Agency group Dentsu today downgraded its 2023 ad spend forecast for the second time, expecting “a flat year for advertising” as macroeconomic factors, turbulent financial sectors and the war in Ukraine continue to squeeze spending.

According to the forecast, global growth will slow from 7.9 percent in 2022 to 3.3 percent this year. This marks the latest downward revision from Dentsu, having predicted 5.4 percent in May 2022 and 3.5 percent in December.

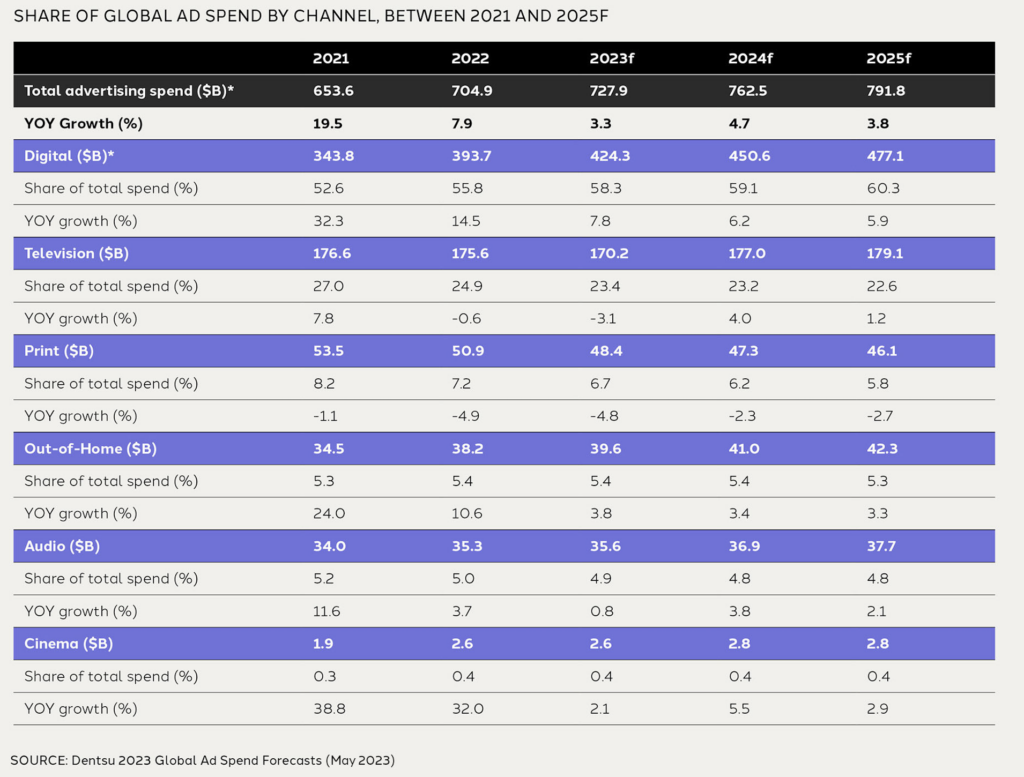

Global ad spend is set to gain $23 billion in 2023 to reach a total $729.9 billion, with media price inflation driving growth, as the Japanese business predicted in December – effectively making ad spend flat in real terms. Spend on digital is expected to add $30.6 billion to reach $424.3 billion – and while outpacing the total growth rate at 7.8 percent, digital spend has only fallen short of double-digit growth twice in the last 20 years (the 2009 financial crisis and 2020 pandemic).

And Denstu’s outlook was weak for TV, estimating a 3.1 percent drop in ad spend this year, reflecting a decline in audience numbers and inventory. But the firm forecast a stronger Q4, when advertisers tend to up their TV investment, before bouncing back to 4 percent growth in 2024.

The business also highlighted connected TV as a “rapid growth” area, with ad spend due to grow by 15.2 percent in 2023. Dentsu noted that live sports will become a key battleground, escalating the competition for sports rights between streaming services. The company added that given the convergence of TV and other forms of online video, marketers expect the same levels of measurement and targeting they get from digital channels.

“Lackluster reality”

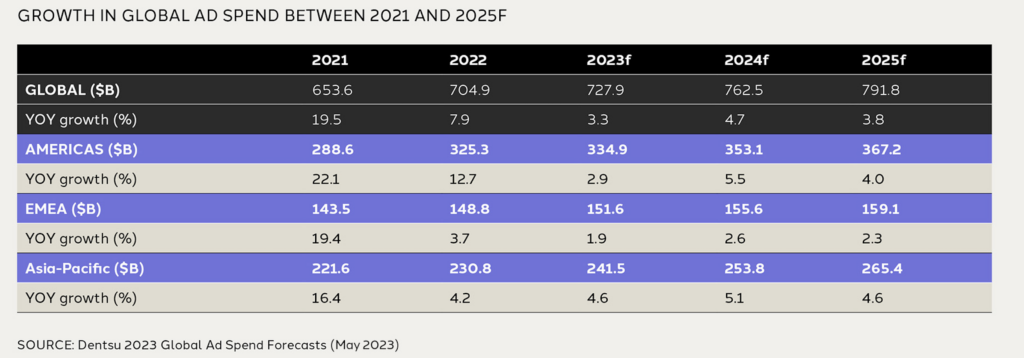

Broken down by region, Asia Pacific looks to be the fastest-growing market in 2023 at 4.6 percent, followed by the Americas on 2.9 percent (2.6 percent for the US), and EMEA trailing at 1.9 percent. The UK was identified as the fastest-growing EMEA market at 3.1 percent, due to reach $42.4 billion in 2023. “Looking ahead to 2024, the UK ad market is forecast to grow by 3.5 percent with a more positive outlook for TV at 2.0 percent,” according to Dentsu.

By category, Dentsu anticipates significant slowdown in the automotive and pharmaceutical sectors, falling from over 16 percent growth in 2022 to 5.3 and 4 percent respectively. The outlook for travel/transport ad spend shows a particularly stark contrast, slowing from 46 percent growth last year to under 5 percent in 2023. The only two categories expected to increase their growth rates are cosmetics/personal care and telecommunications, and both are forecast below 5 percent growth.

On a positive note, the company expects global ad spend to recover in 2024, boosted by the Paris Olympics, UEFA Euro 2024 and the US presidential election. Dentsu anticipates 4.7 percent growth in 2024 to reach $762.5 billion. Meanwhile digital’s share of total ad spend is set to gain one percentage point each year, rising from 58.3 percent in 2023 to hit 60.3 in 2025.

“We still expect global advertising spend to grow despite the economic uncertainty,” said Dentsu Media International Markets CEO Peter Huijboom. “However, media price inflation is the true driver of this increase and hides the more lackluster reality: 2023 will be a flat year for ad spend.”

Dentsu’s outlook is at the lower end of the big agencies’ global forecasts for 2023, with most projections coming in above 4 percent. That said, GroupM’s prediction of 4.6 percent growth was made in December, and further adjustments could be on the horizon as economic realities set in.