Despite rising interest rates and inflation, 2022 kicked off with a wave of M&A … that turned into a trickle … and became a relative dribble by the end of the year.

The ongoing war in Ukraine, global supply chain issues that just won’t quit, signal loss, regulatory scrutiny, ad spending on the decline, tech and media layoffs on the rise – the storm was perfect.

“You’ve got all of this uncertainty brewing,” Conor McKenna, a director at LUMA Partners, told AdExchanger in July, “and that creates a lot of challenges and puts a ton of pressure on valuations and dealmaking.”

But it was practically inevitable that M&A would slow in 2022 after the breakneck pace in 2021, when acquisitions were up 82% year-over-year, according to LUMA.

Yet there’s little doubt that M&A will be muted in the year to come, with fewer big deals getting done. Especially with antitrust antennas up in Washington, DC.

Even so, hope springs eternal, and one company’s headwind is another company’s potential opportunity. Privacy concerns, identity data-related challenges and targeting alternatives, the growth of retail media and the rise of data clean rooms could all spark interest from strategic acquirers.

In the meantime, though, here’s a thorough (but non-exhaustive) refresher on M&A during the year that was.

January

January was so jam-packed with acquisitions, we made a joke about it in the January 20 edition of AdExchanger’s daily news roundup: “Are you sick of hearing about M&A already? TOO BAD! We’ve still got multiple deals being announced on the regular.”

During the first week of January alone, AppLovin closed its acquisition of MoPub, Integral Ad Science bought a French contextual advertising startup called Context, Smartly.io acquired creative management platform Ad-Lib.io, Magnite acquired cryptographic audience data startup Nth Party, CDP BlueConic sold a majority stake to Vista Equity Partners and The New York Times agreed to buy The Athletic.

And then the bonanza just kept on bonanza-ing, with a mix of low-key acquisitions and blockbuster deals.

By the time January drew to a close, T-Mobile had committed itself to rideshare advertising with its purchase of Octopus Interactive, Take-Two Interactive got into mobile gaming with the acquisition of Zynga, Mayfair Equity Partners took a majority stake in outcome-based ads platform LoopMe, video content management platform QuickFrame was acquired by Ryan Reynolds’s favorite ad tech company, MNTN – and a little company named Microsoft proposed a (now very contested) $69 billion deal to buy Activision Blizzard.

And you have six tries to figure out what the New York Times acquired on the last day of January. (Answer: Wordle.)

The torrid pace of M&A continued through the winter, although it was a grab bag of deals ranging from media and CTV to social activation and audio.

ShowHeroes, a video and contextual targeting company based in Europe, entered the Latin American market with the acquisition of cross-screen ad platform smartclip LATAM. (German media conglomerate RTL Group still owns the rest of smartclip’s business.)

But the bigger CTV deal by far was Innovid’s $160 million acquisition of TV measurement platform TVSquared to make inroads with linear advertisers. As Innovid CEO Zvika Netter told AdExchanger at the time, CTV may be “all the rage, but our clients are still spending most of their budgets in linear.”

Meanwhile, publisher analytics company Piano bought OG social media optimization platform SocialFlow, Extreme Reach acquired marketing content and distribution company Synchro Services, and Spotify shored up its ad offering with two podcast analytics acquisitions: Podsights and Chartable.

Vox helped close out the month by closing its acquisition of GroupNine, followed by Verisk’s purchase of identity resolution company Infutor.

March

Despite the first early signs of an economic slowdown, the M&A train kept chugging.

Every manner of deal went down in March:

- Magnite/Carbon (revenue management for publishers)

- Netflix/Night School Studio and Netflix/Boss Fight Entertainment (two game studios)

- AppLovin/Wurl (CTV advertising and analytics)

- Goodway Group/Tuff (growth marketing)

- iSpot/Tunity (OOH TV measurement)

- TripleLift/1plusX (publisher data services)

- Tatari/TheViewPoint (CTV monetization)

- Kargo/Parsec (attention metrics)

- System1/CouponFollow (affiliate commerce)

But the most notable deal, which rounded out Q1, was the $16 billion private equity takeover of Nielsen by Brookfield Business Partners and Evergreen Coast Capital Corp. The move made sense. It’s hard to revamp Nielsen’s entire business while being publicly scrutinized by investors and antagonized by challengers.

April

April showers brought a small handful of acquisitions, including a $100 million deal by OpenWeb for French native ad tech platform Adyoulike and VideoAmp’s purchase of TV analytics platform Elsy.

April showers brought a small handful of acquisitions, including a $100 million deal by OpenWeb for French native ad tech platform Adyoulike and VideoAmp’s purchase of TV analytics platform Elsy.

But the bigger headline in April was the completion of the merger between AT&T’s WarnerMedia unit and Discovery to become the Frankenstein’s monster that is now Warner Bros. Discovery.

Mastercard also closed its acquisition of Dynamic Yield, the personalization platform it bought from McDonald’s last year as a complement to SessionM, the CDP Mastercard acquired in 2019.

May

May was a mixed bag and the start of a marked slowdown in ad tech deal activity.

But for those keeping score, Publicis acquired ecommerce software Profitero, DISQO snapped up a customer feedback and testing tech startup called Feedback Loop and lifecycle marketing platform CleverTap bought customer engagement platform Leanplum.

Meanwhile, Blackstone, parent company of multiple ad tech assets, including Vungle and AlgoLift, was also busy. The private equity firm agreed to buy genealogy provider Ancestry.com for $4.7 billion – along with its massive (and sensitive) data set – and Blackstone-backed Candle Media acquired video content production company ATTN: for $150 million.

June

Although there was a sprinkling of sales throughout June, the pace was still slackening.

Airship got into app store optimization with the acquisition of Gummicube, Pinterest acquired an AI-powered shopping startup called The Yes, GTCR subsidiary Dreamscape bought ad spend tracker Standard Media Index, Mediaocean acquired image recognition platform Drishyam AI, and ad delivery tech vendor Peach grabbed creative automation startup Cape.

Also notable, Index Exchange acquired Rivr Technologies, a German ad tech startup that builds brand-specific bidding algorithms based on an advertiser’s KPIs and specific business goals. Rivr was Index’s first-ever acquisition.

Oh, and fun fact: AT&T completed its sale of Xandr to Microsoft. Less than two months later, Netflix would select Microsoft as its ad tech and sales partner to support the streamer’s AVOD ambitions.

To move from a fun fact to a sobering stat: Excluding digital content, M&A activity was down 21% quarter-over-quarter and down 24% YoY, according to LUMA’s Q2 2022 market report.

And, spoiler alert, total deal volume would be down in the third quarter compared with Q2, largely due to a drop-off in digital content deals, as per LUMA. (Even so, events and publishing company Informa did buy B2B publisher Industry Dive for a cool $525 million in mid-July.)

Yet, if you break out ad tech, deal volume actually increased quarter-over-quarter in Q3, including:

- Tremor’s acquisition from SingTel of TV-focused mobile marketing platform Amobee for $239 million.

- Verve Group’s purchase of Dataseat, a mobile DSP that helps developers bring mobile programmatic in-house.

- Goodway Group’s acquisition (its second this year and ever) of Canton Marketing Solutions, a consultancy that helps clients in-house their digital marketing and programmatic media.

- Podcast hosting and analytics platform Acast’s purchase of podcast database Podchaser for $27 million.

- Brand safety vendor Zefr’s acquisition of AdVerif.ai, a startup that helps identify misinformation on social platforms.

- Human’s merger with cybersecurity and fraud detection service PerimeterX.

- And Unity’s plan to acquire ironSource for $4.4 billion. (More on that little soap opera below.)

August

Regardless of downward pressure on valuations (which was arguably necessary after ad tech valuations shot through the roof in 2021), the summer closed with a little heat.

Customer data platform mParticle acquired Vidora, a customer personalization platform; Criteo completed its acquisition of IPONWEB; Mediaocean announced plans to acquire video ad rendering company Imposium; and mobile measurement provider Branch bought AdLibertas, a first-party data platform for app developers.

On the media front, Axios sold to Cox Enterprises for $525 million, and Sony did two big things: It completed its $37 billion acquisition of video game developer Bungie (famous for most of the Halo titles) and, separately, acquired mobile gaming developer Savage Game Studios.

But back to ad tech – oh, the drama.

In early August, AppLovin offered to buy Unity in an all-stock merger valuing the company at $20 billion, but only so long as Unity didn’t merge with ironSource. A few days later, Unity’s board of directors rejected AppLovin’s bid and reaffirmed the company’s commitment to combine with ironSource.

September

Ad tech deals were thin on the ground in September, although there were a few notables, including an announcement by PE firm Bridgepoint of its plan to take a majority stake in programmatic media platform MiQ.

And PubMatic made its first acquisition in more than eight years, taking on the media measurement and reporting platform Martin.

And PubMatic made its first acquisition in more than eight years, taking on the media measurement and reporting platform Martin.

Zynga, now owned by video game holding company Take-Two Interactive, bought itself an app store optimization platform called Storemaven, Reddit acquired contextual advertising startup Spiketrap, and Instacart added AI pricing and promotion provider Eversight to its cart.

October

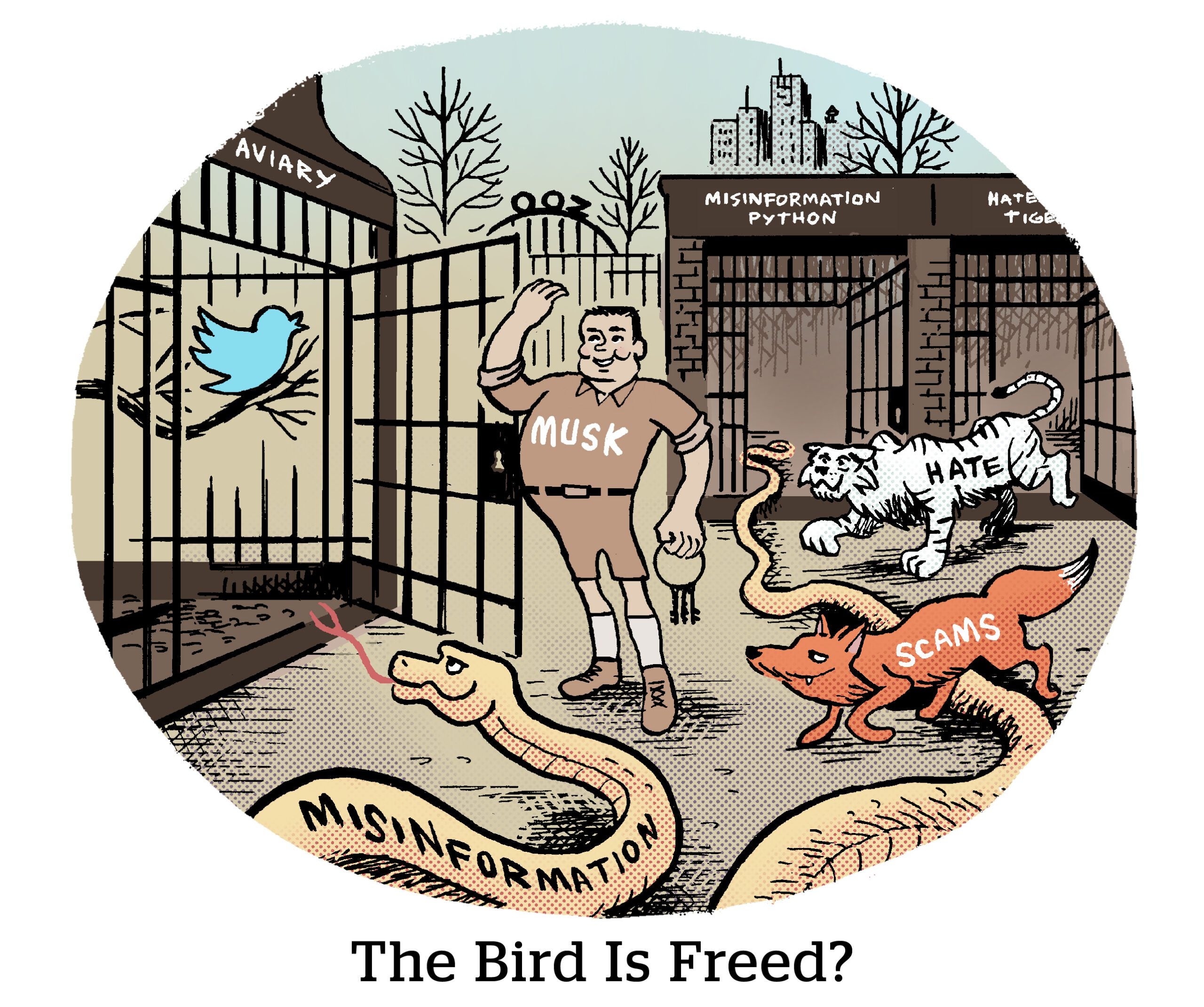

But here’s a question: What does Elon Musk have in common with Kroger?

They’re both putting billions behind a vision.

Musk’s vision apparently involves pouring gasoline on his $44 billion acquisition of Twitter, tossing in a lighted match and seeing what happens.

Kroger’s vision is to combine with rival grocery chain Albertsons in a $24.6 billion merger as part of a bid to become the retail media network to end all retail media networks.

November

Proceeding apace, Human kept up its mini-spree with the acquisition of anti-malvertising and ecommerce fraud startup clean.io, Samba TV bought a startup called Disruptel for ACR-based measurement, and eyeo – the Cologne-based owner of Adblock Plus – acquired ad block revenue recovery company Blockthrough.

Also, Walt Disney Co. paid $900 million to buy Major League Baseball’s remaining 15% stake in BAMTech, the streaming tech provider that powers Disney+, Hulu and ESPN.

And the season finale of “Love Island: Love Triangle” aired in November, during which Unity officially closed its acquisition of ironSource. (AppLovin was not invited to the wedding.)

And the season finale of “Love Island: Love Triangle” aired in November, during which Unity officially closed its acquisition of ironSource. (AppLovin was not invited to the wedding.)

December

And so the year has come to a close, ending far quieter than it began.

But search marketplace Ad.net did acquire IntentX, a commerce platform for publishers, with the intent to help pubs grow their traffic and diversify revenue streams, and meme specialist (yes, this is a thing) Doing Things Media announced its plan to buy social media content brand Overheard.

Here’s to publishers having a better time of it in 2023 than they did in 2022.

If you got to the end of this article, you deserve a cookie. But not a third-party cookie, obviously. Like, a real cookie. Seriously, head to the kitchen, go spend some time with your family or watch a little Netflix – and we’ll see you next year!