In this week’s Week in Review: Tubi announces UK launch plans, Viaplay plots a turnaround, and the UK government intervenes in the sale of The Telegraph.

Top Stories

Tubi Plans UK Launch

Tubi, an ad-supported streaming service owned by Fox Corporation, is planning to launch in the UK alongside other new markets as part of an international expansion. The company has appointed UK-based David Salmon as its EVP and MD of international to lead the international expansion.

Tubi is already a well-established business, counting 70 million monthly active users across the US, Canada, Mexico, Costa Rica, Guatemala, El Salvador, Ecuador, Panama, Australia and New Zealand. It runs a mix of on-demand content and free ad-supported streaming TV (FAST) channels, and claims to be the most watched free TV and movie streaming service in the US.

“Tubi is in a unique position to capitalise on advertising growth internationally, combining an industry-leading technology platform and content discovery algorithm with the world’s largest content library,” the company said in a statement. Tubi hasn’t yet given a date for when it plans to launch in the UK.

Viaplay to Sell Premier Sports UK and Raise Equity in Rescue Plan

Nordic streaming company Viaplay has announced plans to sell Premier Sports UK back to the company it bought it from just over a year ago. The sale forms part of a rescue plan for the struggling business, which also confirmed moves to exit the Baltic and Polish markets by summer 2025.

The company additionally aims to raise SEK 4 billion in new equity, write down SEK 2 billion in debt, and renegotiate the terms of another SEK 14.6 billion worth of debt. The restructuring is expected to wipe most of the value of existing shareholders. Viaplay’s share price plummeted by 82 percent at the announcement.

Viaplay also posted its Q3 earnings, reporting that ad sales were down 10 percent YoY, “as the growth in digital AVOD sales could not offset the fall in linear TV and radio sales.” The company also expects full-year operating losses between SEK 1.0-1.15 billion, “due to the underperformance of the international non-core operations.”

UK Government Intervenes in Telegraph Sale

The UK government has issued a Public Interest Intervention Notice (PIIN) into the proposed acquisition of Telegraph Media Group, which owns both The Telegraph and Spectator magazine, to Redbird IMI, a consortium backed by the UAE. The intervention means the government is concerned there may be significant public harm in allowing the deal to go through, and requires both Ofcom and the Competitions and Markets Authority to clear the deal.

Lucy Frazer, the UK’s culture secretary, cited concerns around the deal’s impact on press freedom and accuracy in the UK. While a number of investors are involved in the consortium, the potential influence of the UAE on The Telegraph’s reporting has the potential to be problematic, in the government’s opinion.

Both the CMA and Ofcom have to report back to Frazer by mid January, and if they don’t find any issues with the deal then it will be cleared to go ahead. But one of the regulators may force binding restrictions on the deal if they take issue with it, which could slow down or scupper the sale.

The Week in Tech

Google’s PMAX Has Run Brands’ Search Ads on Porn and Piracy, claims New Adalytics Report

Search ads bought through Google have ended up on a number of highly questionable sites including hardcore pornographic websites (some of which hosted bestiality content), Iranian websites which may potentially be under US Treasury Office of Foreign Assets (OFAC) sanctions, and pirated content websites among others, according to a new report from advertising analytics business Adalytics.

Adalytics’ report claims that hundreds of these kinds of questionable websites have had their inventory sold through Google via its ‘Search Partner Network’, a tick box option which lets brands extend their search campaigns beyond Google’s core search product. The report suggests that many advertisers may have unknowingly signed up to this product since it’s an opt-out option in regular search campaigns, and can’t be opted out of in Performance Max campaigns (a type of campaign which optimised spend across a range of Google products including search, display, and YouTube). Read VideoWeek’s full analysis here.

X Stands to Lose $75 Million in Ad Revenues

X (formerly Twitter) could lose as much as $75 million in ad revenues this year, according to internal documents viewed by the New York Times. Aside from high-profile brands which have paused their spending on X, including IBM, Apple and Disney, the documents suggest Airbnb, Amazon, Coca-Cola and Microsoft are also considering suspending their advertising. Elon Musk has responded by telling advertisers to “go f*** yourselves” for trying to “blackmail me with advertising.” The fallout comes after Musk endorsed an antisemitic conspiracy theory on X.

Meta Accused of Charging “Privacy Fee” for Ad-Free Apps

Meta has been accused of charging a “privacy fee” for its ad-free versions of Facebook and Instagram, under a complaint filed by Austrian advocacy group NOYB (None Of Your Business). The tech giant launched the ad-free service, which costs €12.99 per month, to comply with new EU rules restricting data collection for targeted advertising. But the digital rights group argued the move could be a slippery slope.

“EU law requires that consent is the genuine free will of the user,” said NOYB lawyer Felix Mikolasch. “Contrary to this law, Meta charges a ‘privacy fee’ of up to €250 per year if anyone dares to exercise their fundamental right to data protection. Not only is the cost unacceptable, but industry numbers suggest that only 3 percent of people want to be tracked – while more than 99 percent don’t exercise their choice when faced with a ‘privacy fee’. If Meta gets away with this, competitors will soon follow in its footsteps.”

Google Doubles Down on Cookie Deprecation Deadline

Google is committed to removing cookies from Chrome at the end of 2024, the company’s VP of global advertising told Digiday this week. One percent of cookies will be gone in January 2024, said Dan Taylor, providing a “real world testing environment” for advertisers. He added that experiments with Topics, a Sandbox API that Google started rolling out this summer, have delivered a “pretty high degree of fidelity.” Taylor also addressed the Department of Justice’s antitrust suit against the tech giant, stating that Google has “no intention of selling or divesting” its advertising business.

Campaign Optimisation Lags Behind Measurement on Converged TV

Innovid, a TV measurement platform, has identified a disconnect between measurement and optimisation across converged TV (linear, digital and streaming). The study found that 62.6 percent of advertisers were measuring campaigns on one platform, only to optimise them on another. And 66 percent of agency respondents said they are more likely to use separate platforms for measurement and optimisation in converged TV campaigns. As a result, measurement data is not being used in real-time, and campaign optimisation is lagging behind the insights. “A lot of times the optimisation is happening well after the insights are gleaned,” said Dave Fahey, VP of agency partnerships at Innovid.

Hawk Brings Samba TV Geodata to DSP

Hawk has announced a partnership with measurement provider Samba TV, to bring geo-audience data to Hawk’s demand-side platform (DSP) in France, Germany and the UK. Based on Samba TV’s automatic content recognition (ACR) data, advertisers on the Hawk platform can optimise campaigns in specific areas across media channels. “As audiences become more fragmented across screens and thereby harder to reach, it’s all the more imperative for advertisers to utilise a more precise, relevant, and scalable approach to omnichannel targeting,” said Jay Fowdar, VP of International Customer Success at Samba TV.

The Week in TV

Channel 4 Explores Debt Facility as Ad Market Tumbles

The TV advertising downturn could force Channel 4 to dip into an emergency £75 milion debt facility next year, the UK broadcaster told a select committee on Tuesday. Facing questions from a House of Commons culture, media and sport select committee, Channel 4 chief executive Alex Mahon said the TV market has been hit by its worst advertising downturn in 15 years. The sector is expected to fall 14 percent this year, according to the broadcaster, which has forecast revenue losses for the next two years. As a result, the ad-funded public service broadcaster (PSB) will consider tapping into the revolving debt facility it set up in 2018 in case of situations where the company required financial assistance. Read on VideoWeek.

ITVX to Introduce Pause Ads Next Year

ITVX has announced a new raft of advertising features coming to the BVOD service in 2024. These include a pause ad, short-form products, sponsorship opportunities and regionalised news ads. ITV said the service had accumulated 2.7 billion streams and 40 million users in its first year. But Cord Busters has raised concerns over the paid tier, which still includes some advertising – and introducing pause ads could further complicate that value proposition.

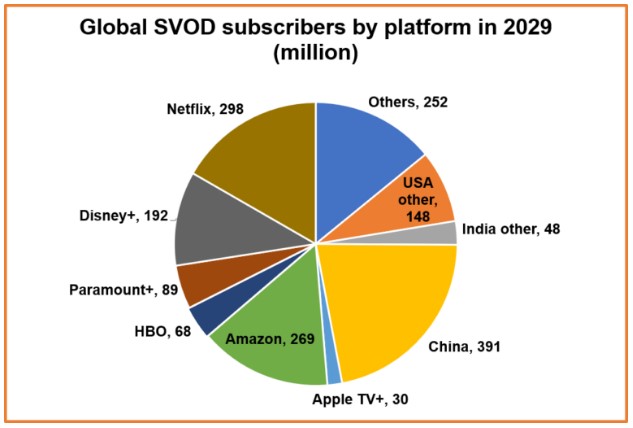

Big Six SVOD Services to Near One Billion Subscribers by 2029

Global SVOD subscriptions will grow by 321 million to reach 1.79 billion in 2029, Digital TV Research has predicted. The total will be largely concentrated in six SVOD services, which are expected to near one billion combined subscribers. The forecast suggests Netflix, Amazon, Apple, Disney+, HBO and Paramount+ will have 946 million subs by 2029, up from 751 million in 2023. Netflix is anticipated to remain the largest service by customer base, adding 44 million subscribers to reach 298 million. Disney+ is set to trail Netflix by more than 100 million subscribers, according to the forecast.

Go Addressable Becomes Trade Body, Welcomes Paramount Global

Go Addressable, an industry initiative formed to promote addressable advertising, has been incorporated as a nonprofit trade organisation. Paramount Global has also joined the membership, which includes Altice USA’s a4 Advertising, Charter Communications’ Spectrum Reach, Comcast Advertising, DirecTV Advertising and Dish Media. “As we reach a pivotal point in the future of addressable TV, Go Addressable continues to find new ways to enhance, innovate and drive momentum behind this medium across the TV ad ecosystem,” said Maribel Becker, VP Addressable Partnerships at Paramount.

UKTV to Rebrand as U

UKTV, a broadcaster owned by BBC Studios, will rebrand as ‘U’ next year. In Summer 2024, the UKTV Play streaming service will be renamed U. The network’s free-to-air channels will also be rebranded as U&Dave, U&DRAMA, U&YESTERDAY and U&W. “The entertainment market is so awash with confusing and bizarrely named offers, so we wanted to strip back, reduce the noise and present this family of brands in a clear, crisp, singular way,” said David Stevens, Executive Strategy Director at brand consultancy Wolff Olins.

Disney Board Battle Reignites Nelson Peltz Feud

Disney has rejected a second attempt by Nelson Peltz to gain a board seat, reigniting the proxy battle between CEO Bob Iger and the activist investor. The entertainment giant appointed two new directors to the board: Morgan Stanley CEO James Gorman, and former Sky boss Jeremy Darroch. But Peltz’s Trian Partners said the appointments would not “restore investor confidence or address the root cause behind the significant value destruction and mis-steps that this board has overseen.”

StudioCanal Launches ArtHaus+ CTV App in Germany

StudioCanal has launched StudioCanal Presents: ArtHaus+ in Germany as a standalone app for smart TVs, web and mobile. A collaboration between Canal+-owned businesses StudioCanal and M7, ArtHaus+ offers over 400 titles from the Germany-based art film label. The app is available for Samsung, LG, Sony and other smart TVs, and will soon be expanded to Amazon Fire TV. “We are pleased to be taking the strategically important step into direct end customer business with the development of the streaming app and to be able to use the strengths of the Canal+ Group,” said Lutz Rippe, Co-Managing Director at StudioCanal Germany.

The Week for Publishers

Vox Media Lays Off Four Percent of Staff

Digital publisher Vox Media is laying off four percent of its staff in its second round of layoffs this year, with cuts primarily affecting the product, design, technology and analytics teams. A Vox spokesperson said the cuts come in response to “continued turmoil in advertising and the need to build even more loyal audience relationships given the increasing volatility of search and social platforms, among other factors.”

Google’s Publisher Council Boots Out Major Publishers

Google’s Publisher Council, a group set up to facilitate two-way dialogue between Google and publishers around its Privacy Sandbox tools, has effectively kicked out USA Today, the Daily Mail, and News Corp, Marketing Brew reported this week. Rob Beeler, a publisher consultant who leads the group, reportedly had heard concerns from Google around engaging with publishers which are actively taking legal action against it (which applies to the Daily Mail and USA Today’s parent company). As a result, Beeler said that if the three publishers didn’t step back from the council, it would have to be dissolved.

Paste Magazine Agrees Deal to Buy Jezebel

Entertainment publisher Paste Magazine has agreed an all-cash deal to buy feminist outlet Jezebel from G/O Media, a move which will avert Jezebel’s planned closure by its current parent company. G/O Media had previously announced plans to shutter Jezebel, stating that the business wasn’t working from a financial perspective, and saying it was unable to find a buyer.

The News Movement Hits Seven Figure Revenues After First Year

The News Movement, a US publisher launched last year which is primarily focussed on distributing video content via short-form video platforms, has hit seven figure revenues according to Adweek. The company makes around half its money from branded partnerships, and making social content for third-party publishers, while it also received money from revenue share deals on some platforms. The business is looking to start turning a profit by the end of next year.

Axel Springer Shuts Down BILD TV Channel

European publishing group Axel Springer is shutting down its German newspaper BILD’s linear TV channel at the end of this year, instead switching its focus to digital channels. BILD will continue creating TV-style content, but instead will distribute this on TV apps and streaming platforms with FAST channels.

Mail Metro Media Named Best Media Owner to Work with in IPA Survey

Mail Metro Media, the advertising sales arm of the Daily Mail & General Trust, was named the best media owner to work with in the IPA Digital Media Owners Autumn 2023 survey, with 87.8 percent of respondents saying that their overall experience working with the company has been good. Mail Metro Media was followed by Blis (87.3 percent) and Reddit (84.6 percent).

Google Agrees Deal to Pay Canadian Publishers $73 Million per Year

Google has agreed a deal which will see it pay out $73 million each year to Canadian publishers, in order to be able to keep showing links to news stories in search results. The deal is a reaction to Canada’s Online News Act, which requires major internet platforms to pay in order to host news content from third-party publishers.

The Week For Brands & Agencies

Madison and Wall Predicts “Better Than Expected” US Ad Growth for This Year and Next

Madison and Wall, strategic financial analyst of global advertising, technology and marketing services businesses, had upped its forecasts for US ad spend in 2023 and 2024 after a stronger-than-expected Q3. Brian Wieser, principal of Madison and Wall, said he now forecasts 5.9 percent underlying ad revenue growth across the whole of 2023, up from his previous forecast of 5.0 percent. And his 2024 forecast has been upped to 5.2 percent, from a previous forecast of 4.3 percent.

US Ad Market Grew for Fourth Consecutive Month in October

The US ad market grew by 3.2 percent in October, the fourth consecutive month of growth, according to Guideline’s U.S. Ad Market Tracker. October was significantly stronger than September, when the ad market grew by just 0.1 percent. The four month streak is a big positive particularly given that the first four months of the year all saw falls in ad spend.

Ubisoft Runs Global Review of Media Business

Gaming giant Ubisoft has launched a global review of its media account, Campaign reported this week. The account has been held by GroupM since 2015 according to Campaign, with sub-agency Wavemaker leading the business.

Globant Acquires Majority Stake in Gut

Digital consultancy Globant has acquired a majority stake in Gut, an independent agency network which won Independent Network of the Year at the 2023 Cannes Lions, for an undisclosed fee. Gut’s leadership will remain in place, and it will continue to operate independently, but the two companies will look for cross-selling opportunities.

UK Brands Aren’t Representing Older Consumers, Report Finds

Brands in the UK have an age blind spot in their marketing, according to a report from marketing consultancy Anything But Grey, with the majority of older consumers feeling unrepresented in ads and marketing materials. In a survey of 1,500 UK consumers aged 40-plus, more than 90 percent couldn’t recall a brand using someone their age in marketing material, Campaign reported this week. And – perhaps as a result, a third of respondents in their 50s couldn’t recall a single brand that they’d seen advertised across any channel recently.

Hires of the Week

Jellyfish Hires Jo Wallace as Executive Creative Director

Jellyfish, a global digital marketing company, hired Jo Wallace as its new global executive creative director (ECD). Wallace will assume responsibility for overseeing content creation, shaping strategic direction, and serve as a “creative champion” for Google, one of Jellyfish’s key clients, as reported by InPublishing. Prior to the appointment, Wallace had worked for HHCL & Partners, J Walter Thompson London (now Wunderman Thompson), and most recently as ECD at Media.Monks.

The News Movement Appoints Ramin Behesti as Interim Chief Executive

The News Movement, Gen-Z focused media start-up, has appointed its current president Ramin Behesti as its interim chief executive. Behesti will begin the role on 1st January, replacing Sir William Lewis who will begin the same position at The Washington Post the following day. Behesti co-founded The News Movement, having previously worked as group chief product and technology officer at Dow Jones, alongside the newsbrand’s editor-in-chief Kamal Ahmed, who will join the company’s board as part of the leadership changes.

Rokt Announces Doug Rozen as New Chief Marketing Officer

Rokt, an e-commerce tech firm, announced Doug Rozen as its new chief marketing officer. Rozen will be charged with overseeing brand, performance, employee, product and sales marketing functions, whilst serving on Rokt’s executive committee. He joins the company having previously worked at Dentsu, a global advertising agency, where he was involved in the company’s Economic Empowerment offering, a media buying diversity initiative while working as media CEO, and as chief media officer for 360i prior to their merger into Dentsu Creative in 2022.

This Week on VideoWeek

America Shows the Future of European Cross-Media Measurement

AI Lets Advertisers Focus on Mid and Upper Funnel Creative Work

How ACR Data Feeds into Omnichannel Buying

Instagram Accused of Serving Sexualised Child Videos on Reels

Google’s PMAX Has Run Brands’ Search Ads on Porn and Piracy, claims New Adalytics Report

Roku UK Launches New Content Discovery and Personalisation Features

Channel 4 Explores Debt Facility as Ad Market Tumbles

Where Innovation Meets Responsibility: The Threats and Opportunities of AI

Ad of the Week

Chevrolet, A Holiday to Remember