Facebook News in the UK, France and Germany.

Roblox Launches Video Ads

Popular video game Roblox this week announced it is testing a new video ad format, as it expands its advertising offering and looks to grow ad revenues for both itself and developers who create games and experiences within Roblox’s platform.

Video ads will appear on existing in-game screens which appear within Roblox’s user-created worlds, which are specifically designed to run ads. Roblox says videos will only start playing when the user looks at the screen for at least half a second, and will be muted unless the user unmutes or opens the video in full-screen. Publishers will earn from either video impressions, where the ad is shown for two seconds and meets certain viewability criteria, or video completions, which have to meet the same viewability criteria.

Roblox developers can also choose to offer in-game rewards in exchange for video completions.

Roblox will initially test the format on ads for user-created Roblox experiences and products, but will later expand to off-platform brands.

The Week in Tech

MiQ Acquires Data Quality Company Grasp

Programmatic specialist MiQ has acquired Grasp, a French media governance and data quality company. The acquisition is designed to tackle waste in media budgets, according to MiQ, using Grasp’s quality assurance and compliance products to eliminate manual errors and overspending. The deal follows MiQ’s acquisition of AirGrid, a privacy-first audience platform, in November 2022. “Our acquisition of Grasp is another exciting step in the evolution of our company as we look to grow, lead the digital advertising industry, and help advertisers forge forward in their programmatic journeys,” said MiQ co-founder and CEO Gurman Hundal.

PubMatic Integrates Experian’s Commerce Data

Supply-side platform PubMatic has agreed a data collaboration with Experian, using its consumer data to provide household-level commerce media targeting capabilities. Experian’s syndicated audiences, which include consumer demographics, spending models and property data, will be integrated into PubMatic’s omnichannel inventory, across mobile, web, in-app and CTV. “By integrating Experian’s robust commerce data into our platform, we give our customers an unprecedented competitive edge by empowering them with a deeper understanding of their target audiences as well as market-leading targeting capabilities, while remaining privacy-centric,” said Peter Barry, VP Addressability & Commerce Mdia at PubMatic.

Meta Denies Political Advertisers Access to GenAI Tools

Meta has barred the use of its generative AI ad products for political campaigns, warning that their capabilities could accelerate election misinformation on Facebook and Instagram. The tools allow advertisers to create backgrounds, image adjustments and variations of ad copy using text prompts. “As we continue to test new Generative AI ads creation tools in Ads Manager, advertisers running campaigns that qualify as ads for Housing, Employment or Credit or Social Issues, Elections, or Politics, or related to Health, Pharmaceuticals or Financial Services aren’t currently permitted to use these Generative AI features,” Meta said in a statement.

Digital Advertising to Rocket in India Says Omdia

Advertising is one of the fastest-growing segments of India’s digital economy, according to figures from Omdia. More than half of India’s 1.4 billion-strong population is under 30 years old, suggesting online advertising is expected to rocket between now and 2027. The digital economy is set for compound annual growth of 9.6 percent, with online ad revenues forecast for 12.7 percent annual growth. Omdia further predicted that YouTube and Meta will see video ad revenues in India grow in the mid- to high-teen percentages until 2025.

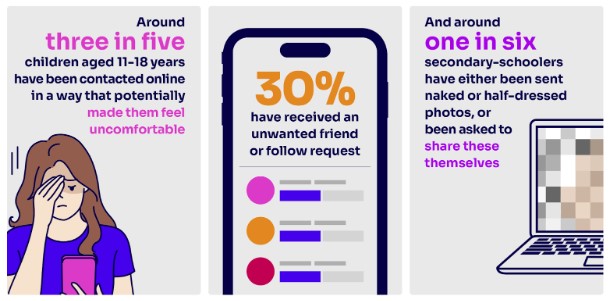

Tech Firms Face New Online Safety Laws in UK and EU

The Online Safety Act has become UK law, increasing protections from online harm, imposing new rules on tech companies, and handing new regulatory powers to Ofcom. As online safety regulator, Ofcom will force tech firms to tackle harmful, fraud and terrorist content on their platforms. Meanwhile the Digital Services Act (DSA) has come into force in the EU. Under the new rules, YouTube and TikTok execs will be asked by EU industry chief Thierry Breton how they protect children from illegal and harmful content on their platforms, according to Reuters.

The Week in TV

ITV Returns to Revenue Growth Via Studios and Digital Ads

British broadcaster ITV announced in a trading update this week that it returned to overall revenue growth in Q3, as growth in ITV Studios and the broadcaster’s digital ads business more than accounted for a year-on-year fall in linear TV ad revenues. In its half year update earlier in the year, ITV had slipped to a one percent drop in total revenues, due largely to an 11 percent fall in total ad revenues. But the third quarter was much more positive for the broadcaster. As a result, ITV has swung back into overall growth for the first nine months of the year, with total revenues up one percent year-on-year to £2,975 million. Read on VideoWeek.

MFE Boosts TV Ad Revenues in Italy

Mediaset’s Italian TV ad revenues saw 8 percent YoY growth in October, according to parent company MFE. A similar rise is expected in November, the broadcaster said, based on data currently available. The figures were reported in a newspaper interview with Publitalia CEO Stefano Sala.

RTL TV Ad Revenues Down Nearly 10 Percent This Year

German broadcaster RTL saw its revenues hit by weak advertising demand in the first nine months of 2023. Total group ad revenues were down 8.5 percent to €2,303 million, with TV ad revenues down 9.8 percent YoY. But streaming revenues rose by 21 percent over the same period, driven by a 30 percent increase in paying subscribers on RTL+ and Videoland. Expecting further TV declines, RTL has lowered its full-year revenue outlook from €7 billion to €6.9 billion.

Warner Bros. Discovery Loses Ad Revenues and Max Subscribers

Warner Bros. Discovery (WBD) saw TV ad revenues fall 12 percent YoY during Q3 2023, the broadcaster revealed on Wednesday. The company also lost 700,000 streaming subscribers compared with Q2, following the US launch of its Max SVOD service in May. WBD CEO David Zaslav noted the impact of the Hollywood strikes on its content and associated revenues. “This is a generational disruption we’re going through,” he said. “Going through that with a streaming service that’s losing billions of dollars, it’s really difficult to go on offense.” Shares dropped more than 16 percent after the earnings announcement.

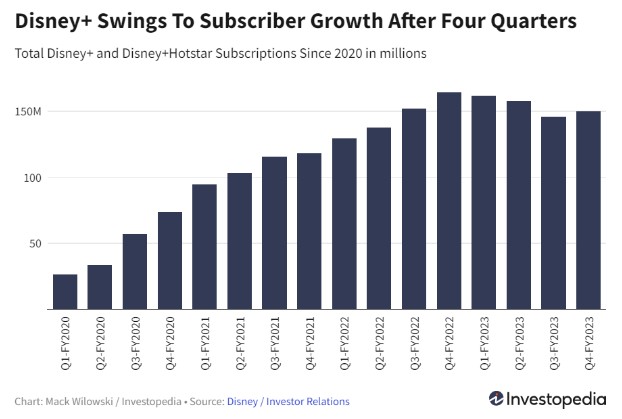

Disney+ With Ads Reaches 5.2 Million Subs

Disney+ added almost 7 million subscribers during the latest quarter, 2 million of which signed up for the ad-supported tier. This brings the Disney+ subscriber base above 150 million, and Disney+ with ads to 5.2 million customers. The company said Disney+ ARPU is now $6.70, up 2 percent on the previous quarter. And though the streaming business lost $387 million during the latest quarter, losses shrank 74 percent YoY. Total revenues at Disney increased 5 percent YoY, missing Wall Street estimates for the second consecutive quarter.

Striking Hollywood Actors Reach “Tentative Deal”

The US actors’ union, SAG-AFTRA, has agreed a “tentative deal” with Hollywood studio bosses. The agreement could end the 118-day strike, whose effects are still expected to rock the TV and streaming industry for months to come. The Alliance of Motion Picture and Television Producers (AMPTP) said its offer “gives SAG-AFTRA the biggest contract-on-contract gains in the history of the union, including the largest increase in minimum wages in the last 40 years; a brand new residual for streaming programmes; extensive consent and compensation protections in the use of artificial intelligence; and sizeable contract increases on items across the board.”

Deutsche Telekom Grows Pay-TV Base in Germany

German telco Deutsche Telekom grew its pay-TV subscriber base by 4.6 percent in Q3 2023, adding 51,000 customers to its MagentaTV offering. As a result, German TV customer revenues climbed 8.6 percent to reach €555 million. The firm also added 52,000 customers in Europe excluding Germany. Total revenues for the telco increased 0.7 percent to hit €27.6 billion.

US Advertisers to Increase FAST Investment Next Year

Free ad-supported streaming TV (FAST) is increasingly becoming a part of media plans, with 84 percent of US advertisers planning to increase their FAST investments in 2024, according to research by Xumo and Comcast Advertising. The study found that nearly half of US consumers regularly watch at least one FAST service, and 94 percent of FAST impressions are delivered on the TV screen. “Every month, FAST channels are attracting tens of millions of viewers due to the plethora of high-quality programming including content like local news, niche sports, themed movies, enthusiast TV shows, and more,” said Marcien Jenckes, President of Xumo and MD of Comcast Advertising. “The results of this research highlight how the advertising industry is responding to FAST, and their increasing interest in its monetisation potential.”

MYTF1 Reaches 27.5 Million Monthly Users

MYTF1 has become the leading free streaming service in France, according to measurement body Médiamétrie. The four-screen TV panel tracks daily viewing across TV, computer, smartphone and tablet. For the first nine months of 2023, MYTF1 averaged 27.5 million monthly users (up 6 percent YoY), and accumulated 758 million viewing hours (up 5 percent YoY). The BVOD service also reached 56 percent of 25-49 year olds, and garnered the largest streaming audience for an episode of crime/comedy HPI, which peaked at 2.3 million views.

The Week for Publishers

New York Times Shares Surge Thanks to Ad Market Rebound

The New York Times’s (NYT) shares have risen 7 percent after a recovery in the advertising market and higher-priced subscriptions surpassed quarterly revenue estimates. The newspaper conglomerate added 210,000 digital-only subscribers in the most recent quarter, having added 180,000 in the prior quarter. Revenue is also above estimations, with their $598.3 million figure higher than analyst’s average forecasts of $589.4 million. NYT also saw quarterly advertising revenue increase 6 percent YoY, although it expects total advertising revenue to decrease 4-8 percent in the fourth quarter.

BuzzFeed Struggles with Short Form Video Monetisation

BuzzFeed saw a 35 percent year-on-year decline in its Q3 ad revenues, the company reported in its quarterly earnings this week, contributing to a 29 percent fall in overall revenues. CEO Jonah Peretti said on an earnings call that the growth of short-form video is a significant factor in the company’s struggles. While short-form performs well in terms of attracting views, monetisation for short-form video is comparatively weak compared with long-form video.

Washington Post Cuts Headcount by Ten Percent Ahead of $100 Million Loss

The Washington Post is cutting its headcount by ten percent, as it expects a loss of around $100 million this year, Reuters reported this week. The publisher is also appointing a new CEO, bringing in William Lewis, ex-CEO of the Wall Street Journal, to replace Patty Stonesifer. In a note to staff, Stonesifer said the publisher had been overly optimistic about traffic, subscriptions, and ad revenues over the past few years.

Footballco US Expansion Kickstarts with North American CEO Hire

Footballco, a global football media company, announced the appointment of Jason Wagenheim as its North America CEO. The newly created position signals the company’s intent to expand its offerings into the US market, with Wagenheim saying, “There is tremendous upside opportunity for soccer in the US, especially with the growing popularity of MLS and the road to the FIFA World Cup hosted across the US, Mexico and Canada in 2026. This is a critical inflection point for the company and sport”. Wagenheim will leave Bustle Digital Group to begin his new role in January, operating out of Footballco’s New York office.

Google’s AdSense Updating Revenue Share Structure

Google’s AdSense is updating its revenue share structure and moving to per-impression payments for publishers. Previously, the program processed fees within a single transaction, but are now splitting the AdSense revenue share into separate rates for the buy-side and sell-side. For displaying ads with AdSense for content, publishers will receive 80 percent of the revenue after the advertiser platform takes its fee, whether that be Google’s buy-side or third-party platforms. AdSense will also transition from primarily paying publishers per click to the display industry standard of paying per impression, with the intention of providing a way to pay publishers for their ad space across Google’s products and third-party platforms, and comparing with their other technology providers.

The Week For Brands & Agencies

S4 Capital Posts Revenue Drop as Tech Ad Spend Remains Muted

Sir Martin Sorrell’s ad business S4 Capital saw a sharp revenue drop in its Q3 financial results, issuing a further profit warning for the business. Total revenues were down by 13 percent year-on-year on a like-for-like basis. S4 Capital has been hit particularly hard by the advertising pullback from tech clients, which currently account for 43 percent of its revenues and the company said this was a major factor behind its Q3 decline.

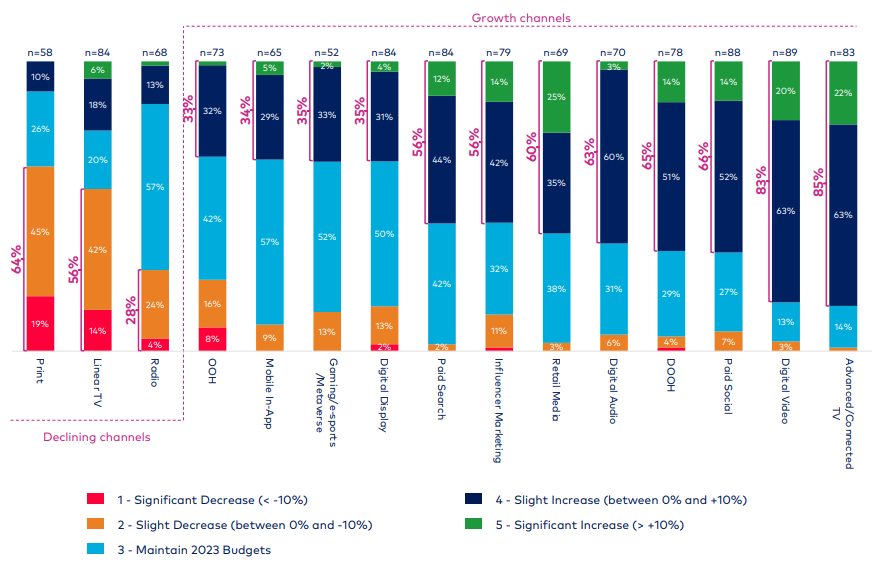

Global Budgets Set to Swing Towards Video and CTV in 2024

Most major brands are planning to increase their global media budgets next year, according to the World Federation of Advertisers (WFA) and Ebiquity, with digital video and connected TV (CTV) expected to be the main recipients of budget increases in 2024. The Media Budgets 2024 study surveyed 92 advertisers, responsible for a combined $50 billion annual advertising spend, and $700 million average spend per brand. The results found that 60 percent of respondents plan to raise their budgets next year, with 14 percent planning a “significant increase”.

Media Price Inflation Set to Slow Next Year

After a period of rapid inflation in media pricing, the rate of inflation is set to gradually decline next year according to the World Federation of Advertisers’ (WFA) latest media price inflation report. Prices at the US TV Upfronts are expected to see flat or single digit increases, compared with high inflation this year. And the rate of inflation across digital video and digital display is predicted to decline slightly.

UK Advertisers Plan £9.5 Billion Spend Over Christmas

Advertisers are set to open their wallets this Christmas season, according to the Advertising Association (AA) and WARC, forecasting a record £9.5 billion ad spend during the festive period. This marks a 4.8 percent increase from last year’s £9 billion, a previous record sum for the UK advertising sector. The uptick points towards optimism around shopping habits this Christmas compared to last year, when consumer spending was hit particularly hard by rocketing energy prices. Read on VideoWeek.

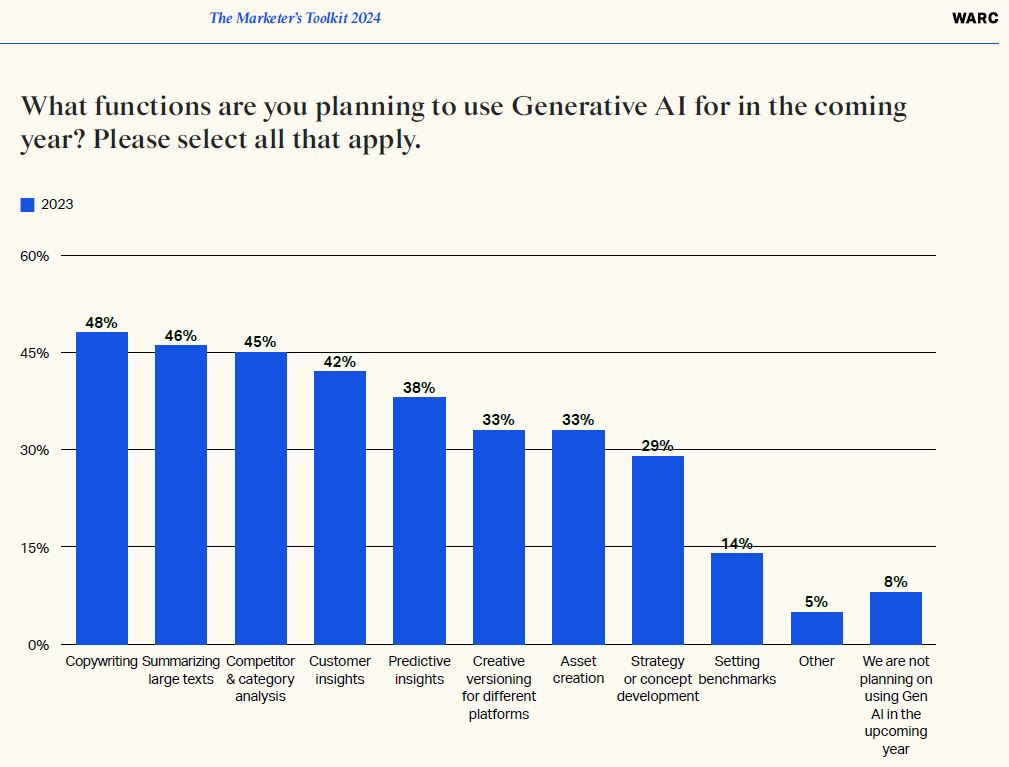

Seventy Percent of Marketers Plan to Unlock Generative AI’s Potential Next Year

Seventy percent of marketers say they plan to “unlock the potential of AI in their marketing” next year, according to WARC’s Marketer’s Toolkit report, released this week. The most commonly cited use cases by respondents to WARC’s survey were copywriting, summarizing large texts, and category ad competitor analysis.

Hires of the Week

Disney Hires Hugh Johnston as New Chief Financial Officer

Walt Disney Co. hired Hugh Jonhston as its Chief Financial Officer (CFO) as part of a restructure. Johnston will be responsible for making Disney’s streaming business profitable, and charting a path for its traditional TV unit. Previously, he worked as Vice Chairman and CFO with PepsiCo, and sits on the boards of Microsoft and HCA Healthcare, and will begin his new role on 4th December after Christine McCarthy vacated the position in June. Jamie Caulfied, CFO for North America at PepsiCo, will be promoted to Johnston’s former position at the company.

NBCUniversal Appoints Alison Levin as Advertising and Partnerships President

NBCUniversal announced Alison Levin as its new president of advertising and partnerships. Levin will join the company in December, and will assume oversight of all advertising sales initiatives across national, local, SMB Growth, Peacock, sports and Olympic/Paralympic Sales. Levi previously worked as VP of global ad revenue and marketing solutions at Roku, sales executive with YuMe, and occupied sales positions with BusinessWeek and IAC. In addition to the hire, NBCUniversal have promoted Karen Kovacs to president of client partnerships.

This Week on VideoWeek

“There is a Place for MFA-Style Websites”

Global Budgets Set to Swing Towards Video and CTV in 2024

ITV Returns to Revenue Growth Via Studios and Digital Ads

Good Signs and Bad Signs for Ad Market in Mixed Week for Media Earnings

Advertisers Enter the Christmas Spirit Despite Cooling on TV

Ad of the Week

Feel It Now, PlayStation 5