Barb will expand its reporting to include YouTube and other “fit-for-TV content” on video-sharing platforms, the UK measurement body announced this morning. The organisation defines fit-for-TV as content that has editorial input and oversight, meets regulatory compliance, and provides a safe and suitable environment for advertisers.

The decision follows an industry consultation designed to establish a consensus on the type of content the Board should include, after initially rejecting YouTube’s application on brand safety grounds. Now Barb will extend its measurement to cover eligible content on YouTube, TikTok and Twitch, having added SVOD services Disney+ and Netflix in recent months.

In recognition of these developments, BARB (Broadcasters’ Audience Research Board) has changed its company name to Barb Audiences Ltd. “The change reflects its heritage of over 40 years of continuous innovation and its ambition to continue extending the industry’s standard measurement across TV companies, VOD streamers and video-sharing platforms,” the company said in a statement.

Fit for purpose

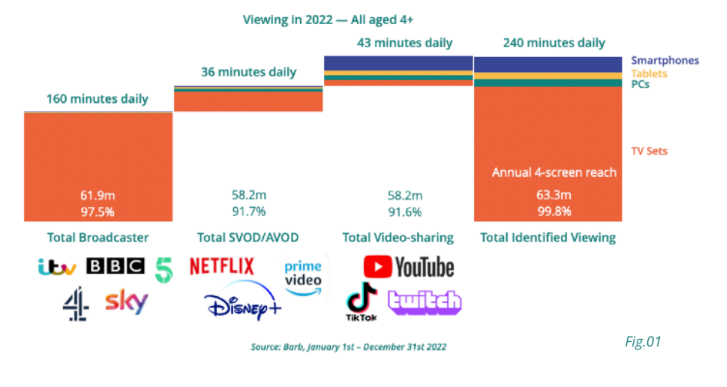

Barb’s reporting previously covered 15 channels that streamed their content on YouTube, finding that 26 percent of 2022 Champions League Final viewers watched the game via YouTube, and this audience trended younger than the average viewer. Furthermore, video-sharing platforms were the second-most watched category of identified viewing in 2022, with people spending an average 43 minutes per day watching the likes of TikTok and YouTube, mostly on smartphones.

With this in mind, Barb launched the consultation into tracking “TV-like content” – and though “there wasn’t an appetite” for that particular phrase, “there was a near-universal appreciation of the definition and role of content quality.” Consensus formed around the level of investment required for quality content, not merely in terms of production budget but in editorial and regulatory scrutiny, as well as brand safety for advertisers.

In addition, the consultation found that reporting fit-for-TV content should include contextual factors relevant to advertisers and agencies. These include the screen or device type, screen orientation, sound on or off, how much of the content is in view, how long the content is watched for, and where the viewing takes place. “The industry’s expectation is these contextual quality factors should be available in any audience reporting for content on video-sharing platforms,” said Barb.

The organisation added that it is still ironing out the details on fulfilling its new commitments. “We don’t yet have all the answers for how and when we will extend our reporting of content on video-sharing platforms,” said Justin Sampson, Chief Executive at Barb. “We’re appreciative of the deep trust the industry has in our track record for delivering an understanding of what people watch. Yet we also hear a clear call to go further. We’ve made great strides to report audiences for VOD streaming services and are delighted Disney+ and Netflix have recognised the value of the insight we deliver.”

“Social glue”

The measurement body noted that SVOD and AVOD viewing trails that of video-sharing platforms, averaging 36 minutes per day. Though this viewing is spread across 16 different services, 99 percent is concentrated in the “big three,” namely Netflix, Amazon Prime Video and Disney+.

The numbers also revealed a higher proportion of viewing on video-sharing platforms during the summer months. “This shows that services such as YouTube and TikTok are bucking established seasonal patterns of viewing,” explained Barb, highlighting the contrast between the steady flow of new content on video-sharing platforms compared with the “carefully-timed content-launch strategies” used by broadcasters and streaming companies.

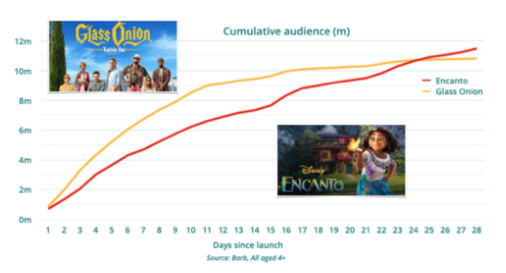

As previously reported by VideoWeek, SVOD titles seldom bother Barb’s top 20 most-watched shows. Instead the list “confirms the power of social-glue programming,” dominated as it is by live football, I’m A Celebrity or news events such as the Queen’s funeral. That said, Glass Onion: A Knives Out Mystery attracted 6.7 million Netflix viewers in its first seven days, and Turning Red 3.6 million on Disney+.

It is worth noting the limitations of tracking a title’s first seven days, as Encanto (released on Disney+ in 2021) trails Glass Onion over its first week but overtakes the Netflix film after 25 days. “Even now, over a year later, Encanto is still frequently in the most-viewed films on SVOD services each week,” said Barb. “This demonstrates the challenge of determining one metric to rule them all. Clearly live sport and major news events will see very little audience growth after the live broadcast.”