In this week’s Week in Review: Big Tech disappoints in Q4 earnings, Publicis Groupe posts solid growth, and MediaForEurope merges with Mediaset España.

Top Stories

Big Tech Takes a Tumble in Q4 Results

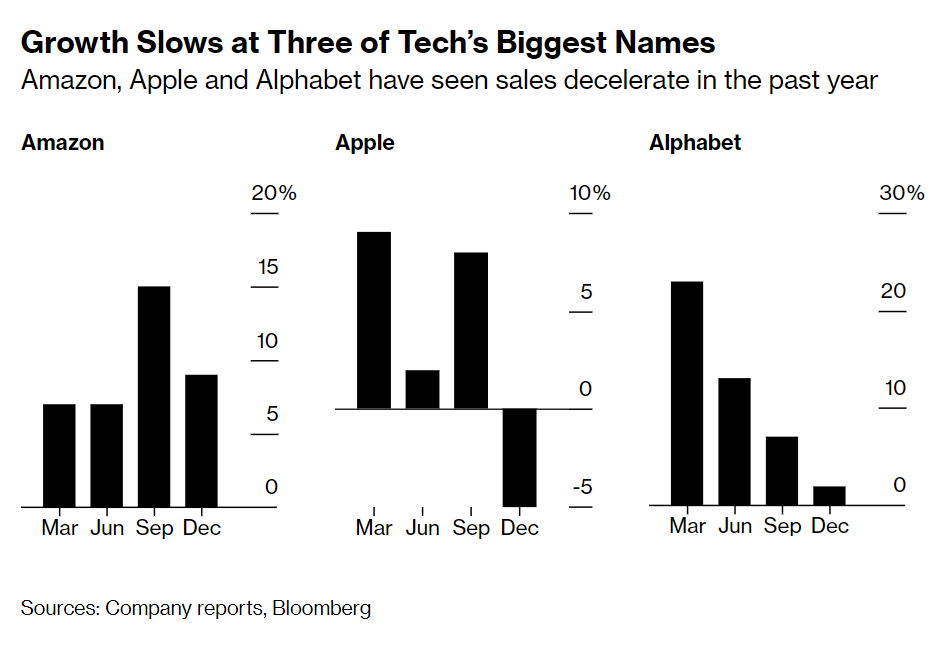

Big Tech took big hits in Q4 earnings reports, with Google, Apple and Meta all knocked by inflationary pressures and economic uncertainty. However, Amazon’s advertising revenue jumped 19 percent YoY to reach $11.56 billion, outpacing Google and Meta, whose ad revenues both dropped 4 percent. Google’s YouTube ad revenues also sank 8 percent YoY to $7.96 billion, facing heightened competition from TikTok.

Amazon’s results were dampened by its Q1 revenue guidance of $121-126 billion, short of Wall Street forecasts at $139.2 billion. “In the short term, we face an uncertain economy, but we remain quite optimistic about the long-term opportunities for Amazon,” said CEO Andy Jassy.

Meanwhile Apple posted its first revenue decline in over three years, falling 5.5 percent YoY and below analyst expectations. The company was hit by supply chain disruptions in China, delaying deliveries of iPhones during the holiday period. The tech giant expects “similar” results in Q1 2023.

The results sent shares sliding for Amazon (-5.4 percent), Alphabet (-3.8 percent) and Apple (-3.2 percent), though Meta stock rallied 23 percent after CEO Mark Zuckerberg announced a $40 billion share buyback and “a year of efficiency” for the embattled big tech firm. Meta, Google, Microsoft and Amazon have collectively cut over 150,000 staff in the last few months.

Publicis Groupe says Clients Still Aren’t Cutting Spend

Despite difficult macroeconomic circumstances across 2022, the major agency groups managed to post solid growth across the year, maintaining a relatively upbeat outlook. And that looks set to continue into 2023 as Publicis, the first of the big four agency holding groups to release its full year results, is forecasting organic net revenue growth of 3-5 percent this year. This follows a strong Q4 for the company, in which organic revenues were up by 9.4 percent.

Throughout 2022, Publicis CEO Arthur Sadoun maintained that clients weren’t pulling back on marketing. In fact in Q3 he said that many were ramping up investment, perhaps in response to economic conditions. And on an earnings call this week he said the group still hasn’t seen clients change their behaviour due to inflation.

MFE Begins Merger, but Won’t Pursue ProSieben Takeover Yet

MediaForEurope, owner of Mediaset Italia, this week formally commenced its merger with Mediaset España, part of a long running plan to create a pan-European media powerhouse.

The merger will give holding company MediaForEurope full control over the two broadcasters, alongside its major stake in German broadcaster ProSiebenSat.1. Silvio Berlusconi, CEO of MediaForEurope, says the merger is “a step towards the construction of a European television hub capable of facing international competition with adequate scale and economic solidity”. MFE’s broadcasters will focus on producing local content, but will work together on pan-European technical infrastructure and commercial platforms.

However MFE also said this week that it isn’t seeking a complete acquisition of ProSieben any time soon, despite having built its stake to become the largest shareholder in the company. Berlusconi said in a press briefing that neither a merger nor a takeover bid is currently possible, though he believes ProSieben will be open to collaborating on joint projects with MFE.

The Week in Tech

Snap Revenues Fall Flat

Snap posted flat YoY growth in its Q4 2022 earnings, reporting $1.3 billion revenues. The firm also forecast negative growth between -2 and -10 percent for Q1 2023. Snap CEO Evan Spiegel pointed to “macroeconomic headwinds” and weak advertising demand, alongside Apple’s ATT changes and the rise of TikTok. “In general, it seems like our partners are managing their spend very cautiously so they can react quickly to any changes in the environment,” he said.

Over Half Ad Companies Not Measuring Carbon Emissions Finds IAB Europe

Over half of digital advertising companies (51 percent) do not measure the emissions produced by the delivery of their ads, according to IAB Europe, despite 53 percent claiming to prioritise sustainability. The State of Readiness – Sustainability in Digital Advertising survey asked agencies, advertisers and ad tech practitioners across 29 markets for their views on the progress being made to tackle the industry’s carbon problem. A typical ad campaign creates around 5.4 tons of CO2, explains the report, heavily contributing to the internet’s carbon emissions which account for 2-4 percent of the global total. Read the full story on VideoWeek.

Advertisers on TikTok Undeterred by Regulatory Pressure

TikTok’s regulatory scrutiny is having little impact on ad spend, according to a report in Adweek. The company’s US ad revenues are projected to reach $6.83 billion this year, up from $5.03 billion in 2022. Its user base is forecast to hit 102.4 million in 2023, accounting for 20 percent of total time spent on social media by 2024. The House Energy and Commerce Committee has accused the firm of enabling “the Chinese Communist Party to access American user data,” but marketers appear undeterred. “At this point for most advertisers, the audience on TikTok is just too good to resist,” said Insider analyst Jasmine Enberg.

Good-Loop Adds Carbon Measurement to Brand Advance SSP

Brand Advance SSP and Good-Loop have formed a partnership allowing advertisers to measure the carbon footprint of their digital campaigns. Good-Loop’s green media tech will be deployed across Brand Advance campaigns, reaching the SSP’s diverse audiences with climate-friendly advertising. “At Brand Advance Group, we pride ourselves on the global audiences we offer to our clients, but can now add our focus on getting as close to Net Zero as possible,” said Christopher Kenna, CEO North America and founder of Brand Advance Group.

EU Report Recommends Banning Big Tech from Collecting Data for Advertising

The status quo in digital advertising is “unsustainable”, according to a new study by data rights agency AWO, conducted on behalf of the European Commission, suggesting a ban on Big Tech companies collecting personal data for advertising purposes. The report, ‘Towards a more transparent, balanced and sustainable digital advertising ecosystem: Study on the impact of recent developments in digital advertising on privacy, publishers and advertisers’, lays out a case to reform the industry, citing issues for publishers, consumer privacy and the environment. Read the full story on VideoWeek.

Scope3 Brings Carbon Monitoring to Adform DSP

Adform and Scope3 have struck a partnership, enabling brands to review, plan, optimise and monitor their campaigns’ carbon footprint through the Adform DSP. Advertisers are due to benefit from a database that scores media owners and supply chains based on their carbon footprint. “We look forward to working closely with Scope3 to make it as easy as possible to invite advertisers to make environmentally positive choices at scale,” said Adform COO Oliver Whitten.

Match Group Announces Redundancies

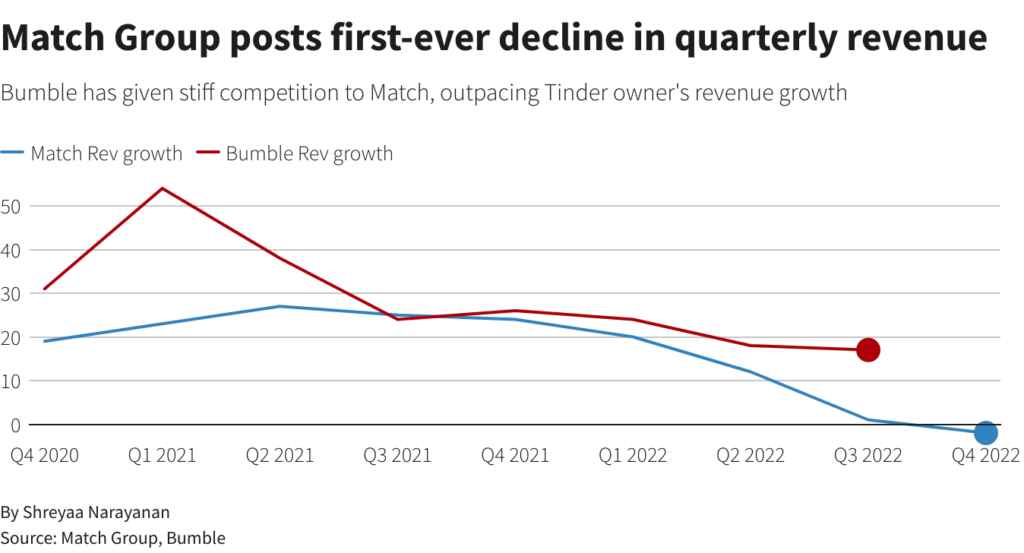

Tinder owner Match Group has announced plans to lay off around 8 percent of its workforce, following its first quarterly drop in revenues and a disappointing forecast for Q1 2023 – between $790 and $800 million, below analysts’ estimates of $817.3 million, according to Refinitiv data. The group also said Tinder will launch its first global marketing campaign this quarter.

Telecoms Advertising Joint Venture Poised to Win EU Approval

The proposed advertising joint venture (JV) between Deutsche Telekom, Orange, Telefonica and Vodafone is set to win unconditional EU antitrust approval, Reuters reported on Wednesday. The JV marks a major play by the telecoms sector to take on Big Tech’s advertising dominance. Following a preliminary review, a European Commission decision is expected on 10th February.

Audio Ad Fraud Could “Migrate Fully Back to CTV” Warns DoubleVerify

DoubleVerify (DV) has uncovered a large-scale ad fraud scheme targeting audio inventory, an iteration of server-side ad insertion (SSAI) fraud initially targeting CTV inventory. “BeatSting” has siphoned an estimated $1 million per month from advertisers, according to DV, and could “migrate fully back to CTV” in future. “Fraud always follows the money, and increasingly that money is flowing to digital audio, a rapidly emerging channel where digital advertising standards are still evolving,” said DV CEO Mark Zagorski. “CTV continues to experience this phenomenon and, increasingly, audio is quietly becoming a new channel of interest and attack.”

Twitter to Charge for API Access, Introduce Payment Services

Twitter is removing free access to its application program interface (API), to be replaced with a paid version from 9th February. The API enables creation of third-party apps, automated bots and customer service tools for brands, as well as access to data for research purposes. Also this week, the social media firm began applying for regulatory licences to build peer-to-peer payments into Twitter, the latest in Elon Musk’s moves to freshen the ailing company’s revenue streams. Musk has form in the fintech world, having co-founded X.com, later part of PayPal. He intends to make Twitter an “everything app”, incorporating messaging, payments and commerce.

Starting February 9, we will no longer support free access to the Twitter API, both v2 and v1.1. A paid basic tier will be available instead 🧵

— Twitter Dev (@TwitterDev) February 2, 2023

The Week in TV

Peacock Drives Comcast Growth, Discontinues Free Tier for New Users

Comcast revenues grew 4.3 percent YoY in 2022 to reach $121 billion, despite a weak Q4 of 0.7 percent growth. Performance was bolstered by SVOD service Peacock, which hit 20 million subs, but still operates at a loss. With losses expected to reach $3 billion in 2023, NBCUniversal has discontinued the free version of Peacock for new subscribers, potentially damaging its status as a market leader in the world of free ad-supported streaming TV (FAST). “The decision to back away from the FAST market now seems illogical and ill-timed,” said NScreen Media founder and chief analyst Colin Dixon.

Paramount+ and Showtime to Merge Across Streaming and Linear

Paramount has announced plans to integrate the Showtime network into its SVOD service Paramount+. Both Paramount+ and the linear Showtime channel will rebrand as “Paramount+ with Showtime” in the US. “With Showtime’s content integrated into our flagship streaming service, and select Paramount+ originals joining the linear offering, Paramount+ will become the definitive multiplatform brand in the streaming space – and the first of its kind to integrate streaming and linear content in this way,” said Paramount Global president and CEO Bob Bakish.

Amazon and Paramount Expand Streaming Inventory Deal

Amazon Publisher Direct (APD) has extended its agreement with Paramount Global, granting advertisers on Amazon’s DSP programmatic access to Paramount’s streaming inventory. The arrangement enables Amazon Ads customers to reach audiences across Paramount’s buying platform EyeQ, which includes Pluto TV and Paramount+. “We are excited Amazon Ads customers will benefit from expanded access to Paramount Global’s premium inventory across devices and in new locales,” said Bryan Quinn, Director, Streaming TV & Audio at Amazon Ads.

BBC iPlayer Scores 7 Billion Streams in 2022

BBC iPlayer surpassed 7 billion annual streams for the first time in 2022, the PSB revealed, a 9 percent increase on 2021. Q4 2022 also became the BVOD’s strongest quarter with two billion streams, driven by the FIFA World Cup. “Alongside the big events like the World Cup and the outstanding coverage of the state funeral for Her Majesty Queen Elizabeth II, people arrived in their millions to watch an array of big drama boxsets including the final series of Peaky Blinders and a large number of brand-new series such as The Tourist, The Responder and SAS Rogue Heroes,” said iPlayer director Dan McGolpin. “Over the last year we’ve added more choice than ever before in every genre, with plenty more in store for 2023.”

Dutch Regulator Blocks RTL Nederland/Talpa Merger

Dutch competition authority ACM this morning rejected the proposed merger of RTL Nederland and Talpa Network, initially announced on 22nd June 2021. Earlier this month, the regulator raised concerns about the merger’s impact on the Dutch TV advertising market. In response, Talpa proposed outsourcing the ad sales of its TV channels to Mediahuis Nederland. The remedy was deemed insufficient in restoring competition, and though ACM has yet to give its final decision, the merger appears to be off the table. Read the full story on VideoWeek.

Q4 Saw 55,000 New Streaming Households in the UK

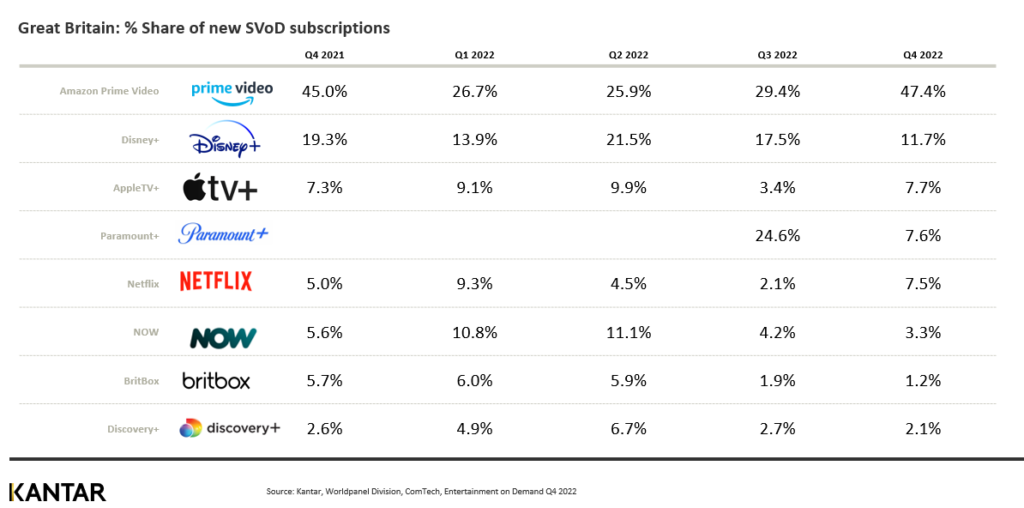

The UK streaming market returned to growth in Q4 2022, according to Kantar, offering relief in a year that saw one million British households cancel their streaming subscriptions. Q4 witnessed 55,000 new streaming households, bringing the total number subscribing to at least one service to 16.24 million, representing 56 percent of households. But Kantar noted that 12 percent plan to cancel their subscriptions in the next quarter (up from 10 percent in Q3), “indicating short-term holiday quarter subscribers are quickly looking to cut back.”

CMA Invites Commentary on 2001 Sky Merger

The UK Competition and Markets Authority has opened an Invitation to Comment on BSkyB’s 2001 takeover of British Interactive Broadcasting Holdings. The CMA reviews past cases to assess the case for lifting out-of-date remedies, and Sky has requested a review of its 20-year-old merger. The regulator will use the comments to determine whether launching a review should be considered an administrative priority.

Finland to Develop Total TV Advertising Currency

Finnish commercial broadcasters MTV Oy and Sanoma Media Finland have teamed up with measurement firm dataBreeders to develop a national Total TV advertising currency. The initiative aims to unify campaign measurement across all broadcast channels. Total TV content measurement has been available in Finland for five years, according to Broadband TV News. “We are extremely excited to be one of the first in the world to enable Total TV currency to the market,“ said Anna Lujanen, Executive Director of Screenforce Finland.

NBCUniversal Restructures Ad Sales Teams

NBCUniversal has restructured its ad sales teams, reflecting investment in its ad tech stack One Platform. Maggy Chan has been named Managing Director & EVP, Global Advertising & Partnerships, while Ad Sales President Mark Marshall will lead a converged National Sales Team. Tom Winiarski continues as President, Platform Monetization, and Krishan Bhatia as Chief Business Officer. “For years we’ve been investing in our One Platform technology stack,” said Linda Yaccarino, Chairman, Global Advertising and Partnerships at NBCUniversal. “We’ve recruited top talent to build it and partnered with the best tech companies to scale it. We’ve doubled down on first-party data with NBCUnified, targeting with AdSmart, programmatic integrations and self-service tools, and a certified measurement program to prove the impact.”

Apple Forgoes Standard Advertising Practices in Sports Streaming

Apple is launching its Major League Soccer (MLS) Pass without seeking buyers for individual ads, Bloomberg reported this week, instead asking marketers to buy a season-long series of spots that will run during the games. Apple has not offered advertisers guarantees of reaching a certain number of viewers, according to sources familiar with the matter, nor is it accepting ads from sports-betting companies. “It’s not unusual for a tech giant to be selective about who can advertise on its platform,” said the report. “Amazon.com Inc., for example, wasn’t accepting commercials from beer companies during Thursday Night Football this past season.”

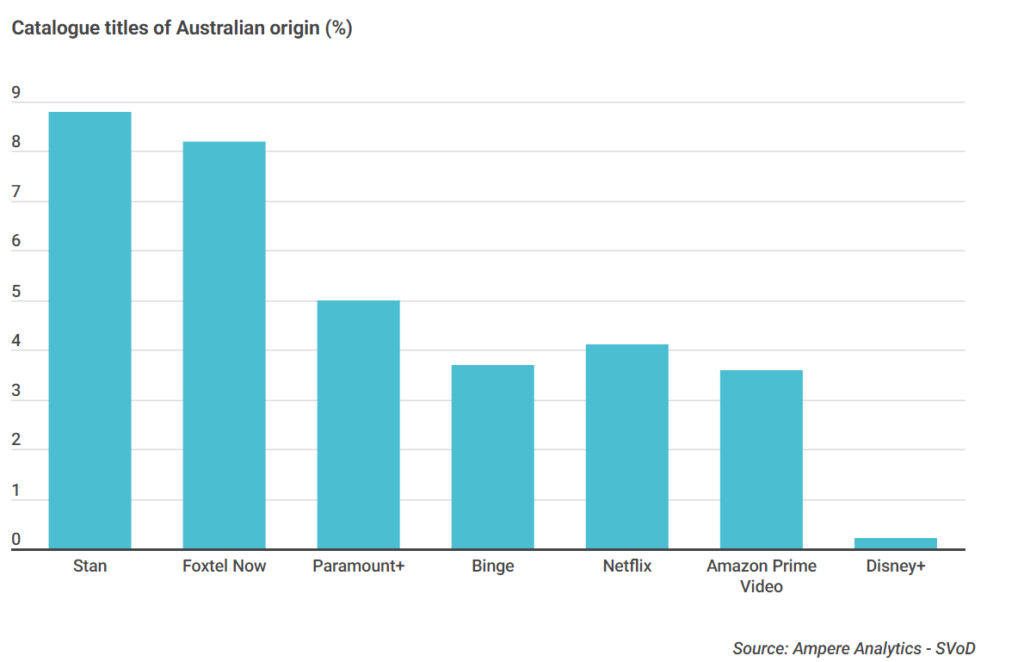

Netflix and Disney+ Could Struggle to Meet Australian Local Content Quota

Netflix and Disney+ require “considerable investment” to meet a local content quota proposed by the Australian government, Ampere Analysis has found. “Netflix in Australia has around 4 percent of its catalogue made up of local content, with Disney+ making up just 0.2 percent,” said Ampere Analyst Rory Gooderick. “Both would need considerable investment to reach as high as 20 percent,” the anticipated quota. The companies would fare better under a revenue quota, noted the report, with Netflix spending a 39 percent share of its revenue on Australian content in 2022. “While Disney+ only spent 15 percent of its revenue on local content in 2022, this is set to increase to 25 percent … in 2023, thereby exceeding the proposed quota,” added Gooderick.

Lionsgate+ Lands on Samsung TVs

Lionsgate+ arrived on Samsung Smart TVs this week, across the UK, Ireland and major Latin American markets. The SVOD service is also available on smart monitors, projectors and other Tizen OS-powered devices. “We are continuing to build on Lionsgate+’s presence across Latin America, the UK and Ireland and offer consumers a range of touchpoints, so we are delighted to make our slate of entertainment available via Samsung’s Tizen-powered devices,” said Darren Nielson, EVP, international networks at Starz. “Samsung’s global reach and premium devices make them an ideal partner for us.”

Vodafone Loses 140,000 TV Customers

Vodafone lost 140,000 European TV customers in Q4 2022, mainly in Germany (-112,000), Italy (-17,000) and CEE markets (-15,000). The group’s only gains were in Portugal (+13,000). Revenues also dropped to €11,638 million, down from €11,684 million in Q4 2021.

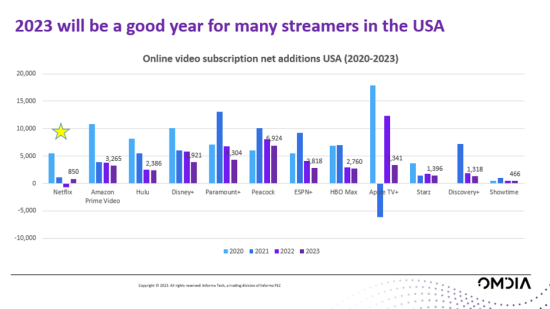

143 Million New SVOD Subs Expected in 2023

The global SVOD market will add 143 million subscriptions this year, according to Omdia, 50 percent less than in 2020. “2020 was a boom year for online video streaming, due to the pandemic and subsequent outdoor limitations which resulted in more than 300 million new global subscription online video services,” said Maria Rua Aguete, Senior Research Director, Media and Entertainment at Omdia. “In fact, in absolute terms, 2020 added more subscribers to the video-on-demand industry than at any other point in history and most likely, at any point to come.” She added that price rises might scare customers in 2023, but ad tiers could see growth.

Netflix Ad Tier Sign-Ups Double in January

Sign-ups on Netflix’s ad tier in January were twice that of December, the streaming company told advertisers this week. No figures were disclosed, but The Information suggests the firm lowballed its expectations when pitching the ad offering last year. Netflix predicted 1.75 million subs at the end of the first quarter, representing 2.4 percent of its North American subscriber base. By way of contrast, around half of Hulu subscribers are on the ad tier.

BARB Launches Viewing Data API, Suggests YouTube Measurement

UK measurement body BARB today launched an API for clients to access viewing data. The API includes three types of linear data: programme audiences, advertising spots and impacts by time segments. The data sets cover all BARB-reported linear channels on a daily basis, by region and demographic. In addition, BARB has reportedly approached YouTube to enroll in the measurement service. The move would see BBC, ITV and Channel 4 shows streamed on YouTube included in the viewing figures. Read the full story on VideoWeek.

The Week for Publishers

Bustle Digital Group Shutters Gawker Amid Wider Layoffs

Media holding group Bustle Digital Group this week announced it is shutting down Gawker, the celebrity and media-focused publication which it revived just 18 months ago. The closure comes amid wider layoffs affecting eight percent of BDG’s staff. CEO Bryan Goldberg said in a note to staff that the decision was made in order to prioritise BDG’s better monetised sites.

Penske Media Corp’s Data Strategy Pays Off

Penske Media Corporation’s investment in its first-party data capabilities and audience segmentation is paying off, Adweek reported this week. PMC’s revenues from first-party data were up by 46 percent in 2022, with around 70 percent of impressions served of PMC’s websites using first-party data.

Bloomberg Doubles Down on CTV with Bloomberg Originals

Financial media business Bloomberg this week announced the launch of ‘Bloomberg Originals’, a new brand for original programming on Bloomberg’s CTV app and linear channels. The move marks further commitment by the publisher to growing its audience on its CTV app. Bloomberg says that its newly commissioned original series will include cinematic documentary-style deep-dives, talk shows, live events and video podcasts. Read the full story on VideoWeek.

Reset Digital Create Programmatic Marketplace for Black-Owned Media Brands

Reset Digital is setting up a programmatic marketplace specifically for Black-owned media brands, AdAge reported this week. The tool will connect advertisers with the 200 Black-owned publishers who are part of the National Newspaper Publishers Association.

The News Movement Acquires The Recount

News startup The News Movement, a social-first publisher which launched at the end of last year, has acquired video news business The Recount for an undisclosed amount of equity. The News Movement, founded by ex-FT business reporter and Dow Jones CEO Will Lewis, produces news clips for TikTok, and will monetise through content studio and social agency capabilities, according to Semafor.

BuzzFeed Integrates OpenAI into Content Creation

BuzzFeed has announced a deal with ChatGPT creator OpenAI which will see the company’s AI technology used to create content for BuzzFeed. BuzzFeed CEO Jonah Peretti said in an internal note seen by the Wall Street Journal that technology will be used to help create quizzes and to personalise some of BuzzFeed’s content.

Over 1000 English Language Media Job Cuts were Made in January

At least 995 jobs were either cut or put at risk by English language news media companies in January, according to analysis from Press Gazette, as news businesses have looked to make savings in light of falling ad revenues and rising costs. This follows on from around 1,400 job cuts in December, according to the Gazette’s figures.

Instagram Founders Launch News App to Challenge Twitter

Instagram founders Kevin Systrom and Mike Krieger have launched a news app called Artifcat, designed to challenge Twitter and tackle misinformation online. The app uses AI to aggregate news and lifestyle articles in a manner that avoids “filter bubbles”, by promoting content that may challenge a reader’s views. “[It is] a particularly timely moment both in the technology industry, with Twitter’s takeover by Elon and Facebook’s focus on the Metaverse,” Systrom told the FT. “And it is particularly a timely moment to focus on text when we need it most because of people’s attention to misinformation and how we consume news today.”

The Week For Agencies

EssenceMediacom Formally Launches

EssenceMediacom, the new media agency formed by GroupM out of (you guessed it) Essence and Mediacom formally launched this week. GroupM says the combined entity has 120 offices and 10,000 staff globally, and will combine Essence’s performance, data, analytics and creative technology specialisation with MediaCom’s scaled multichannel audience planning and strategic media expertise.

Trade Groups Take Issue with David Cohen’s ‘Privacy Extremist’ Remarks

Advertiser trade groups the 4A’s and ANA put out a joint statement this week taking issue with remarks made by IAB CEO David Cohen at the IAB’s ALM conference. Cohen drew criticism for remarks made in his opening keynote, in which he hit out at “extremists” who he said are “winning the battle for hearts and minds in Washington” over privacy legislation. The two trade groups say that the IAB’s posture is not “sufficiently balanced,” saying that the industry should work with politicians, not against them, on privacy issues.

Havas Media NA Agrees SPO Deal with FreeWheel

Havas Media North America has chosen Comcast’s FreeWheel as its preferred supply-side platform partner for premium video, the two announced this week. The deal will give Havas Media’s US clients direct access to FreeWheel’s supply partner, which the two say will help optimise supply chain consistency and financial and operational transparency.

Horizon Integrates its ID with OpenX

US Media agency Horizon Media has deepened its partnership with supply-side platform OpenX, integrating its identifier blu.ID into OpenX’s platform, AdExchanger reported this week. This will give OpenX a unique source of demand compared with other SSPs, according to AdExchanger.

Brian Wieser Launches New Consultancy Madison and Wall

Industry analyst Brian Wieser, who announced his departure from GroupM earlier this month, has launched a new consultancy called Madison and Wall. Wieser says the name reflects the two worlds which much of his work had straddled: advertising and finance. Wieser says the consultancy will cater to investors, private equity firms, and other industry players.

Wavemaker Expands Remit with Adevinta

A GroupM agency team led by Wavemaker has been appointed as the global media agency network for online classifieds business Adevinta. The account, worth around $60 million in total, will add responsibilities for French brand leboncoin and German website Mobile.de to Wavemaker’s remit.

Estée Lauder Chooses Brainlabs for Media Planning and Buying

Cosmetics brand Estée Lauder’s parent company has chosen independent agency Brainlabs to handle media planning and buying, Campaign reported this week. The account was previously handled by Omnicom’s Manning Gottlieb OMD.

Hires of the Week

Imogen Coles Named Ogilvy UK Influence Lead

Ogilvy UK has promoted Imogen Coles to UK Influence Lead. Coles joined Ogilvy four years ago and helped build the agency’s influence offer. She has previously served at Dove, Bacardi and TK Maxx.

LoopMe Appoints CRO, AVP Partnerships

LoopMe has appointed Lisa Coffey as Chief Revenue Officer and Andy Sophocli as AVP Partnerships EMEA. Coffey joins from Amazon, where she was Head of Strategy and Business Development, while Sophocli worked at Azerion as UK Commercial Director.

This Week on VideoWeek

Dutch Regulator Blocks RTL Nederland/Talpa Merger, read on VideoWeek

Netflix on BARB: What We’ve Learnt, read on VideoWeek

Why Ozone is Pushing Attention Metrics Out to All its Advertisers, read on VideoWeek

BARB Launches Viewing Data API, Suggests YouTube Measurement, read on VideoWeek

Businesses Are Still Holding Back on Testing Google’s Privacy Sandbox Solutions, read on VideoWeek

EU Report Recommends Banning Big Tech from Collecting Data for Advertising, read on VideoWeek

Over Half Ad Companies Not Measuring Carbon Emissions Finds IAB Europe, read on VideoWeek

Bloomberg Doubles Down on CTV with Bloomberg Originals, read on VideoWeek

VideoWeek Podcast #36: Toby Jenner, Wavemaker, listen on VideoWeek

Ad of the Week

PlayStation, Live from PS5