In this week’s Week in Review: Rugby fuels strong ad results for TF1, AMC goes all in on programmatic, and IAB reports strong growth in video ad spend.

Top Stories

TF1 Reports Strong Ad Growth in Q3

French broadcaster TF1 reported strong growth in ad revenues in Q3, which were up by 7.0 percent (or 9.7 percent on a constant perimeter basis), thanks in part to extra revenues brought in by the Rugby World Cup. Ad revenues for TF1’s streaming service MyTF1 were particularly strong, up 24.9 percent (though at €22.1 million, this is still a small fraction of €350.8 million total ad revenues).

While the TV advertising market as a whole has been weak for the first half of the year, TF1 says it expects the market for the second half of the year overall to be comparable to the second half of 2022.

Meanwhile non-advertising revenues within the media segment continued to grow, up by 16.6 percent year-on-year, reaching €94.4 million.

Advertisers Invest in Video as UK Ad Spend Grows in H1

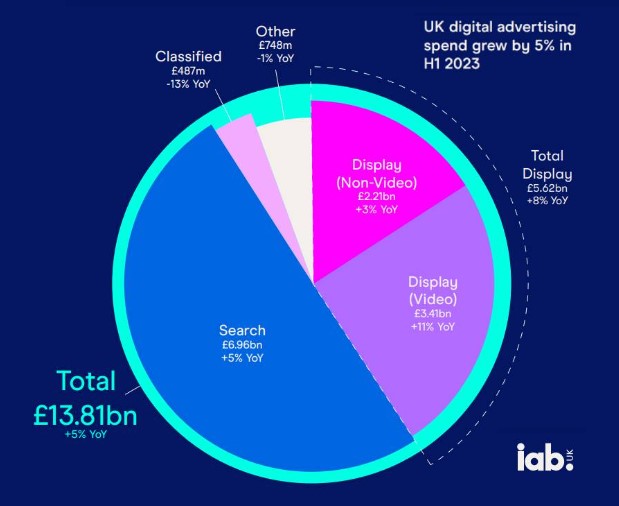

Advertisers are prioritising video amid volatile economic conditions, according to IAB UK and PwC, with video ad spend up 11 percent during the first half of 2023. The half-year update showed the UK digital ad market attracted £13.8 billion of spend in H1, up 5 percent YoY.

Video saw the strongest growth in terms of spend, followed by search at 5 percent and display (non-video) up 3 percent YoY. Classified ads were the only format to see a decline in spend, down 13 percent YoY. The report noted the video push was in line with the rising popularity of short-form video, with over one-third of UK adults watching short-form content daily, according to Ofcom.

“It’s particularly encouraging that video formats are seeing strong investment,” said IAB UK CEO Jon Mew. “Advertisers are increasingly harnessing the creative power of digital channels to bring campaigns to life and deliver long-term results, and we see this reflected in robust video investment.”

AMC Enables Programmatic Buying on Linear Channels

US TV network AMC Networks this week announced it has enabled programmatic ad buying on three of its linear channels, following a successful pilot programme. AMC says advertisers can now buy unified campaigns across digital and linear TV, with all inventory available via real-time bidding. The technology was created in partnership with Freewheel, The Trade Desk, and Canoe Ventures. AMC, WE tv, and BBC America are the three channels currently available through programmatic tools.

AMC ran tests last month with L’Oréal and its agency Omnicom, as well as other advertisers. “During this pilot, we were able to deliver seven distinct creative executions to viewers simultaneously as part of the same national linear commercial slot, through a real-time biddable process,” said Evan Adlman, executive vice president of commercial sales and revenue operations for AMC Networks. “This is a huge advance for us and for the industry and, like our pioneering efforts in addressable advertising, makes our inventory even more valuable.”

The Week in Tech

YouTube Posts Growth in Ad Revenues and Shorts

YouTube revenues climbed 12.5 percent YoY in Q3, according to Alphabet, generating $7.95 billion in ad revenues. The results continue the company’s upward trajectory from Q2, following three consecutive quarters of decline. The business added that YouTube Shorts average over 70 billion daily views, and are watched by more than 2 billion signed-in users every month.

Snap Grows Revenues Citing Improvements to Ad Platform

Snap posted a 5 percent YoY uptick in Q3 revenue, reaching $1.19 billion, citing improvements to its Dynamic Product Ad (DPA) platform. The company also forecast Q4 growth of 2-6 percent YoY, but noted that “it would be imprudent to provide formal guidance for Q4” due to the effects of war in the Middle East. “We are focused on improving our advertising platform to drive higher return on investment for our advertising partners,” said Snap CEO Evan Spiegel.

Meta Warns of “Softening” Ad Spend Due to War

Meta revenues rose 23 percent YoY in Q3 to hit $34.15 billion, beating Wall Street estimates of $33.6 billion. The Facebook and Instagram owner credited a digital advertising rebound and cost-cutting efforts. The company also forecast Q4 revenues of $36.5 billion to $40 billion, but observed some “softening” in ad spend owing to conflict in the Middle East. Meta added that it expects losses from its Reality Labs (Metaverse) division to keep increasing next year.

X Has Lost 94 Percent of Advertisers Says Ebiquity

The number of brands advertising on X (formerly Twitter) has plummeted by around 94 percent since Elon Musk’s takeover, according to marketing firm Ebiquity. The consultancy said that only two of its advertising clients spent on X in September, down from 31 brands in September 2022. “This is a drop we have not seen before for any major advertising platform,” said Ebiquity CSO Ruben Schreurs.

Amazon Ad Revenues Up 26 Percent

Amazon reported a 26 percent YoY jump in Q3 ad revenues, hitting $12.06 billion. According to Insider Intelligence, Amazon’s ad business now accounts for 7.5 percent of the global digital ad market. “I think that we have barely scraped the surface with respect to figuring out how to intelligently integrate advertising into video, into audio and into grocery,” said Amazon CEO Andy Jassy.

The Week in TV

Canal+ Reports Growth, Fined for GDPR Violations

Canal+, the Vivendi-owned pay-TV business, grew its revenues 5.7 percent YoY in Q3. French TV revenues increased 3.3 percent YoY over the first nine months of the year, while international revenues rose 1.7 percent YoY. Q3 also saw the company acquire minority stakes in Asian streaming service Viu and Nordic broadcaster Viaplay. The French competition watchdog (CNIL) also fined Canal+ €600,000 this week for GDPR violations, finding that the broadcaster had collected user data without consent from individuals.

Ligue 1 Rights Auction Scrapped After Lowball Bids

The Professional Football League (LFP) has scrapped its Ligue 1 rights auction, after the domestic broadcast packages failed to attract the desired bids. The LFP was targeting €1 billion per year for both domestic and international rights, according to SportsPro, hoping the incumbents Amazon and Canal+ would initiate a bidding war with BeIN Sports and DAZN. But reports suggest the offers fell short of the LFP’s expectations, while DAZN is thought to be reserving funds for UK Premier League rights.

TV-Based Ad Exposure Set to Drop in Coming Years

Time spent watching ads on TV (including streaming) could fall 24 percent by 2027 in the US, according to Brian Wieser, principal at consultancy firm Madison and Wall. He noted that linear TV will likely remain the primary source of ad inventory, as viewers opt to limit their ad exposure on streaming services. “Consumers of the many SVOD services generally want to choose ad-free options, [and] most of the rest of the services will inevitably be ad-light given the lack of desirability of advertising in the on-demand world that accounts for most of streaming video,” said Wieser.

Disney Nears Sale of Indian Business to Reliance

Disney is closing in on a sale of its India operations, according to Bloomberg, with Reliance Industries expected to pick up a controlling stake of the $10 billion business. Reliance is an Indian conglomerate owned by billionaire Mukesh Ambani, and is considered Disney’s biggest rival in the country due to its own streaming operations. The company values Disney’s Indian assets (Disney+ Hotstar and Star India) around $7-8 billion, and reports suggest a deal could be announced next month.

Viaplay Delays Financial Results Amid Recapitalisation Talks

Viaplay Group, the Nordic streaming company, has delayed the release of its Q3 financial results. The group remains in talks with shareholders, debt providers and bondholders, as the company works through plans on recapitalisation and the potential sale of international assets. The results have been pushed back to 29th November at the latest, according to Viaplay.

Paramount+ to Launch Ad Tier in Australia and Canada

Paramount+ will launch its ad-supported tier in Australia and Canada next year, the broadcaster announced this week. The streaming service will also roll out its premium tier in Australia, Canada, Brazil and Mexico on 16th November. Meanwhile Mexico and Brazil will remain on the mobile-only streaming subscription. “After expanding our footprint to more than 45 markets last year, we are focused on scaling our business and providing customer choice,” said Marco Nobili, EVP and International General Manager at Paramount+.

Channel 4 Inserts Shoppable Ads in Made in Chelsea

Channel 4 is integrating shoppable ad formats into reality shows, The Drum reported on Tuesday. Electronics brand Phililps will initially place ads in three episodes of Made in Chelsea, with a QR code appearing when the cast use a Philips product. “There are other programs in discussion to see what would work,” said Emma Derrick, Commercial Innovation Leader at Channel 4. “It won’t work with everything. It’s a three or four-way consultation between the commissioner, the producer and the brand. We see it working with recipe content, for example. So [viewers] can click to buy all the food for a recipe they watch.”

Sky Starts Measuring Video Across Third-Party Publishers

Sky Media has started reporting “off-platform” distributed video metrics, the broadcaster announced on Wednesday. Rather than only reporting video content delivered on networks owned and operated by Sky, the development measures the incremental audience gained through video content served across third-party websites. The solution was developed alongside Ipsos iris, and is designed to track the increased reach of the ‘Sky Publisher Player’ (SPP) network. For instance, during the first month of measurement, SPP increased Sky Sports’ audience by 16 percent to 9 million UK adults, according to the company.

The Week for Publishers

BuzzFeed Shuts Down Complex Audience Network

BuzzFeed has shut down Catalyst, an audience network launched by Complex Media three years ago, as part of an effort to streamline the business Adweek reported this week. Catalyst had around 100 publisher partners at the time of closure, according to Adweek. The business, while generating millions in revenue, reportedly had substantial administrative costs and caused cashflow issues due to payment windows.

Publishers Report Brand Safety Demonetisation of Israel Palestine Coverage

Demonetisation of news coverage via brand safety tools has been a common theme over the past few years. And publishers are reporting it’s happening again with their coverage of violence in Gaza and Israel, Adweek reported this week. One publisher reported a 12 percent rise in the delivery of house ads on its site since the latest outbreak of conflict, showing a drop in programmatic demand for inventory.

Mail Metro Media says Huge Stores of Data will Protect Against Cookie Loss

Mail Metro Media, the advertising arm of the Daily Mail’s parent company DMGT, says it has 3.5 terabytes of user data, Press Gazette reported this week, which the business believes will protect against negative impacts from the loss of third-party cookies on Chrome next year. Hannah Buitekant, managing director for digital at Mail Metro Media, said at the publisher’s upfront presentation that the group analyses 150 billion data signals to build audience profiles and power targeting and measurement.

Top News Publishers see Fall in Search Visibility

Many major news publishers saw a significant fall in search visibility following changes to Google’s core search algorithm earlier in the year, according to analysis from Press Gazette. Half of 75 major news brands examined by Press Gazette saw a fall in their search visibility, with 24 seeing a double digit drop in their visibility scores.

The Week For Brands & Agencies

WPP Cuts Outlook Following Q3 Revenue Drop

WPP has cut its full year outlook following a tough Q3, in which revenues less passthrough costs were down 0.6 percent on a like-for-like basis. The holding group said that weak performances in North America and China have dragged down stronger results elsewhere, adding that it is seeing continued weakness from tech clients. CEO Mark Read said the group is continuing to target cost reductions and looking to streamline its business, with a particular focus on GroupM.

IPG Posts Organic Fall in Net Revenues for Q3

Interpublic Group reported another tough quarter last Friday, posting an organic decrease in net revenues of 0.4 percent year-on-year. CEO Philippe Krakowsky said that revenue performance for the quarter “did not measure up to expectations”. He cited decreased client activity in the tech and telco client sectors (which was also a factor in the previous quarter) as contributing to the organic fall in net revenues. He also said client concerns around macroeconomic conditions have led to delays of projects and sales cycles).

WPP Sacks Employee Detained in China Over Bribery Allegations

WPP this week sacked a GroupM executive who had been earlier in the week detained on charges of bribery, while also announcing it is launching its own investigation into the matter. A specialist Shanghai police unit announced on Saturday it had detained three people linked to an advertising group, which turned out to be one current and two former GroupM employees. The suspects are accused of taking “[taking] advantage of their positions to accept huge bribes” by the police unit.

Coca-Cola Shifts Spend from TV to Digital

Soft drinks giant Coca-Cola spoke candidly about its marketing strategy on an earnings call following its Q3 financial results this week. John Murphy, CFO and president of The Coca-Cola Company, said that marketing spend was up this quarter compared to the year prior, with CEO James Quincey saying that the company will continue to invest in advertising. But there have been significant changes in where that spend is going in recent years. “Very little time is spent watching traditional TV,” said Quincey. “We’ve been shifting our media spend toward digital. In 2019, digital was less than 30 percent of our total media spend and year to date is over 60 percent.”

GroupM Wins PayPal Media Account

Payments tech company PayPal has handed global media duties to WPP’s GroupM, the company announced this week, following a competitive review. PayPal’s media in Europe was previously handled by Havas according to More About Advertising, while the rest was split between Media.Monks, Spark Foundry, and iProspect.

Top Five Advertisers Remains Unchanged, finds Ad Age

The world’s five largest advertisers – Amazon, L’Oréal, Alibaba, P&G, and Samsung – have remained unchanged since last year, according to Ad Age’s latest ranking of the world’s largest advertisers. Chinese retailer Pinduoduo was the only new entrant to the top ten, according to Ad Age’s data.

Musk says Tesla Plans Large Scale Advertising

Electric car manufacturer Tesla, which for most of its history has not run ads, plans to ramp up its current small scale experiments with advertising into larger scale campaigns, CEO Elon Musk posted on X this week. Musk’s advertising-averse attitude has softened in recent months (perhaps partly due to owning an ad-supported social platform), and the company has started running small digital campaigns.

I said we would advertise. We are doing so at small scale and will do so at larger scale as we figure what works best.

— Elon Musk (@elonmusk) October 23, 2023

Hires of the Week

Unilever to Promote US Head as New Marketing Chief

Unilever, a British multinational, is to name Esi Eggleston Bracey as its new marketing chief as the company looks to grow its advertising share, according to WSJ. Bracey, who presently leads the company’s US business and acts as its North America personal care head, is set to replace Conny Braams in the role, who stepped down in August. Bracey joined Unilever in 2018 following a prior spell with Procter & Gamble.

Dentsu Group Names André Andrade as New EMEA CEO

Dentsu Group, a Japanese-based global advertising company, has promoted André Andrade to EMEA CEO, AdWeek reported. Andrade succeeds Giulio Malegori, who said, “He [Andrade] has extensive understanding of the Europe, Middle East and Africa region which means he is well positioned to understand the diverse needs of our people, clients and consumers”. Andrade originally joined Dentsu in 2004 as Portugal CEO before a move to Spain in 2011, and will oversee the integrated growth strategy and business execution for the network in the EMEA area, being responsible for 16,000 people across 45 markets.

Gerry D’Angelo Joins Cedara Board

Carbon intelligence platform Cedara this week announced that Gerry D’Angelo, former VP of global media at Procter & Gamble (P&G), is joining the company’s advisory board. In his new capacity at Cedara, he will provide guidance on strategy, foster strategic partnerships, ensure alignment with industry frameworks, and assist in co-developing measurement best practices, according to the company.

This Week on VideoWeek

European Broadcasters are Using FAST as a Beachhead into New Markets

Google Tests Tool to Mask IP Addresses for Third-Parties

Advertisers Need to View CTV as More Than an Extension of Broadcast

CTV Combines the “Best Bits” of TV and Digital Advertising

SPO to Accelerate on Both the Buy and Sell Side

CTV Marketplace Has a “Scarcity of Attention”

Ad of the Week

Best Friends, Uber Eats