In this week’s Week in Review: HBO Max will be shuttered to make way for a new combined streaming service, WPP raises its revenue forecast for 2022, and RTL sees continued success in streaming.

Top Stories

Warner Bros. Discovery to Dissolve HBO Max

HBO Max and Discovery+ are set to merge in 2023, Warner Bros. Discovery confirmed on Thursday. The roll-out will begin in markets already carrying HBO Max (the US and Latin America) before reaching Europe and Asia Pacific in 2024. The offering will include a free, ad-supported tier, a paid ad tier and a paid ad-free tier. JB Perrette, President and CEO of Discovery Streaming and International, noted that the FAST platform would house different content to the premium SVOD options. “With over 100,000 episodes across our combined portfolio, there’s a lot of content that wouldn’t necessarily make sense in a premium product that might make sense in a FAST.” Warner Bros. Discovery aims to reach 130 million global subscribers by 2025.

The announcement follows a tumultuous 24 hours for the recently merged company, after it unexpectedly shelved its $90 million Batgirl movie. Reports suggest that CEO David Zaslav thought the film was worth more to the corporation as a tax write-off than an HBO Max release. Six other exclusive titles were also removed from the platform. On Thursday’s earnings call, Warner Bros. Discovery CFO Gunnar Wiedenfels counted the content “restructuring” among the company’s key cost-cutting measures, alongside the shutdown of CNN+ one month after launch. The business then announced that CNN content would relocate to Disney+. Warner Bros. Discovery chose not to divulge separate subscriber numbers for the two streaming services.

WPP Raises its 2022 Revenue Forecast

Agency holding group WPP has upgraded its full year forecast for 2022, following strong earnings in Q2. The company now expects organic growth of 6-7 percent in 2022, up from a previous forecast of 5.5-6.5 percent.

Like-for-like revenues were up by 8.7 percent in the first half of the year, and up by 9.3 percent in Q2 specifically. CEO Mark Read credited WPP’s “growing capabilities in commerce, experience and technology, our continued strength in media and the resurgence in demand for strategic communications advice from our public relations agencies,” for the strong quarter, as well as significant client wins in Audi, Audible, Danone, and Nationwide.

However WPP’s share price fell following the results, as shareholders had hoped for an even more optimistic outlook. While ad-funded tech companies have seen ad revenues slide, agency groups have continued to forecast strong growth – and shareholders has seemingly expected an even higher forecast for the year ahead than the one Read delivered.

RTL Group Sees Continued Success in Streaming Strategy

RTL Group posted record revenues in its H1 earnings, with growth of 8.7 percent pushing revenues to €3.3 billion, as the European broadcaster saw continued success from its streaming push.

The group’s streaming subscriber base in Germany and the Netherlands rose by 48 percent to surpass 4.5 million. Streaming revenue was also up 21.5 percent to hit €130 million. The company added that its merger of RTL Deutschland and Gruner + Jahr is progressing according to plan, alongside the sale of RTL Belgium and RTL Croatia. “We remain convinced that market consolidation is necessary to compete with the global tech platforms,” said RTL Group CEO Thomas Rabe.

RTL did however say that it saw worse than expected ad revenues in March and April, and that most advertising markets in Europe have “continued to soften since then”. But with the FIFA World Cup due in Q4, RTL said the state of the advertising market for the second half of the year is “uncertain”. This was reflected in RTL’s revised full year outlook; the company updated its full year revenue forecast to €7.3-€7.5 billion, from its previous estimate of €7.4 billion.

The Week in Tech

Apple Plans to Build a DSP

Apple is hiring for a role to help build a demand-side platform, according to a job posting first seen by Digiday, suggesting the company is planning to ramp up its own ad sales business. The job posting says whoever is hired will be tasked with driving “the design of the most privacy-forward, sophisticated demand side platform possible”.

Criteo Posts Mixed Q2 Earnings, Completes IPONWEB Acquisition

French ad tech firm Criteo filed mixed results in its Q2 earnings. Net profit rose from $15 million to $18 million, while revenues fell by 11 percent year over year. The company cited advertisers pulling back on spending in anticipation of an economic downturn, alongside the impact of Apple’s privacy changes. Criteo also completed its $250 million acquisition of IPONWEB this week. The deal was initially estimated at $380 million prior to complications caused by the war in Ukraine. The majority of the IPONWEB engineering team was based in Russia before largely relocating to Germany. The company’s Russian subsidiary was ultimately excluded from the purchase.

ISBA Progresses with Consultation on Origin Funding

ISBA has completed its industry-wide consultation into the funding of Origin, its cross-media measurement platform. The proposal sought to partially fund the initiative through an advertiser levy. The “overwhelming weight of positive feedback” from ISBA members, media agencies and UK broadcasters allows the UK trade body to advance to the second phase of consultation later this year, with Origin expected to go live in mid-2024.

Kenyan Watchdog Threatens to Suspend Facebook Over Hate Speech

Kenya’s National Cohesion and Integration Commission (NCIC) has ordered Facebook to tackle hate speech on the platform in relation to next week’s presidential election. The NCIC found Facebook carrying more than a dozen political ads that breached Kenyan rules on hate speech and inflammatory content. The watchdog warned that if the tech giant fails to comply within seven days, Facebook’s operations will be suspended in Kenya.

Google Play to Ban Full Screen Interstitial Ads

Google Play has introduced new advertising guidelines to prevent ads from being shown in “unexpected ways.” Coming into effect on 30th September, the rules will effectively ban full screen interstitial adverts from interrupting game play. “Ads that appear during game play at the beginning of a level or during the beginning of a content segment are not allowed,” said Google. “Full screen interstitial ads of all formats that are not closeable after 15 seconds are not allowed.”

Apple Adds App Store Ad Placements

This week Apple added new advertising placements within the App Store. Developers can now promote their apps within the Today tab (the front page of the App Store) and on app product pages under the “You Might Also Like” section. Apple added that ads will be clearly marked so as to be easily distinguishable from editorial App Store stories. The new advertising options join existing placements in the Search tab and within the Search results page. “Apple Search Ads provides opportunities for developers of all sizes to grow their business,” the company said.

Italian Regulator Fines Google for YouTube Gambling Ads

Italian communication authority AGCOM fined Google €750,000 this week, after finding YouTube in violation of the country’s ban on gambling advertising. AGCOM ordered a further €700,000 fine from TOP ADS, the agency responsible for the adverts. The regulator said the fine was the first it had issued against a video provider for breaching the “Dignity Decree” since its introduction in 2018.

Tech Lobby Spends $120 Million to Fight Antitrust Legislation

Big tech firms have spent almost $120 million on political advertising since the beginning of 2021, AdImpact has revealed. According to Bloomberg, “almost all” of that sum has sponsored adverts opposing Senator Amy Klobuchar’s American Innovation and Choice Online Act, the main antitrust bill moving through Congress. By way of contrast, “advocates supporting the legislation have spent less than $300,000 on advertising.” This marks the first time the tech industry has outspent the pharmaceutical industry on political advertising, noted AdImpact.

DoubleVerify Boosts Revenue with Gaming and Social Video Partnerships

Measurement and verification specialist DoubleVerify reported 43 percent Q2 revenue growth, reaching $109.8 million. DoubleVerify credited the growth to its gaming partnership with Twitch, expansion of its brand safety tools on TikTok, and the acquisition of video verification business OpenSlate. The company’s stock jumped 4 percent following the earnings announcement. It also upped its guidance for the rest of 2022 to a projected 35 percent total revenue growth.

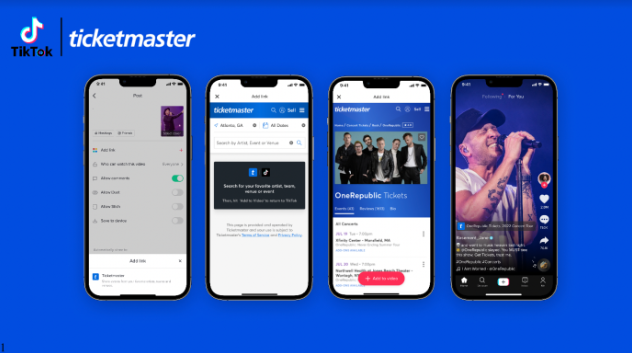

TikTok Teams Up with Ticketmaster

TikTok and Ticketmaster announced a new partnership on Friday that enables users to buy tickets on the social video platform. Select creators will be able to add event links to their TikTok videos, the company said, taking viewers to an in-app browser where they can purchase tickets. The deal follows reports of TikTok parent company ByteDance filing trademark applications for ‘TikTok Music’, fuelling speculation that the Chinese company plans to launch its own Spotify rival.

The Week in TV

SVOD Subs in Decline Finds BARB

SVOD subscriptions were down in Q2 2022, BARB found in its latest Establishment Survey. According to the report, the number of UK households with access to an SVOD service fell to 19.19 million (67 percent of households) in Q2 – a two percent decrease from 19.57 million in Q1. BARB revealed that Netflix subs fell by 1 percent, Amazon Prime Video by 4 percent and NOW by 3 percent. However, Disney+ and Apple TV+ were up by 1 percent and 3 percent respectively. “We don’t ask households why they choose to add or drop subscriptions, although the sharp increase in energy prices in March/April must have been a catalyst for people to review all their monthly outgoings,” said BARB Chief Executive Justin Sampson. “The numbers we report today show SVOD services aren’t immune as households work hard to make ends meet.”

Vice Media Explores Takeover by Antenna Group

Vice Media is in talks for a takeover by Antenna Group, Greece’s largest media company. Vice has been seeking a buyer since May, having abandoned last year’s plans to go public via a merger with technology growth fund 7GC & Co Holdings. Despite its share of political controversy, the company has emerged as a major player in the video and production sector, with assets including in-house creative agency Virtue and recently acquired UK studio Pulse Films.

Paramount+ Adds 4.9 Million Subscribers, Lands on Roku

Paramount+ added 4.9 million subscribers in Q2, bringing its total number of subscribers over 43 million. The company credited its content strategy and inclusion of box office hits on the platform. “Their success demonstrates that our strategy of a big theatrical release with a fast follow to streaming is by far the most effective way to maximise the return on our investments in movies,” said Paramount Global President and CEO Bob Bakish. “Meanwhile, hit CBS originals like NCIS, which consistently dominates ratings on linear, have drawn significant viewership to Paramount+ and driven engagement there.” Also this week, the company agreed a distribution deal to bring Paramount+ to the Roku Channel. The agreement sees Roku create a live TV guide for Paramount+, the first of its kind for a premium subscription partner.

Canal+ Files Revenue and Subscriber Growth

Canal+ Group recorded revenue and subscriber growth for the first half of 2022. The Vivendi-owned pay-TV provider saw revenues increase by 3.3 percent to reach €2,873 million, while subscriptions grew from 22.4 million in the first half of 2021 to hit 23.9 million. Meanwhile the group’s production arm Studiocanal suffered a 23.5 percent drop in revenues. Nevertheless Vivendi revenues grew by 10.9 percent, thanks to its advertising outfit Havas as well as Canal+.

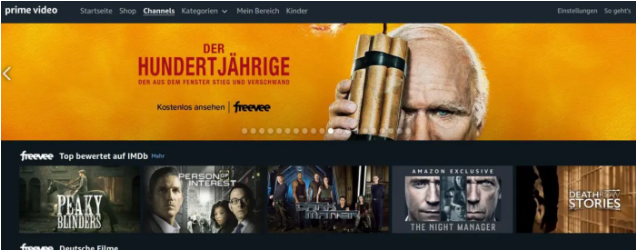

Amazon Launches Freevee in Germany

Amazon this week launched its AVOD service Freevee in Germany, which becomes the third market where the platform is available following its roll-out in the US and UK. Freevee (formerly known as IMDb TV) is also due for release in Austria. “We are offering users a service that they would typically expect to find behind a paywall,” said an Amazon spokesperson.

Liberty Global CEO Doubles Down on Video Services

Video services are “necessary” to Liberty Global’s business, according to the telecoms giant’s CEO Mike Fries. Following disappointing results last week, Fries told analysts that Liberty Global’s integrated entertainment offering was key to its customer retention strategy. “Some have asked, is it necessary to offer a video service? The answer is yes, especially in Europe, where a significant percentage of customers say that’s one reason why they subscribe to our broadband service,” he said. “Fortunately, we’ve been integrating streaming apps into our platforms for some time, and customers increasingly rely on us to access their favourite providers.”

ITV Expectations Are “Too High” Warns Berenberg

ITV’s financial forecasts for the next two years are “too high,” Berenberg analysts warned on Wednesday. Last week the broadcaster posted five percent growth in ad revenue for the first half of the year, expecting its upcoming streaming service ITVX to withstand economic hardships. But Berenberg warned of “headwinds coming in advertising”, predicting overall advertising revenue to decline by 7 percent in 2023. The bank also forecast a drop-off in ITV viewing, alongside competition from streaming platforms introducing ad-supported tiers in the coming months.

Netflix Increases African Content Investment

Netflix is upping its investment in African content, unveiling a slate of originals expected to debut in late 2022 and early 2023. The programming includes the platform’s first Afrikaans-language drama Ludik, a multi-project film partnership with South African director Mandlakayise Walter Dube, and a new season of reality format Young Famous And African. “With an ever-growing slate of series, movies and licensed content across a rich variety of best-in-class content across genres, we want to give our members more moments to share the joy that comes from being immersed in great stories made in Africa, to be watched by the world,” said Tendeka Matatu, Director of Film in Africa at Netflix.

The Week for Publishers

New York Times Expects Q3 Drop in Ad Revenues

The New York Times posted another solid quarter in its Q2 earnings, but its share price fell by over six percent after the new publisher forecasted a Q3 slowdown in ad revenues. “Given the uncertain macroeconomic environment, we’ll continue to look closely at costs while prioritising investment in areas that widen our moat like journalism and digital product development,” said Meredith Kopit Levien, CEO at the NYT.

Forbes Explores a Sale

Digital publisher Forbes is considering a sale, and has hired Citigroup to help handle the process, the company confirmed this week. The move follows an abandoned attempt to go public via a merger with a special purpose acquisition company (SPAC). Forbes is looking for a price of around $630 million, according to the New York Times.

Reuters News Revenues Grow by Nine Percent

Thomson Reuters saw total revenues rise by five percent year-on-year in Q2, while revenues from its news division were up by nine percent. While the company said that the shaky ad market could affect Reuters News, revenues in the previous quarter were strong thanks to its events business and annual increases from payments from a news agreement with Refinitiv, according to Reuters reporting.

Reach Ends Free Newspapers in Manchester Amid Digital Success

Reach has said it will stop distributing free newspapers in Manchester, due to the inflationary pressure on print and the fact that Reach’s digital success has rendered the tactic less relevant. Reach previously has distributed newspapers for free in order to maximise reach for print ads, but the publisher says its large online reach offers an alternative.

TikTok Considers Launching a Music Service

TikTok, which started life as lip syncing video platform Musical.ly, is reportedly exploring launching a dedicated music platform which would let users buy, play and download music. The company has filed a trademark application in the US for TikTok Music, which would presumably put TikTok in direct competition with Spotify if a product were to come to market.

Reuters Journalists Go on Strike

Almost 300 US-based Reuters journalists went on strike this week, hitting back against a proposed guaranteed one percent annual pay rise offered by management. The NewsGuild union which represents Reuters journalists described the offer as “miserly” and “hard to swallow”.

National World’s Digital Revenues Grow 41 Percent

National World’s digital revenues were up 41 percent year-on-year for the first half of the year, making up for falling print revenues. The UK regional media business saw total revenues grow by three percent, while pre-tax profits were up by 60 percent year-on-year.

The Week For Agencies

Havas Posts 11.4 Percent Organic Growth in H2

French agency group Havas posted 11.5 percent organic revenue growth for the first half of the year in its earnings this week, while total revenues were up 19.9 percent year-on-year. Organic growth was strongest in Latin America, at 47.7 percent, while organic growth in Europe was 11.7 percent.

The Brandtech Group Explores Jellyfish Acquisition

The Brandtech Group (formerly You & Mr Jones) confirmed this week it is exploring an acquisition of digital agency Jellyfish, having entered into exclusive negotiations with Jellyfish’s majority stakeholder Fimalac.

Stagwell Reports 16 Percent Organic Growth in Q2

UK-based agency group Stagwell posted 16 percent year-on-year organic growth in Q2, driven primarily by media and digital according to CEO Mark Penn. “Due to our unique mix of digital and creative capabilities, clients now recognize Stagwell as a serious alternative to legacy incumbents – and we are now a regular contender in many of the largest global pitches,” said Penn.

Dentsu Buys Majority Stake in Extentia

Dentsu Group has entered an agreement to acquire a majority stake in Extentia, a global technology and services firm with a focus on enterprise mobility, cloud engineering, and user experiences. Extentia, which specialises in Salesforce, will join Merkle, Dentsu’s data-driven customer experience management company.

Planet Fitness Ends Publicis Relationship After Less than a Year

US gym chain Planet Fitness is reuniting with creative agency Barkley, ending its relationship with Publicis less than a year after appointing it as its agency of record. Publicis is continuing to run national media and buying until the end of the year, after which point independent media agency Crossmedia will take over, according to AdAge.

UK Toughens Rules on Ads for High-Risk Financial Products

The UK’s Financial Conduct Authority (FCA) this week finalised new rules for advertising particular high-risk financial products. The new rules state that firms issuing marketing materials must have appropriate expertise of these products, and must thoroughly check that customers understand the risks. Risk warnings within ads must also be made clearer, and ‘refer a friend bonuses’ are now banned, according to Reuters.

Publicis Wins PepsiCo Media Duties in Southeast Asia

Food and drinks business PepsiCo has handed media duties in Southeast Asia to Publicis Groupe, which has created a bespoke unit Plus+ to handle the business. The account was previously held by WPP’s Mindshare.

ASOS, Boohoo and Asda Investigated Over Green Claims

The UK’s Competition and Markets Authority is investigating three retailers; ASOS, Boohoo, and Asda; over green fashion claims, as part of an ongoing investigation into potential greenwashing. Among concerns listed by the CMA are the use of broad and vague statements and language relating to items, low standards for including items in collections which are marketed as green or sustainable, and missing information on items included within these collections.

Hires of the Week

S4 Capital Brings Colin Day to Board

S4 Capital has appointed board member Colin Day, former non-executive director of WPP. Also this week, MightyHive co-founder Chris Martin was named COO. The Sir Martin Sorrell-led advertising firm has lost 80 percent of its stock market value this year, now enlisting industry veterans to oversee its audit and risk requirements.

Warner Bros. Discovery Names UK Team

Warner Bros. Discovery has named its UK leadership team reporting to General Manager Antonio Ruiz, and joining Katie Coteman, VP and Head of Advertising and Partnerships. The appointments are as follows:

- Alex Foley, VP of Portfolio Planning and Insights

- Clare Laycock, SVP and Head of lifestyle and Entertainment Brands

- Alex Lewis, SVP and Director of Marketing

- Neil Marshall, Head of Theatrical Film Distribution and Local Film Production and Acquisition

- Alison Morris, SVP of Sales for UK, Ireland and Sub-Saharan Africa

- Rachel Wakley, SVP and General Manager for UK and Ireland

This Week on VideoWeek

The Buy-Side View: Q&A with Spark Foundry’s Rebecca Candeland, read on VideoWeek

ProSieben and RTL Deutschland Team Up to Grow Addressable TV in Europe, read on VideoWeek

Inside CFlight’s Quiet Revolution of TV Measurement, read on VideoWeek

Facebook Shutters Live Shopping in Continued Push for Short-Form Video, read on VideoWeek

VideoWeek Podcast #33: Erin Schmidt, BEN, listen on VideoWeek

Ad of the Week

HP, Work Happy