In this week’s Week in Review: WARC predicts global ad spend to top $1 trillion, the DSA comes into force for largest tech platforms, and Nielsen folds ACR data in its currency.

Top Stories

Global Ad Spend to Top $1 Trillion Next Year

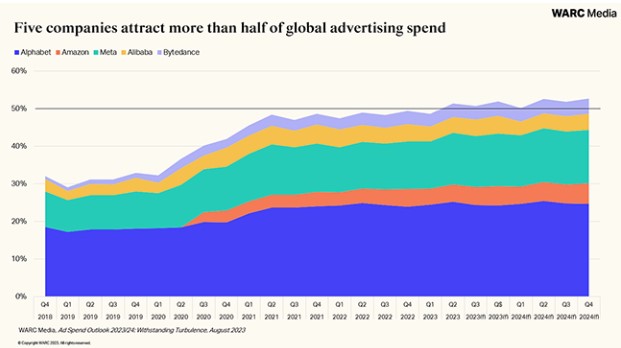

Next year, global ad spend will top $1 trillion for the first time, according to WARC’s latest outlook. Ad spend is projected to grow 4.4 percent in 2023 and 8.2 percent in 2024, with the US election, Paris Olympics and UEFA men’s Euros due to drive growth.

Social media is expected to be the fastest-growing channel, with spend rising to $227.2 billion next year, accounting for 21.8 percent of total spend. Meta is set to take 64.4 percent of social spend. Retail media spend is on track to reach $141.7 billion in 2024, representing 13.6 percent of all spend. Amazon is slated to take 37.2 percent of retail media spending.

Meanwhile CTV is forecast to climb 11.4 percent this year and 12.1 percent next year, hitting $33 billion in 2024. WARC notes this is only 3.2 percent of all spend, but 16.2 percent of premium video spend (CTV and linear TV combined).

The research also predicts five major tech firms will take more than half of global ad spend this year. The outlook suggests Alibaba, Alphabet, Amazon, ByteDance and Meta will yield a combined market share of 51.9 percent by 2024.

Digital Services Act Enforcement Begins for Biggest Tech Platforms

The EU will begin enforcing some of the rules introduced by its Digital Services Act – one of two pieces of legislation (alongside the Digital Markets Act) introduced with the aim of reigning in the tech giants – from today. The 19 tech platforms picked out by the EU as either ‘Very Large Online Platforms’ (VLOPs) or ‘Very Large Online Search Engines’ (VLOSEs) were given up until today to ensure they comply with new rules targeted at the very largest tech players.

The DSA places specific obligations around transparency, giving users control over data, and protecting against harmful content on VLOPs and VLOSEs. As such, a number have released statements in recent weeks outlining updates policies for EU users. TikTok for example announced it will stop personalising ads for users under 18, and allow users to turn off personalisation of their news feeds. Meta has similarly announced new tools which will let users see an algorithm-free news feed.

Whether these measures are enough in the EU’s eyes will now be put to the test. Those found to have fallen short could be hit with fines of up to six percent of global turnover, and repeat offenders could be banned from operating in Europe altogether.

Nielsen Folds ACR Data into TV Currency

Nielsen has finalised its plans to start folding automatic content recognition (ACR) data into its US TV measurement currency, AdExchanger reported this week, following trials of the combination earlier in the year.

The change comes as part of Nielsen ONE, Nielsen’s effort to modernise its TV measurement methodology following criticism from some buyers. Buyers will now be able to choose whether they want to use Nielsen’s panel data, or a mix of panel and ACR data, when using Nielsen as a currency. The measurement company says this will allow for more accurate measurement, particularly for shows which draw smaller audiences (where it was previously possible than none of Nielsen’s panellists tuned in, resulting in a zero rating).

Currently, this is only available for national TV buys. Nielsen’s chief data officer Pete Doe told AdExchanger this is because Nielsen’s local measurement solution already uses more granular data.

The Week in Tech

Infillion Wins MediaMath Assets

Infillion, a US-based ad tech firm, has won possession of MediaMath’s assets, following a bidding process and sale hearing which took place on Wednesday. MediaMath, a demand-side platform, filed for Chapter 11 bankruptcy in June. Infillion made the winning bid of $22 million, according to court filings, with sports data firm Genius Sports the second-highest at $20.55 million.

Agencies Concerned Over YouTube Trading on its Own Survey Data

Some advertising agencies have criticised YouTube’s move to start trading based on its own surveys, which are used to calculate how many people are watching ads on CTV, according to Ad Age. From January, YouTube will begin billing based on its survey-sourced co-viewing data, for YouTube Select video inventory on CTV. “The fundamental problem is that it contradicts their approach and the principles they laid out I think a couple of months ago, when they called for third-party measurement and called for it to be comprehensive,” said one agency executive. “But then they’re doing their own thing and pushing that down in the marketplace.”

TikTok Rolls Out Search Ads

TikTok has launched search ads for all advertisers, in an expansion to tests that commenced last year. Advertisers will automatically appear in search results and can opt out within TikTok’s ad platform. Marketers can also apply “negative keywords” to avoid appearing in certain search queries. “By keeping the toggle set to “on,” search results ads will be automatically created using the advertiser’s existing In-Feed Ad content and targeting, and served against relevant user queries adjacent to organic video results,” TikTok said in a blog post.

Microsoft Retools Activision Deal in New Submission to UK Regulator

Microsoft’s takeover of Activision Blizzard could respawn in the UK after the tech giant submitted new proposals for the terms of its acquisition. On Tuesday, the UK’s Competition and Markets Authority (CMA) announced a new investigation into the deal, after blocking the merger in April. Microsoft and Activision have submitted a new deal to the UK regulator, triggering a fresh Phase 1 investigation by the CMA. The restructured terms stipulate that Microsoft will not acquire the cloud streaming rights to any Activision game released in the next 15 years. Read on VideoWeek.

Meta Announces Transparency Updates Under Digital Services Act

Meta has announced new transparency tools intended to comply with the EU’s Digital Services Act (DSA). The Facebook and Instagram owner is expanding its Ad Library to display and archive all ads that target people in the EU, according to the company, alongside the dates the ad ran, targeting parameters, and who was served the ad. The updates also offer transparency into Meta’s AI tools, releasing 22 system cards for Facebook and Instagram, containing information about how AI systems rank content for Feed, Reels and Stories. “We welcome the ambition for greater transparency, accountability and user empowerment that sits at the heart of regulations like the DSA, GDPR, and the ePrivacy Directive,” Meta said in a blog post.

Reddit Introduces First-Party Measurement Tools

Reddit has introduced first-party measurement tools for the first time. Reddit Brand Lift measures the incremental impact of Reddit Ads on brand perception, while Reddit Conversion Lift analyses the actions taken as a result of viewing an ad on Reddit. The tools were developed in tandem with third-party measurement solutions from Oracle Moat and DoubleVerify. “The way advertisers and marketers measure success is constantly evolving, and understanding impact beyond traditional signals like clicks has become increasingly important to understanding campaign effectiveness,” said Jim Squires, EVP Business Marketing and Growth at Reddit. “Our investment in our own first-party measurement tools follows a year of focused investment in our Ads Manager and ads product roadmap, and reflects the evolved needs of our advertisers.”

Meta Fights Daily Fine for Data Privacy Violations in Norway

Meta is breaking European data privacy rules in Norway, the Norwegian Data Protection Authority told a court on Wednesday. The tech giant is seeking an injunction to stop a $94,313 daily fine imposed by the watchdog, Datatilsynet, for harvesting user data for targeted advertising. Meta told the court it has committed to seeking user consent, and that Datatilsynet used an “expedited process” that did not give the company sufficient time to respond. The regulator argued that it was unclear when and how Meta would seek consent from users, whose rights were being violated in the meantime. “There is no discussion on whether the company is in violation of [GDPR] rules,” said Hanne Inger Bjurstroem Jahren, a lawyer representing Datatilsynet.

Meta Launches Threads on Web as Usage Falls

Meta has launched a web version of Threads, its rival to Twitter (now known as X). The roll-out follows waning uptake of the app, which launched on 5th July and amassed 100 million users in the first week, albeit boosted by the integration with Instagram accounts. But usage dropped off within three weeks, from 49 million peak active users to 12 million by 22nd July.

The Week in TV

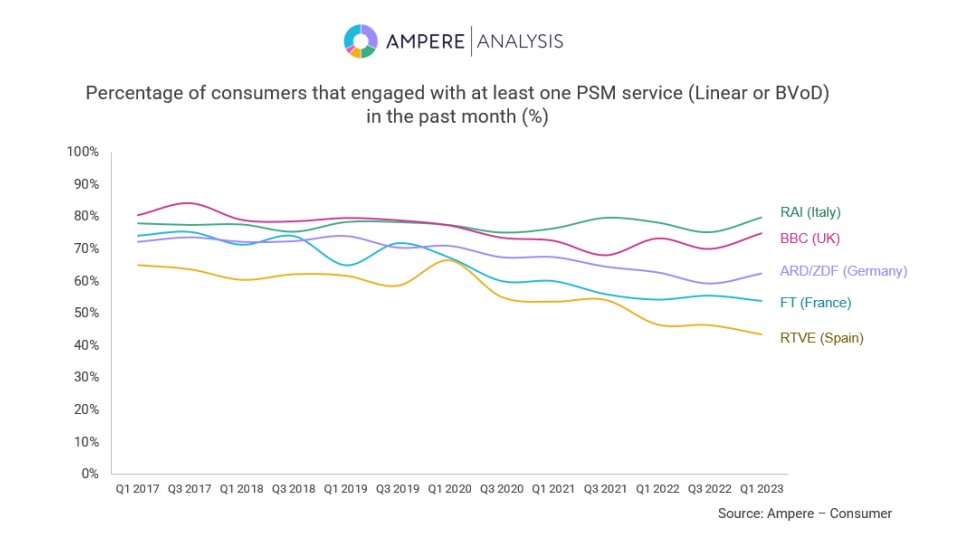

Audience Engagement with European PSBs has Dropped 15 Percent in Six Years

Audience engagement with public service media (PSM) companies’ linear and broadcaster video on-demand (BVOD) services has fallen by 15 percent in Europe’s largest markets over the past six years, according to consumer research carried out by Ampere Analysis. Ampere’s report suggests that adoption of broadcaster-owned streaming services hasn’t been high enough to prevent an overall drop in engagement, highlighting the challenges faced by PSMs in holding onto their audiences. Read on VideoWeek.

CITV to close on 1st September

ITV has confirmed that its children’s linear channel CITV will close on 1st September. It will be replaced by ITVX Kids on the company’s BVOD service. Also this week, ITV MD Kevin Lygo said the broadcaster has no plans to cut its budget. “Our advertising revenue is enormous and the studios division is very profitable,” Lygo told the Edinburgh TV Festival.

UKTV Launches First FAST Channels

UKTV has entered the free ad-supported streaming TV (FAST) market, launching four channels on Samsung TV Plus and Pluto TV: UKTV Play Heroes, UKTV Play Laughs, UKTV Play Full Throttle, and UKTV Play Uncovered. The branded channels will host content from the commercial broadcaster’s free-to-air channels, Dave, Drama, W and Yesterday. “FAST is a fantastic opportunity to reach new audiences with our rich content catalogue and showcase a wide array of genres across the four new channels,” said Jonathan Newman, General Manager, Commercial at UKTV.

Analyst Forecasts US OTT Market to Stall in Next Six Years

The US OTT market is set to stall in the next six years, according to Digital TV Research. The analysts forecast TV and film revenues to reach $82 billion in 2029, up from $74 billion in 2023. Meanwhile SVOD revenues are projected to grow just $2 billion, hitting $55 billion in 2029. “Advertising growth will be lower than our previous forecasts due to tougher market conditions and greater caution from the platforms,” said Simon Murray, principal analyst at Digital TV Research. “Platforms are more wary about increasing content spend which will stifle subscriber development.”

Google Adds Live Channels, NFL Sunday Ticket to Google TV

Google has announced updates to its CTV platform Google TV. These include 25 new live channels, and the integration of NFL Sunday Ticket on YouTube and YouTube TV in the US. “This means you can now access live out-of-market Sunday afternoon games, see top highlights and get recommendations for top games of the week, all right on your Google TV home screen,” Google said in a blog post.

“App Hopping” on the Rise in US

One-sixth of US SVOD subscribers are “app hoppers”, according to Aluma Insights, that is people who sign up for a service for less than three months before cancelling. The figure has more than doubled since 2017, when 7 percent would hop between apps. One example is “Binge & Bolt” behaviour, the research said, where users cancel after watching all the interesting content as quickly as possible. The findings suggest 14 percent of SVOD users engage in this behaviour fairly often, and 5 percent very often. Michael Greeson, founder and principal analyst at Aluma, said app hopping is “certain to increase given the current milieu.”

Amazon Launches New Centralised Hub for FAST Content

Amazon has announced the launch of its new Fire TV Channels app in the US, advancing its investment in free ad-supported streaming TV (FAST) by centralising FAST channels in one place. The new app essentially acts as the electronic programming guide (EPG) for the FAST content it hosts, giving it significant power over discovery and promotion of FAST content. Read on VideoWeek.

The Week for Publishers

Germany’s Ad Alliance Takes Over Marketing of Bauer Advance’s Digital Portfolio

German cross-media ad sales business Ad Alliance will take over marketing of Bauer Advance’s digital portfolio from the start of next year, the two reported this week. “We see great potential for development in marketing through Ad Alliance, we want to continue to successfully expand the digital business area for the Bauer Media Group and maximize digital marketing revenues,” said Tim Lammek, MD of Bauer Advance. “A particular focus will also be on strengthening conceptual digital marketing as well as brand and contextual environment marketing.”

New York Times Considers Legal Action Against OpenAI

The New York Times is considering taking legal action against OpenAI in an effort to protect intellectual property rights associated with its content, NPR reported this week. The Times and OpenAI have been in conversation over a licensing deal which would see the ChatGPT creator pay the Times in order to use its reporting to inform its AI models. But conversations have been far from smooth, according to sources which spoke with NPR, leading to the Times considering legal action.

NewsGuard Identifies Dozens of Websites Using AI to Repurpose Stolen Content

News ratings company NewsGuard has identified dozens of websites which are using AI chatbots to copy and rewrite news articles taken from other news websites, posting that content without attributing the source, Bloomberg reported this week. The findings from NewsGuard highlight the increased risk for publishers and advertisers that AI tools will help make it easier for bad actors to steal content from legitimate news publishers in order to siphon off ad revenues.

X Plans to Strip Headlines and Text Links from News Articles

X is reworking how links to news articles appear within its feed, the social platform’s CTO Elon Musk confirmed this week, with plans to strip out headlines and text links to the story, with only the main image appearing when a user posts a link. Musk said the move will “greatly improve the esthetics [sic]”. But some have seen it as a move to decrease the prominence of links outside of X to third-party publishers.

Most Top News Sites Saw Traffic Fall in July

The Daily Mail and CNN were the only two out of the world’s top ten news websites to see year-on-year global traffic growth in July, up three percent and one percent respectively, according to Press Gazette’s analysis of Similarweb data. Google News meanwhile saw the largest fall, down 19 percent year-on-year.

Pink News Pivots to Direct Partnerships

LGBTQ+ publisher Pink News is working to reduce its reliance on social media platforms, and foster more revenues from direct partnerships, as revenues from social media companies have lowered over the past year. Pink News CEO Ben Cohen told Press Gazette that the change is putting its company in a much stronger position, since it has more control and visibility into future sales with its direct strategy.

The Week For Brands & Agencies

GroupM Launches New Protections Against MFA Sites

WPP’s media arm GroupM has announced a new partnership with Jounce Media which it says will provide extra protection against ‘made for advertising’ (MFA) websites and domains. The partnership with see Jounce’s technology, which detects and tracks MFA domains, integrated into GroupM’s campaign planning processes. GroupM says that the deal will help protect against new technologies which allow MFA sites to be created and populated with content more quickly, and at greater scale.

OMG Signs Deal for Tesco Clubcard Data

Omnicom Media Group has signed a deal with data business Dunnhumby which will give its clients access to data from Tesco’s 20 million Clubcard members, Campaign reported this week. The deal will allow OMG to directly devise, activate, and measure retail media campaigns on Dunnhumby’s platform, which the two say will enable better optimisation of retail media spend.

IPG Mediabrands Plans Two New AI Tools Via Google Deal

IPG Mediabrands has agreed a deal with Google whereby it will incorporate Google’s generative AI tools with machine learning models available in Google Cloud, in order to develop new generative AI tools for clients, AdAge reported this week. IPG is initially planning two products: ‘BrandVoice AI’, which will aim to capture brands’ voice and visual style in order to generate written and image-based content; and ‘BrandPortrait AI’, a conversation tool to help Mediabrands strategists plan campaigns and find relevant research.

IPA Dismissed Claims of Right Wing Media Boycott

The UK’s Institute of Practitioners in Advertising (IPA) has responded to claims from some UK MPs that various advertisers and agencies are engaging in a boycott of right-wing media. “Advertising agencies work closely on a case-by-case basis with individual clients to agree the media plans for advertising campaigns,” said Paul Bainsfair, director general of the IPA. “Advertisers are perfectly entitled to advertise wherever they wish within legal advertising channels. There is no collective boycott of any Ofcom-regulated channel.”

Omnicom Agrees Commerce Insights Deal with Criteo

Following Omnicom Media Group’s deal with Dunnhumby (see above), Omnicom announced a further commerce media deal with Criteo on Thursday, giving Omnicom access to Criteo’s ‘digital shelf’ data and insights. The two say that the gives advertisers get visibility into sales rank, attributed sales, and other metrics to allow for data-driven decision making throughout the commerce media lifecycle, from media planning to campaign execution and optimisation.

GroupM Partners Begins Carbon Cutting Drive with SeenThis

WPP’s GroupM has announced a partnership with adaptive streaming company SeenThis, which the two say will play into GroupM’s efforts to cut its carbon footprint, Adweek reported this week. SeenThis’ streaming tech uses less data-heavy techniques for delivering video, resulting in lower carbon emissions generated by video campaigns.

Hires of the Week

WFA Makes Three Appointments

The World Federation of Advertisers (WFA) has announced three appointments this week: Brenna Brandes joins as Junior Marketing Services Manager; Rishi Saxena as Global Product Lead for Halo (WFA’s cross-media measurement initiative); and Tejash Natali as Technical Programme Manager for Halo.

Pinterest Enlists Meta’s Clément Schvartz

Pinterest has named Clément Schvartz as Country Manager of EMEA Growth Sales. Clément has previously served at Meta, Unilever, Orange and Google, where he spent 12 years in both EMEA and the US.

Spark Foundry Names Kate Anthony Chief Client & Transformation Officer

Publicis-owned Spark Foundry has appointed Kate Anthony to the newly created role of Chief Client & Transformation Officer. Anthony joins from GroupM’s EssenceMediacom, where she was Managing Director Creative Futures Global/EMEA.

This Week on VideoWeek

Audience Engagement with European PSBs has Dropped 15 Percent in Six Years

Amazon Launches New Centralised Hub for FAST Content

Microsoft Retools Activision Deal in New Submission to UK Regulator

Adalytics Unveils Fresh Evidence of Behavioural Targeting on YouTube Kids Videos

Government Intervention in CAN’s Work Would be “Anti-Commercial Freedom”

AI is Driving the Proliferation of Made for Advertising Websites

Ad of the Week

PayU India, Seven Languages, One Culture