Most major brands are planning to increase their global media budgets next year, according to the World Federation of Advertisers (WFA) and Ebiquity, with digital video and connected TV (CTV) expected to be the main recipients of budget increases in 2024.

The Media Budgets 2024 study surveyed 92 advertisers, responsible for a combined $50 billion annual advertising spend, and $700 million average spend per brand. The results found that 60 percent of respondents plan to raise their budgets next year, with 14 percent planning a “significant increase”.

This marks a twofold increase on last year, when just 29 percent of brands said they expected to up their media budgets. Yet budgets remain tied to the trajectory of the economy, with 74 percent of respondents agreeing that their 2024 media budget decisions are influenced by the economic climate.

But brand building remains key during periods of economic downturn. According to the survey, 35 percent of advertisers will increase their share of branding in 2024, versus 21 percent shifting budgets towards performance. And given that economic uncertainty, 23 percent expect to up their share of flexible/biddable buys, compared to 16 percent pivoting to more upfront commitments.

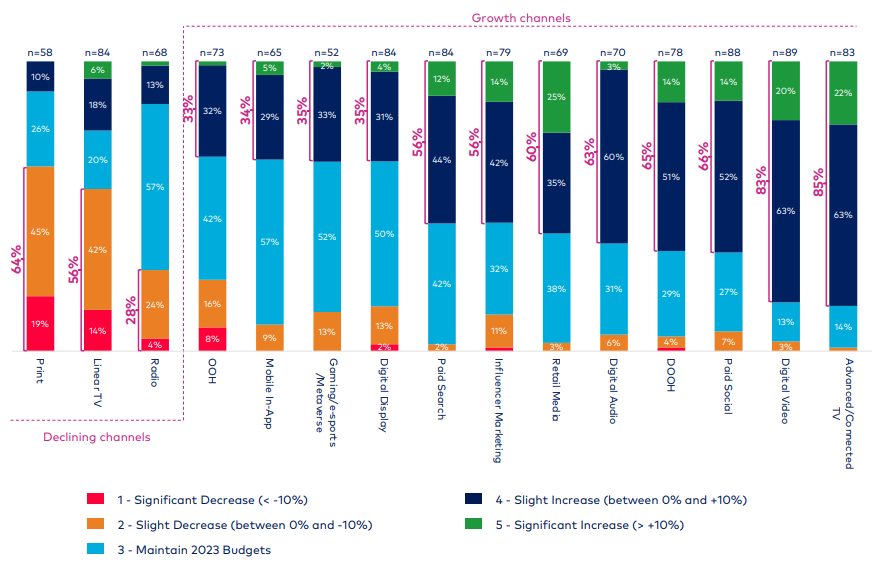

As a result, linear TV (56 percent) and print (64 percent) budgets are expected to decline in 2024. The more flexible media channels, digital video (83 percent) and CTV (85 percent), are set for the largest increase.

“There is some cautious optimism returning to media spending and, predictably, the money is flowing towards digital,” said WFA CEO Stephan Loerke.

Unlocking growth

The study also assessed progress on key issues for the advertising industry, as outlined in the WFA’s Media Charter, which included brand safety, misinformation and sustainability. The results showed “unilateral progress” being made on brand safety, with 70 percent of respondents claiming to regularly review their inclusion/exclusion lists.

There has been slower progress on checking whether ads are running on misinformation sites (37 percent) and ‘Made for Advertising’ content (35 percent). Meanwhile, measuring and reducing carbon emissions from media activity was seen as a priority, with 37 percent of respondents planning to do so in 2024/2025. However, 26 percent said they had no such plans in the near/medium term.

“To enable longer-term digital market growth, we have to fix key issues of quality, transparency, responsibility, measurement and, importantly, sustainability,” said Stephan Loerke. “We call on the industry to rally around the steps outlined in the WFA’s new Media Charter. Fix the fundamentals to unlock growth.”

“Once again this annual survey of major advertisers reveals fascinating insights into future investment intentions,” added Ebiquity CEO Nick Waters. “With 60 percent of respondents planning to increase advertising budgets, we see a level of confidence that seems contradictory to the prevailing economic outlook. (…) With advertising typically seen as a two-quarter leading indicator of the wider economy, does this signify a recovery coming in mid-2024?”

That sentiment chimes with recent forecasts for the UK economy, and its impact on ad spend. Last week, the Advertising Association and WARC projected spend to pick up next year in line with economic recovery, with TV returning to growth in 2024. But the IPA suggested that UK recovery lay further down the road, predicting ad spend to fall next year, before starting to grow in real terms in 2025.