In this week’s Week in Review: WBD makes a first-party data play, YouTube’s ad revenues show its continued dominance of video, and a Thinkbox study shows TV produces disproportionate returns on spend.

Top Stories

Warner Bros. Discovery Launches First-Party Data Platform Olli

Warner Bros. Discovery this week announced the launch of Olli, a new proprietary first-party data platform which will cover campaign planning, activation, and measurement across the media conglomerate’s entire portfolio of inventory. The company says Olli will help advertisers run more efficient campaigns, giving a clearer view across its different media channels. For example, WBD says an integration with VideoAmp will help advertisers exclude heavy linear TV viewers early in the planning process, redistributing that spend to boost reach and frequency.

WBD says Olli has an audience graph covering its direct relationships with consumers which covers over 100 million households and 700 million devices across the US, which it says enables it to recognise its audience across different devices and media types. First-party data is also attached to these profiles to enable audience targeting, while WBD says clean room solutions provided by Snowflake will enable advertisers to fold in their own data. Olli also streamlines WBD’s ad tech processes, according to the company, for unified planning across its portfolio.

On the measurement front, WBD says Olli will provide more actionable campaign insights through partnerships with ABCS Insights and LoopMe. “Our goal is to ensure that every connection between brand and audience is reached in the most efficient and effective way across our vast expanse of digital and traditional platforms,” said Ryan Gould, head of digital ad sales at Warner Bros. Discovery.

YouTube Revenues Top $8 Billion in Q1 as Short-Form Monetisation Improves

YouTube has posted its highest Q1 earnings to date, generating $8.1 billion in ad sales during the first quarter of 2024, up 21 percent year-on-year.

Revenues were boosted by YouTube’s continued growth on connected TVs, a major focus for the company in recent years. YouTube says that viewers are on average watching over one billion hours of content daily on TV screens. For context, Netflix suggested last year that it gets around 100 billion viewing hours over a six month period, so roughly half a billion hours per day.

And ad income was also boosted by improved monetisation on YouTube Shorts, YouTube’s TikTok competitor. Philipp Schindler, chief business officer of parent company Alphabet, said that monetisation relative to in-stream viewing has doubled in the past year. YouTube also released new ad formats for Shorts last week, expected to boost monetisation further.

YouTube’s figures, when compared with other industry data, further demonstrate the company’s dominant place in the video landscape. For example, IAB data from earlier this week projected that total US digital video ad spend this year – including all CTV and social video – will hit $63 billion, or roughly $16 billion per quarter. Thus, YouTube’s ad revenues are equal to more than half of all US digital video ad revenues, including all CTV revenues made by streaming companies in the US.

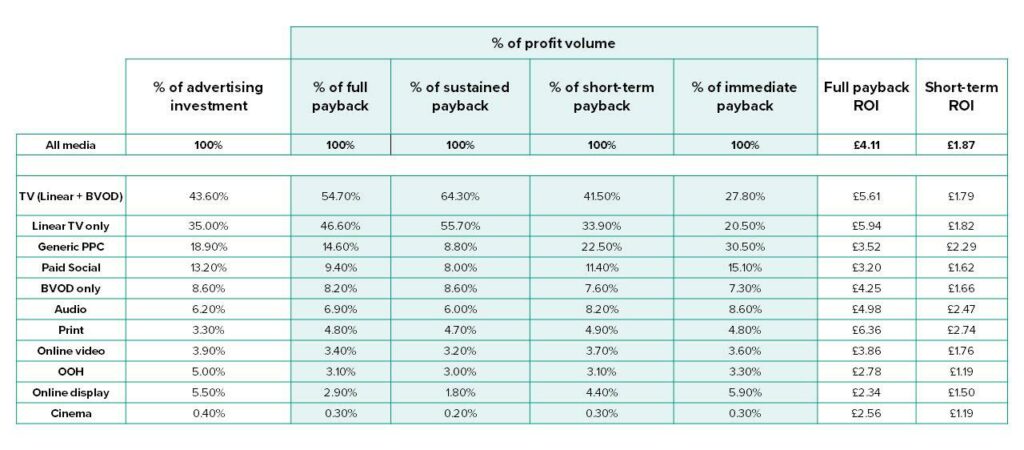

TV Accounts for Over Half of Ad Return but Less Than Half of Investment

A new Thinkbox study has found that £1 invested in advertising returns just over £4 in profit, based on client data from Ebiquity, EssenceMediacom, Gain Theory, Mindshare and Wavemaker UK. The research revealed that TV accounts for 54.7 percent of advertising’s full payback but only accounts for 43.6 percent of total ad investment. Within this, linear TV accounts for 46.6 percent of full payback, while BVOD accounts for 8.2 percent.

The study also showed that TV has an average full profit ROI of £5.61 for every pound spent. By comparison, online video (predominantly YouTube) has an average full profit ROI of £3.86 for every pound spent, and accounts for 3.4 percent of full advertising-generated profit.

“Despite the upheaval the world has been through, the fundamentals of advertising effectiveness still apply,” said Matt Hill, Research and Planning Director at Thinkbox. “It’s great to see TV performing so strongly at whatever speed you want to drive profit, but this is about the strength of advertising as a business investment that grows the bottom line and grows the economy. I hope business acts on these findings.”

The Week in Tech

Google Pushes Back its Cookie Deadline Until 2025

Google has announced that it is once again pushing back its deadline for removing third-party cookies from its Chrome browser. The deadline, originally set for the start of 2022, was previously penned for the end of this year, having already been moved back several times. But Google has said that more time is needed, in order to take industry feedback into account and to give the UK’s Competition and Markets Authority, which has regulatory oversight of Google’s decision, to review evidence. Now it says it expects to start ramping up cookie deprecation “starting early next year”. Read industry reactions to the news on VideoWeek.

EU Threatens to Suspend TikTok Lite Over Addictiveness Among Children

The European Commission has threatened to suspend TikTok Lite, the company’s reward programme that offers payment in return for watching and liking videos, over concerns of addictiveness for children. “Unless TikTok provides compelling proof of its safety, which it has failed to do until now, we stand ready to trigger DSA [Digital Services Act] interim measures including the suspension of TikTok Lite feature which we suspect could generate addiction,” said EU industry chief Thierry Breton. TikTok responded that the feature is not available to under 18s.

YouTube Signs Up to Ipsos Measurement for UK Online Viewing

Market research firm Ipsos this morning announced it will add UK viewing data from YouTube into its online audience measurement platform, Ipsos iris. The integration will allow media owners, agencies and advertisers to analyse viewing data across online video publishers in one place, according to Ipsos, enabling businesses to shape content and advertising strategies. Ipsos iris reports viewing across uniform demographics, and will provide YouTube measurement across more than 500 audience segments. Read more on VideoWeek.

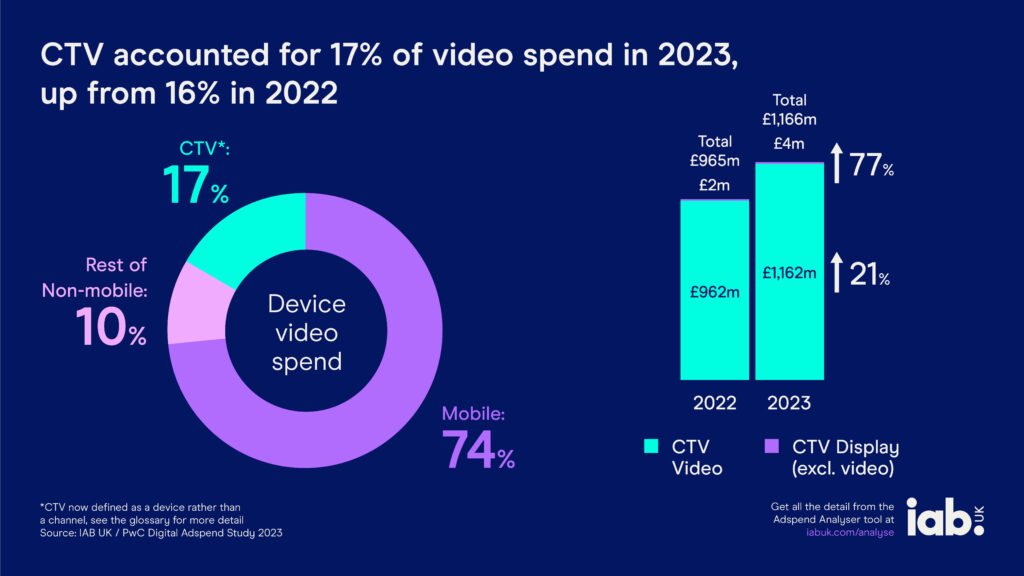

Advertisers Look to CTV and Social Video in the Run-Up to Cookie Deprecation

CTV spending surged in the UK last year, according to the latest IAB Digital Adspend report, as advertisers look to invest in cookieless environments. Conducted alongside PwC, the study found that ad spend on CTV devices (£1.2 billion) grew 21 percent YoY, accounting for 17 percent of all video spend in 2023. The research showed that the UK digital ad market grew 11 percent YoY, reaching £29.6 billion in 2023. The report notes the growth rate outpaces GDP at 0.1 percent, revealing the appetite among advertisers to capitalise on growing engagement in online entertainment, and its associated digital ad formats. Read more on VideoWeek.

Deutsche Telekom and Equativ Bring Addressable Ads to MagentaTV

Deutsche Telekom this week announced that MagentaTV, the German telco’s TV offering, will enable addressable advertising from mid-2024. Addressable ads will be traded programmatically through Equativ, a French ad tech firm which owns an ad server, supply-side platform (SSP) and demand-side platform (DSP). The telco recently revamped MagentaTV, which offers live TV and on-demand content, including free ad-supported streaming TV (FAST) channels. The platform carries a range of different broadcaster content, and the partnership with Equativ allows major TV broadcasters to market their own inventory programmatically on MagentaTV. Read more on VideoWeek.

Meta Shares Tumble at AI Spending Spree

Mark Zuckerberg vowed to increase spending during Meta’s earnings call this week, promising to turn the company into “the leading AI company in the world” and sending its shares tumbling almost 12 percent in the process. Meta’s revenues climbed 27 percent YoY during Q1, but the tech giant also raised its full-year capital expenditure guidance from $37 billion to $40 billion to cover its AI investments. The spending spree follows Zuckerberg’s “Year of Efficiency” in 2023, when capital expenditure totalled $28.1 billion.

Ad Targeting Improvements Start Paying Off for Snap

Snap revenues rose 21 percent YoY during Q1 2024, the company announced in its earnings on Thursday, citing improvements to its ad targeting capabilities. Snap shares jumped 25 percent at the results. “Given the progress we have made with our ad platform, the leadership team we have built, and the strategic priorities we have set, we believe we are well positioned to continue to improve our business performance,” Snap told investors.

Onetag Partnership Brings Inventory Curation to Multilocal

Multilocal, a programmatic specialist, will grant clients access to Onetag’s publisher inventory, under a new partnership with the curation platform. The integration brings Onetag DealCurate into Multilocal’s offering, using impression-level traffic shaping to eliminate low-quality media in the programmatic supply chain. “This partnership between two major players in the curation space cements curation’s place as a key component of the programmatic ecosystem,” says Multilocal CEO James Leaver. “Curation is intrinsically agnostic and opens up increased options and scale for both buyers and sellers. This integration is proof of its increasing importance, and will make it easier for Multilocal’s clients to tap into its many benefits.”

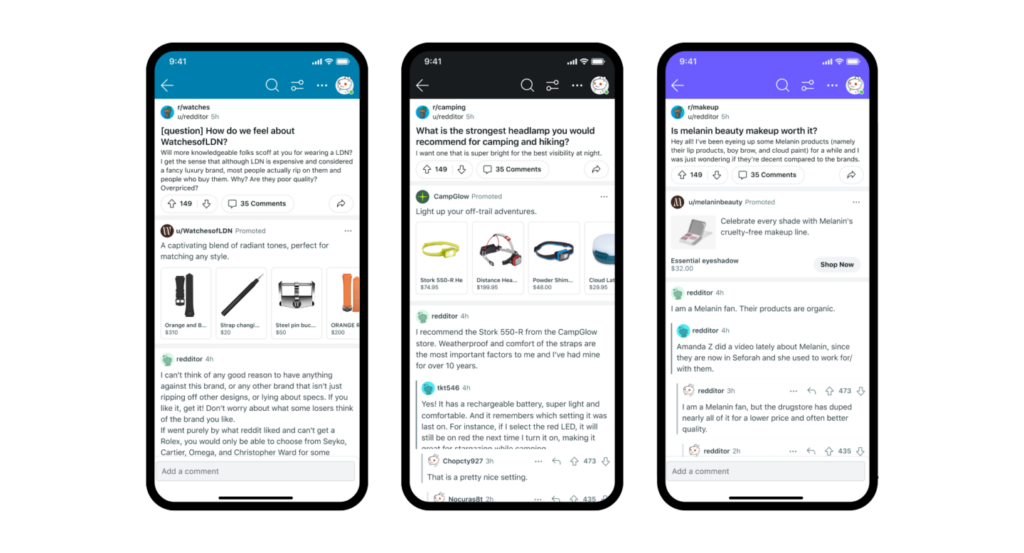

Reddit Introduces Ad Format for E-Commerce Advertisers

Reddit has introduced a new ad format as part of its commerce offering, Reddit Shopping suite. The format, Dynamic Product Ads, enables e-commerce advertisers to promote relevant products where people are discussing and deciding what to buy. “Over the coming years, we intend to continue investing in both advertising and organic shopping solutions to further build on Reddit’s rich shopping conversations, and the opportunity for e-commerce brands to bring their products into the most relevant communities,” the company announced.

Playground xyz to Rebrand as GumGum in APAC

Playground xyz will rebrand as GumGum in the APAC region, following its acquisition by the contextual ad tech firm in 2021. Playground xyz creates high-attention ad formats, which are now fully integrated into GumGum’s fleet of ad solutions. The company said the APAC integration will feed the global rollout of The Mindset Platform, bringing together GumGum’s media products, contextual targeting platform Verity, and Playground xyz’s Attention Intelligence Platform (AIP), which will continue as a standalone solution.

X TV App “Coming Soon”

X (formerly Twitter) this week announced that its CTV app will be “coming soon to most smart TVs.” Elon Musk first trailed the app in July 2023, before rekindling the rumours last month. The company also said users would be able to cast video from the mobile app onto TV, as the struggling social media firm continues to adopt YouTube-style products in its ongoing video push.

The Week in TV

Viaplay Continues Recovery with Renewed Focus on Core Markets and Distribution Partnerships

Nordic streaming company Viaplay has reported a solid start to 2024, becoming the latest European broadcaster to indicate signs of recovery in the TV ad market. The company’s sales climbed 6 percent YoY during Q1, matching the quarterly growth rates of both MFE and ProSiebenSat.1. Following a recapitalisation programme, which it called “an important step” in returning to profitability, the company said it was on track to meet its full-year targets. Read more on VideoWeek.

Ads Prompt Subscriber Churn at Amazon Prime Video

Amazon Prime Video has experienced “significant” subscriber churn since introducing ads, according to Kantar. The research found that Prime’s share of new subscribers, total number of subscribers, proportion of Prime users engaging with Prime Video and subscriber advocacy all “fell significantly” during Q1. According to the report, Prime Video was “the only major service whose subscribers display an active net dissatisfaction with the number of ads being served.”

Paramount to Handle Ad Sales on SkyShowtime’s New Ad Tier

SkyShowtime, a European streaming joint venture (JV) between Comcast and Paramount, has introduced an ad-supported tier across all markets, with Paramount handling ad sales. The Standard with Ads plan contains around four to five minutes of ads per hour, according to the JV. “By leveraging our deep relationships with some of the world’s leading marketers, incredible product offerings and innovative technology, Paramount Advertising is the perfect partner for SkyShowtime,” said Lee Sears, President of International Markets Ad Sales at Paramount.

EBU Report Highlights Economic Contribution of Sport Broadcasting by PSBs

Public service sports broadcasting contributed €4.9 billion to Europe’s GDP and supported over 60,000 jobs in 2022, according to a new Oxford Economics report, commissioned by the European Broadcasting Union (EBU). “Our analysis unveils a symbiotic relationship between free-to-air sports broadcasting and economic vitality, illustrating the far-reaching ripple effects of this dynamic industry right across the continent,” said Doug Godden, Lead Economist at Oxford Economics and author of the report. “What’s more, providing sporting action to audiences for free has great value to the public of the countries in which EBU Members operate.”

Sky Media Expands Search Behavior Targeting with Captify

Sky Media has expanded its relationship with Captify, a search intelligence platform, allowing brands to target TV audiences based on online search behaviour. The announcement comes six months after the companies launched Search Behaviour Targeting on Sky. Since then, the number of categories available for advertisers has doubled, now offering 18 audiences. “We are delighted by the growing demand from Sky Media’s clients to use Captify search data to reach desired target audiences,” said Rishi Chande, SVP of Global Strategy & Business Development at Captify. “We are working closely with the Sky Media team to improve the targeting and attend to the demands of their different clients.”

Apple Aims for FIFA Club World Cup Rights

Apple is closing in on rights to the FIFA Club World Cup, the New York Times reported on Monday. Sources said a deal worth $1 billion could be signed soon, following its $2.5 billion payout for Major League Soccer (MLS) in 2022. But reports suggest FIFA executives have expressed concern about the competition being exclusively available to Apple TV+ subscribers.

Peacock Posts Gains as Comcast Loses Broadband Customers

Peacock revenues increased 54 percent YoY during Q1, according to parent company Comcast, adding 3 million subscribers to reach a total 34 million. But the media conglomerate suffered heavy broadband losses, sending shares down 6 percent on Thursday. “We do not see this trend improving in the near term,” said Comcast CFO Jason Armstrong.

GB News to Cut 40 Staff Amid £42 Million Loss

GB News has begun laying off staff, after its accounts revealed an operating loss of £42.4 million. The UK news channel is seeking to cut 40 roles, according to Press Gazette, with one staff member reporting “a real ‘last days of Saigon’ vibe in the office right now.”

The Week for Publishers

Dow Jones Hands UK Inventory to Ozone

Dow Jones, which owns media brands The Wall Street Journal, Barron’s, and MarketWatch, has agreed a deal with UK publisher alliance Ozone which will see Ozone sell UK audience inventory for Dow Jones. “We’re delighted to welcome these three Dow Jones power brands to Ozone’s UK audience alliance,” said Danny Spears, Ozone’s chief operating officer. “Not only do they epitomise the premium, editorially-governed publisher profile that is the core differentiator of Ozone partners, but they also bring a highly sought after audience to our advertiser offering.”

The Guardian Asks Readers to Opt In After Updating Consent Mechanism

The Guardian has updated its consent mechanism for collecting user data to be in line with guidance from the UK’s data regulator the ICO, making it as easy to ‘reject all’ non-essential collection of data as accepting all. At the same time, the newspaper published a blog explaining the consequences of the move to its readers – namely that with lower consent rates, ad revenues could be hit. “The reality is that without the use of data to personalise advertising to readers, brands will spend less money on advertising with publishers like us,” Katherine Le Ruez, The Guardian’s director of digital, said in the blog post. “Less money generated from advertising means that we need to ask readers to contribute to funding our journalism directly.”

Axel Springer Boss Defends AI ‘Deal with the Devil’

Mathias Dopfner, chief executive of European publishing giant Axel Springer, defended his company’s strategy of agreeing deals with AI businesses, saying he wanted to establish a precedent of publishers being paid for use of their content in AI systems. Speaking at the INMA World News Media Congress, as reported by Press Gazette, Dopfner was questioned on Axel Springer’s “deal with the devil” with OpenAI. Dopfner replied that his company and others fought for years to get remuneration from tech platforms for sharing their content, and that with the arrival of AI, he decided it was better to agree deals quickly in order to establish a model whereby publishers are paid by AI companies for access to their content as standard.

CNET Partners with Best Buy for New Retail Media Product

Tech-focussed digital publisher CNET and retailer Best Buy have partnered for a new retail media offering, Adweek reported this week. Advertisers will be able to buy ads across both Best Buy and CNET’s digital properties, according to Adweek, while CNET’s reviews and expert picks will feature in Best Buy stores and on its ecommerce site.

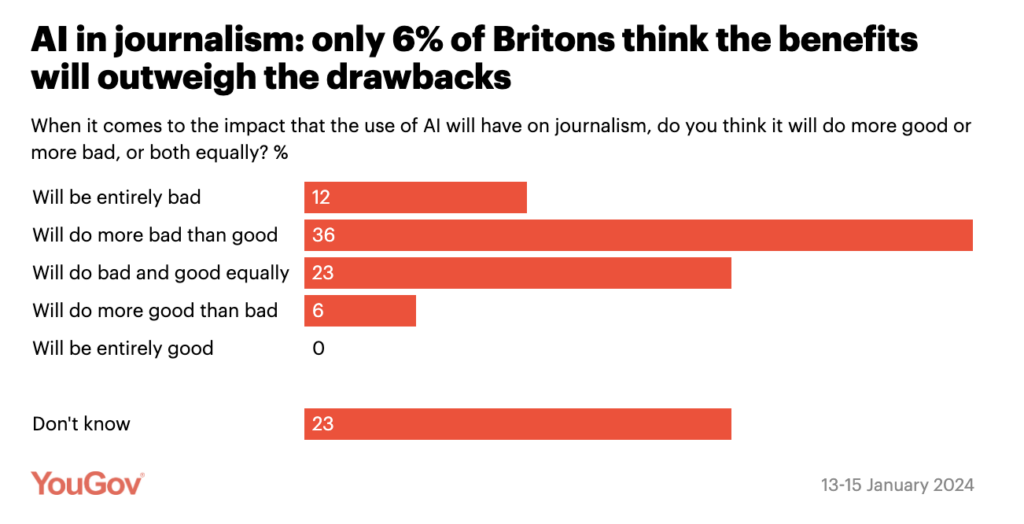

UK Audiences Fear Negative Consequences of AI in Journalism

Only six percent of UK residents believe AI’s use in journalism will do more good than bad, according to research from YouGov, while 36 percent believe it will result in more bad than good, and 12 percent expect entirely bad outcomes. There are some specific use cases where the majority of YouGov’s respondents said they find use of AI acceptable, namely translating articles into foreign languages, and performing spelling and grammar checks.

Le Monde Keeps Faith in English Language Expansion, Despite Missing Targets

French newspaper Le Monde fell short of its goal of reaching 30,000 subscribers to its new English language product at the end of last year, Adweek reported this week. But the publisher is still keeping faith in the strategy, aiming for profitability for the standalone unit by 2027. A lot of focus has initially been improving on the product, and bringing down the costs of translating Le Monde’s reporting. Now the company will focus on building brand recognition as it looks to build readership in English speaking markets.

The Week For Brands & Agencies

IPG Reports Improving Marketer Sentiment with Q1 Organic Growth

Interpublic Group this week reported 1.3 percent organic growth in net revenues for the first quarter of the year, with total revenues down year-on-year but above Wall Street expectations. “The strength of our capabilities in media, healthcare and specialty marketing services was once again evident, as was the impact of macro uncertainty and challenges due to clients in the technology sector,” said IPG’s CEO Philippe Krakowsky. “These cross-currents continue to be in effect as we move into 2024.”

Tech’s Ad Spend Pullback Continues for WPP

WPP meanwhile posted a 1.6 percent drop in like-for-like revenues less passthrough costs for Q1, due to the loss of Pfizer as a client, and continued dampened spending from tech companies. GroupM grew 2.4 percent during the quarter, but this was offset by revenue declines in creative agencies. WPP’s CEO Mark Read said Q1 had a particularly tough comparison with the year prior, and WPP still expects to return to growth across the balance of the year.

P&G Continues to Bump Up its Ad Spend

P&G’s marketing spend in its most recent quarter was up by around 14 percent year-on-year, executives said on an earnings call following the FMCG giant’s recent financial results, as the company continues to put faith in advertising. “We continue to invest in reach frequency with strong quality of communication across the markets,” said CFO Andre Schulten on the earnings call. “We are very diligent in pre ROI analysis and very diligent in post event analysis to ensure that we understand whether the spending is effective. And if you look at the results, I would argue it is.” Schulten added that P&G is focussing on building the same sorts of digital capabilities in Europe that it already has in the US.

AA and WARC Forecast 5.8 Percent UK Ad Spend Increase This Year

Total UK ad spend grew by 6.1 percent last year, according to the latest Expenditure report from the AA and WARC, with 5.8 percent growth forecasted for 2024. Despite the overall growth across the industry, TV had a tough year, with total TV ad spend down by 8.9 percent last year according to the report. But a return to growth is expected for 2024, with 15.9 percent increased spend in BVOD projected to drive 2.6 percent overall growth in TV.

4As Says It’s Too Early for Alternative Currencies

American advertiser trade group the 4As, having analysed alternative currencies via its measurement committee, believes it may be too early for brands to put these currencies centre stage, AdExchanger reported this week. GroupM’s Bharad Ramesh, who chairs the committee, said that newer data sets need more time to stabilise, while advertisers need time to test them too. A lack of MRC accreditation is also a concern, according to AdExchanger.

Tesla Lays Off Marketing Team After Dabbling in Advertising

Electric car maker Tesla has laid off its entire marketing team just four months after putting the team together, Bloomberg reported this week. Tesla has historically steered clear of advertising, but began spending on paid ads – perhaps partly due to the awkwardness of CEO Elon Musk also running an ad-supported business while seemingly not seeing value in advertising his own products. But Tesla looks set to end its experimentation with ads. Musk implied on X that he hadn’t been impressed with the ads run by Tesla’s team.

Exactly. The ads were far too generic – could’ve been any car.

— Elon Musk (@elonmusk) April 22, 2024

IPG Mediabrands Launches Climate Action Accelerator Programme

IPG’s media arm IPG Mediabrands this week launched the Climate Action Accelerator Programme, which it says will give clients and media partners access to sustainability solutions covering emissions measurement, renewable energy, carbon removal, and carbon responsive research. Mediabrands says that the programme will provide streamlined and cost-effective access to these sustainability tools for its partners.

Hires of the Week

EssenceMediacom Names Luis Pedro Martinez Head of Ecommerce

EssenceMediacom UK, a GroupM agency, has appointed Luis Pedro Martinez as Managing Partner, Head of Ecommerce. Martinez joins from the agency Jellyfish, where he served as VP Partnerships at Jellyfish Commerce.

Carsten Schwecke Joins RTL Deutschland Management

Carsten Schwecke has been named Chief Commercial, Technology and Data Officer at RTL Deutschland, replacing Matthias Dang who is leaving the broadcaster after more than 30 years. Schwecke previously served as Head of Sales at Seven.One Entertainment Group.

This Week on VideoWeek

What Do Buyers Want from Total Video?

How Utiq Hopes to Become “Fundamental to the Digital Advertising Ecosystem”

YouTube Signs Up to Ipsos Measurement for UK Online Viewing

Viaplay Continues Recovery with Renewed Focus on Core Markets and Distribution Partnerships

Advertisers Look to CTV and Social Video in the Run-Up to Cookie Deprecation

RTL AdAlliance Research Finds Big Differences Between US and European Attitudes to TV Advertising

Deutsche Telekom and Equativ Bring Addressable Ads to MagentaTV

The Buy-Side View: Q&A with Havas’ Harry Packshaw

The Industry Reacts: Google Pushes Back its Cookie Deadline Once Again

Ad of the Week

Snickers, Misprompt