In this week’s Week in Review: Sony injects quality content into Europe’s FAST ecosystem, ProSieben rejects MFE’s call to split up its business, and S4 Capital forecasts another tough year.

Top Stories

Sony Launches FAST Channels Across Europe

Sony Pictures Entertainment, Sony’s media and production arm, announced this week it is launching 54 free ad-supported streaming TV (FAST) channels across Europe, on FAST platforms including LG Channels, Samsung TV Plus, and TiVo+. The launch, due in April, will inject a large quantity of high-quality content into Europe’s FAST ecosystem. Shows and films which will be available on Sony’s channels include Breaking Bad, Better Call Saul, Seinfeld, Community, District Nine, Men in Black, and Zombieland. Territories at launch include the UK, France, Italy, Germany, Spain, Sweden, Denmark, Norway and Finland.

Sony is one of the few major media companies which has chosen to largely sit as an arms dealer in the streaming wars, rather than spinning up its own direct-to-consumer offering. With FAST however, the company sees an opportunity to directly distribute some of its content without massively disrupting its ability to license content out to on-demand platforms, or incurring the costs associated with launching its own dedicated app.

“Sony Pictures recognizes the potential of the free ad-supported television space to engage new viewers globally with our extensive feature film and TV series catalogue spanning 100 years”, said Pete Wood, SVP of digital sales and distribution at Sony Pictures Entertainment.

ProSieben Rejects MFE Proposal to Split Up its Business

German broadcaster ProSiebenSat.1 has rejected a proposal from fellow European media giant MFE, its largest shareholder, to split off some of its more peripheral businesses, namely its ecommerce and dating assets. ProSieben’s executive board voted against the move, saying it would increase its financial leverage and be detrimental to the development of its core business in the medium term. Spinning off these assets would, according to the board, be solely “in the unique interest of MFE”.

MFE asked ProSieben’s board to vote on the move last week, whilst also saying it wouldn’t make a move to acquire ProSieben unless it streamlined its business to focus on its core TV operations. In a statement following the vote, ProSieben’s board defended the value of these peripheral units to its core business. As an example, splitting up the company would also entail getting rid of SevenVentures, ProSieben’s media for equity arm. This in turn would result in a significant loss of advertising synergies, harming ProSieben’s core business, according to the board.

S4 Capital Reports 4.5 Percent Net Revenue Drop After Tough 2023

S4 Capital posted a 7.8 percent fall in like-for-like revenues, and a 4.5 percent drop in like-for-like net revenues for 2023, following a tough year for the company which has seen its share price beaten down amid difficult market conditions.

The company said the results reflect global macroeconomic conditions and client caution due to recession fears. S4 says it saw longer sales cycles than normal, particularly for large transformation projects, as well as a reduction in smaller project-based assignments. And the business expects 2024 to be a tough year too, predicting another fall in like-for-like net revenues while targeting similar levels of profitability.

“We remain confident that our talent, business model, strategy and scaled client relationships position us well for above average growth in the longer term, with an emphasis on deploying free cash flow to boost shareowner returns,” said Sir Martin Sorrell, executive chairman of S4 Capital.

The Week in Tech

EU Opens DMA Non-Compliance Probes into Google, Apple and Meta

The European Commission is investigating Google, Apple and Meta for self-preferencing their own products and services, in violation of the Digital Markets Act (DMA). The regulator will probe Google Play and Google Search, Apple’s App Store, and Meta’s “pay or consent” model, which requires users to pay in order to withdraw consent for their data being used for advertising purposes. “The Commission suspects that the measures put in place by these gatekeepers fall short of effective compliance of their obligations under the DMA,” said the European Commission.

AudienceXpress Plans to Integrate iSpot Data Into its Platform

Comcast-owned ad tech business AudienceXpress announced a deal with alternative measurement provider iSpot to evaluate how iSpot’s national TV ratings can be folded into the AudienceXpress platform. The two say integrating iSpot’s data will help create better performance marketing solutions for advertisers, as well as attribution reporting for TV campaigns.

Wurl Launches BrandDiscovery for Real Time CTV Contextual Targeting

CTV ad tech business Wurl this week launched BrandDiscovery, a new tool that enables real time contextual targeting against CTV content. Wurl says the new tool uses generative AI to match ads to CTV content at the scene level, based on factors including emotion, genre, and brand safety/suitability. Wurl says a case study run with Media.Monks found the tool improved one client’s cost-per-engagement by over 200 percent.

IAS Starts Measuring Brand Safety and Suitability on Snapchat

Integral Ad Science this week announced a partnership with Snap which will see it provide its Total Media Quality brand safety and suitability measurement on Snapchat. IAS already runs viewability and invalid traffic measurement on Snapchat, and says its post-bid TMQ measurement will be available to advertisers later this year.

Social Media Exerts “Significant Influence” on News Consumption Finds Ofcom

Online intermediaries, such as social media and search engines, exert a “significant influence” on news consumption, according to Ofcom. The research found that the ranking of news content in a social media feed has a “substantial impact” on the amount of time people spend engaging with it. “We also know from existing research that people who get their news via social media may see less diversity of viewpoints, as well as more polarising and false content, which tends to drive high user engagement,” said Ofcom.

Seedtag Launches Contextual TV

Contextual advertising specialist Seedtag this week announced a new product called Contextual TV which, as the name suggests, will offer contextual targeting on CTV ad buys. Seedtag will draw on contextual signals from TV viewing, including automatic content recognition (ACR) data, while also layering in insights from its observations of the open web.

ID5 Integrates with Adobe Advertising

Identity provider ID5 this week announced a partnership with Adobe Advertising, which will make ID5’s identifier available to buyers for targeting and measurement. The two say buyers using Adobe Advertising will be able to automatically transform signals from their own sites into ID5 identifiers, and activate audience segments based on the identifier when using Adobe’s DSP.

The Week in TV

France Télévisions CEO Calls Salto Closure “Strategic Mistake”

Delphine Ernotte-Cunci, CEO of French public broadcaster France Télévisions, has called for more cooperation between domestic broadcasters. She said the decision to close Salto, the streaming joint venture between France Télévisions, M6 and TF1, was a “strategic mistake.” Speaking at the Series Mania Forum, Ernotte-Cunci also praised Freely in the UK, the upcoming CTV app co-owned by the BBC, ITV, Channel 4 and Channel 5.

Tim Davie Calls for Rapid Modernisation at the BBC

The BBC needs to “rapidly modernise”, director-general Tim Davie said in a speech on Tuesday, ahead of the BBC’s annual report. The transformation should include more partnerships with media, entertainment and technology giants, according to Davie, pointing to the BBC’s Doctor Who distribution deal with Disney. He also said the BBC will develop “unique ethical algorithms” to increase personalisation, ensuring recommendations are guided by “what our BBC editors may judge to be important stories.”

M6 Publicité Adopts ID Solutions From LiveRamp, The Trade Desk and ID5

M6 Publicité, the sales house of French broadcaster M6, has announced identity partnerships with LiveRamp, The Trade Desk and ID5. Ahead of Google’s deprecation of third-party cookies, the partnerships will see M6 adopt alternative ID solutions which its advertisers can use to target audiences. “M6 Publicité is keen to be compatible with IDs, alternatives to third-party cookies, which will be used by brands and their media agencies, to allow them to continue working with complete peace of mind and maintain current performance.”

CTV to Generate $20 Billion in US Ad Revenues This Year

Connected TV is set to amass $20 billion in US ad revenues this year, according to the latest forecast from Brian Wieser, principal of consultancy Madison and Wall. The economist projects 18 percent growth for CTV in 2024, and the same rate of growth during the first quarter. Wieser defines CTV as digital extensions of traditional media and other professionally produced content which is primarily viewed in the living room, as opposed to on a phone or PC. The channel will represent 29 percent of all TV advertising in 2024, according to the forecast. Read more on VideoWeek.

BBC Leans on Co-Production Deals to Boost Content Horsepower

The BBC says it will lean much more heavily on commercial partnerships around content and technology, though not necessarily traditional content licensing deals, as it grapples with real term cuts to its budget. In a speech at the Royal Television Society addressing the future of the BBC, director general Tim Davie said a recent co-production deal for Doctor Who struck with Disney sets a good blueprint for how the BBC can keep funding content while managing costs. The Doctor Who deal saw Disney provide funding for the upcoming season of Doctor Who, which the BBC has historically funded alone. Disney also has creative input into the series. In exchange, Disney+ has streaming rights for this new season outside of the UK. Read more on VideoWeek.

IPL Becomes Fastest-Growing Sports Property

The Indian Premier League (IPL) has been identified as the world’s fastest-growing major sports property by Omdia, as the cricket league’s media rights continue their fast-paced upswing. Omdia calculates that IPL rights are worth $16 million per game, higher than the average $15.7 million for a Premier League football match. But the report notes that the IPL does not have the Premier League’s international reach, although its owners are in talks to set up T20 franchises in the Middle East, South Africa and the US. Read more on VideoWeek.

The Week for Publishers

Mail Metro Media Monetises TikTok Success with New EDITS Offering

Mail Metro Media, which sells ads for the Daily Mail, Metro, i, and New Scientist among others, has launched a new vertical video partnership offering called EDITS. The sales house says EDITS will use content creators from its editorial team to create and deliver vertical video story clips which will run across its channels. Short-form social video has been a major focus for the Daily Mail in particular, and this new product will help the newspaper monetise an otherwise hard-to-monetise channel. Read more on VideoWeek.

French Antitrust Regulator Fines Google €250 Million Over Failure to Engage with Publishers

France’s antitrust regulator has handed Google a €250 million fine over an alleged failure to meet its legal requirements to negotiate fairly with publishers. France’s implementation of EU law requires Google and other large platforms to enter good faith negotiations with publishers over payments for use of their content. The regulator said that Google’s AI chatbot Bard is an important factor, since it makes use of publisher data without their consent, and publishers can’t opt-out without affecting their relationship with other Google products.

G/O Media Sells The A.V. Club and The Takeout

Digital media holding company G/O Media this week continued its selling spree, offloading film and TV publisher The A.V. Club and food website The Takeout. The A.V. Club was sold to Paste Media, which also bought Jezebel and Splinter from G/O Media earlier this year. The Takeout meanwhile was sold to Static Media, which owns other food-based media properties including Tasting Table and The Daily Meal.

Fortune Plans Big Expansion of UK and European Operations

Business publisher Fortune is planning a large expansion of its UK and European operations, with new leadership appointed to lead the charge. Alex Wood Morton, Fortune’s new executive editor for Europe, told Press Gazette that the company is hiring more editorial staff in Europe, and will create more Europe-specific content, while also exploring new commercial opportunities across the continent.

Digitalbox Blames Facebook and Google for 22 Percent Revenue Drop

UK publishing group Digitalbox, which owns Entertainment Daily, The Tab, The Daily Mash and The Poke among other websites, saw a 22 percent drop in revenues in 2023, which it attributed largely to falling traffic referrals from Facebook and Google. Entertainment Daily was blocked by various Google services at the start of 2023 according to Press Gazette, leading to a 27 percent fall in traffic. And a major Facebook page run by The Tab was flagged for months, significantly reducing the page’s reach.

Reach Streamlines Content Operations with Centralised Hub

UK publishing group Reach, which owns several national newspapers as well as a host of local titles, has created a new central team of journalists to create traffic-driving content which will sit across its websites. Around 300 editorial staff are being moved to the new unit, tasked with writing multiple stories on the same topic for different Reach titles. The aim is to reduce overlap where multiple journalists might write essentially the same story for different websites, according to Press Gazette.

The Week For Brands & Agencies

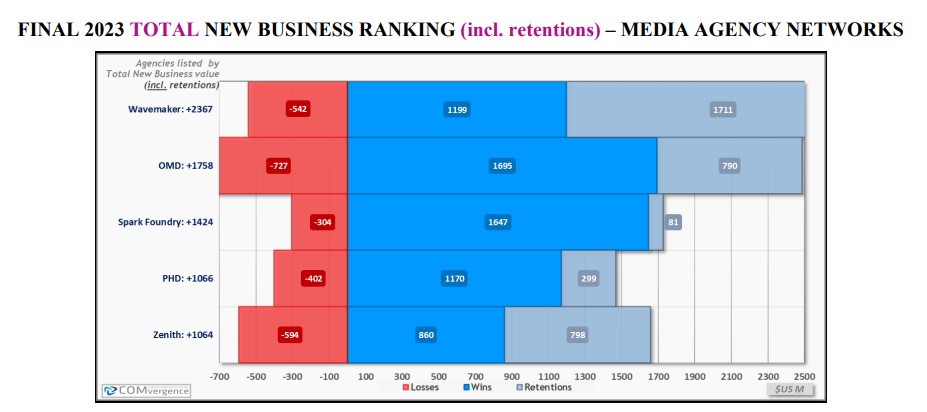

Wavemaker Tops COMvergence’s Media Agency New Business Rankings for 2023

WPP’s Wavemaker has topped COMvergence’s ranking of global media agencies based on their new billings gained in 2023, demonstrating a strong year of pitching for the company. Wavemaker’s net new business, including retentions, was +$2.8 billion, above second placed OMD with +$1.8 billion. Excluding retentions, Publicis’ Spark Foundry came out on top, with +$1.3 billion worth of new business.

At the group level, Publicis Media beat out its rivals, with over $5 billion worth of new business, and $2.9 billion of retentions.

Hovis Returns to TV with VCCP and Medialab

British bread and bakery products brand Hovis is returning to TV, with a new campaign run by its newly appointed agencies VCCP and Medialab. Hovis has a long history of advertising on TV, but hasn’t run any TV ads since 2021 according to More About Advertising.

GroupM Plans to Double Investment in Women’s Sport

WPP’s media arm GroupM announced this week it is committing to doubling its ad investment in women’s sports with the creation of a dedicated marketplace. The agency says it will seek first look and first-to-market opportunities beginning with the 2024-2025 Upfronts alongside advertisers including Adidas, Ally, Coinbase, Discover, Google, Mars, Nationwide, Unilever, Universal Pictures, among others.

Publicis Wins Pfizer Creative Duties from IPG

Publicis Groupe has been awarded a chunk of Pfizer’s creative account, previously held by IPG, following a review. IPG was awarded the account just ten months ago, when Publicis was handed the pharma giant’s media duties, as well as creative production responsibilities. IPG will retain some creative responsibilities, as well as PR work.

Three New Agencies Join the IPA

The Institute of Practitioners in Advertising (IPA) announced this week that three new agencies have signed up for membership: Croud, Sid Lee London and tmwi. “We are looking forward to working with them and building strong relationships in the coming months and years,” said the IPA’s director of memberships Tom Mott.

Hires of the Week

S4 Capital Appoints Jean-Benoit Berty as COO

S4 Capital has appointed Jean-Benoit Berty as its new chief operating officer. Berty was formerly a senior partner at consulting firm EY. S4’s executive chairman Sir Martin Sorrell said Berty’s “extensive management consulting experience” will be of “great value in focusing on the opportunities and challenges we face”.

DoubleVerify Appoints Regional VPs in Europe

DoubleVerify has appointed two new regional vice presidents in Europe. Anna Forbes has been picked as regional vice president for Northern Europe, and Natalie Denyer has been chosen as VP of account management for EMEA.

This Week on VideoWeek

CTV to Generate $20 Billion in US Ad Revenues This Year

Mail Metro Media Monetises TikTok Success with New EDITS Offering

TV Tunes in to Sustainable Advertising

IPL Becomes Fastest-Growing Sports Property

BBC Leans on Co-Production Deals to Boost Content Horsepower

Ad of the Week

Corpse Paint, Liquid Death x e.l.f. Cosmetics