Publishers are focused on building their first-party data offerings in preparation for cookie deprecation, but uninterested in testing Google’s Sandbox tools, the Association of Online Publishers (AOP) revealed in its third annual survey. The study also found that one-quarter of publishers have editorial policies in place prohibiting the use of generative AI.

The AOP asked the digital publishing industry about their attitudes to different challenges and opportunities facing their businesses, including cookie deprecation, generative AI and sustainability. The study found that publishers feel generally prepared for the future, rating their confidence an average 7.1 out of 10.

Asked to rank their business priorities for the future, developing new revenue streams through product innovation came out on top, with an average score of 4.3 out of 5. Data privacy compliance and transparency, recruiting and retaining talent, and ensuring a diverse and inclusive workplace all came in second at 3.9. Preparing for deprecation of third-party cookies placed mid-table with a score of 3.7.

Emptying the Sandbox

Looking specifically at strategies for cookie deprecation, 37 percent of respondents called “improving our engagement funnel to build better first-party data” their prime focus. Notably, none of the publishers cited testing Google Sandbox (the company’s set of tools to replace third-party cookies) as their key focus. This emphasis on building their own first-party data sets suggests publishers “are looking to take back control,” according to the AOP.

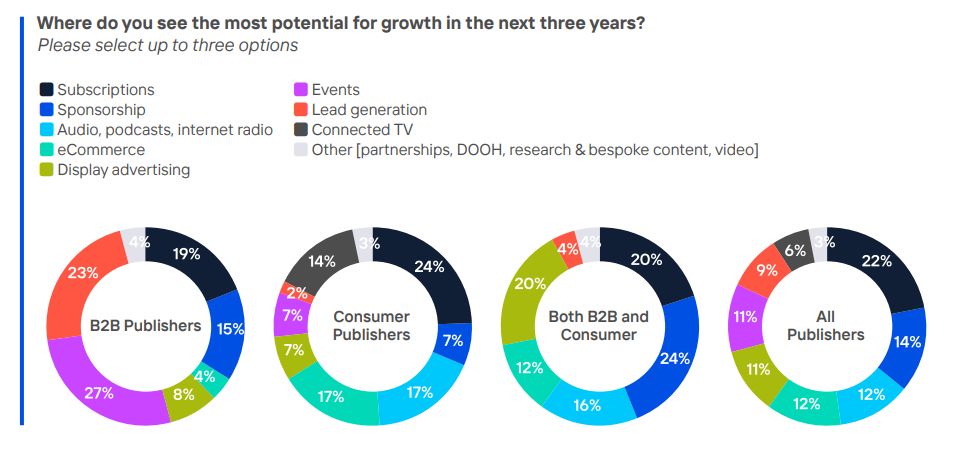

The survey also asked commercial publishers where they saw the most potential for revenue growth in the next three years. Subscriptions remained top of the list (22 percent), followed by sponsorships (14 percent), audio, podcasts and internet radio (12 percent), ecommerce (12 percent), display advertising (11 percent), lead generation (9 percent), connected TV (6 percent), and other (3 percent).

But connected TV ranked much higher for consumer publishers at 14 percent. Audio and ecommerce also climbed to 17 percent for consumer publishers, knocking sponsorship and display advertising from the top three position they held in last year’s survey, falling to 7 percent each this time around.

In terms of ad revenues, the AOP asked publishers where they see the most revenue generated: direct deals, private marketplaces (PMP) or open marketplaces. The results found that direct deals currently provide the greatest source of revenues (78 percent) and are expected to keep doing so in the next three years (77 percent). PMPs and open marketplaces both trail as current revenue sources (11 percent), but revenues from PMPs are expected to grow (18 percent) at the expense of open marketplaces (5 percent).

AI content by the bucket load

Respondents were then asked to assess the impact of generative AI on their business on a scale of 0 (negative impact) to 10 (positive impact). The average score was 5.5, suggesting publishers either “see positive and negative benefits in balance, or that they are not yet sure of the repercussions,” according to the AOP.

Publishers were also asked how they are preparing for the “inevitable growth” of generative AI. The most popular use cases were delivering efficiencies within businesses (76 percent) and product development (70 percent). Interestingly, 26 percent of respondents said they have an editorial policy that prohibits the use of generative AI.

And when invited to suggest issues the AOP should explore on behalf of its members, publishers expressed concern over the impact of generative AI. The comments focused on how to “combat AI clickbait” and ringfence premium online content, and whether consumers are prepared for the potentially negative consequences of generative AI, “ie: a bucket load of synthesised content.”

The study additionally assessed the industry’s progress on environmental, social and governance (ESG) goals. While 62 percent agreed that their business places “strong importance” on ESG strategies, 33 percent said they neither agree nor disagree. Most agreed that their business was focused on reducing its carbon footprint (67 percent), and had a “clear strategy” to create a more diverse and inclusive workforce (66 percent).

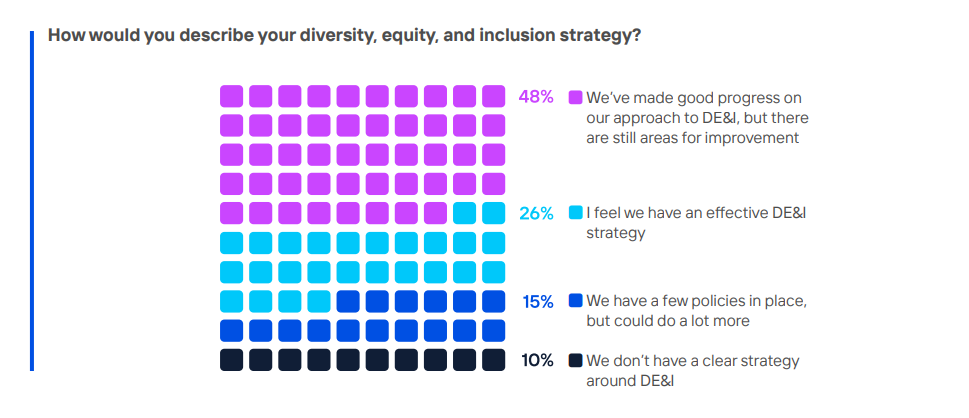

Asked to rank their organisation’s diversity, equity, and inclusion (DEI) strategy, 48 percent said they have made good progress, while acknowledging there are still areas for improvement. This was followed by 26 percent claiming an effective DE&I strategy, 15 percent acknowledging they have “a few policies in place”, and 10 percent reporting they don’t have a clear strategy around DE&I.