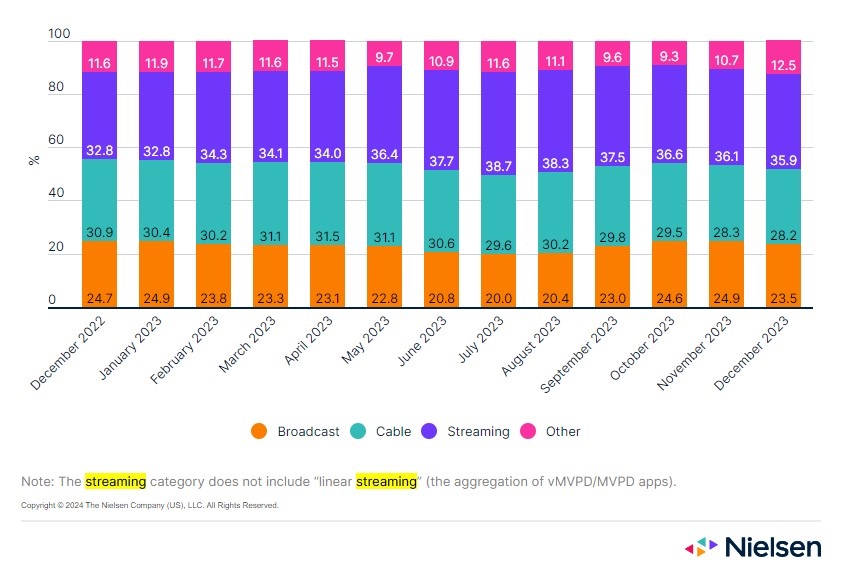

For years, streaming has been steadily growing its share of the time US audiences spend in front of their TV sets. But new data from Nielsen suggests that streaming, for now at least, has stopped stealing share from broadcast and cable.

When Nielsen released its first monthly ‘The Gauge’ report covering May 2021, streaming accounted for 26 percent of all TV usage in the US. Cable was the dominant force, covering 39 percent of time spent, with broadcast sitting at 25 percent. ‘Other’ (which includes gaming, and other activity not covered by the other three categories) was at nine percent.

By December 2022, streaming’s share had jumped to 32.8 percent. This had come primarily at the expense of cable, which fell to 30.9 percent. These stats actually understate streaming’s gain, since for the 2021 data Nielsen included vMVPD/MVPD viewing in the streaming category, but subsequently moved it to the ‘other’ category.

This growth continued up to July last year, when streaming (not including vMVPD/MVPD viewing) accounted for 38.7 percent of all viewing. But since then, streaming share of viewing has actually rolled back. In Nielsen’s latest figures, covering December, streaming covered 35.9 percent of all TV activity.

This doesn’t mean that people are streaming less – overall TV time continues to grow, meaning streaming has a smaller slice of a larger pie. But it’s significant nonetheless as a slowdown in streaming’s erosion of cable and broadcast viewing.

December is an unusual month – Christmas holidays drive up time spent playing video games, stealing share from competing categories’ ‘Other’ activity accounted for 12.5 percent of TV activity, its highest share of the year, which Nielsen accounted to videogames.

Nonetheless, Nielsen’s data suggests streaming’s encroachment on cable and broadcast viewing hours has been at least temporarily halted. Since streaming’s July peak, broadcast’s share of TV time has fallen from 29.6 percent to 28.2 percent. This is a fall, but a smaller fall than streaming. Broadcast meanwhile has actually grown its share, from 20.0 percent to 23.5 percent.

Nielsen’s analysis suggests that sports have played a significant role, thanks to a busy American football schedule with a number of high profile games. But interestingly in December, feature films accounted for the most viewing minutes on cable channels. Feature films made up 21.4 percent of cable viewing, compared to 8.1 percent for sports.

Big players hit hardest

For all the talk of an emerging oligopoly of a few big players in the streaming world, it’s notable that it was the biggest streaming players who lost the biggest share of TV time.

In July, YouTube (which has quietly become the most viewed streaming platform in the US by a decent margin) accounted for 9.2 percent of all TV time. Second largest player Netflix meanwhile covered 8.1 percent, and third-placed Hulu took 3.6 percent. In December, these figures dropped to 8.5 percent, 7.7 percent, and 2.6 percent respectively.

Other players meanwhile more or less held firm. Amazon’s share dropped marginally from 3.4 percent to 3.3 percent over this time period. Disney+ similarly fell from 2.0 percent to 1.9 percent. Tubi held firm at 1.4 percent, and Peacock actually rose from 1.1 percent to 1.3 percent.