In this week’s Week in Review: The BBC buys ITV’s 50 percent BritBox stake, IPG announced a generative AI deal with Adobe, and publishers including Axel Springer sure Google for alleged abuses of dominance in digital advertising.

Top Stories

ITV Sells its Half of BritBox to BBC Studios

ITV has sold its 50 percent share of BritBox to co-owner BBC Studios, for a cash consideration of £255 million. The sale reflects ITV’s renewed focus on ITVX and its Studios division, the commercial broadcaster said in a press release this morning.

BritBox launched in the US in 2017 and the UK in 2019, in efforts to combine British broadcaster content in the face of competition from US streaming companies. But evidently those moves did not drive the desired results for ITV, which launched its new streaming service in 2022, and folded BritBox into the premium tier.

BritBox is to close its standalone streaming service in the UK on 30th April 2024, although ITV will continue to provide content for the international service. “Under the terms of the agreement, ITV Studios will continue to receive an ongoing revenue stream from BritBox International similar to current levels,” said the release.

Meanwhile the launch of joint broadcaster app Freely, slated for Q2 2024, could help revive the collaborative streaming ambitions of the public broadcasters, essentially replacing BritBox as a combined platform for their on-demand content and linear channels.

IPG Announces New Adobe-Powered Generative AI Product ‘IPG Engine’

Agency group Interpublic Group has launched IPG Engine, a new platform which uses Adobe’s generative AI technology to automate and scale creative content and audience building. IPG says the new tool will speed up content ideation, creation, production and activation, pairing Adobe’s generative capabilities with its own audience data for campaign targeting and optimisation.

The IPG engine is a new marketing technology platform being rolled out across IPG’s entire group. Like other agency groups, IPG is looking to make its bank of data (gained through its Acxiom data and identity products) more accessible and usable across its entire workforce. IPG’s engine is the proposed solution, acting as an “operating system” across the group.

Adobe’s generative AI tools will act as the creative component of this operating system. In essence, IPG will derive insights around targeting and optimisation through its data (as well as clients’ data, where possible), and Adobe’s tools will then help deliver content based on these insights.

“We’re deploying a unified operating system across our entire portfolio, fuelled by data and audience insights, to craft content strategies that enhance human creativity with ethically sourced gen AI,” said Philippe Krakowsky, CEO of IPG.

Publishers Including Axel Springer Sue Google for $2.3 Billion Over Digital Ad Practices

A group of 32 European publishers including Axel Springer and Schibsted have filed a $2.3 billion lawsuit against Google, claiming damages caused by unfair practices in digital advertising. The companies accused Google of “abuse of its dominant position” in the digital ad market, claiming that if Google had played more fairly, they would have “received significantly higher revenues from advertising and paid lower fees for ad tech services”.

Other publishers involved in the lawsuit include Ringier, Sanoma, Agora, TV2, Presna Iberica, DPG Media and Mediahuis. A spokesperson from Google dismissed the claim as “speculative and opportunistic”.

The new lawsuit joins a long list of inquiries into Google’s dominance of the web alongside other tech giants. The company faces multiple antitrust cases in the US and Europe, some of which focus specifically on its ad tech products and positioning. And it has already faced successful claims against its business, including a €220 million fine from France’s competition authority back in 2021 – a case which was cited in this new lawsuit.

The Week in Tech

Vibe Raises $22.5 Million to Power Mission to Become Google Ads for Streaming TV

Vibe.co, an ad tech company positioning itself as a streaming TV ad platform for small and medium-sized businesses (SMBs), has announced the completion of a $22.5 million Series A funding round led by venture firm Singular. Existing investors Elaia Partners and Sequioa’s Scout Fund, as well as a number of ad tech investors, also joined the funding round. Vibe launched its self-serve ad platform back in 2022 after completing a $7 million seed-funding round. The company pitches itself as ‘the Google Ads of streaming’, aiming to bring the simplicity of Google’s platform – a key selling point for SMBs – to the streaming world. Read more on VideoWeek.

Sir Martin Sorrell’s S4S Ventures Joins $9.4 Million Funding Round for tvScientific

CTV advertising platform tvScientific, a specialist in performance advertising on streaming TV, has completed a $9.4 million convertible note funding round (a type of funding which allows investors to convert debt into equity for a set price at a later date). S4S Ventures, a venture capital firm co-founded by Sir Martin Sorrell, joined the funding round as a new investor alongside BDMI and Progress Ventures. NBCU, Hearst Ventures, Aperiam Ventures and Norwest Capital Partners are also investors in the firm. Read more on VideoWeek.

Google Allows Advertisers to Audit PMax Placements

Google is enabling advertisers to audit their ad placements on its Search Partner Network (SPN), websites added to Google Search campaigns bought through the tech giant’s PMax product. PMax has long been criticised for its black box nature, leading to multiple reports of ads ending up on inappropriate or illegal content. The company said that from 4th March 2024, advertisers will have greater visibility into the placement of ads across the SPN.

Amazon Plans Post-Cookie ID Solution

Amazon appears to be planning a post-cookie identity solution, AdAge reported on Tuesday. The company reportedly posted (then deleted) job listings for a project called ID++, described as “the next generation of innovative products and services that will fuel the future growth of Amazon’s ad solutions in an identity-restricted world.” Amazon confirmed that the project is in development, with a view to create “addressability models” for cookieless environments.

Lumen Secures Eye-Tracking Tech Patent

Lumen Research, an attention measurement firm, has secured a patent for its eye-tracking data collection platform. Initially granted in the EU, the patent covers Lumen’s technology for measuring points of interest on web pages, based on eye-tracking data obtained through mobile and desktop environments via webcam. “This patent is an exciting milestone in Lumen’s history and proves that our specific application of understanding visual consumer behaviour on the screen through webcams is truly unique,” said Lumen co-founder Navid Hajmirza.

TikTok Attracts Quarterly Ad Spend Over $1 Billion

Ad spend on TikTok exceeded $1 billion in the final quarter of 2023, according to data from MediaRadar, as advertisers flocked to the video-sharing platform. The advertising intelligence firm analysed ad spend on TikTok for 2023, which reached $3.8 billion across the full year. The data showed that ad spend climbed each quarter, from $805 million in Q1 to $1.2 billion in Q4, an increase of 43 percent. Read more on VideoWeek.

FreeWheel Brings Programmatic Bidding to Upfront Buys

FreeWheel, a Comcast-owned ad tech firm, has launched a new tool allowing advertisers to include biddable programmatic inventory in their Upfront buys. The ‘Allocation Module’ is said to give advertisers more flexibility around Upfront commitments, while providing publishers with more transactional opportunities for their inventory. “Existing systems have been holding back the modern day Upfront,” said FreeWheel CPO David Dworin. “There has been an inherent conflict between the concept of Upfront commitments and programmatic bidding, which happens in real time. This new solution bridges that gap and has the potential to turbocharge the shift to programmatic as part of the next Upfront.”

Meta Hit by Fresh Wave of GDPR Complaints

Meta was hit by a fresh wave of privacy complaints by EU consumer groups on Thursday, the latest in a long line of grievances against the company’s use of data for advertising. Eight consumer groups asked EU regulators to intervene in alleged GDPR breaches by Meta, accusing the tech giant of collecting vast amounts of user data without consent. “Surveillance-based business models pose all kinds of problems under the GDPR and it’s time for data protection authorities to stop Meta’s unfair data processing and its infringing of people’s fundamental rights,” said Ursula Pachl, deputy director general of the European Consumer Organisation.

Reddit Declares Financial Results in IPO Preparation

In preparation for its stock market debut, Reddit has disclosed its financial performance in a filing to the Securities and Exchange Commission. The IPO filing revealed that Reddit revenues grew by roughly 21 percent in 2023, while the platform has 267.5 million active weekly users. It also revealed that OpenAI CEO Sam Altman is the company’s third-largest shareholder, with an 8.7 percent stake.

IAB Europe Issues Recommendations for Retail Media Standards

IAB Europe has published the first set of recommendations for retail media standards in Europe. They suggest establishing Primary Media Metrics to ensure digital retail media ads adhere to the same standards as other digital ads, and Attribution Metrics to enable brands to compare their advertising investments across channels. The recommendations are open for industry comment before the final standards are released in April.

Publisher-focused Ad Tech Company Nexx360 Launches in the UK

French ad tech start-up Nexx360, which says it helps publishers increase revenues and reduce carbon footprints, has launched in the UK. The company’s core product, the Nexx360 Programmatic Cloud, enables publishers to connect with multiple ad tech partners (supply side platforms, or SSPs) using cloud-based, server-side bidding solutions. The company says this uses less processing power, improved website performance, and is more carbon efficient.

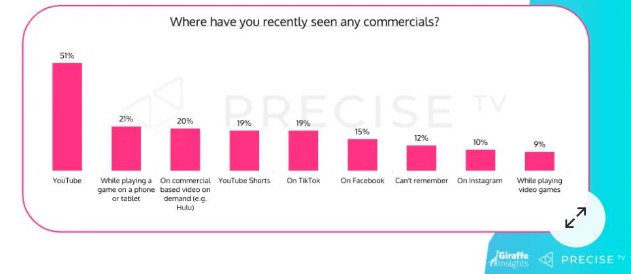

YouTube Drives Ad Recall Among Kids Finds New Report

YouTube dominates viewing among 2-12 year olds, according to research by Precise TV and Giraffe Insights, demonstrating high levels of ad recall from products they see on the video-sharing platform. The ‘Precise Advertiser Report: Kids (PARK)’ report found that children watch an average 106 minutes of YouTube per day, with 95 percent of families co-viewing that content, creating further advertising opportunities. PARK suggested that 60 percent of parents are more likely to purchase a product they have seen advertised while co-viewing with their child, and 80 percent said their child has asked for something from an ad they have seen while co-viewing.

The Week in TV

Paramount to Slash Content Spend as Paramount+ Nears Profitability

There were brighter signs on the horizon after a gloomy year for Paramount Global, whose Q4 2023 earnings came in below market expectations on Wednesday. Paramount’s quarterly revenues slid by 6 percent YoY (in line with WBD’s 7 percent drop), pulled down by a 15 percent slump in linear ad revenues. But Paramount CEO Bob Bakish pointed to an optimistic scatter market. And the streaming business remains relatively healthy, having passed the peak of its losses in 2022. Paramount+ revenues climbed 69 percent YoY, and added 4.1 million subscribers during the quarter, bringing its total user base to 67.5 million. Read more on VideoWeek.

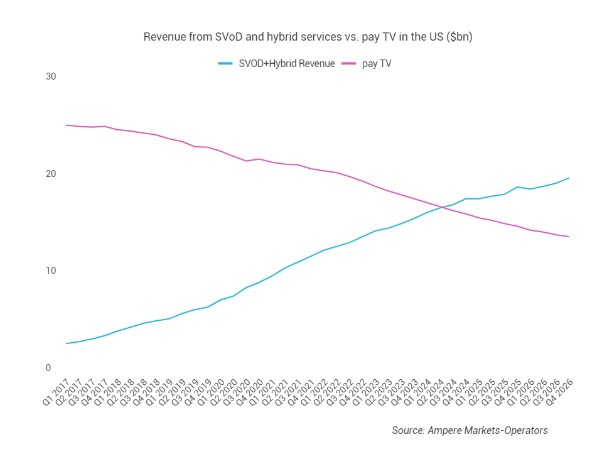

Streaming Revenues Forecast to Overtake Pay-TV This Year

US streaming revenues are set to overtake pay-TV subscriptions in Q3 2024, according to Ampere Analysis. The forecast includes ad revenues from hybrid streaming services, noting the impact of cheaper ad tiers in driving additional revenues for streaming companies. “Revenues from ad tiers will pass $9 billion in the US this year, bolstered by Amazon Prime Video’s new advertising tier which launched this quarter,” said Rory Gooderick, Senior Analyst at Ampere Analysis. “Increased revenue from advertising and a boost in subscriber growth, alongside the decline in traditional pay TV, has led to this important inflection point being reached.”

Reliance and Disney Announce Indian Merger

Reliance Industries and Disney announced a major merger on Wednesday, combining their Indian TV/streaming assets to create an $8.5 billion media giant with 120 TV channels, two streaming platforms and key cricket rights. Disney lost the Indian Premier League (IPL) streaming rights to Reliance in 2022, prompting a mass exodus from its Hotstar service. Reliance will inject $1.4 billion into the merged entity for a 63 percent stake, with Disney owning the rest. The merger values Disney’s Indian unit around $3 billion, a steep drop from the $15 billion valuation given the business when Disney acquired it from Fox in 2019.

Netflix Joins Kantar for Cross-Platform Measurement in Spain

Netflix has joined Kantar’s measurement portfolio in Spain, giving the streaming giant a cross-platform view of its performance alongside linear and on-demand channels. Kantar’s Cross-Platform View product is currently available in Spain and Brazil. “Netflix’s decision to join our service provides them with a single view of their audience and reflects the strength of our audience measurement solutions to unlock value for media and entertainment brands,” said Antonio Wanderley, CEO of Spain, Latin America, APAC and Africa at Kantar Media.

CTV Devices Overtake Traditional TV for Watching Video in India

Internet-connected devices have overtaken traditional TV as India’s most popular method for watching video content, according to Kantar and the Internet and Mobile Association of India (IAMAI). The ‘Internet in India Report 2023’ report found that internet penetration has reached 820 million active users, a year-on-year increase of 8 percent. And video/audio streaming was identified as the most popular online activity among Indian internet users. According to the findings, 208 million individuals exclusively use connected devices to watch video, versus 181 million using conventional TVs. Read more on VideoWeek.

Canal+ Ordered to Make Multichoice Buyout Offer

Canal+ has been ordered by the South African takeover regulator to make an immediate buyout offer to Multichoice shareholders. The French company reached the threshold that triggers a mandatory offer when it raised its stake to 35 percent. Last month, Multichoice rejected a $1.7 billion bid by Canal+ to acquire the remaining stake in the South African pay-TV business.

Charter Communications Mulls Altice USA Takeover

US telco Charter Communications is considering buying Altice USA, a cable TV provider, according to Bloomberg. Charter declined to comment, but in November, CEO Chris Winfrey remarked: “I don’t think there’s any cable company out there that at the right price, we wouldn’t be willing to acquire.” Altice USA’s stock jumped 40 percent following the reports.

Canal+ Ups Viu Investment to 30 Percent

Canal+ has upped its stake in Viu, an Asian streaming service, to 30 percent. The French company took a 26 percent stake in Viu last year, under a $300 million staged investment plan that allows Canal+ to ultimately reach a majority (51 percent) holding. Canal+ said the move reflects its “confidence in Viu and its team and commitment to developing Asia as its next growth engine.”

The Week for Publishers

Publishers Push Parliament for AI Regulation

Executives from several publishers spoke before the House of Lords Communications Committee this week, urging Parliament to take action to stop AI tools from scraping and reusing publishers’ content without their consent. Speakers from the FT, News UK, The Guardian and DMG Media said the issue should be a pressing matter for Parliament. The FT’s chief commercial officer Jon Slade referenced the slow speed with which regulation relating to digital media has historically emerged, adding that he hopes that’s “no indication of the speed with which we can provide greater clarity around copyright law as it relates to artificial intelligence, because the threat of disintermediation is really significant”.

Daily Mail Projects 41 Percent Drop in Ad Revenue from Cookie Consent Mandate

Speaking at the same Parliamentary session mentioned above, DMG Media’s editor emeritus Peter Wright said that a recent push from the Information Commissioner’s Office for publishers to take a firmer approach to consent collection for use of advertising cookies has the potential to seriously harm publisher revenues. Wright said his own company’s projections suggest that the standards being pushed for by the ICO, which push publishers to collect more active and informed consent, could drop advertising revenues by 41 percent.

The Independent Sees Strong Audience Growth in the US

The Independent, one of a number of UK news publishers searching for growth by growing their audiences in the US, is seeing this strategy pay off, the company announced this week. The Independent had a US audience of 25.2 million in January, up 28 percent month-on-month. This figure brought it ahead of the LA Times as the news brand with the eight biggest readership in the US, The Independent claimed.

Google News Showcase Launches in Finland

Google News Showcase, a product whereby Google pays publishers in exchange for tailored content for a specialised news feed, is launching in Finland. Google says Sanoma Media Finland and Keskisuomalainen, which represent 24 different news publications between them, have signed up at launch. And Google said that News Showcase publishers in Finland have elected to add a feature where Google pays for readers’ access to a limited amount of their paywalled content.

NMA Chairman Predicts UK Legislation to Protect News Publishers will Arrive This Year

Danny Cammiade, chairman of trade group the News Media Association, believes legislation will be announced in the UK this year which will strengthen publishers’ hands in negotiations over fees with tech companies. Australia successfully rolled out legislation along these lines several years back, and other markets have followed suit. “The playing field is not level but it’s moving positively so that there will be clear legislation that means that copyright in paying for the use of other people’s work is clarified,” Cammiade told Press Gazette.

Future Reorganises into Three Core Divisions

Specialist publisher Future has announced it has reorganised its business into three unit with the creation of a new B2B internal unit. The new unit will sit alongside B2C and Go.Compare, each led by separate management. Future says the new structure will enhance organisational agility and enable it to operate more efficiently to meet the needs of its audiences and partners around the world.

The Week For Brands & Agencies

Stagwell Predicts Return to Growth After Six Percent Organic Revenue Fall in 2023

Agency group Stagwell posted its full year financial results this week, recording a six percent year-on-year drop in organic net revenue, with a seven percent drop in Q4 specifically. CEO Mark Penn said the company has been hit by a drop in demand for marketing and business transformation services, but the company expects improvement next year, forecasting organic net revenue growth of between 5-7 percent. “2024 promises to be a year of growth and expanded margin as we go into the political season and our AI and AR products come to market,” said Penn.

Karen Blackett Leaves WPP

Karen Blackett, WPP’s UK president, announced this week she is leaving the agency group after nearly 29 years within the company, working across a range of roles. Other major roles held by Blackett include UK country manager and UK CEO of GroupM. Announcing her departure on LinkedIn, Blackett wrote “I genuinely hope that as I wave goodbye for now, I have made a difference and that the industry continues to flex and change for the better”.

Just Eat Cut Marketing Spend by Twenty Percent in 2023

Food delivery business Just Eat revealed in its financial results this week that it cut its marketing spend by 20 percent in 2023 compared with 2022, down from €735 million to €588 million. The company said the reduction in spending was “mainly driven by measures taken to increase efficiency and automation in the business” which helped it make savings in staff-related expenses and professional fees.

Puma Plans Marketing Push to Drive Growth

Sportswear brand Puma announced this week it is planning a significant brand marketing push for later this year as it seeks to drive growth, following a tough few months for the company. The push will make heavy use of partnerships and influencers to try to drive brand growth which the company says it has struggled with over the past few years.

Stagwell Acquires Digital Agency What’s Next Partners

Stagwell has entered an agreement to acquire What’s Next Partners, a French digital brand and marketing consultancy specialising in data-powered strategies, integrated communications, and creative content. The fee for the acquisition was not disclosed. What’s Next Partners will become part of the Anomaly Alliance, a partnership model with Stagwell’s Anomaly designed to expand the agency’s reach beyond its existing locations.

Brainlabs Wins Polaroid’s Global Media Account

Independent agency Brainlabs has won global media planning and buying duties for camera brand Polaroid, Campaign reported this week. Assembly and Jellyfish also reportedly pitched for the account while the incumbent, Dept, didn’t compete.

New Book Calls for Advertising to Help Accelerate the Sustainable Economy

A new book written by Ad Net Zero chair Sebastian Munden and Matt Bourn, communication director at the Advertising Association, lays out a manifesto and roadmap for how advertising can help build a sustainable economy. The book, titled ‘Sustainable Advertising – How advertising can support a better future’, builds on the Ad Net Zero 5-point action plan and draws together interviews, insights, research, reports, and case studies from more than 70 global, international and UK organisations across the advertising, sustainability, and political landscape, according to the authors.

Hires of the Week

Vudoo Names Billy Kinchin CPO

Vudoo, a content commerce company, has hired Billy Kinchin as global Chief Product Officer. Kinchin joins from publishing tech firm Oovvuu, following a 15-year stint at Google.

Saatchi & Saatchi Promotes Sarah Jenkins to COO

Saatchi & Saatchi has promoted Sarah Jenkins to the newly created role of Chief Operating Officer. Jenkins joined as Managing Director in 2019, and will be replaced in that role by Jonathan Tapper.

This Week on VideoWeek

How Warner Bros. Discovery Turned a Profit in Streaming

Google’s Privacy Sandbox Risks “Fragmenting the Internet” Says IAB Tech Lab

TikTok Attracts Quarterly Ad Spend Over $1 Billion

CTV Devices Overtake Traditional TV for Watching Video in India

Strength in Media, Mixed Fortunes in America: How the Big Four Agency Groups Performed in Q4

Sir Martin Sorrell’s S4S Ventures Joins $9.4 Million Funding Round for tvScientific

Paramount to Slash Content Spend as Paramount+ Nears Profitability

Vibe Raises $22.5 Million to Power Mission to Become Google Ads for Streaming TV

Ad of the Week

Electoral Commission UK, Register to Vote