In this week’s Week in Review: Senators call for YouTube investigation, TV4 launches a new streaming service, and Mediaocean trials alternative currency capabilities.

Top Stories

Senators Call for FTC Investigation Following Children’s Privacy Concerns on YouTube

Democrat Senator Edward J. Markey and Republican Senator Marsha Blackburn have sent a joint letter to the Federal Trade Commission (FTC) demanding that the regulator investigate allegations that YouTube has been potentially placing children’s data at risk.

“This behaviour by YouTube and Google is estimated to have impacted hundreds of thousands, to potentially millions, of children across the United States,” the two senators said in the letter. “As such, YouTube and Google may have violated COPPA – as well as its 2019 FTC consent decree – in an egregious manner.”

The demand follows yesterday’s release of a new report from Adalytics, which claims that YouTube has been using behavioural and demographic data to personalise ads on children’s videos, and has also in some cases been dropping advertising cookies and setting persistent identifiers for users watching children’s videos.

Google however denies the claims of the report. “This is the second time in recent weeks that Adalytics has published a deeply flawed and misleading report,” the company said in a statement. “Personalised advertising has never been allowed on YouTube Kids, and in January 2020 we expanded this to anyone watching “made for kids” content on YouTube, regardless of their age. The report makes completely false claims and draws uninformed conclusions based solely on the presence of cookies, which are widely used in these contexts for the purposes of fraud detection and frequency capping — both of which are permitted under COPPA. The portions of this report that were shared with us didn’t identify a single example of these policies being violated.”

TV4 Launches Combined Streaming Service TV4 Play

Telia-owned broadcaster TV4 launched a new streaming service on Monday, called TV4 Play. TV4 Play combines pay-TV channel C More with content from free-to-air network TV4, alongside original series exclusive to the service. The company is additionally introducing a paid “Plus” tier with the option to remove ads, as well as first access to shows before they are broadcast on the TV4 channel.

Sports coverage will also move to the new streaming service, including Swedish Hockey League (SHL) and the UEFA Champions League. And the restructuring effectively retires the C More brand, for instance renaming C More Hockey as TV4 Hockey.

“This is a historic and important day for TV4,” said TV4 CEO Mathias Berg. “TV4 Play is the platform where we will build TV4’s future. TV4 Play as users know it, with news and entertainment, is always open and free. At the same time, as from today, we also offer the option to buy more content, with or without advertising. With the new TV4 Play, we now place all of Sweden on one and the same service where all users can find all our content.”

The launch comes at a tumultuous time for Telia, whose media revenues and share prices have been hit by an advertising downturn. Meanwhile CEO Allison Kirkby is set to leave the company to become chief executive of BT.

Paramount and OMG Test Out VideoAmp as Alternate Currency

Paramount and Omnicom Media Group are both trialling use of audience data from VideoAmp as an alternative currency, as part of a test run with tech provider Mediaocean.

Mediaocean’s widely used platform has previously only been built to accommodate data from Nielsen for use as a currency. But as both buyers and sellers are increasingly looking to use alternative currencies, and want to be able to use multiple currencies across different transactions, Mediaocean is looking to build this functionality into its systems.

While it’s possible for agencies and broadcasters to use alternative currencies without this functionality, it’s a much more manual process. This is a significant deterrent, and as Paramount itself has said, alternative currencies have to fit into the ways which buyers and sellers already transact in order to really be viable. Hence, these tests represent the removal of a significant barrier to further adoption of alternative currencies.

The Week in Tech

InMobi Acquires Quantcast’s Consent Management Platform

Mobile ad network InMobi has acquired Quantcast Choice, the ad tech firm’s consent management platform. The deal offers publishers using InMobi more control over their data usage and consent preferences, according to the company. It follows the ad network’s purchase of Appsume, a performance measurement business, in 2021. “We want to maintain our position of privacy first and leading in privacy in the mobile app environment,” said InMobi chief business officer Kunal Nagpal. “This acquisition allows us to bring a world-class solution to developers the world over, with no new integrations.”

Brands Suspend Ads on X After Appearing on Pro-Nazi Account

At least two brands have said they will suspend advertising on Elon Musk’s X after their ads appeared alongside pro-Nazi posts, CNN reported on Wednesday. News watchdog Media Matters for America reported that ads from multiple brands, including Adobe, Gilead and NCTA-The Internet and Television Association, had appeared on an account promoting Hitler and the Nazi Party. NCTA and Gilead announced they had paused spending on X as a result. “Brand safety will remain an utmost priority for NCTA, which means suspending advertising on Twitter/X for the foreseeable future and heavily limiting NCTA’s organic presence on the platform,” NCTA spokesperson Brian Dietz said in a statement.

Google Refunds Advertisers After Claims of Fraudulent Placements

Google is refunding some advertisers after Adalytics accused the company of fraudulently running TrueView ads on third-party websites, multiple ad execs have told Ad Age. The tech giant confirmed it had issued refunds but denied they were related to the allegations. “As part of ongoing relationship building, we sometimes issue credits to advertisers, this is not uncommon,” said a Google spokesperson. “As we’ve stated repeatedly, Adalytics used a flawed methodology to make wildly inaccurate claims about Google Video Partners.”

Brightcove Adds Audience Segments to Video Cloud Platform

Brightcove, a streaming tech company, has added the ability to create audience segments within its Video Cloud platform. The segments are based on video engagement data, allowing advertisers to target similar audiences. The new Audience Sync feature enables customers to connect to marketing integrations (such as MAPs/CRMs) directly in Video Cloud; and Segment Sync pulls video data to form target audience groups that can sync with Audience Sync.

Equativ Bolsters Targeting Capabilities with Nano Interactive

Ad tech firm Equativ has partnered with Nano Interactive, a privacy-first ad targeting provider. The agreement grants Equativ publisher domains new targeting capabilities, according to the company, without the use of profiling or personal data. Nano’s consumer intent algorithm uses consumer journey data, on-page contextual analysis and machine learning technology in a cookieless environment. This means Equativ can offer advertisers ID-free audience personas with customisable segmentation options. The partnership launches in the UK, France and Germany, with plans to expand into Central and Eastern Europe (CEE) and the Middle East and North Africa (MENA), and eventually the US and Canada.

Amazon Plans In-House SSP

Amazon is developing a publisher-focused ad tech team, according to Insider, including building its own supply-side platform (SSP) to serve its in-house properties. Based on 11 job listings, the “PubTech” unit will sit within Amazon Ads, with the aim of growing revenues at Twitch, Freevee and FireTV. The company said the new division will provide “pioneering novel experiences” for Amazon-owned publishers to sell video, audio and display ads.

X Accused of Throttling Traffic to Online Rivals

X (formerly Twitter) has reportedly been slowing access to third-party links, the Washington Post reported on Tuesday. The move allegedly targets rivals that Elon Musk has previously attacked, including Facebook, Instagram, Bluesky, Reuters and the New York Times. The delay affects the t.co domain, the link-shortening service used on X, which allows the company to control activity to the target website.

The Week in TV

German Public Broadcaster ARD to Shutter Unconfirmed Linear Channel

German public broadcaster ARD looks likely to close one linear channel this year, Cablevision Europe reported this week. The organisation is planning to make one channel digital-only as a cost-saving measure. It operates Tagesschau24, ARD-alpha and One, the latter being considered the most likely to make the transition due to its younger audience. “There is no final decision yet,” said an ARD spokesperson. “We will have a result before the end of the year.”

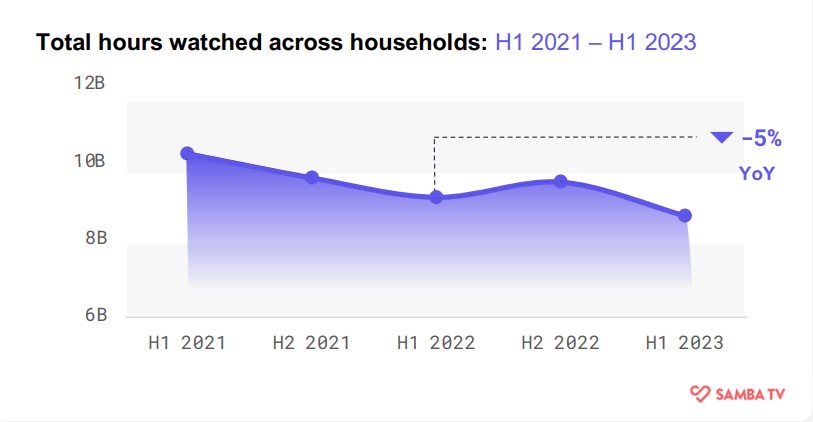

Linear TV Reaches Half of UK Population, Finds Samba TV

Linear viewing in the UK has fallen to its lowest rate in two years, according to Samba TV’s State of Viewership report. According to the findings, linear viewing dropped below 9 billion hours during the first half of 2023, reaching 14 million households, roughly half of the UK. Meanwhile BVOD penetration was up 6 percent YoY, with 59 percent of the population watching BVOD content. “Advertisers relying on linear to reach audiences should switch gears to engage with consumers who have shifted away,” noted the report.

Netflix Games Goes Multi-Platform with Cloud Gaming Tests

Streaming giant Netflix has revealed an expanded push into gaming, announcing tests of cloud gaming and controller technologies which will allow Netflix to run games on a wide range of devices including TVs and desktops. The company is running games tests in the UK and Canada with a small number of users on specific TVs, as well as on PCs and Macs via its web browser site. Initially two games – Oxenfree from Night School Studio, a Netflix Game Studio, and Molehew’s Mining Adventure, will be available. Read on VideoWeek.

Netflix and Amazon Prime Lose Households, Disney+ Gains in BARB Survey

Netflix and Amazon Prime Video penetration fell in Q2, according to BARB’s Establishment Survey. Netflix penetration stood at 57.7 percent of UK households, down from 59 percent in Q1. Meanwhile Prime Video reached 44 percent, down from 44.9 percent in Q1. Disney+ gained households during the quarter, hitting 25.2 percent penetration, up from 24.8 percent in Q1. NOW and Apple TV+ held steady at 7.1 and 6.6 percent respectively. BARB also added Paramount+ data for the first time, finding the SVOD service present in 5.9 percent of UK households in Q2. Overall SVOD penetration reached 65.9 percent of UK households.

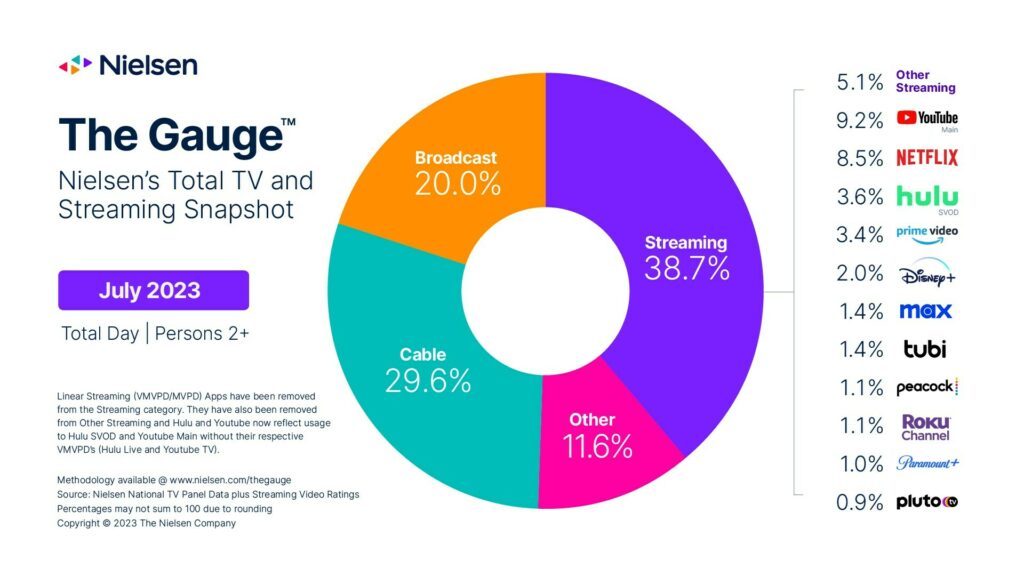

Linear TV Dips Below Fifty Percent of All US TV Viewing for the First Time

Traditional linear TV viewing – made up of broadcast and cable viewing – accounted for less than half of all TV usage in the US in July according to Nielsen’s monthly The Gauge report. This marks the first time that linear TV has made up less than half of all TV time in America, a significant milestone as CTV usage continues to rise. Meanwhile streaming – unsurprisingly – reached a new record high, accounting for 38.7 percent of all TV usage, with total time spent streaming via a TV set up 2.9 percent in July compared with June. Read on VideoWeek.

The Week for Publishers

Daily Mail Owner Confirms Interest in Buying The Telegraph

The Daily Mail & General Trust (DMGT), owner of The Daily Mail alongside other publications including The i and New Scientist, has confirmed its interest in buying The Telegraph, which was placed into receivership earlier this summer. A spokesperson for the DMGT told Sky, “We have been engaged with many parties over the possible synergies between DMG Media and the Daily Telegraph and have registered our interest with Lloyds [Banking Group] but we have no formal plans and there is no consortium.” Fellow UK news group National World is the only other party to have publicly expressed an interest.

Salon Reports Growth After Cutting Off Resellers

Digital media business Salon says it has managed to grow ad revenues after taking the decision to cut off the majority of resellers of its inventory, Adweek reported this week. Salon says that doing so has allowed it more control over pricing of its inventory, helping to raise CPMs, while also cutting down on ad tech fees. Revenue per thousand impressions was reportedly up by 83 percent in June compared with January, thanks to the change.

Publishers Start Running Amazon Sponsored Product Ads

A number of publishers including Hearst, BuzzFeed, and Pinterest will start running Amazon’s sponsored product ads (the ads which appear in search results), thanks to deals with the ecommerce giant. These publishers all use Amazon’s DSP to fill their ad inventory according to AdAge, though not all publishers using Amazon’s DSPs will receive these ads (at first, at least).

Losses Mount at the Evening Standard

The Evening Standard saw losses rise by 14 percent pre-tax in the year ending October 2nd 2022, according to financial reports published this week, as the company looks to rethink its revenue strategy. The Standard, which was hit particularly hard by the pandemic thanks to its commuter distribution model, is looking to expand revenues from its digital properties and events to cover shortfalls in print.

The Telegraph Hits One Million Subscribers

The Telegraph has hit its target of one million subscribers before the end of this year, with more than 70 percent of these subscriptions being digital. “We set an ambitious goal for ourselves in 2018 and I am thrilled we have surpassed this milestone,” said chief executive Nick Hugh. “As we look to the future, we will continue to grow our subscriptions, develop our subscriber community and set new records for the Telegraph.” (It’s worth noting that The Telegraph’s figure has been substantially aided by its acquisition of The Chelsea Magazine Company, as the FT covers here).

The Week For Brands & Agencies

Dentsu Reports 4.7 Percent Organic Revenue Slide

Dentsu reported its Q2 financial results this week, which showed a 4.7 percent organic decline in revenues year-on-year. Dentsu attributed the fall partly to strong comparables in 2022, as well as weakness from both technology and finance clients this year. The group does expect things to pick up in the second half of the year, thanks in part to one-off events like the Rugby World Cup and Tokyo Mobility Show, but still expects full year organic revenue growth to be between 0 and -2 percent.

WFA Reports “Unprecedented Desire” from Brands to Manage Risk and Reputation

The WFA’s director of policy Will Gilroy said in a blog post that the organisation has seen an unprecedented level of concern from its members around managing risk and reputation, against a very polarised political backdrop. Citing recent cases of brands facing backlash from conservative groups including Bud Light, Target, and Nike, Gilroy said that the WFA is having more conversations with brands who are looking for insights on how to avoid similar incidents.

Stagwell’s Assembly Launches Retail Media Division

Stagwell-owned media agency Assembly has launched a new retail media division in Europe, which it says has been created to meet “booming demand” in the region. Assembly says the new division will deliver “end-to-end connected commerce solutions that help retail and direct-to-consumer (DTC) brands scale, automate and improve margins at all stages of the consumer journey”. The team, led by Ada Wachowska, will start with 25 dedicated staff for the unit.

Merkle Launches AI-Enabled Google Technology Practice

Merkle, Dentsu’s customer experience management (CXM) company, this week announced the launch of what it claims to be the UK’s largest Google technology practice, integrating its Google Marketing Platform and Google Cloud Platform teams across the group. The new practice will also see the launch of Accelerator, a technology built within the Google environment which Merkle says will automate configuration, deployment and activation of advanced marketing analytics solutions.

WPP UK Launches Creative Tech Apprenticeship

WPP is launching the Creative Tech Apprenticeship, a nine-month paid programme which will develop candidates skills in coding, film, and design among other areas, is launching in the UK. The launch follows a pilot programme earlier this year, which saw the majority of apprentices offered jobs at WPP’s production arm Hogarth. WPP says the programme has a particular emphasis on educating apprentices about how these technologies can impact the individual, brands and society, and puts ethics, accessibility, and inclusion at the heart of the curriculum.

IPG Receives TAG Platinum Status Globally

Interpublic Group announced this week that it has received TAG Platinum status globally, claiming to be the first agency holding group to do so. The certification, handed out by the Trustworthy Accountability Group (TAG), signifies that a company has achieved the TAG Certified Against Fraud, Certified Against Malware, and Brand Safety Certified Seals. Individual IPG agencies Reprise, Kinesso, and Matterkind all also received TAG Platinum status individually.

Hires of the Week

Wavemaker Promotes Sian Runnacles to Chief Growth Officer

Wavemaker has promoted Sian Runnacles to Chief Growth Officer. Runnacles has spent 13 years at the agency, most recently serving as Client Managing Director. She succeeds Katie Lee, who was promoted to Chief Operating Officer last year.

the7stars Announces Four Appointments to Investment Team

Independent agency the7stars has made four senior hires across its investment team. Lewis Shaw is named Investment Managing Partner; Adam Pace as Digital Investment & Partnerships Lead; Nene Harrison as Client Commercial Director; and Ian Daly as Head of AV Investment.

This Week on VideoWeek

Agency Groups Lay Out AI Strategies After Mixed Q2

Netflix Games Goes Multi-Platform with Cloud Gaming Tests

Linear TV Dips Below Fifty Percent of All US TV Viewing for the First Time

The State of the German Ad Market: Broadcasters

New Adalytics Report Claims YouTube is Violating is Own Policies on Kids Content

Ad of the Week

Samsung, Tab S9: Ecosystem