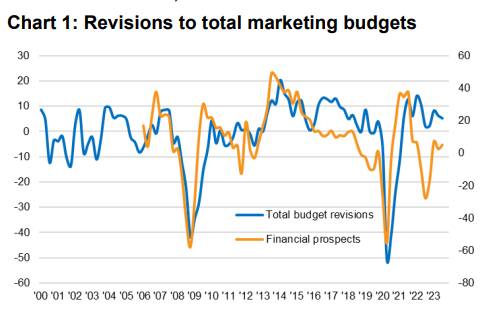

UK marketers increased their budgets in Q3 2023, according to the latest IPA Bellwether Report, though that growth was weakened by ongoing economic pressures.

The study surveyed around 300 UK-based marketing professionals, and found that 21.1 percent increased their total marketing spend in Q3. But 15.8 percent of respondents downgraded their budgets over the same period, resulting in a net balance of +5.3 percent.

This made Q3 2023 the weakest quarter of marketing budget growth since Q4 2022 (+2.2 percent), according to the Bellwether report. The study cited persistent inflationary pressures, further increases in borrowing costs and a subsequent deterioration in the UK economic outlook as reasons for this caution among marketers.

Respondents who did revise their budgets upwards noted that marketing activities were deployed “both as a defensive and offensive manoeuvre,” aiming to reinforce their brand’s position in anticipation of economic downturn. As a result, the main media advertising category saw the strongest growth (+7.4 percent), with video remaining in growth territory (+0.9 percent) and AI tools helping to drive innovation.

The report contrasted these results with the previous quarter (+6.4 percent), when marketers lent on sales promotions to steer consumers through the cost-of-living crisis. In Q3 however, spending on sales promotions shrunk from +13.4 percent to -1.5 percent.

The road ahead

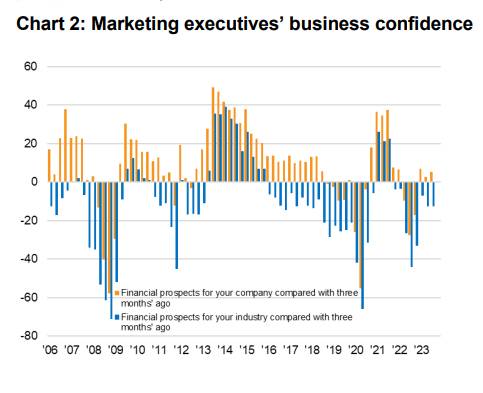

The survey also gauged sentiment around financial prospects for the quarter. The results showed little change from the previous quarter, with respondents remaining “generally subdued” on the outlook for their own companies and the wider industry.

Asked about the financial outlook for their own businesses, 25.4 percent of UK marketers were more upbeat than in Q2. But 20.2 percent were comparatively downbeat, resulting in a net balance of +5.2 percent optimism (up from +2.6 percent last quarter). The majority of companies (54.3 percent) reported no change in their assessment of financial prospects.

There was also little movement in marketers’ prospects for the UK industry as a whole. Respondents who were pessimistic in their outlook for their sector (24.9 percent) were twice those who felt optimistic (12.1 percent). This resulted in a net balance of -12.7 percent, largely unchanged from the previous quarter (-12.6 percent), and signalling the most negativity towards industry prospects so far in 2023.

With that in mind, ad spend is set to fall in 2023 and 2024, by -0.6 percent and -0.4 percent respectively. According to S&P Global Market Intelligence, the UK economy will expand in 2023 by 0.3 percent. But the firm has downwardly revised its growth forecast for 2024 from 0.4 percent to -0.1 percent. As the impact of the Bank of England’s interest rates rises fully materialise, and inflationary pressures remain elevated, S&P Global expects the UK economy to endure a shallow recession in 2023-24.

With that in mind, ad spend is set to fall in 2023 and 2024, by -0.6 percent and -0.4 percent respectively. According to S&P Global Market Intelligence, the UK economy will expand in 2023 by 0.3 percent. But the firm has downwardly revised its growth forecast for 2024 from 0.4 percent to -0.1 percent. As the impact of the Bank of England’s interest rates rises fully materialise, and inflationary pressures remain elevated, S&P Global expects the UK economy to endure a shallow recession in 2023-24.

The forecast suggests ad spend will only start to grow in real terms in 2025, projecting a modest recovery of 1.3 percent annual growth as the UK economy begins to pick up. S&P Global predicts GDP growth of 0.9 percent in 2025, and further improvement in 2026, when economic growth reaches 1.4 percent year-on-year. For 2026 and beyond, annual ad spend growth is expected to accelerate to 2.0 percent.

“Against a backdrop of economic stagnation and ongoing elevated levels of inflation in the UK, coupled with increasing global geopolitical volatility, the trading environment for companies is unquestionably tough,” said Paul Bainsfair, Director General of the IPA. “But instead of seeing a re-run of last quarter’s slightly concerning results where companies revised up their short-term sales promotional activity to record amounts while reducing their main media spend, this time we are buoyed to see a more considered, reverse state of affairs.”

“It would be a fool to say that we’re not living in challenging times, with a number of well-publicised headwinds, but it would be equally foolish to pack up and go home as there is plenty to look forward to,” added Sean Feast, Co-Founder and Director at Gravity Global, an IPA member marketing consultancy.