In this week’s Week in Review: ProSieben announced a strategic overhaul, The Telegraph’s sales process kicks off, and M6 uses AI to explain its ad offering.

Top Stories

ProSieben Announces €1 Billion Content Investment to Offset Linear Declines

ProSiebenSat.1 will invest over €1 billion in content next year across its linear networks and streaming service Joyn, according to CEO Bert Habets.

“There has been an unprecedented decline in the TV advertising market,” Habets told a press conference at MIPCOM. “But that is why we are pivoting so much on building Joyn and our other digital assets. Digital revenues are growing at double digit growth despite the decline in the TV market.” He added that the digital business should offset the TV decline “in two to three years time”.

In the meantime the German media company will reduce staff and sell off its commerce and venture division, alongside its online dating business.

M6 Publicité Launches AI Tool for Ad Offering

French broadcaster M6’s ad sales arm M6 Publicité has launched a new AI tool called Cé6lia, which is designed to quickly answer buyers’ questions about the TV company’s ad offering to aid their planning and buying.

Cé6lia (pronounced Cécilia) is built on OpenAI’s ChatGPT 3.5, and trained on M6’s data around its products and offerings. The tool can help advertisers understand what certain products are – for example explaining what addressable TV advertising is and how it works. It can also provide audience insights, for example describing key audiences for specific M6 shows. M6 says Cé6lia can be used both by advertisers and agencies, but also by its own employees, providing help when they themselves are answering buyers’ questions.

“With Cé6lia, access to our essential information is now remarkably simple, whether you are a prospect or a media expert looking for details on the M6 Group’s advertising offering,” said Maxime André, marketing, innovation and communication director at M6 Publicité.

Telegraph and Spectator Sales Processes Kick Off

The Boards of the parent companies of Telegraph Media Group and The Spectator have announced that the formal sales process for the two newspapers has officially kicked off today, firing the starting gun for interested parties to place their bids.

Lloyds Banking Group placed the two papers’ parent company into receivership earlier this year as it sought to recover debts owed by the Barclay family, who own the holding group.

A number of suitors have publicly registered their interest. Fellow news publishers the Daily Mail & General Trust, Axel Springer, and National World are all known to be interested in bidding. Various independent buyers and investment groups have also signalled their intention to compete.

The Week in Tech

Azerion Acquires Hawk

Azerion, a gaming monetisation platform, has acquired Hawk, a digital ad tech firm. Azerion will take a 100 percent stake in Hawk for an upfront consideration of €7 million, with an earn-out over the following three years to be capped around €20 million. Hawk reported revenue of approximately €50 million in 2022. It becomes the latest in a string of ad tech acquisitions by Azerion, which has bought Vlyby, Hybrid Theory and Sublime over the past two years.

Musk Says X Ad Revenues Hit by War

Ad revenue on X (formerly Twitter) “drops massively during war,” according to Elon Musk. The billionaire owner made the comment in response to a user noting that her payouts from the platform were dropping. Musk also said X will launch two premium subscription tiers. “One is lower cost with all features, but no reduction in ads, and the other is more expensive, but has no ads,” he posted. The company has started rolling out a $1 annual charge to use X in New Zealand and the Philippines, in a move apparently aimed at combating bots.

Advertising revenue on our platform drops massively during war

— Elon Musk (@elonmusk) October 14, 2023

Snap Shares Bounce at Projected 2024 Growth

Snap shares jumped 11 percent on Monday after a leaked internal memo showed strong expectations for 2024. According to the document, Snapchat expects 20 percent ad revenue growth next year, above Wall Street estimates of 14 percent growth. The social media app also anticipates 475 million daily active users in 2024, beating Wall Street expectations of 447 million. The news follows a troubling period for Snap, whose ad revenues and share price have taken a number of hits over the last couple of years.

IAS Launches MFA Avoidance Product

Integral Ad Science (IAS), a measurement and verification firm, has launched a new product designed to detect and avoid Made for Advertising (MFA) content. The tool uses AI to identify MFA characteristics, such as ad-to-content ratio, ad refresh rate, and traffic sources. “The industry faces a significant challenge in combating MFA sites,” said IAS CCO Yannis Dosios. “By leveraging AI, we have developed a scalable way to identify these low quality sources of inventory and improve overall campaign performance.”

Microsoft Closes Activision Takeover

Microsoft has completed its $69 billion acquisition of Activision Blizzard, marking the largest deal of its kind in the gaming industry. Last week, the UK’s Competition and Markets Authority (CMA) approved renewed terms for the takeover, almost two years after the deal was first announced. Activision CEO Bobby Kotick confirmed he will step down at the end of 2023.

YouTube Updates Smart TV App

YouTube has announced a raft of new features, including updates to its smart TV app. A new vertical menu will display the video description, comments, the subscribe button and video chapters, according to a blog post. The video sharing platform has also introduced an AI tool enabling Android users to search for a song by playing, singing or humming it. “These changes will roll out gradually to our users around the world over the coming weeks,” the company said.

The Week in TV

Netflix Raises Premium Prices to Help Grow Ad-Supported Tier

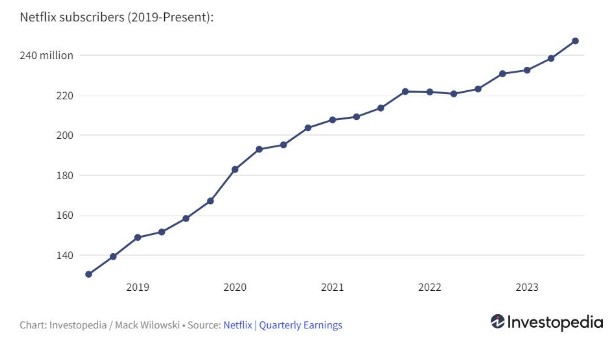

Netflix reported Q3 revenues of $8.54 billion, up 7.8 percent YoY. The streaming service also added 8.76 million more subscribers than Q2, suggesting its password-sharing crackdown is having the desired effect. But ARPU fell by 1 percent YoY, prompting the company to raise the prices of its ad-free plans. However, the cost of the ad-supported tiers will remain the same, aiming to drive signups to the ad-funded level. Netflix said ad-supported membership was up 70 percent on the previous quarter, with an average 30 percent of signups choosing the AVOD tier.

Warner Bros. Discovery Lays Out Plans for Max European Launch

Warner Bros. Discovery plans to roll out its flagship streaming service Max in 22 European markets next year, the company’s president of international Gerhard Zeiler said at MIPCOM in Cannes on Monday. But while the expansion will cover a number of major markets, some of Europe’s biggest markets including the UK, Germany, and Italy still aren’t set to receive the service, due to existing rights and distribution deals with Sky. Read on VideoWeek.

ITV Launches 15 New FAST Channels

ITV has launched 15 more free ad-supported streaming TV (FAST) channels across 16 territories, including channels dedicated to Schitt’s Creek and Eggheads, on Samsung, Pluto, LG and Rakuten services. The UK broadcaster’s latest push follows Channel 4’s entry into the FAST market in the US. “It’s amazing to see our strategy now coming to life with so many of our iconic brands and incredible content attracting new viewers in both the FAST and social space, continuing to serve existing superfans around the world and at the same time creating new ones,” said Graham Haigh, EVP, Global Digital Partnerships at ITV Studios.

BBC Expected to Reinvest News Budgets into Streaming Services

The BBC is set to reveal cost-cutting plans, according to the FT, including reinvesting news budgets into digital and streaming services. The reorganisation comes as the government seeks a new BBC chair, with contenders including acting chair Dame Elan Closs Stephens and Sir William Sargent, founder of VFX company Framestore. Reports suggest a reluctance among candidates, as the BBC faces a number of challenges ahead of the charter renewal in 2027.

Paramount to Shutter Showtime Sports in Shift to Streaming

Paramount will shut down Showtime Sports at the end of the year, the broadcaster announced this week. The boxing-centric pay-TV channel has been on air since 1986. But earlier this year, Showtime was merged with the Paramount+ SVOD service, bringing Showtime’s boxing matches and sports documentaries into the streaming offering. CBS Sports, which owns the NFL rights, is expected to become the home of all Paramount sports content.

NBCU on Track to Double its 2020 Olympics Ad Sales

NBCUniversal’s ad sales for the 2024 Olympics are double that of 2020, according to Adweek, when the broadcaster exceeded $1.2 billion in revenues. 10 months out from the Paris games, NBCU has reportedly sold out all live opening ceremony positions, as well as halftime sponsorship slots for soccer and basketball. The company will also limit its primetime Olympic advertising to one 60-second break per half hour, with a single advertiser mentioned each night during the lead-up to an event. “So if it were the 100-meter final, you might see them stretching, getting ready, but we certainly wouldn’t have an ad running during the race,” said Dan Lovinger, President of Olympic and Paralympic Sales at NBCU.

Analysts Value ESPN at $22 Billion

ESPN could be worth $22 billion, according to analyst estimates, after the entertainment giant broke out standalone earnings for the sports division for the first time. Earlier this year, CEO Bob Iger re-organised Disney into three divisions (entertainment, sports and parks), and said it will seek investors for ESPN as it transitions towards a streaming offering. The filing showed that sales at the sports TV networks have declined 1.3 percent in 2023, reaching $13.2 billion. This still points to a fairly profitable operation, according to Bloomberg Intelligence analyst Geetha Ranganathan, supporting a valuation up to $22 billion.

TF1 Plays With Gamified Ads

TF1 has unveiled a selection of gamified ad offerings, aiming to help brands capture viewers’ attention. These include a format whereby advertisers can sponsor the creation of a free digital game (such as karaoke or a quiz) designed around flagship TF1 content. Another product allows advertisers to develop a “phygital” experience, a field activation enabling public interaction both on the ground and via an app. The products integrate QR codes in broadcast spots and on the MYTF1 streaming service, as well as on the broadcaster’s social channels.

The Week for Publishers

News UK Launches New Publisher Ad Planning Tool

Publishing group News UK is launching a new publisher ad planning tool called Nucleus Plan, which will sit within its existing data offering called Nucleus Platform. News UK says Nucleus Plan will create planning insights using its first-party data, backed by third-party measurement partners including Adelaide and Brand Metrics. These insights will help advertisers optimise their campaigns based on one of six KPIs: viewability, CTR, brand awareness, consideration, purchase intent and attention. Campaigns based on these KPIs can then be delivered using seven variables including audience, context, emotion and format.

LADbible Buys US Women’s Brand Betches for $24 Million

UK publishing group LBG Media, owner of LADbible, has acquired US women’s brand Betches for $24 million. Betches is geared specifically towards millenial and GenZ women according to LBG, and will provide the group with expanded reach and footprint in the US. LBG says that Betches will remain a stand-alone business, but will work with LBG Media’s existing US team to develop larger direct brand partnership opportunities that can span LBG Media and Betches brands and audiences.

New York Times Reportedly Reopens Open Programmatic Pipes

The New York Times, which publicly announced it would no longer sell inventory via open programmatic auctions a few years back, has quietly reintroduced open programmatic sales on its mobile app, according to a report from Business Insider. The NYT cut off open programmatic sales due to their negative impact on overall user experience, but Insider says the publisher has turned the tap back on for mobile as the revenue loss was deemed to be too steep.

TIME Launches FAST Channel on Freevee

US news magazine TIME is moving into free ad-supported streaming TV (FAST), announcing plans to launch its first FAST channel on Amazon’s Freevee. TIME says it will use content from its existing premium digital video channel to populate the channel, hosting news coverage, documentaries, interviews and other features. Some of this content will be produced specifically for the FAST channel, according to TIME.

Black-Owned Publishers May be Hurt by MFA Pushback

Several Black-owned publishers have expressed concerns that an industry pushback against made for advertising (MFA) websites will inadvertently hurt their businesses, Digiday reported this week. The publishers said that some of the deals which agency groups have created with them, designed to funnel more ad-spend to Black-owned publishers, have certain ad impression requirements. With traffic from social platforms falling, these publishers have started buying more traffic in order to hit these requirements. But high levels of traffic acquisition is seen as a marker of MFA sites, meaning these Black-owned publishers risk getting demonetised if they’re mistakenly identified as MFA sites themselves.

Reach Expands Ad-Free App Offering

UK publishing group Reach has launched ad-free app offerings for a number of its local brands, HoldtheFrontPage reported this week. Reach earlier this year began running ad-free apps for some of its brands, which offer a small number of articles for free, but then require users to buy a subscription to read more. Reach has recently expanded this model to the Birmingham Mail, Newcastle Chronicle, Hull Daily Mail, Teesside Gazette, Belfast Live, Yorkshire Live and Wales Online according to HoldtheFrontPage.

Activist Investors Call for News Corp Spin-Offs

Investment group Starboard, which owns a stake in News Corp, is calling for News Corp to spin off its real estate websites in order to unlock more overall value, the Wall Street Journal reported this week. Starboard believes News Corp trades at a significant discount relative to the potential value of its assets, due to the way the company is structured.

The Week For Brands & Agencies

UK Marketers Raise Media Budgets Anticipating Economic Downturn

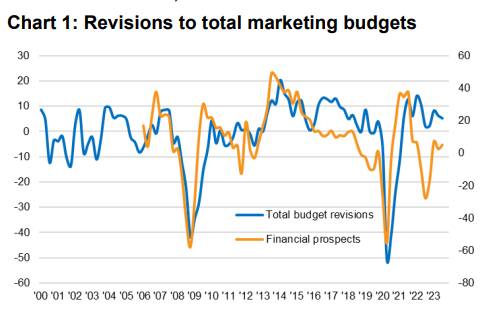

UK marketers increased their budgets in Q3 2023, according to the latest IPA Bellwether Report, though that growth was weakened by ongoing economic pressures. The study surveyed around 300 UK-based marketing professionals, and found that 21.1 percent increased their total marketing spend in Q3. But 15.8 percent of respondents downgraded their budgets over the same period, resulting in a net balance of +5.3 percent. This made Q3 2023 the weakest quarter of marketing budget growth since Q4 2022 (+2.2 percent), according to the Bellwether report. Read on VideoWeek.

Omnicom Report 3.3 Percent Organic Revenue Growth for Q3

Omnicom this week reported 3.3 percent organic revenue growth for Q3, exceeding Wall Street predictions and remaining in line with full-year expectations. Campaign Asia reported the company’s global revenue of $3.58 billion was up from six analysts surveyed from LSEG’s forecast of $3.55 billion. The business earned $1.86 per share, contrasted to analysts’ predictions of $1.84. Omnicom’s net income rose 2 percent to $371.9 million, while they experienced particular growth in their advertising and media division, posting a revenue increase of 6.1 percent to $1.9 billion.

IPG’s UM Hired as General Mills Global Media Agency

General Mills has appointed Interpublic Group’s UM as its global media agency, the FMCG brand announced this week. UM will be responsible for strategy, planning, buying, analytics, performance and commerce across more than 36 markets. The deal was completed under review from Mediasense. General Mills’ media was previously handled by GroupM’s Mindshare.

Havas Posts 4.5 Percent Q3 Growth

Havas, a French agency group, posted organic revenue increases of 4.5 percent in Q3, attributed largely to growth in Latin America, which surged to 51.1 percent. PR Week reported that the agency saw additional growth in Europe (1.5 percent), North America (3.0 percent) and Asia Pacific (2.0 percent). Havas’s revenues for the first nine months of 2023 were €2 billion, a 4.3 percent organic increase after pass-through costs deductions.

Procter & Gamble Ad Spend Increases Above Expectation

FMCG giant Procter & Gamble boosted their ad spending by $445 million in its fiscal first quarter, exceeding analyst predictions, AdAge reported this week. The company’s sales also increased, up 6 percent to $21.9 billion (7 percent organically), while net earnings rose around 15 percent to $4.6 billion, with the company’s reported net earnings per share up 17 percent. Andre Schulten, P&G CFO, predicted continued aggressive spending through the remainder of the fiscal year, saying, “We’ll continue to invest as long as we can drive a healthy return on investment, which is the case with marketing spending.”

Retail Media Ad Spend To Reach $128 Billion This Year

WARC Media, a marketing and research platform, have forecasted global advertising spend to hit $128 billion this year. A 10.2 percent YoY increase, ad investment is tipped to increase to $141.7 billion in 2024, and is on track to surpass linear TV as the third largest channel spend in a few years, according to Mobile Marketing. WARC’s report found Amazon is set to supplant Alibaba as the world’s largest retail media owner in terms of ad revenue this year with the pair dominating growth in retail media. Between them, they earned an estimated $80 billion in advertising revenue in 2022, equivalent to 68.3 percent of global retail media investment.

WPP Merges Agencies to Form VML

WPP has combined its VMLY&R and Wunderman Thompson creative agencies to form VML, a new setup creating a business of more than 30,000 people in 64 markets. Jon Cook and Mel Edwards will lead the operation as Global CEO and Global President respectively, with WPP stating the new entity will begin business on 1st January. Prior to the merger, Wunderman Thompson and VMLY&R had partnered with clients such as Colgate-Palmolive, Dell, Ford, Microsoft, Nestlé and The Coca-Cola Company.

Hires of the Week

ProSiebenSat.1 Appoints Katharina Frömsdorf as Joyn CEO

ProSiebenSat.1, a German media and digital company, announced Katharina Frömsdorf as CEO of its streaming platform Joyn. She will begin the role 1st November 2023, where she will be joined by Nicole Agudo Berbel and Benjamin Risom in the management team reporting to group CEO Bert Habets. Frömsdorf replaces Tassilo Raesig and René Sahm, outgoing CEO and CFO/COO of Joyn respectively, and she will also take on the role of Chief Platforms & Growth Office of Seven.One Entertainment Group.

TF1 Names François Xavier Pierrel as Data and Ad Tech Chief

TF1, a French broadcast group, has named François Xavier Pierrel as its chief data and ad tech officer. Pierrel will head up a new unit, reporting into François Pellissier, deputy CEO for business and sport, responsible for managing the company’s user data lake, data science and analytics, and ad serving. He will also be tasked with optimising the TF1 Pub, the group’s ad sales arm and their technology partnerships. Pierrel previously served as chief data officer at JCDecaux, and director of data at Renault.

Ofcom hires Cristina Nicolotti Squires as Broadcasting and Media Director

Ofcom, the UK’s communications regulator, has hired Cristina Nicolotti Squires to lead its TV, radio and on-demand industry regulations. She will join the Senior Management Team as Group Director for Broadcasting and Media, having previously worked as Director of Content at Sky News, Editor at ITN’s 5 News, as well as holding leadership roles with ITV News. Nicolotti Squires will replace current interim Siobhan Walsh, who is Ofcom’s senior broadcasting director.

This Week on VideoWeek

Will Money Move from Desktop and Mobile to CTV After Cookies Disappear?

Warner Bros. Discovery Lays Out Plans for Max European Launch

UK Households Are Taking to FAST Channels in New Kantar Study

How to Optimise Digital Advertising for Maximum Attention and Sustainability

UK Marketers Raise Media Budgets Anticipating Economic Downturn

Ad of the Week

Donald Glover, Sound is Power, Bose