For over two years now, those of us in the automotive industry have begun to measure time in a different way: pre- and post-pandemic. The global coronavirus pandemic was a metaphorical earthquake that sent ripples through every aspect of our lives, shaking up the automotive industry in unprecedented ways. Collapsing demand was the first domino to knock over, followed by supply chain issues and manufacturing delays that seemed to pile up. These issues aren’t solved overnight — in fact, Accenture predicted in April 2020 that it would take “more than two years for global recovery” within the automotive industry.

Here’s a short recap of some automotive trends over the past two years:

- New cars dipped to low demand, whereas used cars became in high demand

- Supply chain shortages have delayed the production of new cars

- Autonomous, connectivity, electrification, and smart, shared-mobility (ACES) trends have accelerated

Increasing number of reservations for electric vehicles including the GMC Hummer, Ford F-150 Lightning, and Ford Maverick

So, where does that leave us? Where are we headed?

Where Are Trends Headed?

While we can’t predict when the industry will no longer feel the effects of the pandemic, experts do have some key insights to trends and goals for the future.

Automotive Market Value Projection

Statista reports that the global automotive manufacturing market revenue was worth about US $2.86 trillion in 2021, down from US $3 trillion in 2019. Experts predict the value will be US $2.95 trillion by the end of 2022.

According to J.D. Power, the significant increase in new-vehicle demand means the industry is doing well, despite current economic conditions seen at the gas pumps, the record-high average new-vehicle retail transaction price, and rising average interest rates for new vehicle loans.

Used Vehicle Demand

Supply and demand for new and used cars are on a delicate scale that requires near-perfect balance for sales of both to succeed. The fluctuating demand for new vehicles and ongoing microchip shortage tipped the scale toward used vehicles, which is why we saw used vehicle prices skyrocket over the past year. Demand for used vehicles also spiked due to factors including rising cost of new vehicles, higher gasoline prices, and delayed availability of new vehicles. As manufacturers are catching up, demand for used cars is starting to go down. Experts predict the price will steadily decline over time, balancing the scale.

EV Growth

There are different types of electric vehicles, and it’s important to understand the terminology.

- Hybrid electric vehicle (HEV) — A vehicle with a conventional gas internal combustion engine (ICE) and one or more electric motors. Most modern hybrid vehicles generate electricity through regenerative braking, which converts kinetic energy into electric energy that can be stored.

- Plug-in hybrid electric vehicle (PHEV) — Includes the same components of a HEV with a larger battery and the ability to be recharged from any external source of electricity.

- Full-hybrid electric vehicle (FHEV) — These models run on an internal combustion engine and eclectic motor that uses energy stored in a battery. Though they can’t run on just electric power, they maximize fuel efficiency by shutting off the internal combustion engine during complete stops.

- Mild-hybrid electric vehicle (MHEV) — These models use a modest 48-volt battery and electric motor to increase the efficiency of their internal combustion engine. Unlike HEVs, MHEVs do not run solely on electric power. The internal combustion engine can be shut off during braking, coasting, and stopping. The electric motor can also power nonessential features, such as seat heaters or air conditioning.

- Battery electric vehicle (BEV, but more commonly referred to as EV) — A vehicle that is powered exclusively through electric motors. EVs rely on large battery packs to power the electric motors.

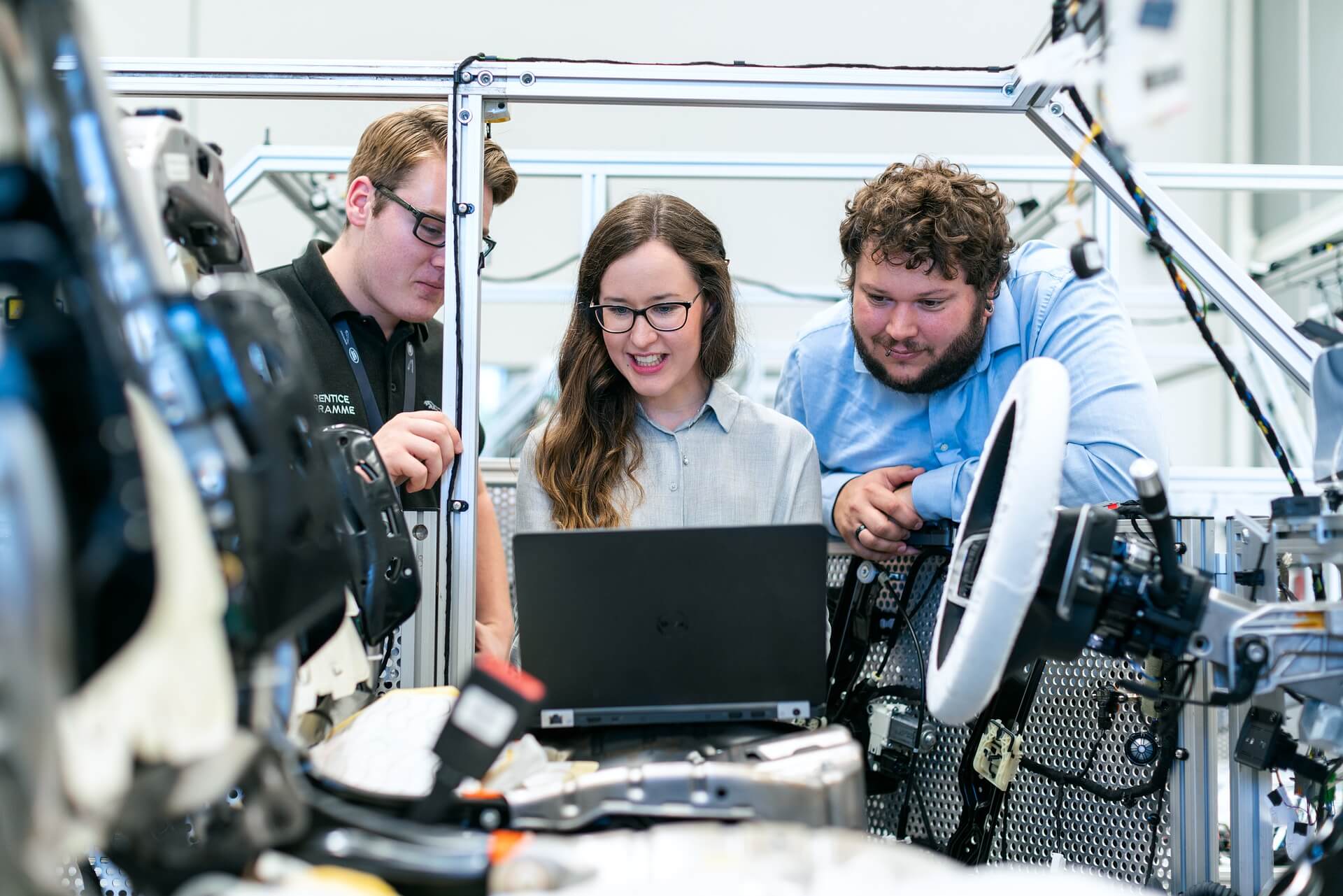

While EVs have been around since the late 19th century, interest in EVs took off in the 21st Century thanks to technological advances, an increased focus on climate change, increased EV performance, and incentives provided by the government. The future of EVs looks bright — according to Brand Finance®, all major OEMs have multi-billion-dollar investment plans to electrify their ranges. Ford, General Motors, and Stellantis aim to achieve 40 to 50 percent of all U.S. sales from EVs by 2030, in addition to an executive order signed by President Joe Biden that sets a goal to have EVs account for 50% of new vehicles sold by 2030.

Looking Forward

In summation, the pandemic threw a wrench in the automotive industry that we’re still working to bounce back from. As we look to the future, we can expect to see demand for used cars ease up, more electrified options on the road, and a booming automotive market by 2030.

At Aronson Advertising, we offer an array of digital marketing and traditional advertising services. To learn more, visit our website or give us a call at (847) 297-1700. Looking to join our team? View our current openings!