Just three months after Netflix surprised the world with the news that it plans to launch an ad-supported tier, the streaming leader has settled on its third-party vendor of choice: Microsoft.

But why Microsoft?

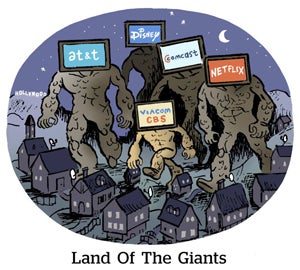

Netflix’s choice might seem strange because, although Microsoft Advertising (by one name or another, formerly all grouped under the Bing brand) has been around since 1997, Microsoft wasn’t considered a serious programmatic contender until it bought the longtime programmatic tech leader Xandr (née AppNexus) from AT&T – which was announced in December of last year but didn’t close until last month.

Needless to say, the ad tech industry was taken aback. “Xandr has never been mentioned in conversations with digital video leaders about what’s going to happen with Netflix,” said Nicole Scaglione, global VP of OTT and CTV at PubMatic. Xandr has a deep foundation in programmatic – it’s one of the oldest and largest SSPs – but given the short integration window with Microsoft and the rise of other players in CTV, specifically, it was a dark horse contender for the Netflix account.

“The usual top-of-mind suspects were Google and FreeWheel,” she added.

Still, something made Microsoft stand out.

“It’s the ad tech giant that doesn’t have a streaming library,” Scaglione said. Google’s YouTube and YouTube TV, as well as Comcast’s Peacock streaming service, compete directly against Netflix. Bearing that in mind, she said, “this [choice] makes a ton of sense in hindsight.”

Microsoft also has a strong position in gaming, since it owns Xbox and acquired Activision this year. Netflix dove head-first into gaming last year and has since acquired three gaming studios. Aside from the pure game development and distribution angle, Xbox also is a streaming platform where users can … drumroll … download and watch Netflix.

Microsoft’s acquisition of Xandr and its longstanding market hold in console gaming combine to give it an “excellent position to deliver brand-safe advertising [for Netflix],” said Jeff Sue, GM of Americas at Mintegral. (Plus, it checks the box for non-interruptive content.)

Eye of the storm

While the partnership makes sense (and Microsoft is likely celebrating bottomless ad dollars in Aruba), stepping out into the AVOD space is no walk in the park.

Netflix has never had to face any of the chaos, crudeness, consumer dissatisfaction or controversy that CTV advertising is known for.

For one thing, “measurement is a mess,” Scaglione said.

Deduplicated measurement and frequency control across streaming channels is one of the biggest pain points in the CTV ecosystem, and now it’s an issue that must keep Netflix on its toes (if not up at night).

“CTV measurement is much more fragmented than in mobile advertising,” Sue said, referring to all of the heated competition among third-party providers. “This [fragmentation] has already created issues for AVOD monetization.

The biggest challenge is going to be balancing efficient monetization without turning away subscribers that are accustomed to ad-free content.

“The best way to accomplish this balance is rigorous attention to frequency management,” said James Brooks, CEO of performance-based ad exchange GlassView. “Making the viewer experience top-of-mind is the most important priority. [Netflix] doesn’t want to lose a whole bunch of viewers from this,” he added, portending the potential friction when millions of Netflix users, many of whom don’t track the ad industry closely, could be horrified to discover ads on Netflix.

Netflix is avoiding this by making the ad-supported tier a new option. All current subscribers are ad-free and must deliberately switch to the cheaper tier with ads (so they won’t be surprised but not delighted by the new ads).

Microsoft, which transitioned from just console-based gaming to shoulder its way into digital and in-game advertising, is primed to help Netflix deliver a less-than-messy ad experience. But Microsoft’s limited market footprint in programmatic and CTV advertising could be both a blessing and a curse.

Microsoft just doesn’t have the household scale compared to Google or Comcast, said John Hamilton, CEO of CTV data company TVDataNow.

Now that Microsoft has access to premium streaming content top brands will want, it’s unclear how Microsoft will be able to “handle” Netflix’s massive inventory and the deluge of ad buyers, Hamilton said.

But with Microsoft’s lack of a proprietary streaming service, the fact that it has to build a footprint with CTV and TV advertisers could be a plus for Netflix, too, Hamilton said. After all, he added, building the tech and sales stack practically from the ground up is “almost akin to Netflix building their own solution.”